Russia E-commerce Market Size, Share, Trends and Forecast by Type, Transaction, and Region, 2025-2033

Russia E-commerce Market Size and Share:

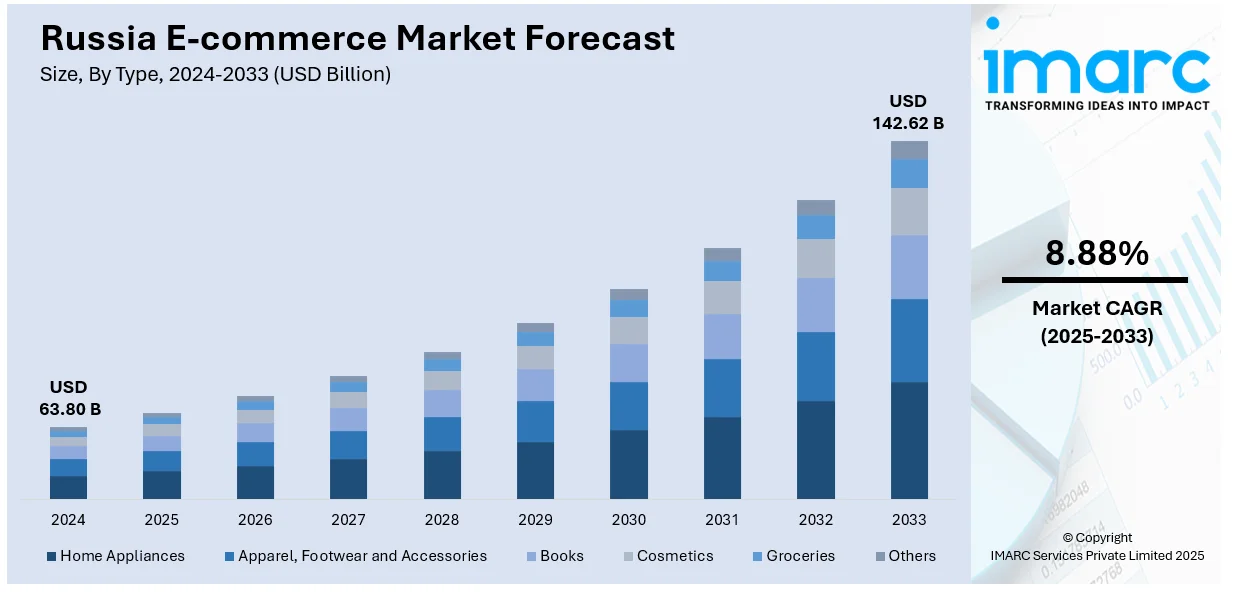

The Russia e-commerce market size was valued at USD 63.80 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 142.62 Billion by 2033, exhibiting a CAGR of 8.88% from 2025-2033. The market is driven by universal internet penetration, smartphone penetration, and enhanced digital payment infrastructure. Enhanced logistics and boosting digital literacy are also driving consumer shift to online shopping. Consumers enjoy quicker delivery, greater access to products, and smooth mobile experiences. Social media influence and targeted digital advertising are also strong enablers. driving the strong growth of the Russia e-commerce market share, both domestically and internationally.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 63.80 Billion |

| Market Forecast in 2033 | USD 142.62 Billion |

| Market Growth Rate 2025-2033 | 8.88% |

The Russia online shopping market has experienced significant growth fueled by rising internet penetration, growing smartphone use, and improving consumer comfort with online platforms. Through recent years, a considerable percentage of the population has accessed high-speed internet, facilitating effortless online browsing and payments. The increase in low-cost smartphones has also helped facilitate mobile commerce, with shoppers in both urban and rural areas increasingly using mobile apps to shop online. In addition, a shift in consumer behavior driven by generation, most notably among the younger crowd has created more familiarity with digital transactions, from discovery of the product to payment and tracking of delivery. E-commerce has also gained from the cultural shift towards digital payment systems, which are being taken up at a faster pace because of their convenience and security aspects. For example, in July 2024, online platform Qifa ventured into facilitating Russia-China bilateral trade, settling payment concerns and projecting \\$350 billion yearly trade by 2028 with B2B digital trade growing ten times over. Furthermore, as consumers increasingly demand convenience, they are turning to online shopping channels that offer flexible delivery terms and a wider variety of products than is usually found in brick-and-mortar stores.

