UK Streaming Services Market Size, Share, Trends and Forecast by Content Type, Revenue Model, Streaming Platform, Vertical, and Region, 2025-2033

UK Streaming Services Market Overview:

The UK streaming services market size reached USD 3,548.01 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 22,153.49 Million by 2033, exhibiting a growth rate (CAGR) of 22.60% during 2025-2033. The UK streaming services market share is expanding, driven by the growing shift towards digital content, along with the rising number of social video, platforms that attract younger audiences and enhance engagement on streaming platforms.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,548.01 Million |

| Market Forecast in 2033 | USD 22,153.49 Million |

| Market Growth Rate 2025-2033 | 22.60% |

UK Streaming Services Market Trends:

Increasing Digital Media Usage

The rising adoption of digital media is offering a favorable UK streaming services market outlook. A report from the Office of Communication (Ofcom) showed that in 2023, people in the UK watched an average of 4 hours and 31 minutes of TV and video content at home each day. This was primarily due to a 12% increase in daily viewing of video-sharing platforms, which reached 49 minutes. In line with this, the use of broadcasters’ video-on-demand services, such as iPlayer and ITVX, grew by 29%, averaging 20 minutes per day. This change indicates a wider trend of using on-demand content, as audiences favor digital platforms for different types of media, such as entertainment and social interaction. This enhanced online accessibility is encouraging streaming services to improve their features, emphasizing intuitive interfaces and varied content collections. In addition to this, as individuals shift from television to online platforms, streaming services are reacting by funding original content and improving their offerings for mobile and smart devices. This is creating the need for mobile viewing by allowing people to watch their favorite shows and films anytime and anywhere. Streaming services are utilizing data analysis to tailor content suggestions, helping users find applicable materials swiftly, thereby enhancing overall contentment. Moreover, with binge-watching becoming more popular, platforms are providing a large volume of content simultaneously, attracting viewers who enjoy watching videos at their preferred speed.

Rising Number of Social Video Platforms

The increasing number of social video platforms is impelling the UK streaming services market growth, especially among younger audiences. As per the latest viewing trends published by the Office of Communication (Ofcom), about 5.2 Million 15-24-year-olds in the UK spent an average of 58 minutes daily on TikTok in 2023. The rise of these platforms signifies a major change in audience engagement with media, favoring shorter and more dynamic content instead of conventional long-form content. This trend is encouraging streaming services to adjust by creating captivating and concise formats that appeal to shorter attention spans, enabling them to attract this audience. The increasing interest in interactive experiences among audiences is creating the need for engagement and interactivity in streaming applications. Consequently, businesses are integrating live chats, polls, and user-generated content (UGC) to improve the viewing experience, creating a more interactive environment. This innovation motivates users to engage and take part rather than just watching content passively, promoting a sense of community and enhancing their overall enjoyment. Additionally, the influence of social media personalities is altering the kinds of content favored by younger viewers. Streaming platforms are addressing the demand for partnerships with influencers and the incorporation of UGC, attracting younger audiences and broadening their content libraries in the industry.

UK Streaming Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on content type, revenue model, streaming platform, and vertical.

Content Type Insights:

- Music Streaming

- Video Streaming

The report has provided a detailed breakup and analysis of the market based on the content types. This includes music streaming and video streaming.

Revenue Model Insights:

- Advertising

- Subscription

A detailed breakup and analysis of the market based on the revenue models have also been provided in the report. This includes advertising and subscription.

Streaming Platform Insights:

- Smartphone and Tablet

- Laptop

- Smart TV

- Others

The report has provided a detailed breakup and analysis of the market based on the streaming platforms. This includes smartphone and tablet, laptop, smart tv, and others.

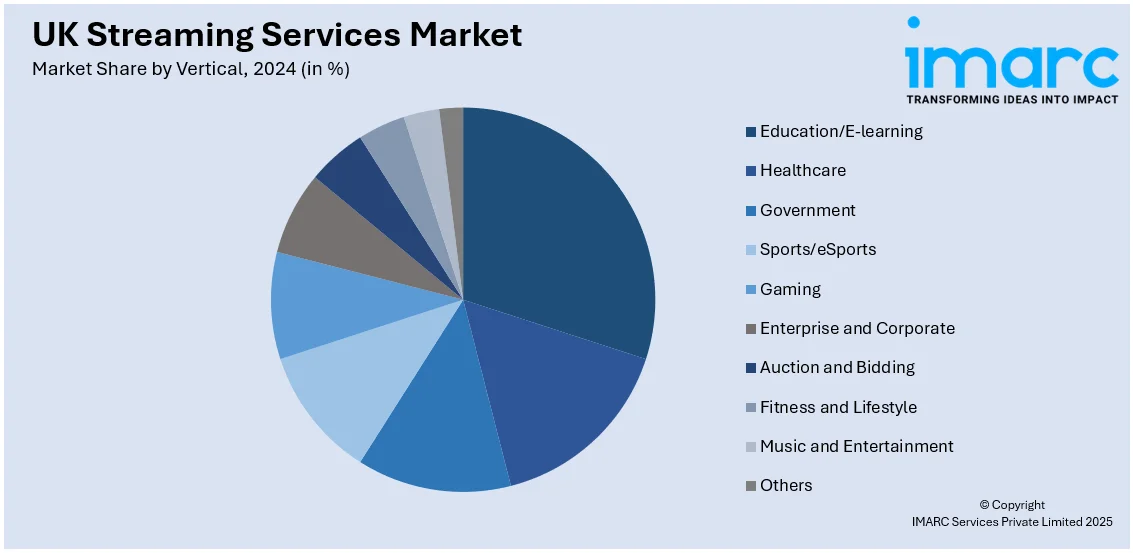

Vertical Insights:

- Education/E-learning

- Healthcare

- Government

- Sports/eSports

- Gaming

- Enterprise and Corporate

- Auction and Bidding

- Fitness and Lifestyle

- Music and Entertainment

- Others

A detailed breakup and analysis of the market based on the verticals have also been provided in the report. This includes education/e-learning, healthcare, government, sports/esports, gaming, enterprise and corporate, auction and bidding, fitness and lifestyle, music and entertainment, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Streaming Services Market News:

- In July 2024, Tubi, the free ad-supported streaming service, announced its release in the UK, broadening its catalog of movies and TV episodes on all top CTV platforms, mobile apps, and web browsers.

- In April 2024, The UK's public service broadcasters, including the ITV, Channel 4, BBC, and Channel 5, unveiled Freely, a combined streaming platform offering access to live television channels and on-demand material from top broadcasters.

UK Streaming Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Content Types Covered | Music Streaming, Video Streaming |

| Revenue Models Covered | Advertising, Subscription |

| Streaming Platforms Covered | Smartphone and Tablet, Laptop, Smart TV, Others |

| Verticals Covered | Education/E-learning, Healthcare, Government, Sports/eSports, Gaming, Enterprise and Corporate, Auction and Bidding, Fitness and Lifestyle, Music and Entertainment, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK streaming services market performed so far and how will it perform in the coming years?

- What is the breakup of the UK streaming services market on the basis of content type?

- What is the breakup of the UK streaming services market on the basis of revenue model?

- What is the breakup of the UK streaming services market on the basis of streaming platform?

- What is the breakup of the UK streaming services market on the basis of vertical?

- What are the various stages in the value chain of the UK streaming services market?

- What are the key driving factors and challenges in the UK streaming services?

- What is the structure of the UK streaming services market and who are the key players?

- What is the degree of competition in the UK streaming services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK streaming services market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK streaming services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK streaming services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)