Saudi Arabia Fiber Optics Market Report by Cable Type (Single Mode, Multi-Mode), Optical Fiber Type (Glass, Plastics), Application (Telecom, Oil and Gas, Military and Aerospace, BFSI, Medical, Railway, and Others), and Region 2026-2034

Market Overview:

Saudi Arabia fiber optics market size reached USD 744.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,451.3 Million by 2034, exhibiting a growth rate (CAGR) of 7.70% during 2026-2034. The market is growing owing to increasing demand for high-speed connectivity, sustainability in network deployment, and the expansion of cloud computing. Advanced fiber technologies, smart telecom infrastructure, and increased private sector involvement, all aligning with Vision 2030’s digital transformation goals, are contributing to the Saudi Arabia fiber optics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 744.7 Million |

|

Market Forecast in 2034

|

USD 1,451.3 Million |

| Market Growth Rate2026-2034 | 7.70% |

Fiber optics is a technology that utilizes thin strands of glass or plastic to transmit data in the form of light pulses. These strands, called optical fibers, carry information over long distances at extremely high speeds. The key advantage of fiber optics lies in its ability to transmit large amounts of data over long distances with minimal signal loss and electromagnetic interference. In fiber optic communication, data is encoded into pulses of light, which are then sent through the optical fibers. The fibers use the principle of total internal reflection to keep the light within the core of the fiber, ensuring efficient transmission. This technology is widely used in telecommunications, internet communication, and networking systems. Fiber optics offer higher bandwidth and faster data transmission compared to traditional copper-based systems, making them crucial in supporting the increasing demand for high-speed and reliable communication in various industries.

Saudi Arabia Fiber Optics Market Trends:

Growing Demand for High-Speed Connectivity and Data Transmission

The fiber optics market in Saudi Arabia is witnessing significant growth driven by the rising demand for fast internet access and effective data transfer. With the Kingdom experiencing widespread digital transformation in multiple sectors, the need for dependable, low-latency, and high-capacity networks is growing. Fiber optics technology allows for enhanced performance over conventional communication systems, providing smooth data transmission and reliable connectivity. Companies, organizations, and individuals depend on cutting-edge broadband technologies to facilitate cloud computing, digital interactions, and online services, all of which demand significant bandwidth. The increasing reliance on data-heavy applications and linked devices is highlighting the necessity for high-speed network infrastructure. The strategic emphasis on enhancing national connectivity is strengthening the use of fiber-based networks as the foundation of Saudi Arabia’s digital framework. The rising reliance on quick, reliable, and expandable communication infrastructure is leading to ongoing investment and contributing to growth in the Kingdom’s developing fiber optics sector.

Increasing Focus on Sustainability and Energy Efficiency in Network Deployment

With environmental factors taking precedence in infrastructure design, fiber networks are preferred over conventional copper systems due to their enhanced energy efficiency and extended lifespan. The reduced energy usage of fiber optics is in line with the Kingdom’s sustainability goals and reinforces its dedication to adopting green technologies. Telecom companies and infrastructure suppliers are integrating sustainable practices in cable production, installation, and network upkeep to diminish carbon emissions. Moreover, the implementation of smart monitoring systems enables enhanced network management, reducing energy waste and operational expenses. These developments aid in establishing a more sustainable digital framework that can responsibly meet future technological requirements. The connection between fiber optics advancement and environmental efficiency objectives is supporting the Saudi Arabia’s wider dedication to sustainable development while providing lasting operational and economic advantages for the communications industry.

Rise of Cloud Computing and Data Center Infrastructure

With more businesses and public organizations utilizing cloud-based systems for storage, analysis, and operational management, the demand for dependable, high-speed, and low-latency connections is growing. Fiber optic networks act as the essential framework facilitating uninterrupted communication among data centers, cloud servers, and end users. IMARC Group’s estimated that Saudi Arabia's data center market hit USD 2.1 Billion in 2024, highlighting the swift digital transformation of enterprise environments and the growing need for strong connectivity. The combination of artificial intelligence (AI), big data analytics, and enterprise automation are catalyzing the demand for robust, high-capacity fiber networks. These systems facilitate real-time data processing, synchronization, and secure transmission throughout various sectors. The ongoing integration of cloud computing and fiber infrastructure is bolstering Saudi Arabia’s progress towards a wholly connected, efficient, and digitally empowered economy, in line with its long-term modernization objectives.

