Mexico Footwear Market Report by Product (Non-Athletic Footwear, Athletic Footwear), Material (Rubber, Leather, Plastic, Fabric, and Others),Distribution Channel (Footwear Specialists, Supermarkets and Hypermarkets, Departmental Stores, Clothing Stores, Online Sales, and Others), Pricing (Premium, Mass), End User (Men, Women, Kids), and Region 2025-2033

Mexico Footwear Market Size, Share & Analysis

Mexico footwear market size reached USD 3.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.2 Billion by 2033, exhibiting a growth rate (CAGR) of 3.2% during 2025-2033. The widespread adoption of advanced technologies by key players to introduce innovative designs that offer more comfort to individuals is primarily propelling the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Market Growth Rate (2025-2033) | 3.2% |

Mexico Footwear Market Insights:

- Major Market Drivers: Urbanization, increasing disposable income, and boosted youth population are driving shoe purchases in Mexico. Athletic, fashion, and comfort shoes demand is amplifying with the rise of health awareness and social media and celebrity endorsement influence.

- Key Market Trends: Sustainable manufacturing, online-first selling strategies, and athleisure growth are major Mexico footwear market trends. Customization, influencer partnerships, and hybrid footwear (sport-casual) demand are also influencing consumer tastes and product development through retail channels.

- Competitive Landscape: The Mexico footwear market boasts high competition from international players, local producers, and upstart D2C brands. Global players lead in branding, but local companies establish a foothold through affordability, sustainability, and local cultural relevance. E-commerce is making the competitive landscape more balanced.

- Challenges and Opportunities: Major challenges are fake products, increased input prices, and uneven distribution in rural areas. Threats are sustainable production, penetrating untapped semi-urban markets, exploiting artificial intelligence (AI) for personalization, and amplifying omni-channel capacities to increase customer reach and loyalty.

Footwear serves the dual purpose of offering comfort and safeguarding the feet. This category encompasses an array of items like shoes, boots, sandals, slippers, etc., crafted from diverse materials, such as wood, canvas, leather, jute, plastics, rubber, etc. Its primary function is to protect the feet and provide support during activities like walking or engaging in various tasks. Additionally, footwear has evolved into a fashion accessory, allowing individuals to express their personal style. Tailored designs cater to specific activities, be it athletic endeavors like running or hiking, or daily activities such as work. Available commercially in a wide range of shapes, sizes, and colors, footwear can also be personalized with text, logos, and prints. Notably, it is designed to be environmentally friendly, easily decomposing and avoiding contributions to landfill waste or water pollution.

Mexico Footwear Market Trends:

Rise of Eco-Friendly and Ethical Footwear

The footwear market in Mexico is experiencing a significant transition as consumers increasingly demand products that are aligned with environmental and social concerns. Brands are moving in this direction by using recycled materials, biodegradable materials, and green-based manufacturing practices. This shift is redefining the Mexico footwear market size, especially as sustainability moves from being a niche market to becoming a common expectation. Ethical sourcing and openness are also emerging as major purchasing drivers, particularly among urban and youth audiences. Brands are also embracing circularity, for instance, take-back initiatives and returnable packaging, to support their sustainability pledges. The heightening availability of sustainable products is also driving design, promotion, and retail plans across price segments. As this category matures, it will be instrumental in influencing forthcoming collections and customer interaction initiatives. Furthermore, the intensifying focus on sustainability is expected to consolidate long-term market opportunities and make a huge contribution to the changing Mexico footwear market forecast.

Growth of Sports and Athletic Footwear Segments

Health-conscious lifestyles and sporting leisure activities are taking center stage in encouraging the growth, especially in the athletic footwear segment. Consumers are turning towards high-performance footwear for running, fitness in gyms, and sporting activities outdoors. With increasing demand, companies are introducing high-technology designs with breathable materials, cushioned insoles, and ergonomic build. This trend growth has also supported Mexico footwear market share, mainly among young professionals and active buyers. Online and mobile are further driving this growth by improving accessibility and facilitating customized experiences. In addition, influencer marketing and celebrity endorsement are further motivating product visibility and aspirational value. Sport shoes are not only meeting functional requirements but are also becoming a part of casual wear, combining comfort and wearability. All these trends are likely to play a pivotal role in the Mexico footwear market analysis, supporting the significance of innovation and performance in helping the sector sustain its competitive edge.

Shift towards Casual and Versatile Footwear Styles

Shifts in lifestyle, office settings, and fashion choices are contributing to the amplifying demand for casual and versatile footwear in the Mexico market. Buyers now prefer footwear that is both stylish and comfortable, including loafers, slip-ons, and brand sneakers, acceptable in a range of everyday environments. For instance, in March of 2025, Onitsuka Tiger launched the MEXICO 66 TGRS, a Mary Jane-inspired reimagining of its original shape, blending elegant ballet style with sneaker usability, comfort, and practical everyday wearability. Moreover, this transformation is remaking the character of Mexico footwear market demand, as consumers want shoes that go hand-in-hand with hybrid work patterns and changing social habits. It is being driven by millennials and Gen Z consumers, fueled by digital media, fashion influencers, and international streetwear styles. As a response, brands are broadening their casual lines, improving material quality, and launching limited-edition collections that reflect changing seasonal trends. Retailers also refine omnichannel experiences to provide convenience and personalization. Since this segment continues to grow, it will redefine footwear standards and act as a pillar for long-term brand strategies, the larger Mexico footwear market trends believe.

Mexico Footwear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, material, distribution channel, pricing, and end user.

