United States Population Health Management Market Size, Share, Trends and Forecast by Component, Mode of Delivery, End User, and Region, 2026-2034

United States Population Health Management Market Size and Share:

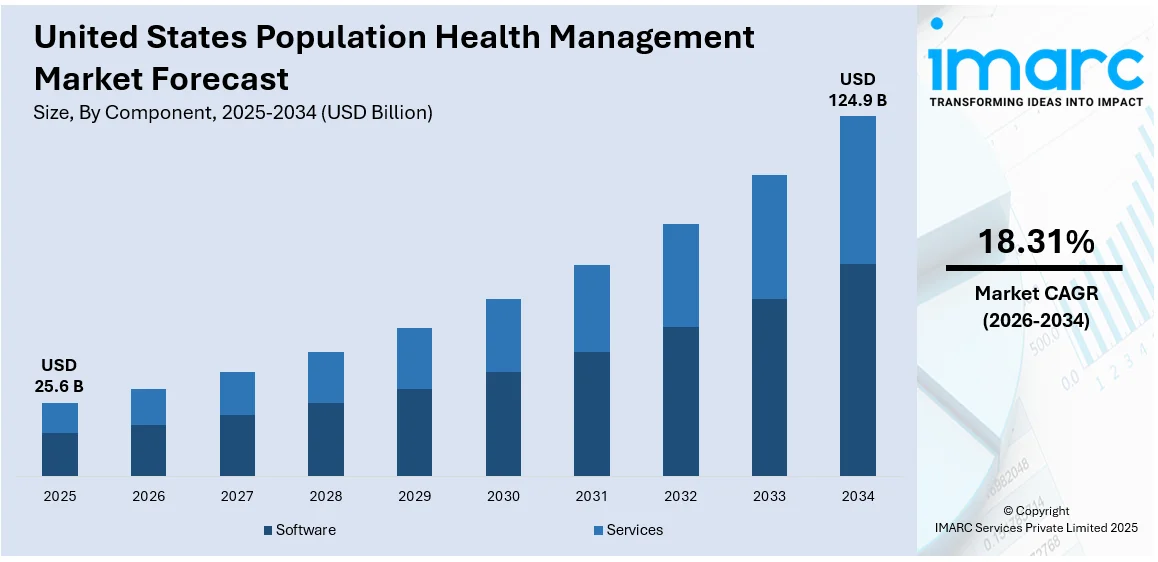

The United States population health management market size was valued at USD 25.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 124.9 Billion by 2034, exhibiting a CAGR of 18.31% from 2026-2034. The market is primarily driven by the increasing focus on value-based care, which emphasizes improving patient outcomes while reducing costs. Rising chronic disease prevalence, aging demographics, and the growing adoption of advanced healthcare information technology (IT) solutions, such as data analytics, Electronic Health Record (EHR) integration, and predictive modeling, further fuel United States population health management market share. Additionally, government initiatives promoting preventive care, regulatory support, and the shift toward patient-centric care models are accelerating PHM adoption across hospitals, clinics, and payer organizations nationwide.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 25.6 Billion |

| Market Forecast in 2034 | USD 124.9 Billion |

| Market Growth Rate 2026-2034 | 18.31% |

The shift from fee-for-service to value-based care is a significant catalyst for PHM adoption. The healthcare provider's interest is now directed to patient outcomes and cost efficiency and the overall value of care provided, as opposed to service volume and profit. The PHM solution services allow providers to measure and track their population health metrics and identify who the high-risk patients are, as well as input individual interventions. PHM can also improve care coordination and decrease hospital readmissions, which is aligned with value-based reimbursement models, which is critical for healthcare organizations working towards quality targets and working toward reducing overall operational costs.

To get more information on this market Request Sample

The market for population health management (PHM) in the United States is mostly driven by the rising incidence of chronic diseases like diabetes, cardiovascular disorders (CVD), and obesity. In 2023, approximately 93% of older Medicare recipients had at least one chronic condition, highlighting the urgent need for continuous monitoring, timely interventions, and lifestyle management, which traditional healthcare delivery often struggles to provide. PHM platforms address these challenges by leveraging predictive analytics, risk stratification, and patient engagement tools to manage high-risk populations effectively. By enabling proactive care, reducing complications, and minimizing avoidable hospitalizations, PHM solutions help providers and payers improve healthcare outcomes and lower long-term costs.

