UK Health Insurance Market Report by Provider (Private Providers, Public Providers), Type (Life-Time Coverage, Term Insurance), Plan Type (Medical Insurance, Critical Illness Insurance, Family Floater Health Insurance, and Others), Demographics (Minor, Adults, Senior Citizen), Provider Type (Preferred Provider Organizations (PPOs), Point of Service (POS), Health Maintenance Organizations (HMOs), Exclusive Provider Organizations (EPOs)), and Region 2025-2033

UK Health Insurance Market Summary:

UK health insurance market size reached USD 64.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 96.1 Billion by 2033, exhibiting a growth rate (CAGR) of 4.57% during 2025-2033. This growth is driven by 14% of adults (7.6 million) holding private medical insurance and healthcare cash plans increasing to 5.1 million holders. NHS pressures, rising healthcare costs, and growing awareness of private options also contribute significantly. Additionally, factors such as an aging population, mental health focus, employer-sponsored health benefits, and technological advancements support market expansion, especially as NHS waiting lists surged to 7.42 million in March 2025.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 64.3 Billion |

| Market Forecast in 2033 | USD 96.1 Billion |

| Market Growth Rate 2025-2033 | 4.57% |

Health insurance is a financial agreement designed to offer individuals and families protection against medical expenses. It operates as a contractual arrangement between an individual (known as the policyholder) and either an insurance company or a healthcare provider. In return for regular premium payments, the insurance company commits to covering a portion or the entirety of the policyholder's eligible medical costs, contingent on the terms and conditions outlined in the policy. The policy explicitly outlines the medical services and expenses that fall under coverage, encompassing various aspects such as doctor's visits, hospitalization, prescription medications, preventive care, surgeries, and more. Depending on the policy in place, health insurance may also include provisions for dental and vision care, mental health services, and other healthcare necessities.

UK Health Insurance Market Trends:

Digitalization and Customer-Centricity

The UK health insurance market is rapidly evolving through digitalization, enhancing customer experiences with mobile apps and online platforms. These tools streamline policy management, claims processing, and improve communication between insurers and clients. This digital shift makes healthcare more accessible and efficient, encouraging greater engagement and loyalty. Insurers are also using digital channels to educate consumers and promote healthier behaviors, particularly in UK private healthcare and UK health and medical insurance. As customer expectations grow, a focus on digital innovation helps companies stand out in a competitive market, driving overall growth and improving service delivery.

Personalized Insurance Plans

Consumers increasingly demand insurance solutions tailored to their individual health conditions, lifestyles, and financial situations. Insurers are responding by utilizing data analytics to design flexible and customizable plans such as term insurance UK and death insurance UK products that meet diverse needs. Personalized products improve risk assessment and customer satisfaction, creating stronger client relationships. This approach attracts various demographic groups, from young professionals to seniors, allowing insurers to expand their offerings and better manage risks. The move toward bespoke insurance plans strengthens market competitiveness and supports sustainable growth in a dynamic healthcare environment.

Focus on Wellness Programs and Preventive Care

Wellness initiatives and preventive care are becoming integral to insurance offerings, encouraging healthier lifestyles and early disease detection. Insurers are incorporating programs such as fitness incentives, mental health support, and routine screenings to reduce long-term medical costs and improve policyholder health. These proactive strategies help mitigate risk for insurers while enhancing value for customers. Emphasizing wellness aligns with broader public health goals and fosters positive engagement between insurers and clients, contributing to improved healthcare outcomes and sustained market expansion within the UK life insurance market.

Integration of AI and Data Analytics

Artificial intelligence and data analytics are transforming underwriting, fraud detection, and claims management processes across the UK general insurance sector. Advanced algorithms enable precise risk profiling and personalized premium setting, increasing operational efficiency. AI-driven insights help insurers detect fraudulent claims faster and tailor products to customer needs, optimizing resources. This technological integration enhances customer service, reduces costs, and supports innovative product development. Embracing AI positions insurers to better anticipate market trends, manage risks effectively, and maintain a competitive edge in a rapidly evolving industry.

Growth of the Private Sector

Rising demand for private health services amid NHS pressures is driving growth in the UK’s private health insurance market, impacting overall UK health insurance market share. Employers increasingly offer health benefits as part of employee packages, while individuals seek faster access and broader treatment options. Government initiatives also support private sector expansion, encouraging innovation and improving service quality. This shift is contributing to a more diverse insurance landscape, increasing competition and consumer choice. The private sector’s rise plays a vital role in meeting evolving healthcare needs and fostering a more resilient insurance market.

UK Health Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country levels for 2025-2033. Our report has categorized the market based on provider, type, plan type, demographics, and provider type.

Provider Insights:

To get more information on this market, Request Sample

- Private Providers

- Public Providers

The report has provided a detailed breakup and analysis of the market based on the provider. This includes private providers and public providers.

Type Insights:

- Life-Time Coverage

- Term Insurance

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes life-time coverage and term insurance.

Plan Type Insights:

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the plan type. This includes medical insurance, critical illness insurance, family floater health insurance, and others.

Demographics Insights:

- Minor

- Adults

- Senior Citizen

A detailed breakup and analysis of the market based on the demographics have also been provided in the report. This includes minor, adults, and senior citizen.

