India Casting and Forging Market Size, Share, Trends, and Forecast by Component Type, Material Type, Manufacturing Process, Sales Channel, and Region, 2025-2033

India Casting and Forging Market Size and Share:

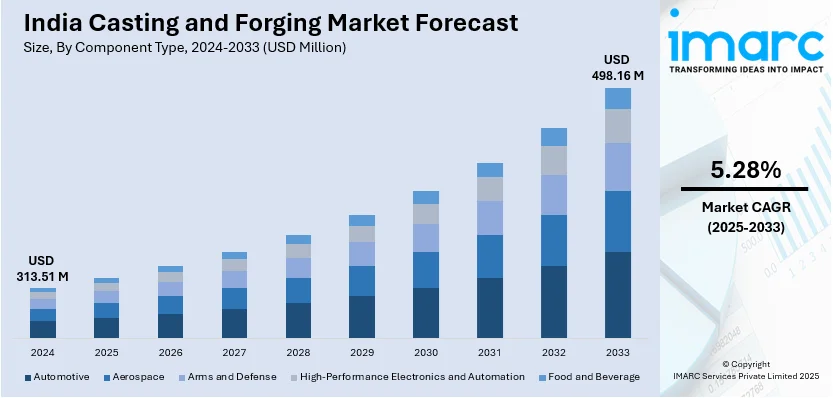

The India casting and forging market size reached USD 313.51 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 498.16 Million by 2033, exhibiting a growth rate (CAGR) of 5.28% during 2025-2033. The market is witnessing significant growth, driven by the widespread adoption of advanced technology in casting and forging processes and an increasing demand from automotive and aerospace sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 313.51 Million |

| Market Forecast in 2033 | USD 498.16 Million |

| Market Growth Rate (2025-2033) | 5.28% |

India Casting and Forging Market Trends:

Adoption of Advanced Technology in Casting and Forging Processes

With the adoption of advanced technologies to improve production efficiency, precision, and product quality, the Indian casting and forging industry is witnessing very large-scale changes. Technologies, such as 3D printing, automation, and artificial intelligence (AI) are increasingly being used to decrease inefficiencies in manufacturing processes. More importantly, additive manufacturing has enabled the production of complex components while minimizing the wastage of materials, thereby facilitating cut costs and enhancing design flexibility. Also, AI systems allow real-time monitoring and predictive maintenance, thus optimizing downtime and enhancing productivity. Along with technological advancements, the use of robotics in the casting and forging industry is assisting in optimizing repetitive tasks and thereby enhancing labor productivity and minimizing human errors. Such innovation not only improves product quality but also reduces lead times, hence recognizing the surge in demand across various sectors, including automotive, aerospace, and heavy machinery. For instance, in December 2024, Jaya Hind Industries announced the installation of India’s largest 4400-ton high-pressure die-casting machine at its Pune plant, enhancing aluminum component production for EVs and commercial vehicles, boosting capacity, and advancing Indian die-casting capabilities. As a result, India’s casting and forging market is evolving towards a high-tech, sustainable future, positioning itself as a competitive player on the global stage. The continuous integration of these cutting-edge technologies is expected to drive substantial growth in the industry, making it more resilient and adaptable to future challenges.

To get more information on this market, Request Sample

Increasing Demand from Automotive and Aerospace Sectors

The Indian market for casting and forging is witnessing a phenomenal upswing as there is continuous emerging demand from the sectors such as automotive and aerospace. The automotive industry is among the largest consumers, as emerging future trends focus on less weight with better performance components that drive the demand in automobiles, especially as the industry is shifting focus on using electric vehicles (EVs) and fuel-efficient workhorses of the internal combustion engine (ICE). The growing movement on the path of EV has called upon the need for precision-engineered castings and forgings for use in components such as motors, batteries, and transmission systems. The aerospace sector also contributes to the market with a big share and witnesses huge demand since it needs components such as turbine blades, gears, and other blocks that require very high strength and lightweight material for casting or forging. The aforementioned components can be produced using very good castings and forgings to comply with stringent safety, standards, and performance requirements. For instance, in June 2024, Aerolloy Technologies, a PTC Industries subsidiary, developed India’s first advanced casting technology for Single Crystal and Directionally Solidified blades, enabling Aero-engine and gas turbine manufacturing at its Lucknow facility. This demand is further fueled by India’s increasing role in the global aerospace supply chain, with both commercial and defense sectors ramping up their production capabilities. As a result, manufacturers in India are investing in advanced production techniques, capacity expansion, and quality certifications to cater to the rising demand. This trend is expected to continue, driving sustained growth in India's casting and forging market over the coming years.

India Casting and Forging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component type, material type, manufacturing process, and sales channel.

