Advanced Metering Infrastructure (AMI) Market Size, Share, Trends and Forecast by Product Type, End User and Region, 2025-2033

Advanced Metering Infrastructure (AMI) Market Size and Share:

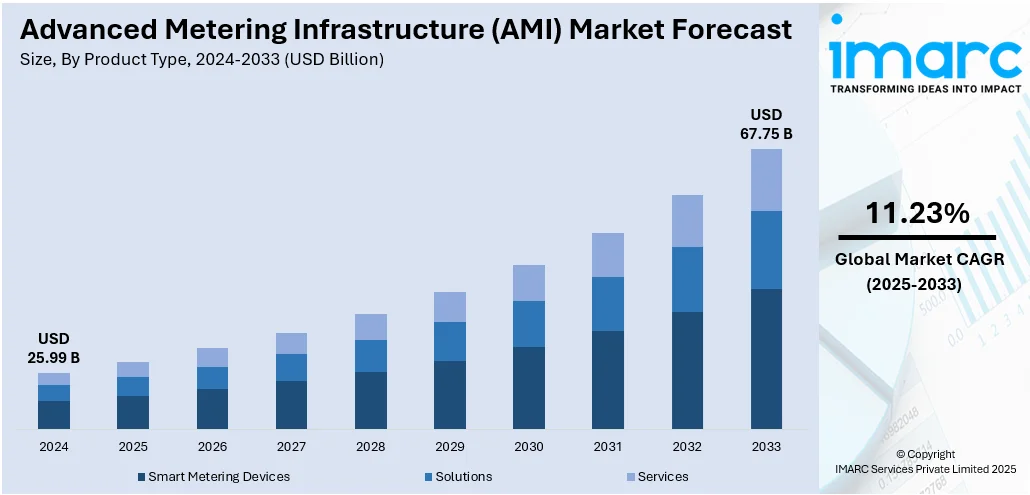

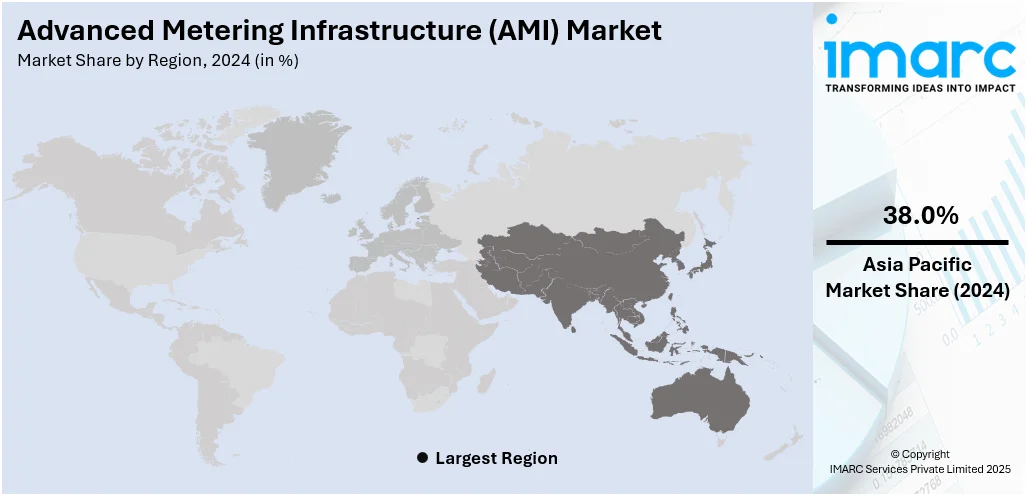

The global advanced metering infrastructure (AMI) market size was valued at USD 25.99 Billion in 2024. The market is projected to reach USD 67.75 Billion by 2033, exhibiting a CAGR of 11.23% from 2025-2033. Asia-Pacific currently dominates the market, holding a market share of 38.0% in 2024. At present, the growing demand for precise water billing systems is motivating utilities to utilize smart water meters that ensure accurate and real-time measurement of usage. Apart from this, the continued efforts to save fresh water are fueling the advanced metering infrastructure (AMI) market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 25.99 Billion |

|

Market Forecast in 2033

|

USD 67.75 Billion |

| Market Growth Rate (2025-2033) | 11.23% |

The market is expanding because of the rising need for effective energy usage and immediate oversight. Utilities are implementing AMI systems to enhance billing precision, lessen manual meter readings, and identify energy theft. Government bodies are backing AMI with policies that encourage smart grid development and sustainable energy practices. With the assimilation of additional renewable energy sources into the grid, AMI aids in regulating energy distribution and balancing demand. The emergence of smart cities and digital evolution is accelerating the use of smart meters. AMI facilitates bidirectional communication between individuals and utilities, enhancing the management of energy utilization.