Moreover, developing logistics infrastructure and government-supported digital programs have been important factors in consolidating Russia's e-commerce sector. For instance, in May 2023, Russian e-commerce company Wildberries opened a 3.5MW, 16,000 sqm Moscow data center with direct free-cooling technology and a 1.2 billion rubles investment to fuel its operations. Moreover, warehousing investment, delivery networks, and last-mile connectivity have resulted in reduced shipping times and enhanced service reliability. These improvements have facilitated easier access to customers by retailers throughout the country, including rural regions that were not previously easily served efficiently. Growing sales of online stores and expansion into new categories have further fueled consumer interest, providing buyers access to everyday needs as well as high-end electronics. Integration into social media platforms and custom-tailored advertising have also powered market growth as consumers become ever more affected by digital content, reviews, and influencer suggestion. Furthermore, the application of machine learning and artificial intelligence (AI) for customer care and inventory control has increased user experience, encouraging confidence and repeat purchases. All of these drivers for the market in aggregate sustain Russia's long-term growth of e-commerce and depict a larger retail digitalization trend.

Russia E-commerce Market Trends:

Expansion of Online Payment Solutions

The expansion of online payment solutions in Russia is playing a crucial role in propelling the market growth. For instance, 57% of Russians owned a debit card, and 20.08% had a credit card. Traditional payment methods like cash on delivery (COD) are getting replaced by more secure and convenient digital payment options. The proliferation of digital wallets, online banking, and fintech innovations are also making it easier for people to complete online transactions confidently. Apart from this, companies are introducing secure and user-friendly payment gateways that cater to the local market's needs. Moreover, the integration of global payment solutions is enabling Russian e-commerce platforms to cater to international customers, enhancing cross-border trade. For instance, recently, five-nation BRICS group consisting of Brazil, Russia, India, China, and South Africa announced the plan of working together on creating a payment system on the basis of blockchain and digital technologies.

Increasing Internet Penetration and Digital Literacy

The rapid growth of internet penetration in Russia is significantly supporting Russia e-commerce market growth. According to reports, in 2024, Russia's internet penetration rate stood at 90.4 percent of the total population. With a large population having access to the internet, more consumers are turning to online platforms for shopping. The increase in digital literacy, particularly among younger demographics, has bolstered this trend. As internet infrastructure is improving, even remote regions are gaining access to online shopping, expanding the market's reach. Initiatives of governing agencies of the country to enhance digital connectivity and promote e-commerce adoption are further supporting the market growth. Additionally, the rise in mobile internet usage has made online shopping more accessible, as consumers can shop anytime, anywhere. Mobile apps and responsive websites tailored for smartphones enhance user experience, encouraging frequent online transactions. This widespread internet availability and growing digital proficiency among Russians provide a robust foundation for the continued expansion of the e-commerce sector. In 2024, Russia announced its plan to launch Starlink-style internet network. The network access will be presented by operators of new satellite systems in non-geostationary orbit, enabling private users or a transport company to purchase a transmitter-receiver that will connect them to the internet after installing it in a vehicle or an aircraft.

Rising Number of Companies Opening Their E-Commerce Websites

With the rising availability of various products like gadgets, clothes, groceries, and household items online, people are preferring to shop via e-commerce platforms rather than visiting brick-and-mortar stores. Additionally, detailed descriptions and reviews of products present on these platforms are assisting buyers in making informed purchasing decisions. Thus, the increasing preference for online shopping among the masses is encouraging more companies to open their e-commerce website to connect with their customers and increase their sales. They are also relying on advanced technologies like artificial intelligence (AI), big data analytics, and cloud computing for offering personalized shopping experiences and optimizing their operations. According to Artem Sokolov, the chairman of the Association of Internet Trade Companies (AKIT), the e-commerce turnover in Russia might increase by 25 to 30% in 2023, hitting 63-66 Trillion rubles.

Russia E-commerce Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Russia e-commerce market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type and transaction.