Provider Type Insights:

- Preferred Provider Organizations (PPOs)

- Point of Service (POS)

- Health Maintenance Organizations (HMOs)

- Exclusive Provider Organizations (EPOs)

The report has provided a detailed breakup and analysis of the market based on the provider type. This includes preferred provider organizations (PPOs), point of service (POS), health maintenance organizations (HMOs), and exclusive provider organizations (EPOs).

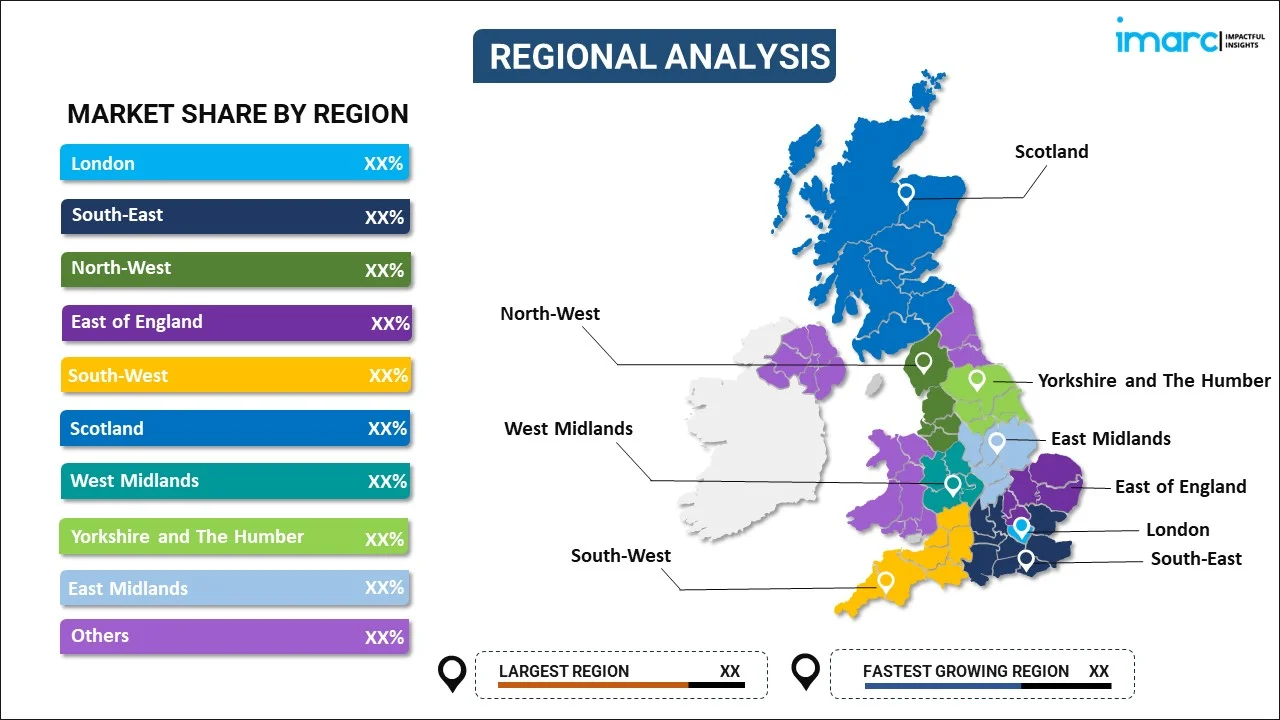

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Top UK Health Insurance Companies:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Health Insurance Market News:

- In July 2025, AXA Health reduced premiums by 20% for its Personal Health policy and 10% for its Health For You plan. The insurer emphasized no changes to product features, aiming to offer better value amid rising healthcare costs. The move, outside its usual review cycle, targets greater affordability in a competitive UK health insurance market.

- In May 2025, Bupa partnered with Lloyds Banking Group to offer Lloyds Premier account holders remote access to Bupa’s digital health services, including GP consultations, physiotherapy, and mental health support. The partnership enhances quick healthcare access for customers with incomes or assets over £100,000. Lloyds Premier also provides financial benefits such as cashback, mortgage discounts, savings bonuses, investment options, financial coaching, lifestyle perks, and fee-free global spending. Bupa aims to deliver over 1 million digital GP appointments in 2025, promoting faster treatment and improved health outcomes.

UK Health Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Providers Covered | Private Providers, Public Providers |

| Types Covered | Life-Time Coverage, Term Insurance |

| Plan Types Covered | Medical Insurance, Critical Illness Insurance, Family Floater Health Insurance, Others |

| Demographics Covered | Minor, Adults, Senior Citizen |

| Provider Types Covered | Preferred Provider Organizations (PPOs), Point of Service (POS), Health Maintenance Organizations (HMOs), Exclusive Provider Organizations (EPOs) |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK health insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK health insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK health insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UK health insurance market size reached USD 64.3 Billion in 2024.

The market is expected to reach USD 96.1 Billion by 2033, exhibiting a CAGR of 4.57% during 2025-2033.

Market trends include increasing demand for private healthcare, rising healthcare costs, NHS pressures, growing awareness of private insurance options, an aging population, focus on mental health, employer-sponsored health benefits, and technological advancements, including digital health solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)