Saudi Arabia Fiber Optics Market Growth Drivers:

Deployment of Advanced Fiber Technologies and Shared Network Models

The rollout of advanced broadband technologies is improving connectivity performance, scalability, and service effectiveness throughout the nation. In 2025, Nokia revealed the launch of Saudi Arabia’s inaugural 25G PON-based neutral host network by ACES-NH, highlighting a major progress in high-capacity fiber infrastructure. This communal fiber optic network enables various service providers to function on a single infrastructure, offering lightning-speed, low-latency connections for diverse applications. The program advances Vision 2030 by fostering digital transformation, enhancing infrastructure efficiency, and reducing redundancy in network implementation. Embracing shared infrastructure models promotes collaboration, lowers operational expenses, and speeds up the deployment of broadband services across Saudi Arabia. These advancements highlight the Kingdom’s dedication to modernizing its telecommunications landscape and moving towards a completely integrated, high-performance digital economy.

Expansion of Smart Telecom Infrastructure

The governing body's dedication to creating a technologically sophisticated communication infrastructure is apparent through significant funding and licensing efforts. For instance, in 2025, the Communications, Space & Technology Commission (CST) revealed SR 1 billion investments and granted four new licenses at LEAP25 to boost the growth of intelligent telecom infrastructure throughout the Kingdom. Organizations such as Saudi Arabia Railways and SKYFive Arabia received licenses to improve fiber-optic networks and satellite communication systems that are non-terrestrial. These programs aim to enhance the fusion of ground and satellite connectivity, boost broadband accessibility, and assist the digital transformation goals outlined in Vision 2030. Through fostering involvement from the private sector and promoting technological advancements, such strategic initiatives are establishing a strong foundation for high-speed, resilient, and secure communication systems, elevating Saudi Arabia as a regional pioneer in the development of advanced fiber and telecom networks.

Increasing Private Sector Participation and Strategic Partnerships

The fiber optics market in Saudi Arabia is influenced by the growing involvement of private firms and the establishment of strategic alliances to improve national connectivity. Telecommunications companies, infrastructure builders, and tech firms are more frequently working together to enhance network reach, improve systems, and launch new broadband options. These collaborations promote sharing of knowledge, enhance the efficiency of project execution, and draw foreign investment into advanced communication technologies. The private sector contributes to infrastructure development by enhancing government efforts and speeding up fiber installation in urban, industrial, and residential areas. Partnerships between local and international firms are encouraging the exchange of technical know-how and the implementation of worldwide best practices in network management. This unified strategy is enhancing the overall competitiveness of the fiber optics sector while guaranteeing service variety and cost-effectiveness. The collaboration between public goals and private funding persists in driving notable growth, supporting Saudi Arabia’s aspiration of creating a top-tier digital communications infrastructure.

Saudi Arabia Fiber Optics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on cable type, optical fiber type, and application.

Cable Type Insights:

- Single Mode

- Multi-Mode

The report has provided a detailed breakup and analysis of the market based on the cable type. This includes single mode and multi-mode.

Optical Fiber Type Insights:

- Glass

- Plastics

A detailed breakup and analysis of the market based on the optical fiber type have also been provided in the report. This includes glass and plastics.

Application Insights:

- Telecom

- Oil and Gas

- Military and Aerospace

- BFSI

- Medical

- Railway

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes telecom, oil and gas, military and aerospace, BFSI, medical, railway, and others.