Analysis by Type:

- Home Appliances

- Apparel, Footwear and Accessories

- Books

- Cosmetics

- Groceries

- Others

In 2024, the apparel, footwear, and accessories category dominated Russia's e-commerce product categories at 24.3% share of online retail sales. Behind this leadership are increasing consumer inclination towards digital fashion experiences, virtual try-on solutions, tailored product recommendations, and easy return experiences. The segment also benefits maximally from mobile-first browsing activities and high interest through influencer marketing and social media. Younger shoppers, especially in cities, have high style consciousness and prefer convenience, wide product variety, and seasonal designs. Moreover, online stores have bolstered their competitiveness by providing size guide tools, expedited shipping, and promotional offers based on customer choice. The product category has continued to be robust during economic upswings and downturns, with consistent demand bolstered by improvements in user interface design and logistics. The growing convergence of omnichannel retailing approaches, including online-to-offline shopping, further accentuates apparel's visibility in the Russian digital retail environment.

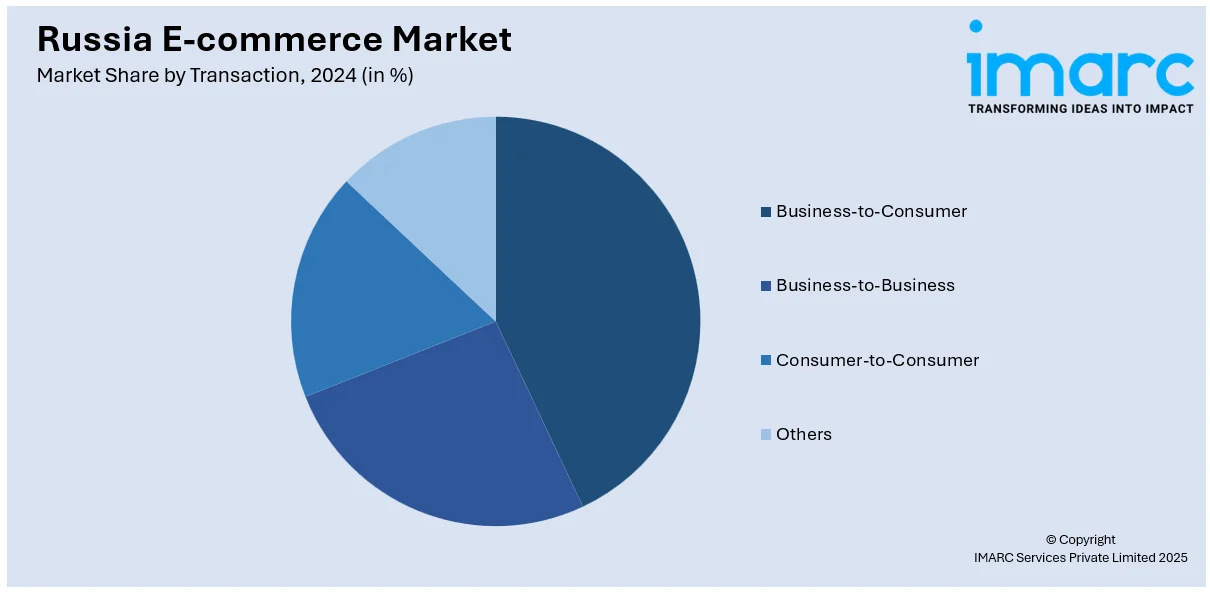

Analysis by Transaction:

- Business-to-Consumer

- Business-to-Business

- Consumer-to-Consumer

- Others

The Business-to-Consumer (B2C) model of transaction continues to be the core support structure of Russia's e-commerce market in 2024, still driving most of the online sale activity. As percentage share figures are not given, B2C transactions prevail as they are easily accessible and have the broad coverage of online portals serving directly at the end-consumer level. Both large domestic retailers and global brands have taken advantage of customer demand for convenience, low prices, and wide product offerings. Mobile-optimized interfaces, secure digital payment infrastructures, and fast delivery systems have enabled B2C growth, which has increased customer trust and transaction volumes. Additionally, targeted marketing, loyalty programs, and interactive customer service have improved the consumer experience, driving repeat purchases. With continued investment in last-mile delivery, AI-powered recommendations, and localized language capabilities, B2C e-commerce continues to lead traditional retail formats as the channel of choice for Russian consumers across a range of demographic groups.