Product Insights:

- Non-Athletic Footwear

- Athletic Footwear

The report has provided a detailed breakup and analysis of the market based on the product. This includes non-athletic footwear and athletic footwear.

Material Insights:

- Rubber

- Leather

- Plastic

- Fabric

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes rubber, leather, plastic, fabric, and others.

Distribution Channel Insights:

- Footwear Specialists

- Supermarkets and Hypermarkets

- Departmental Stores

- Clothing Stores

- Online Sales

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes footwear specialists, supermarkets and hypermarkets, departmental stores, clothing stores, online sales, and others.

Pricing Insights:

- Premium

- Mass

A detailed breakup and analysis of the market based on the pricing have also been provided in the report. This includes premium and mass.

End User Insights:

- Men

- Women

- Kids

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men, women, and kids.

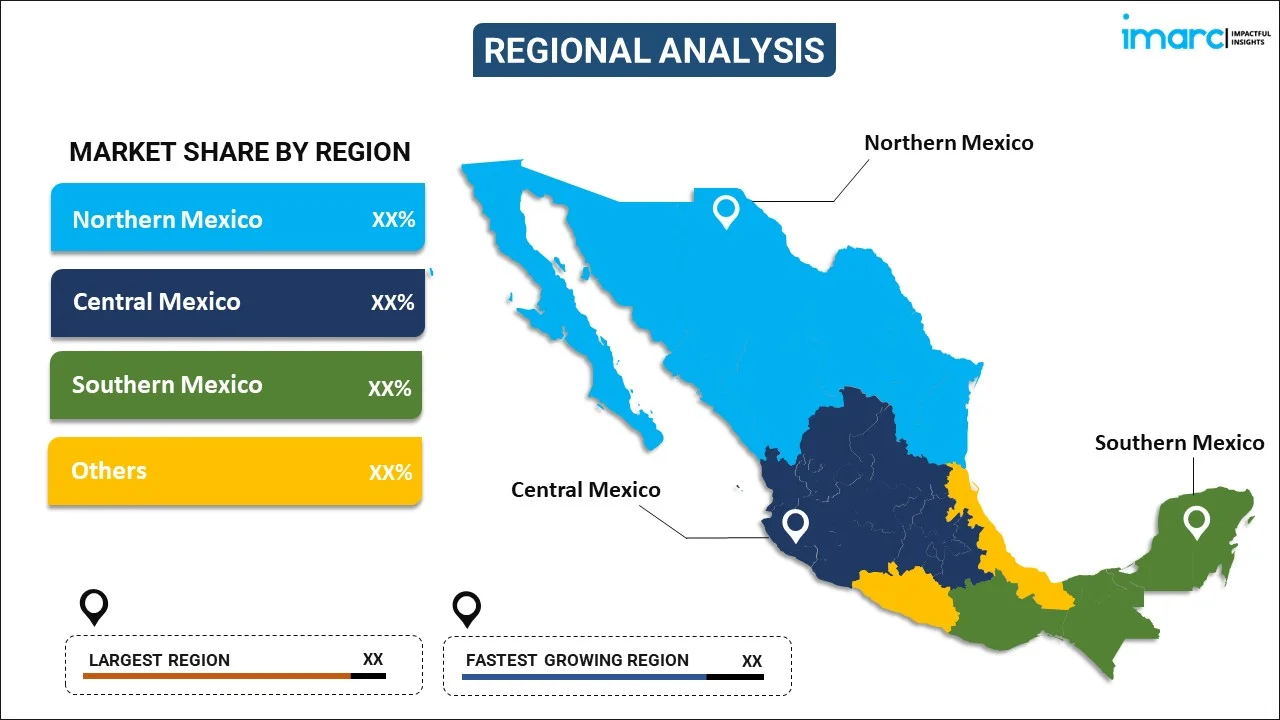

Regional Insights:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Mexico, Central Mexico, Southern Mexico, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In March 2025, Adidas released special-edition Samba "Mexico" to celebrate the Mexican National Football Team's 2025 Gold Cup uniform. Wearing a black and gold color scheme with mariachi-inspired trim and "México" monogramming, the shoe embodies national spirit and cultural identity. It debuted on March 14 at Foot Locker and adidas.com.

- In July 2025, Nike and Jordan Brand opened their Mexico City flagship store, a significant retail landmark in Latin America. The store opening saw the introduction of the Air Jordan V "El Grito," a culturally relevant sneaker celebrating Mexico's independence through heritage-driven design and modern streetwear inspiration.

Mexico Footwear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Non-Athletic Footwear, Athletic Footwear |

| Materials Covered | Rubber, Leather, Plastic, Fabric, Others |

| Distribution Channels Covered | Footwear Specialists, Supermarkets and Hypermarkets, Departmental Stores, Clothing Stores, Online Sales, Others |

| Pricings Covered | Premium, Mass |

| End Users Covered | Men, Women, Kids |

| Regions Covered | Northern Mexico, Central Mexico, Southern Mexico, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Mexico footwear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Mexico footwear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Mexico footwear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The footwear market in the Mexico was valued at USD 3.8 Billion in 2024.

The Mexico footwear market is projected to exhibit a CAGR of 3.2% during 2025-2033, reaching a value of USD 5.2 Billion by 2033.

Key factors driving Mexico’s footwear market include urbanization, growing youth population, expanding middle class, increased demand for casual and sports footwear, influence of global fashion trends, and the rise of online retail and promotional campaigns by local and international brands.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)