To get more information on this market, Request Sample

The United States has emerged as a major region in the advanced metering infrastructure (AMI) market owing to many factors. Increasing efforts to modernize the electric grid and improve energy efficiency are fueling the advanced metering infrastructure (AMI) market growth. Utility companies are employing AMI to enable accurate billing, reduce operational costs, and monitor real-time energy utilization. Federal and state government agencies are supporting the rollout of smart meters through funding programs and regulatory mandates. The encouragement for clean energy and the integration of renewables into the grid are making AMI essential for managing variable power sources. The growing employment of the Internet of Things (IoT) and data analytics is strengthening the value of AMI by offering insights into usage patterns. As per industry reports, the United States data analytics market size is set to exhibit a growth rate (CAGR) of 26.80% during 2024-2032.

Advanced Metering Infrastructure (AMI) Market Trends:

Rising demand for precise water billing systems

Increasing demand for precise water billing systems is offering a favorable advanced metering infrastructure (AMI) market outlook. Traditional water billing methods often rely on estimated usage, leading to customer dissatisfaction and revenue losses for service providers. AMI allows automated data collection, eliminates manual meter reading, and supports transparent billing, which improves customer trust and operational efficiency. As water scarcity is becoming a critical concern, accurate measurement also aids in promoting responsible utilization and conservation. Utilities are employing AMI systems to detect leaks and manage peak demand. Government agencies are supporting this shift through smart city initiatives and funding programs that promote smart water management. In May 2025, the City of Kyle Water Utilities Department in Texas, US, released AMI, a modern water meter upgrade that could provide residents with real-time data on water usage in their households. Once the installation was finalized in late 2025, residents would easily access the water utilization data, enabling them to track their consumption and utilize water reports to lower their monthly expenses.

Ongoing efforts to preserve fresh water

Ongoing efforts to preserve fresh water are among the major advanced metering infrastructure (AMI) market trends. In March 2025, the Government of India unveiled the sixth version of its flagship initiative, ‘Jal Shakti Abhiyan: Catch the Rain–2025,’ aimed at promoting community participation in water conservation activities. The event revealed significant infrastructure initiatives under the Swachh Bharat Mission–Grameen, including borewell recharge schemes, rainwater harvesting systems, and a Water Resources Atlas, along with efforts to promote awareness. AMI helps detect leaks, track consumption patterns, and reduce water waste through real-time data collection and automated alerts. These systems support efficient water resource management by enabling timely interventions and better demand forecasting. As concerns about water scarcity are growing, especially in urban areas, AMI is enabling both providers and users to employ water more responsibly. Utilities rely on AMI to manage supply more effectively, prevent losses, and improve infrastructure planning.

Advancements in grid modernization

Advancements in grid modernization are fueling the market growth. In March 2025, the Reading Municipal Light Department (RMLD) in Massachusetts, US, initiated the RMLD Advanced AMI replacement initiative in collaboration with Tantalus Systems, a Canadian company specializing in smart grid solutions. This innovative technology would transform RMLD's meter infrastructure into a multidirectional, advanced grid, accelerating grid modernization via AMI and allowing RMLD to offer customers reliable, affordable, and increasingly carbon-free electricity. As utilities are upgrading outdated electrical grids, they are integrating AMI to support real-time monitoring, automated meter reading, and two-way communication between providers and users. These modern grids rely on digital technologies, sensors, and analytics, which work seamlessly with AMI to improve efficiency, reliability, and outage detection. With the growing demand for cleaner energy and the integration of renewable sources, AMI is enabling dynamic load balancing and supporting demand response programs. Grid modernization also enhances data-oriented decision-making, allowing utilities to forecast usage patterns and optimize energy distribution.

