India Marine Equipment Market Size, Share, Trends and Forecast by Equipment Type, Application, End-User, and Region, 2025-2033

India Marine Equipment Market Overview:

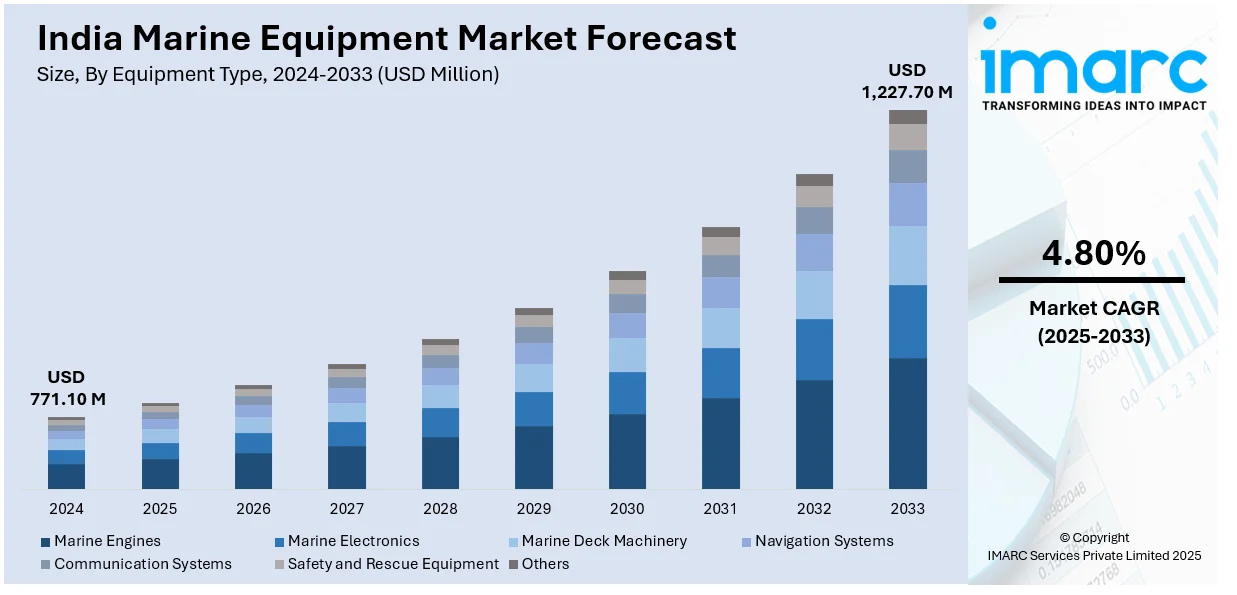

The India marine equipment market size reached USD 771.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,227.70 Million by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. The market is advancing with increased investment in port infrastructure, inland waterways, and defense modernization. Additionally, demand is rising for energy-efficient systems, locally manufactured components, and digital technologies, as operators prioritize operational efficiency, regulatory compliance, and reduced reliance on imported machinery and propulsion solutions, significantly impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 771.10 Million |

| Market Forecast in 2033 | USD 1,227.70 Million |

| Market Growth Rate 2025-2033 | 4.80% |

India Marine Equipment Market Trends:

Rising Demand for Coastal and Inland Waterway Equipment

India’s renewed focus on coastal shipping and inland water transport is driving consistent demand for marine equipment tailored to shallow drafts and riverine conditions. With the government investing in port modernization and waterway development under programs like Sagarmala and Jal Marg Vikas, there is a notable uptick in the requirement for tugboats, barges, dredging equipment, and navigation aids. For instance, there are 839 projects identified under this initiative, with an estimated investment of approximately ₹5.8 lakh crore, which will be implemented by 2035. Private sector participation in port-led development is also boosting procurement of handling equipment, deck machinery, and propulsion systems. Concurrently, equipment manufacturers are responding by designing modular and low-maintenance solutions that meet operational needs in varying salinity, water depth, and current conditions. However, inland terminals and river ports increasingly require scalable systems that can operate in constrained spaces while maintaining efficiency. As a result, this shift is opening opportunities for both domestic OEMs and foreign suppliers entering through joint ventures or technical collaborations. Overall, the inland and coastal push is diversifying the product demand beyond deep-sea applications into smaller, high-volume utility systems.