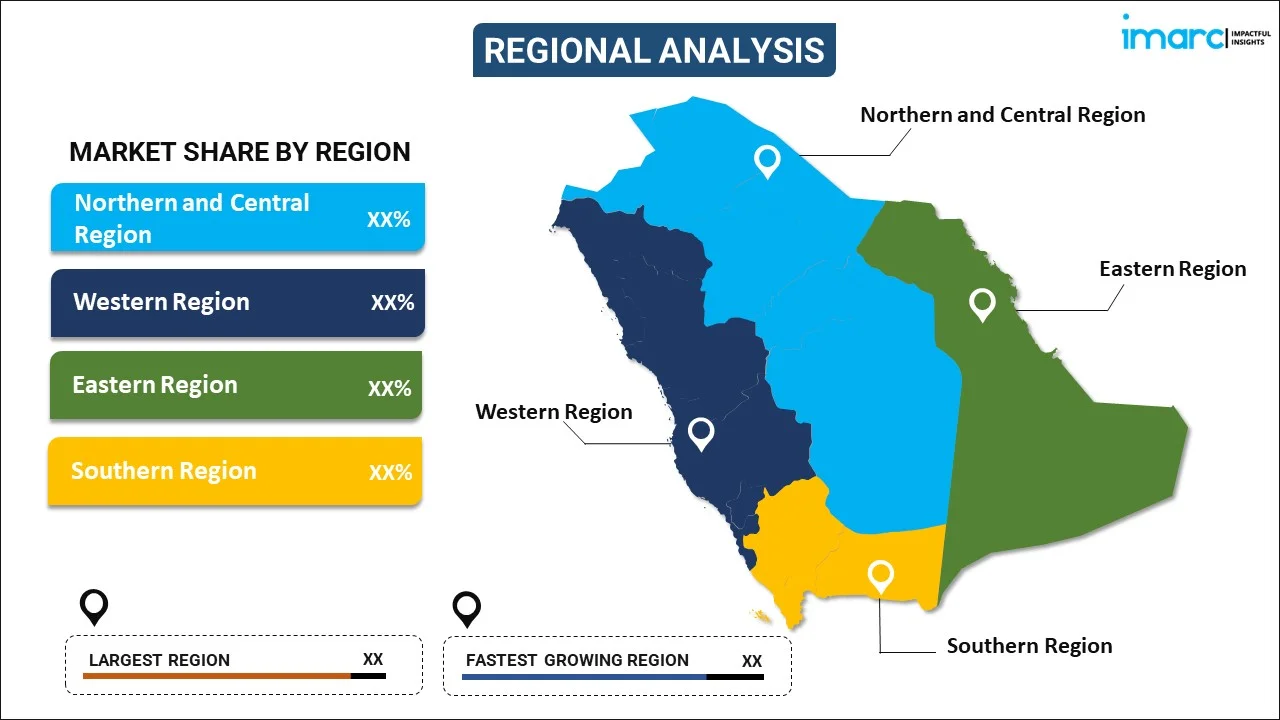

Regional Insights:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern and Central Region, Western Region, Eastern Region, Southern Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Saudi Arabia Fiber Optics Market News:

- July 2025: Rawasi Al-Bina signed a five-year agreement with Saudi Telecom Company (STC) to deploy external fiber optic networks across Saudi Arabia, supporting Vision 2030’s digital goals. The deal, expected to exceed 5% of Rawasi’s 2024 revenue, aims to enhance national digital infrastructure and broadband access. Implementation is anticipated to start in early 2026, boosting Saudi Arabia’s telecom backbone and digital economy.

- June 2025: stc group and Huawei launched the MENA region’s first live optical fiber sensing trial in Riyadh. The AI-powered system, tested over 50 km, achieved over 95% threat detection accuracy to enhance network security and reduce downtime. This innovation marks a major advancement in fiber optic cable monitoring.

- March 2025: stc Group and Ooredoo Oman announced the SONIC Project, a joint initiative to build a terrestrial fiber optic corridor between Saudi Arabia and Oman. Set for completion by 2026, the project aims to boost regional and international connectivity with redundant paths linking submarine cable landing stations and data centers. It supports subsea routes between Asia and Europe, enhancing digital infrastructure across the region.

Saudi Arabia Fiber Optics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Cable Types Covered | Single Mode, Multi-Mode |

| Optical Fiber Types Covered | Glass, Plastics |

| Applications Covered | Telecom, Oil and Gas, Military and Aerospace, BFSI, Medical, Railway, Others |

| Regions Covered | Northern and Central Region, Western Region, Eastern Region, Southern Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Saudi Arabia fiber optics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Saudi Arabia fiber optics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Saudi Arabia fiber optics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fiber optics market in Saudi Arabia was valued at USD 744.7 Million in 2025.

The Saudi Arabia fiber optics market is projected to exhibit a CAGR of 7.70% during 2026-2034, reaching a value of USD 1,451.3 Million by 2034.

The Saudi Arabia fiber optics market is driven by the growing demand for high-speed internet connectivity, expansion of digital infrastructure, and government initiatives promoting technological advancement. Rising adoption of cloud services, data centers, and smart city projects is further strengthening the market growth, supporting efficient communication networks and enhancing overall digital transformation across the Kingdom.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)