Component Type Insights:

- Automotive

- Engine Components

- Transmission Components

- Structural Components

- Suspension Components

- Exhaust System Components

- Powertrain Components

- Interior Components

- Exterior Components

- Others

- Aerospace

- Safety Critical Structural Parts

- Non-Safety Critical Parts

- Arms and Defense

- Mobility

- Arms & Gear

- High-Performance Electronics and Automation

- Heat Management

- Electronic-Housings

- Automation Structural Parts

- Food and Beverage

- Structural Components

- Functional Components

The report has provided a detailed breakup and analysis of the market based on the component type. This includes automotive (engine components, transmission components, structural components, suspension components, exhaust system components, powertrain components, interior components, exterior components, others), aerospace (safety critical structural parts, non-safety critical parts), arms and defense (mobility, arms & gear), high-performance electronics (heat management, electronic-housings, automation structural parts) and food and beverage (structural components, functional components).

Material Type Insights:

- Aluminium Alloy 2xxx Series

- Aluminium Alloy 3xxx Series

- Aluminium Alloy 5xxx Series

- Aluminium Alloy 6xxx Series

- Aluminium Alloy 7xxx Series

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes aluminium alloy 2xxx series, aluminium alloy 3xxx series, aluminium alloy 5xxx series, aluminium alloy 6xxx series, and aluminium alloy 7xxx series.

Manufacturing Process Insights:

- Casting Process

- Sand Casting

- Die Casting

- High Pressure Die Casting

- Others

- Forging Process

- Open Die Forging

- Closed Die Forging

- Upset Forging

- Precision Forging

- Rheocasting Process

- Others

A detailed breakup and analysis of the market based on the manufacturing process have also been provided in the report. This includes casting process (sand casting, die casting, high pressure die casting, others) forging process (open die forging, closed die forging, upset forging, precision forging) rheocasting process, and others.

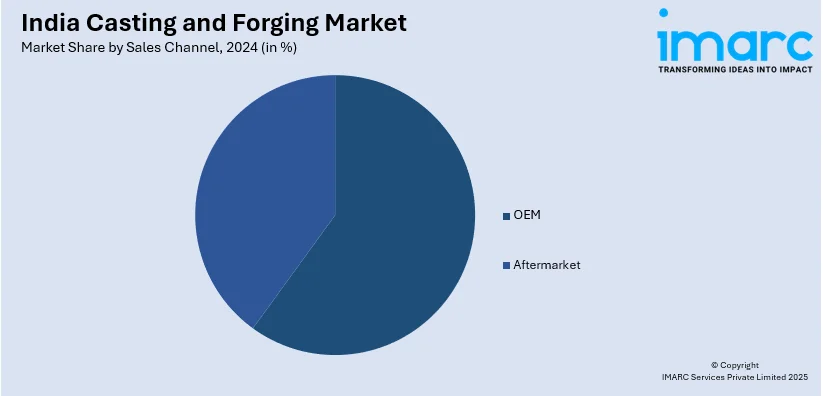

Sales Channel Insights:

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes OEM and aftermarket.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Casting and Forging Market News:

- In February 2025, Bharat Forge Ltd. and Liebherr-Aerospace & Transportation SAS announced partnership to establish a high-tech manufacturing facility in India. This investment includes a ring mill, advanced machining, and raw material processing to produce high-precision landing gear components, reinforcing Bharat Forge’s commitment to global aerospace industry demands and Liebherr’s customer base.

- In January 2025, Ramkrishna Forgings Limited announced board approval for a new casting project in Jamshedpur, designated as Plant 8, with a 30,000 metric ton annual capacity. Funded through debt and internal accruals, this expansion aims to strengthen its presence in automotive casting, offering a comprehensive product range to existing and new customers.

India Casting and Forging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered |

|

| Material Types Covered | Aluminium Alloy 2xxx Series, Aluminium Alloy 3xxx Series, Aluminium Alloy 5xxx Series, Aluminium Alloy 6xxx Series, Aluminium Alloy 7xxx Series |

| Manufacturing Processes Covered |

|

| Sales Channels Covered | OEM, Aftermarket |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India casting and forging market performed so far and how will it perform in the coming years?

- What is the breakup of the India casting and forging market on the basis of component type?

- What is the breakup of the India casting and forging market on the basis of material type?

- What is the breakup of the India casting and forging market on the basis of manufacturing process?

- What is the breakup of the India casting and forging market on the basis of sales channel?

- What is the breakup of the India casting and forging market on the basis of region?

- What are the various stages in the value chain of the India casting and forging market?

- What are the key driving factors and challenges in the India casting and forging?

- What is the structure of the India casting and forging market and who are the key players?

- What is the degree of competition in the India casting and forging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India casting and forging market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India casting and forging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India casting and forging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)