Europe Rechargeable Battery Market Size, Share, Trends, and Forecast by Battery Type, Capacity, Application, and Country, 2025-2033

Europe Rechargeable Battery Market Size and Share:

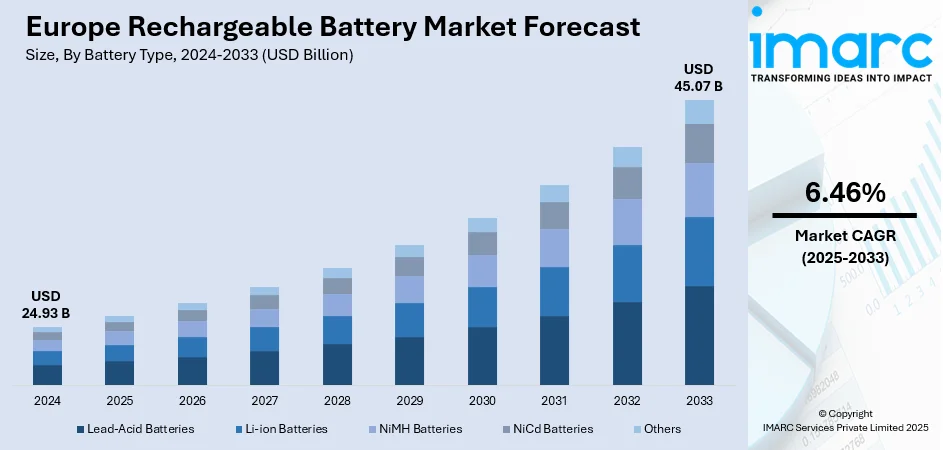

The Europe rechargeable battery market size was valued at USD 24.93 Billion in 2024. Looking forward, the market is expected to reach USD 45.07 Billion by 2033, exhibiting a CAGR of 6.46% during 2025-2033. Germany currently dominates the market, holding a significant market share in 2024. The market is growing steadily, fueled by rising demand for electric vehicles, expanding renewable energy integration, and increasing use in consumer electronics. Technological advancements and supportive government policies further drive adoption, enhancing sustainability and energy efficiency while strengthening the overall Europe rechargeable battery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 24.93 Billion |

|

Market Forecast in 2033

|

USD 45.07 Billion |

| Market Growth Rate 2025-2033 | 6.46% |

The market is witnessing strong growth, driven by multiple factors that are reshaping the region’s energy and mobility landscape. A key driver is the rapid use of electric vehicles (EVs), supported by strict emission regulations, government incentives, and consumer demand for sustainable mobility solutions. Automakers across Europe are investing heavily in EV production, creating substantial demand for high-performance rechargeable batteries with greater energy density and faster charging capabilities. Another major factor is the integration of renewable energy sources such as wind and solar into the power grid. Rechargeable batteries play a crucial role in storing intermittent renewable energy and ensuring grid stability, driving large-scale deployment of advanced energy storage systems. This transition aligns with the EU’s long-term carbon neutrality goals. For instance, in February 2025, the European Defense Agency (EDA) launched a three-year research project to monitor and predict aircraft battery performance using Prognostic Health Management (PHM). Led by Italy with Belgium, Greece, the Netherlands, and Germany, the initiative focuses on structural Li-Ion/Po rechargeable batteries for hybrid-electric aircraft and UAVs in defense.

To get more information on this market, Request Sample

The Europe rechargeable battery market growth is also driven by technological advancements in lithium-ion and emerging chemistries, such as solid-state and flow batteries, which are improving safety, lifespan, and performance, making rechargeable batteries suitable for wider applications. The presence of strong recycling infrastructure and circular economy initiatives also supports market growth by enhancing sustainability and reducing raw material dependency. For instance, in March 2025, TotalEnergies, in collaboration with Kyon Energy, is set to roll out 221 MW of new battery energy storage projects in Germany, adding to the 100 MW capacity already under construction in the country. Most of the systems will be equipped with batteries provided by Saft, TotalEnergies’ subsidiary renowned for its expertise in advanced battery technologies, especially those tailored for renewable energy applications. This initiative reflects the company’s ongoing commitment to enhancing energy storage capacity and supporting the integration of renewables into the German power grid.

Europe Rechargeable Battery Market Trends:

Technological Advancements and Performance Improvements

Leading manufacturers in Europe are focusing on enhancing the performance and efficiency of rechargeable batteries, which is fueling market growth. Companies are investing in innovative technologies, such as flow batteries, that deliver superior output compared to conventional systems. For instance, in June 2025, Invinity Energy Systems’ vanadium flow batteries were selected for nine UK long-duration energy storage projects, each with a 400 MWh capacity, under the government’s cap-and-floor support scheme. Additionally, advancements in electrochemical compositions have led to lower self-discharge rates, making rechargeable batteries more reliable and long-lasting. These continuous innovations are helping the industry meet rising energy storage demands while supporting renewable energy integration and broader electrification goals across Europe.

