India CCTV Market Size, Share, Trends and Forecast by Type, End User Vertical, and Region, 2025-2033

India CCTV Market Overview:

The India CCTV market size reached USD 4.22 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 20.33 Billion by 2033, exhibiting a growth rate (CAGR) of 19.08% during 2025-2033. The India CCTV market is expanding due to rising security concerns, smart city initiatives, and increasing adoption in residential and commercial sectors. Government mandates for surveillance in public spaces, technological advancements like artificial intelligence (AI)-based analytics, and declining costs of internet protocol (IP) cameras are further driving growth, fostering a shift from analog to digital solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.22 Billion |

| Market Forecast in 2033 | USD 20.33 Billion |

| Market Growth Rate (2025-2033) | 19.08% |

India CCTV Market Trends:

AI-Powered Video Analytics Integration

The integration of AI-driven video analytics is revolutionizing the India CCTV market, enhancing real-time threat detection, facial recognition, and behavioral analysis. Businesses and law enforcement agencies are increasingly adopting AI-enabled cameras for automated monitoring, reducing manual efforts and improving security efficiency. These advanced systems facilitate predictive security measures by proactively detecting anomalies and unauthorized access. AI-based analytics also support traffic management, crowd control, and retail insights, making them essential for urban safety. With India’s AI market projected to reach $8 billion by 2025, growing at a CAGR of over 40% from 2020 to 2025, the demand for intelligent surveillance is surging. Government initiatives promoting AI-driven security in public infrastructure, banking, and transportation are further driving adoption, reinforcing the role of smart surveillance in crime prevention and urban development.

.webp)

To get more information on this market, Request Sample

Transition to Cloud-Based Surveillance

Cloud-based CCTV systems are becoming popular in India as organizations look for scalable, affordable, and remotely managed security systems. Cloud storage removes the requirement of costly on-site infrastructure, decreasing maintenance expenses and facilitating real-time video access across different locations. Retail and hospitality businesses are utilizing cloud surveillance for centralized monitoring and data protection. Hybrid cloud environments are being increasingly embraced by government bodies and major businesses, layering local storage over cloud-based backup for redundancy. This migration is facilitated through better internet connectivity, rising concerns around data security, and necessity for smooth compatibility with Intent of Things (IoT) and analytics driven by AI. Emerging trend towards subscription-based cloud-based CCTV models propels market growth, making business surveillance cheaper and more flexible.

Rising Demand for High-Resolution and Smart Cameras

There is growing demand for high-definition (HD) IP cameras with sophisticated features in India as customers focus on clearer image output, broader coverage, and smart security features. HD and ultra-HD (4K) cameras are replacing old analog systems to deliver crisp video evidence and improved facial recognition. Night vision, motion detection, and thermal imaging are becoming indispensable in surveillance offerings, especially in banking, transport, and government segments. Smart cameras with edge computing locally process data, minimizing network traffic and lowering response times. Increasing adoption of fifth generation (5G) connectivity and IoT integration is also enhancing the adoption of smart surveillance systems, driving real-time monitoring and automation of security in residential, commercial, and industrial markets.

India CCTV Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and end user vertical.

Type Insights:

- Analog Cameras

- IP Cameras (excluding PTZ)

- PTZ Cameras

The report has provided a detailed breakup and analysis of the market based on the type. This includes analog cameras, IP cameras (excluding PTZ), and PTZ cameras.

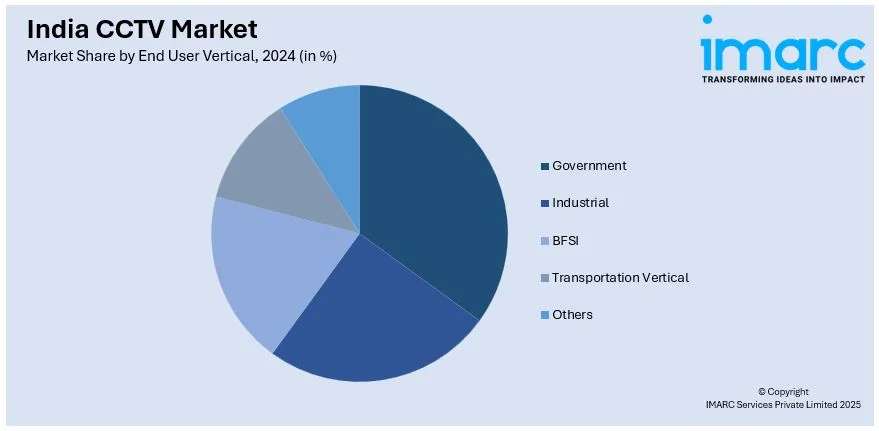

End User Vertical Insights:

- Government

- Industrial

- BFSI

- Transportation Vertical

- Others

A detailed breakup and analysis of the market based on the end user vertical have also been provided in the report. This includes government, industrial, BFSI, transportation vertical, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India CCTV Market News:

- In November 2024, Avathon, a leader in AI for industrial operations, partnered with CP PLUS, a top CCTV manufacturer, to integrate advanced computer vision technology into surveillance cameras across India. This collaboration empowers SMBs with AI-driven security, enabling real-time anomaly detection and intelligent monitoring. The partnership aims to enhance workplace safety and drive innovation in AI-powered surveillance solutions.

- In August 2024, Bosch Building Technologies launched its India assembly line for FLEXIDOME IP Starlight 5000i cameras, reinforcing its commitment to localization. Equipped with AIoT capabilities, cybersecurity features, and advanced analytics, these cameras enhance security solutions for India’s growing smart city and infrastructure sectors. This move aligns with Bosch’s "Make in India" strategy, driving innovation and strengthening its market presence in intelligent video surveillance.

India CCTV Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Cameras, IP Cameras (excluding PTZ), PTZ Cameras |

| End User Verticals Covered | Government, Industrial, BFSI, Transportation Vertical, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India CCTV market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India CCTV market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India CCTV industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The CCTV market in India was valued at USD 4.22 Billion in 2024.

The CCTV market in India is projected to exhibit a CAGR of 19.08% during 2025-2033, reaching a value of USD 20.33 Billion by 2033.

The CCTV market in India is driven by increasing security concerns, urbanization, government initiatives like Smart Cities, and rising crime rates. Technological advancements such as AI, IoT, and cloud storage, along with growing demand from sectors like retail, transportation, and infrastructure, are accelerating the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)