To get more information on this market, Request Sample

Transition Toward Electrification and Hybrid Propulsion Systems

The marine equipment sector in India is gradually shifting toward energy-efficient and low-emission technologies, with a growing interest in electrified and hybrid propulsion systems. Ports and operators are actively seeking alternatives to diesel-driven systems, both to comply with evolving environmental standards and to reduce long-term fuel costs. Ferries, patrol boats, and workboats used in coastal and inland applications are emerging as early adopters of battery-powered or hybrid-electric propulsion. For instance, Jawaharlal Nehru Port Authority (JNPA) announced electric ferry services between Mumbai and JNP commencing January 2025. The ferries operate under the Harit Sagar initiative, ensuring zero-emission travel, air-conditioned seating, shorter journey time, and uninterrupted service throughout the year, with ticketing managed through a convenient online system. Additionally, equipment manufacturers are introducing electric winches, motors, and auxiliary systems designed for reduced noise, lower emissions, and minimal maintenance. Shore power infrastructure, which allows vessels to plug into the grid while docked, is also gaining relevance at modernized ports. Furthermore, Indian shipyards and component suppliers are now exploring opportunities in electrical integration and battery management systems, positioning themselves for long-term competitiveness in a market increasingly aligned with global decarbonization goals.

India Marine Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on equipment type, application, and end-user.

Equipment Type Insights:

- Marine Engines

- Marine Electronics

- Marine Deck Machinery

- Navigation Systems

- Communication Systems

- Safety and Rescue Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes marine engines, marine electronics, marine deck machinery, navigation systems, communication systems, safety and rescue equipment, and others.

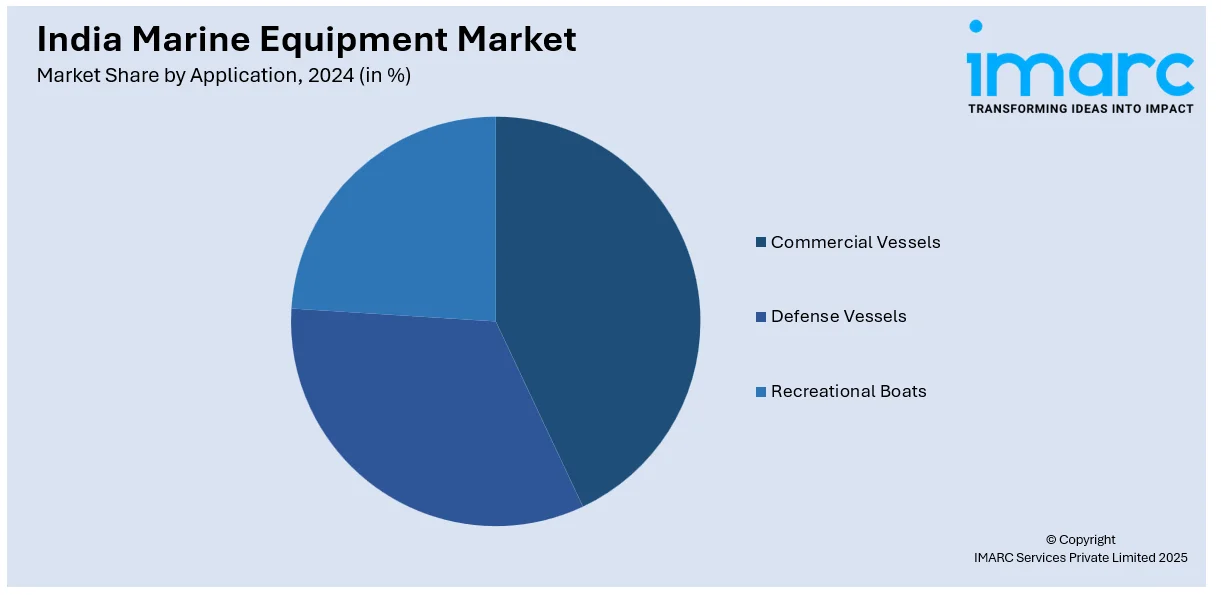

Application Insights:

- Commercial Vessels

- Defense Vessels

- Recreational Boats

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial vessels, defense vessels, and recreational boats.

End-User Insights:

- Shipbuilding Companies

- Shipping Companies

- Naval Forces

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes shipbuilding companies, shipping companies, naval forces, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Marine Equipment Market News:

- In November 2024, India and the UK announced a framework agreement to jointly develop electric propulsion systems for large naval ships. This initiative aims to power future Landing Platform Docks built in Indian shipyards, enhancing energy efficiency and strengthening naval capabilities.

India Marine Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Marine Engines, Marine Electronics, Marine Deck Machinery, Navigation Systems, Communication Systems, Safety and Rescue Equipment, Others |

| Applications Covered | Commercial Vessels, Defense Vessels, Recreational Boats |

| End-Users Covered | Shipbuilding Companies, Shipping Companies, Naval Forces, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India marine equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India marine equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India marine equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The marine equipment market in India was valued at USD 771.10 Million in 2024.

The India marine equipment market is projected to exhibit a CAGR of 4.80% during 2025-2033, reaching a value of USD 1,227.70 Million by 2033.

The market is advancing with increased investment in port infrastructure, inland waterways, and defense modernization. Additionally, demand is rising for energy-efficient systems, locally manufactured components, and digital technologies, as operators prioritize operational efficiency, regulatory compliance, and reduced reliance on imported machinery and propulsion solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)