Advanced Metering Infrastructure (AMI) Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global advanced metering infrastructure (AMI) market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and end user.

Analysis by Product Type:

- Smart Metering Devices

- Electricity

- Water

- Gas

- Solutions

- Meter Communication Infrastructure

- Software

- Services

- System Integration

- Deployment

- Program Consulting

Smart metering devices (electricity, water, and gas) held 73.2% of the market share in 2024. They serve as the core component for monitoring and managing energy utilization. These devices enable two-way communication between users and utility providers, allowing real-time data collection, remote meter reading, and faster issue detection. Utilities rely on smart meters to improve billing accuracy, reduce operational costs, and prevent energy theft. As energy efficiency is becoming a key focus, smart meters help people track their usage and adjust behavior to reduce waste. The assimilation of renewable energy sources and electric vehicles (EVs) also requires smarter grid management, which smart meters support by offering detailed insights into employment patterns and demand fluctuations. Government agencies and regulatory bodies are promoting smart meter deployment through mandates and incentive programs, further accelerating their adoption. Their ability to manage peak load makes them essential for modern grid infrastructure, securing their dominant position in the AMI market.

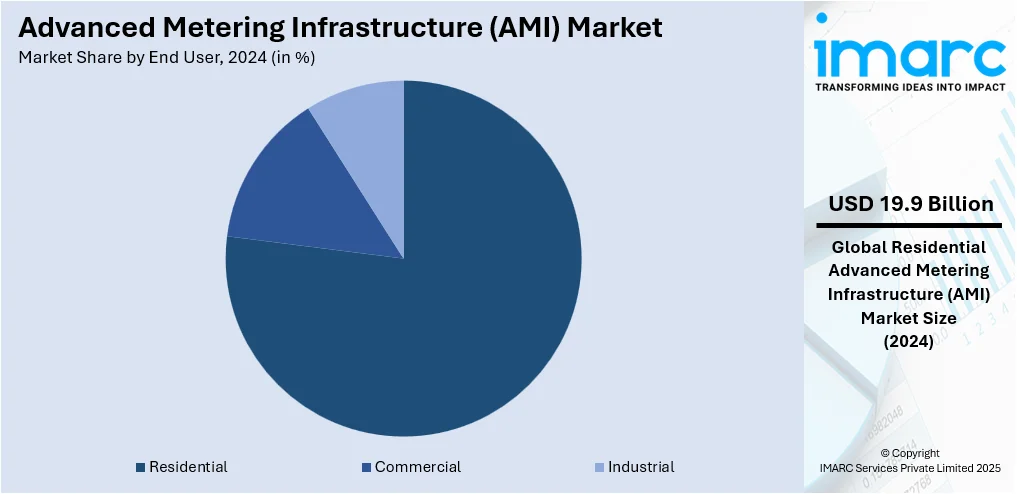

Analysis by End User:

- Residential

- Commercial

- Industrial

Residential accounts for 76.7% of the market share. It represents the largest and most consistent segment of energy users. With the growing urbanization and rising electricity demand in residential areas, utility companies are prioritizing smart meter installations in homes to improve energy management and billing accuracy. Residential users benefit directly from AMI by gaining real-time insights into their electricity usage, allowing them to reduce utilization and lower energy bills. Government agencies and regulatory authorities often launch large-scale programs focused on residential smart meter rollouts to promote energy optimization and sustainability. The integration of renewable energy systems like rooftop solar and the use of EVs at the household level is further creating the need for smart energy monitoring. Additionally, residential customers are experiencing better service with quicker outage detection and resolution, contributing to higher satisfaction. As per the advanced metering infrastructure (AMI) market forecast, with the growing focus on digital transformation in daily living, this segment will continue to dominate the industry.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific, accounting for a share of 38.0%, enjoys the leading position in the market. The region is noted for rapid urbanization activities, large population, and the growing energy demands across the region. Countries like India, Japan, and South Korea are spending on smart grid development to improve energy efficiency and support sustainable growth. Government agencies are implementing favorable policies and funding programs that promote smart meter adoption, especially in urban and semi-urban areas. Utility companies across the region are modernizing aging power infrastructure and turning to AMI to enable real-time monitoring, accurate billing, and improved outage management. The region’s strong manufacturing base and technological capabilities are also supporting the production and deployment of smart meters at scale. In addition, the rise of smart cities and increasing awareness about energy conservation are encouraging people and businesses to employ AMI solutions. Moreover, the growing adoption of the IoT, in countries like Japan and India, is enabling simultaneous data gathering, distant observation, and smooth interaction among devices, refining utility operations. As per the IMARC Group, the Japan IoT market is set to attain USD 1,86,064.6 Million by 2033, exhibiting a growth rate (CAGR) of 13.30% during 2025-2033.