Regional Analysis:

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

In 2024, the Central Federal District, which includes the capital Moscow, held the biggest slice of Russia's e-commerce market at 40.0%. The district’s strong internet penetration developed digital infrastructure, and number of tech-enabled, urbanized consumers explain its top spot. The region's positive socio-economic characteristics, such as increased average incomes and developed logistics networks, lead to strong online buying behavior in all categories. Top online retailers have forged robust operating operations in Moscow, providing deep inventory availability, same-day delivery and integrated customer services. The neighborhood is also at the forefront of digital innovation with retailers launching numerous pilot programs around personalized shopping, AI-powered analysis, and multi-channel fulfillment in the district regularly. Shopping patterns in the Central District also see early adoption in consumer behavior as there is significant mobile commerce propensity and secure payments digitally. Its sustained dominance reinforces the region's strategic significance in determining the wider direction of Russia e-commerce market forecast.

Competitive Landscape:

Russia e-commerce market outlook is highly competitive with a spread of players ranging across various sectors and products offered. Online sellers range across industries, from clothes and electronics to home appliances and groceries, satisfying consumer as well as business orders. The online market is spearheaded by widespread use of payment systems, smartphone-friendly websites, and enhanced shipping services, providing a better purchase experience. Established players still control the market through a wide range of products, low prices, and timely delivery options. New players are, however, entering the fray, offering innovative solutions in niche segments, custom services, and quicker delivery. Digital marketplaces, local vendors, and B2B platforms are also bringing about increased competition, coupled with higher consumer demands for convenience and affordability. As digital infrastructure keeps getting better, the stage is likely to become more vibrant, with business houses competing in terms of market share through differential offerings and rich customer experiences.

The report provides a comprehensive analysis of the competitive landscape in the Russia e-commerce market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Russia's Wildberries launched the 'Star Program' to attract Chinese entrepreneurs after completing brand registration in China, expanding its e-commerce outreach. The initiative offered commission discounts, traffic boosts, and shipping support, drawing 2,000 attendees and strengthening Wildberries' position in the Russian e-commerce market.

- April 2025: Russia and Belarus announced the launch of a joint e-commerce platform for jewellery exports, targeting China, the UAE, Vietnam, and Southeast Asia. The initiative had included hallmark recognition, digital traceability, and engagement with the Kimberley Process, with support from the Eurasian Development Bank.

- April 2025: Russia’s e-commerce giant Wildberries expanded into Tajikistan, marking its fourth Central Asian market and ninth overall. The company launched full-scale online operations with deliveries via Wildberries.tj and local pick-up points in Dushanbe and Khujand.

- April 2025: Russia’s state-owned Rosselkhozbank acquired a 50% stake in e-commerce platform Avito from Kismet Capital Group, marking a strategic shift in Russia’s digital economy toward greater state control. The acquisition followed Ivan Tavrin’s 2022 purchase of Avito and was reported to involve credit elements from the bank, while no immediate management changes were planned.

- April 2025: PeckaDesign launched a new e-commerce platform for Super zoo, enhancing the Plaček Group’s pet retail network across Central Europe. The move, indirectly impacting Russian e-commerce trends through regional competition and tech adoption, reinforced cross-border digital retail momentum.

Russia E-commerce Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Home Appliances, Apparel, Footwear and Accessories, Books, Cosmetics, Groceries, Others |

| Transactions Covered | Business-to-Consumer, Business-to-Business, Consumer-to-Consumer, Others |

| Regions Covered | Central District, Volga District, Urals District, Northwestern District, Siberian District, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Russia e-commerce market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Russia e-commerce market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Russia e-commerce market industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The e-commerce market in the Russia was valued at USD 63.80 Billion in 2024.

The Russia e-commerce market is projected to exhibit a CAGR of 8.88% during 2025-2033, reaching a value of USD 142.62 Billion by 2033.

The major drivers for the Russia e-commerce market include growing internet penetration, extensive adoption of smartphones, growing use of digital payments, and the developing trend of convenience and cost-cutting online purchases. Furthermore, growth in logistics infrastructure, efficient delivery systems, and the growing popularity of digital platforms have additionally contributed to expanding the market.

The Central Federal District takes the biggest percentage of Russia's e-commerce market, at 40.0% in 2024. Its leadership is fueled by a high level of internet penetration, advanced infrastructure, concentrated urban consumers, and solid logistics capacity built around Moscow.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)