United States Population Health Management Market Trends:

Shift Toward Value-Based Care:

The U.S. healthcare system is increasingly transitioning from fee-for-service models, which focus on service volume, to value-based care (VBC) models that reward improved patient outcomes and cost efficiency. This shift is a major United States population health management market trend for rising adoption, as providers and payers require tools to support preventive care, chronic disease management, and care coordination. PHM platforms facilitate comprehensive patient data integration, real-time analytics, and risk stratification, enabling organizations to identify high-risk populations and implement targeted interventions. Hospitals participating in programs such as the Hospital Readmissions Reduction Program (HRRP) have achieved a 1.3% annual decrease in 30-day readmission rates, demonstrating the effectiveness of VBC initiatives. By reducing readmissions, optimizing resource use, and improving overall population health, PHM systems help healthcare organizations meet value-based reimbursement incentives, achieve measurable quality outcomes, and lower operational costs nationwide.

Technological Advancements in Healthcare IT:

The growth of the U.S. PHM market is strongly fueled by advancements in healthcare information technology, including electronic health records (EHRs), predictive analytics, artificial intelligence (AI), and big data platforms. These technologies allow providers to collect, integrate, and analyze large volumes of patient data, enabling accurate risk stratification, trend prediction, and outcome measurement. Cloud-based PHM platforms and interoperability standards facilitate seamless data sharing among hospitals, payers, and clinics, improving care coordination. Additionally, mobile health applications and telehealth solutions enhance patient engagement and remote monitoring. These innovations enable proactive population health management, improve clinical decision-making, and support compliance with regulatory requirements. The continuous development of sophisticated, scalable, and user-friendly IT solutions accelerates the adoption of PHM across healthcare organizations, driving United States population health management market growth.

Rising Prevalence of Chronic Diseases:

Chronic diseases such as diabetes, cardiovascular conditions, obesity, and respiratory disorders are rapidly increasing in the U.S., placing a substantial burden on healthcare systems and escalating long-term costs. As of 2023, nearly 60% of American adults live with at least one chronic condition, and this number is projected to nearly double by 2050, underscoring the urgent need for effective management strategies. Population Health Management (PHM) solutions address this challenge by providing continuous patient monitoring, predictive analytics, and personalized care plans. Early detection of high-risk individuals enables medical professionals to provide prompt interventions, lower consequences, and save needless hospital stays. Patient engagement tools, including reminders, remote monitoring, and educational resources, empower individuals to proactively manage their health. Rising chronic disease prevalence makes PHM essential for improving outcomes, enhancing quality of life, and optimizing resource allocation across large populations.

United States Population Health Management Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States population health management market, along with forecast at the regional, and country levels from 2026-2034. The market has been categorized based on component, mode of delivery, and end user.

Analysis by Component:

- Software

- Services

Platforms for data integration, risk assessment, predictive analytics, and patient involvement are all included in PHM software. It enables healthcare providers to monitor population health, identify high-risk patients, and implement targeted interventions. Continuous updates and AI-driven tools enhance care coordination, improve clinical decision-making, and support value-based care initiatives efficiently.

Besides this, the PHM services encompass consulting, implementation, training, and managed support in the United States population health management market outlook. These services help healthcare organizations deploy PHM solutions, optimize workflows, ensure regulatory compliance, and maximize system utilization. By providing ongoing guidance and technical support, service offerings enable providers and payers to achieve better population health outcomes and improve operational efficiency across diverse healthcare settings.

Analysis by Mode of Delivery:

- Cloud-based

- Web-based

- On-premises

Cloud-based PHM solutions offer scalable, flexible, and remotely accessible platforms. They enable real-time data integration, analytics, and patient engagement across multiple sites. Reduced infrastructure costs, automatic updates, and enhanced interoperability make cloud deployment ideal for large healthcare networks seeking efficient, secure, and collaborative population health management.