Rising Environmental Concerns and Climate Change

Growing environmental awareness and the urgent need to reduce greenhouse gas emissions are driving the demand for rechargeable batteries in Europe. With climate change accelerating, sustainable energy storage solutions have become increasingly important. In the final quarter of 2024, the European Union's economy saw an increase in greenhouse gas emissions, rising by 2.2% to an estimated 897 Million Tons of CO2-equivalents (CO2-eq). This figure is up from the 878 Million Tons recorded during the same period in 2023. Such figures highlight the pressing requirement for cleaner technologies, encouraging governments, businesses, and consumers to shift towards energy-efficient and eco-friendly solutions like rechargeable batteries. This trend underpins the growing adoption of renewable energy storage systems and sustainable mobility solutions across the region.

Rising Adoption of Electric Vehicles

The transition toward electric mobility is a major factor propelling the Europe rechargeable battery market trends. The rapid adoption of electric vehicles (EVs) has led to increased demand for advanced battery technologies that can deliver higher capacity, faster charging, and longer lifespans. According to the latest data from EV Volumes, over 2.96 million electric vehicles (EVs) were registered in Europe throughout 2024, reflecting strong consumer acceptance and regulatory support. This surge in EV registrations directly boosts battery production and innovation, creating growth opportunities for manufacturers. Although the COVID-19 pandemic temporarily disrupted supply chains and reduced short-term demand, the market is expected to rebound strongly as restrictions ease, supported by government incentives and rising sustainability goals.

Europe Rechargeable Battery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Europe rechargeable battery market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on battery type, capacity, and application.

Analysis by Battery Type:

- Lead-Acid Batteries

- Li-ion Batteries

- NiMH Batteries

- NiCd Batteries

- Others

Lead-acid batteries hold the largest share in the market due to their cost-effectiveness, reliability, and widespread application across multiple industries. They are extensively used in automotive vehicles for starting, lighting, and ignition functions, as well as in backup power systems, uninterruptible power supplies (UPS), and industrial machinery. Their well-established recycling infrastructure in Europe also enhances sustainability, making them a preferred option despite the rise of newer technologies. Additionally, lead-acid batteries offer proven performance, easy availability, and lower upfront costs compared to alternatives like lithium-ion, which is creating a positive impact on the Europe rechargeable battery market outlook. Their ability to deliver high surge currents and operate effectively in diverse conditions further supports their dominance, ensuring continued preference in both traditional and emerging applications across the region.

Analysis by Capacity:

- 150 - 1000 mAh

- 1300 - 2700 mAh

- 3000 - 4000 mAh

- 4000 - 6000 mAh

- 6000 - 10000 mAh

- More than 10000 mAh

The 6000–10000 mAh capacity segment holds the largest share in the market because it strikes a balance between high energy storage and compact design, making it ideal for consumer electronics, portable devices, and mid-range power applications. According to the Europe rechargeable battery market forecast, smartphones, tablets, laptops, and wearable gadgets commonly utilize batteries within this range, driving widespread adoption. Additionally, this capacity segment is increasingly used in power banks and small-scale backup systems, supporting consumer demand for longer operating hours without frequent charging. Its versatility, affordability, and suitability for daily-use devices ensure strong market penetration. As digital lifestyles expand and reliance on portable electronics grows, the 6000–10000 mAh battery segment continues to dominate the rechargeable battery landscape across Europe.

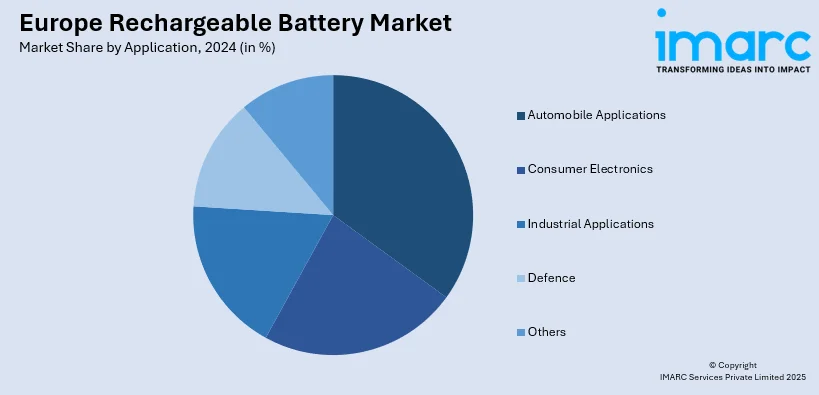

Analysis by Application:

- Consumer Electronics

- Industrial Applications

- Automobile Applications

- Defence

- Others

Automobile applications hold the largest share in the market due to the rapid growth of electric vehicles (EVs) and the continued reliance on batteries for conventional vehicles. Rechargeable batteries are essential for EV propulsion, hybrid systems, and energy storage, while lead-acid batteries remain widely used for starting, lighting, and ignition functions in traditional cars. Strong government policies promoting clean mobility, coupled with rising consumer adoption of EVs, have further boosted demand. Additionally, advancements in battery technologies, including higher energy density and faster charging, are supporting automotive applications. With the automotive industry being the largest consumer of rechargeable batteries, this sector continues to dominate, driving innovation and large-scale production across Europe’s energy storage landscape.

Country Analysis:

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

The Europe rechargeable battery market demand in Germany is driven by strong government support for clean energy transition and electric mobility. Policies promoting renewable integration and subsidies for electric vehicles (EVs) have accelerated demand for advanced rechargeable batteries. Germany’s thriving automotive industry, with leading carmakers investing heavily in EV production, significantly contributes to market growth. Additionally, the country’s commitment to reducing carbon emissions and phasing out fossil fuels boosts the need for reliable energy storage solutions. Growing adoption of consumer electronics, industrial automation, and backup power systems further supports demand. Moreover, technological advancements in lithium-ion and alternative battery chemistries enhance efficiency, performance, and safety, making Germany a central hub for innovation in the European rechargeable battery market.

Competitive Landscape:

The competitive landscape of the Europe rechargeable battery market is characterized by the presence of global leaders and regional players focusing on innovation, capacity expansion, and sustainability. Key companies such as LG Energy Solution, Panasonic, Samsung SDI, Saft, and Northvolt are investing heavily in advanced lithium-ion technologies and localized production facilities to meet growing EV and energy storage demand. European automakers are also forming strategic partnerships with battery manufacturers to secure supply chains and reduce import dependency. Additionally, established players in lead-acid batteries continue to maintain relevance in automotive and industrial segments. Intense competition is driving innovation in high-energy density solutions, recycling initiatives, and cost optimization, shaping a dynamic and fast-evolving market landscape across the region.

The report provides a comprehensive analysis of the competitive landscape in the Europe rechargeable battery market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: Ionly launched the XYZ 5 kWh rechargeable residential battery, made with 90% European-sourced components. Featuring LiFePO4 technology, it offers a 95% depth of discharge, 6,000 cycles, and a 10-year warranty. The battery will be available in September 2025, with plans to expand production and introduce commercial versions.

- June 2025: Campine announced its plan to acquire Ecobat’s two French lead-acid battery recycling plants. This acquisition will increase Campine’s recycling capacity by 70,000 tonnes annually, focusing on rechargeable lead-based batteries. The deal aims to enhance lead alloy production and boost Campine’s operations in France.

- April 2025: Asahi Kasei Microdevices launched the AP4413 series of ultra-low current power management ICs for energy harvesting applications. With a current consumption of 52 nA, the ICs support rechargeable batteries in devices like IoT sensors and Bluetooth trackers. This aligns with Europe's push for rechargeable batteries per Regulation (EU) 2023/1542.

- April 2025: ITEN unveiled its breakthrough Powency solid-state battery series, featuring a 200C discharge rate, ideal for IoT and wearables. Manufactured in Europe, the batteries offer superior power density, safety, and sustainability, with rapid charging, long life, and enhanced performance, setting a new standard for miniaturized energy storage.

- December 2024: Stellantis and Zeta Energy announced a partnership to develop lithium-sulfur EV batteries. The collaboration aims to produce lighter, cost-efficient batteries with improved fast-charging capabilities. Using waste materials, these batteries will be manufactured within existing gigafactory technology in Europe and North America, targeting production by 2030.

Europe Rechargeable Battery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

|

Scope of the Report

|

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Battery Types Covered | Lead-Acid Batteries, Li-ion Batteries, NiMH Batteries, NiCd Batteries, Others |

| Capacities Covered | 150 - 1000 mAh, 1300 - 2700 mAh, 3000 - 4000 mAh, 4000 - 6000 mAh, 6000 - 10000 mAh, More than 10000 mAh |

| Applications Covered | Consumer Electronics, Industrial Applications, Automobile Applications, Defence, Others |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Europe rechargeable battery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Europe rechargeable battery market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Europe rechargeable battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The rechargeable battery market in Europe was valued at USD 24.93 Billion in 2024.

The Europe rechargeable battery market is projected to exhibit a CAGR of 4.43% during 2025-2033, reaching a value of USD 45.07 Billion by 2033.

The Europe rechargeable battery market is driven by expanding chemical exports, widespread adoption in wastewater treatment plants, and rising investments in oil and gas projects. Additional demand stems from applications in mining and pharmaceuticals, alongside growing automation and strategic manufacturing expansions that enhance efficiency and strengthen market growth across the region.

Germany currently dominates Europe rechargeable battery market due to its strong chemical and pharmaceutical industries, extensive wastewater treatment infrastructure, and advanced manufacturing practices. Growing investments in automation, energy, and industrial projects further support adoption, reinforcing Germany’s role as a key contributor to the Europe rechargeable battery market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)