Apart from this, the web-based PHM platforms provide access through standard web browsers without extensive local installation. They support real-time patient monitoring, reporting, and care coordination. These solutions are convenient for providers requiring quick deployment, cross-device accessibility, and centralized data management, facilitating timely interventions and streamlined population health oversight with minimal IT maintenance.

Furthermore, the On-premises PHM solutions are installed locally within an organization’s infrastructure, offering full control over data security and customization. They are preferred by healthcare providers with strict regulatory compliance needs or existing IT systems. On-premises deployment ensures data privacy and tailored integration but requires higher upfront investment and ongoing maintenance.

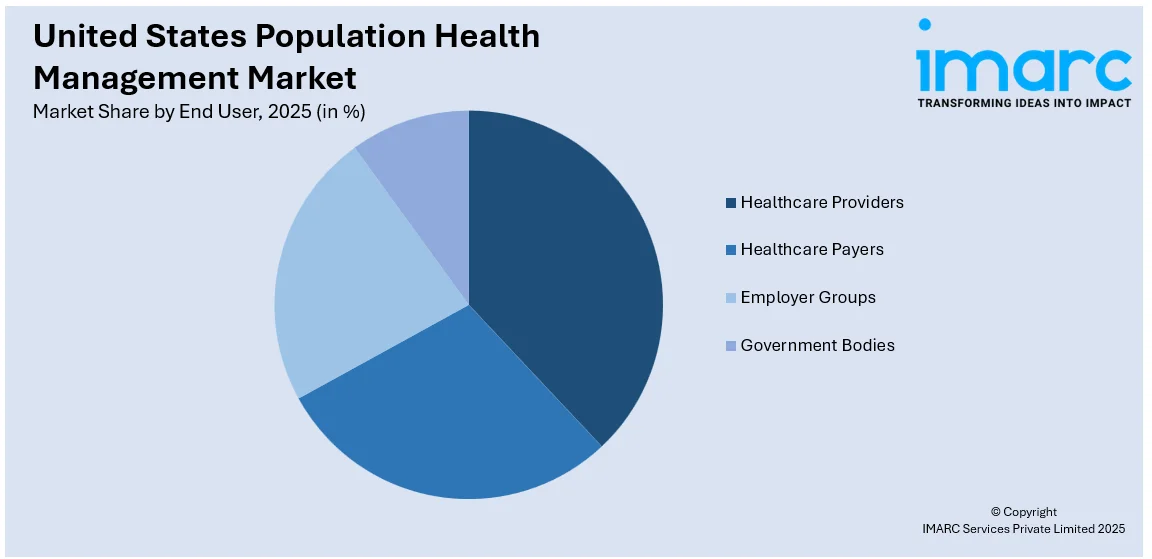

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Healthcare Providers

- Healthcare Payers

- Employer Groups

- Government Bodies

Healthcare Providers involves the hospitals, clinics, and physician groups, use PHM solutions to monitor patient populations, manage chronic diseases, and implement preventive care programs. These tools improve care coordination, reduce readmissions, and support value-based reimbursement models, enhancing clinical outcomes and operational efficiency across healthcare delivery systems.

Additionally, insurance companies and health plans leverage PHM platforms to analyze member data, assess risk, and design cost-effective care programs. By identifying high-risk populations and promoting preventive care, payers reduce healthcare expenditures, improve member health outcomes, and align with value-based reimbursement strategies.

Besides this, the employers utilize PHM solutions to support workforce wellness programs, monitor employee health trends, and reduce healthcare costs. By encouraging preventive care, chronic disease management, and health engagement initiatives, these tools enhance productivity, decrease absenteeism, and promote long-term employee well-being.

Furthermore, the government agencies deploy PHM platforms to manage public health programs, monitor population health metrics, and improve healthcare resource allocation. These tools facilitate preventive initiatives, chronic disease management, and regulatory compliance, enabling efficient public health planning and policy implementation.

Breakup by Region:

- Northeast

- Midwest

- South

- West

The Northeast region exhibits strong PHM adoption due to high hospital density, advanced healthcare infrastructure, and a focus on value-based care initiatives. Providers leverage PHM solutions to manage chronic diseases, improve care coordination, and optimize population health outcomes, supporting efficient resource utilization in this healthcare-intensive region.

Moreover, the Midwest, PHM growth is driven by a mix of urban and rural healthcare systems seeking cost-effective population health solutions. Providers and payers adopt PHM tools to enhance preventive care, reduce hospital readmissions, and manage chronic conditions, improving patient outcomes while addressing regional healthcare disparities.

Besides this, the Southern U.S. sees increasing PHM adoption due to high chronic disease prevalence, including obesity and diabetes. Healthcare organizations use PHM platforms to implement targeted interventions, monitor high-risk populations, and improve care coordination, aiming to reduce long-term healthcare costs and enhance population health outcomes.

Along with this, the Western region benefits from technologically advanced healthcare systems and high digital adoption rates. PHM solutions are widely implemented to integrate electronic health records, support predictive analytics, and facilitate patient engagement, enabling proactive population health management and improved clinical decision-making across diverse patient populations.

Competitive Landscape:

The competitive market is typified by deep innovation and technological diversification. Major players aim to build comprehensive, data-driven platforms that integrate predictive analytics, risk stratification, care coordination, and patient engagement tools. Competition in the market is about providing scalable solutions, enhancing interoperability with electronic health records, and making user-friendly interfaces for providers as well as patients. Strategic alliances, mergers, and affiliations with healthcare providers, payers, and technology vendors are the norm to grow service lines and customer bases. Further, focus on compliance with regulations, customizable solutions, and capabilities in advanced analytics helps differentiate the competition, encouraging ongoing innovation and fostering a dynamic setting that focuses on efficiency, preventive care, and value-based healthcare delivery.

The report provides a comprehensive analysis of the competitive landscape in the United States population health management market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: ZeOmega and MedeAnalytics launched the Population Health Navigator (PHN), integrating predictive analytics with care management to streamline operations, reduce costs, and improve outcomes. The platform enhances value-based care, offering a unified solution for payers and providers to manage risk, quality, and costs effectively.

- July 2025: Johns Hopkins launched Illustra Health, a population health analytics platform designed to support value-based care. It integrates data analysis, decision-making tools, and predictive risk scores, helping healthcare providers optimize clinical and financial outcomes while addressing health equity disparities and improving care management.

- February 2025: Azara Healthcare and i2i Population Health merged to enhance population health management, supported by an investment from Insight Partners. The combined platform will streamline care coordination, improve outcomes, and support value-based care for underserved communities, impacting over 50 million patients across the U.S.

- October 2024: Henry Ford Health launched Populance, a non-profit subsidiary focused on advancing population health. Populance offers value-based care services, including care management and patient monitoring, to improve outcomes for patients with chronic conditions. It serves 600,000 patients and aims to reduce healthcare costs and improve equity.

- August 2024: Panda Health launched Population Health Management (PHM) software, designed to analyze patient data for proactive care. PHM enhances care coordination, reduces hospital readmissions, and improves patient outcomes while supporting cost reduction and long-term adaptation to value-based care models for hospitals and health systems.

United States Population Health Management Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Mode of Deliveries Covered | Cloud-based, Web-based, On-premises |

| End Users Covered | Healthcare Providers, Healthcare Payers, Employer Groups, Government Bodies |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States population health management market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States population health management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States population health management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The population health management market in the United states was valued at USD 25.6 Billion in 2025.

The United States population health management market is projected to exhibit a CAGR of 18.31% during 2026-2034, reaching a value of USD 124.9 Billion by 2034.

The U.S. population health management market is driven by the shift toward value-based care, emphasizing improved patient outcomes and cost efficiency. Rising chronic disease prevalence and an aging population increase demand for proactive care. Additionally, advancements in healthcare IT, including data analytics, predictive modeling, and EHR integration, along with government initiatives promoting preventive and patient-centric care, further accelerate market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)