Key Regional Takeaways:

United States Advanced Metering Infrastructure (AMI) Market Analysis

The United States holds 85.00% of the market share in North America. The market is primarily driven by regulatory support and grid modernization efforts across the country. Federal and state mandates, along with funding programs, have incentivized utilities to roll out smart metering systems. These systems enable two-way communication between utilities and customers, facilitating the collection of real-time data and the implementation of dynamic pricing models. For instance, in April 2025, the Brownsville Public Utilities Board (BPUB) in Brownsville, Texas, initiated its smart meter program for AMI to enhance utility services for customers by providing increased convenience, improved efficiency, and real-time information. In this initiative, BPUB would upgrade old electric and water meters to advanced digital smart meters throughout its service area, allowing for automated meter readings and removing the need for usage estimates in hard-to-access meter locations. Additionally, technological advancements in IoT-enabled meters, edge computing, and artificial intelligence (AI) are also reducing the cost of deployment while improving data analytics, enabling predictive maintenance and faster outage detection. Furthermore, high-profile, successful AMI installations in large and diverse markets have demonstrated tangible benefits, such as minimizing non-technical losses and facilitating demand response programs, leading to wider nationwide adoption.

Europe Advanced Metering Infrastructure (AMI) Market Analysis

In Europe, the growth of the market is largely fueled by policy mandates and environmental goals. Ambitious green energy targets and decarbonization efforts across the European Union are leading to widespread grid upgrades, with smart meters playing a vital role in enabling demand-side management and integration of renewables. For instance, in December 2024, the European Commission revealed the fifth financing round of the Innovation Fund (IF). In this funding round, the EU designated € 4.6 Billion for decarbonization initiatives and renewable technologies. This spending was set to aid the European Union in achieving its aim of decreasing net greenhouse gas emissions by at least 55% by 2030. National regulatory frameworks, such as the EU’s Clean Energy Package, also require member states to deploy intelligent metering systems. Moreover, utilities are actively modernizing infrastructure to enhance system resilience, automate meter readings, minimize energy theft, and improve billing accuracy. Furthermore, technological advancements in IoT connectivity, edge-computing-enabled meters, and big data analytics are driving down deployment costs while enabling real-time insights into utilization patterns. This has opened the door for innovative user offerings, including dynamic pricing schemes, personalized energy usage feedback, and streamlined assimilation with smart-home technologies.

Asia-Pacific Advanced Metering Infrastructure (AMI) Market Analysis

The Asia-Pacific market is expanding due to technological innovations and government-backed pilot projects and initiatives that promote the adoption of AMI systems. For instance, in January 2025, India's Central Electricity Authority (CEA) launched detailed regulations for the standardization and interoperability of AMI systems. Referred to as ‘Guidelines for Standardization and Interoperability in AMI Systems for End-to-End Communication between Smart Meter, HES and MDM,’ these regulations would unify certain AMI technologies across the country, including a singular ‘Unified head-end system (HES)’, encouraging broad implementation. Numerous government agencies are also prioritizing digital infrastructure upgrades to support reliable electricity distribution in areas prone to outages and natural disasters. Increasing energy trading between regional grids is also creating the need for accurate, real-time data provided by AMI systems.

Latin America Advanced Metering Infrastructure (AMI) Market Analysis

In Latin America, the market is experiencing robust growth due to infrastructure enhancements, regulatory reforms, and evolving user demands. Government agencies and utilities across countries, such as Brazil, Mexico, and Colombia, are launching national smart-grid initiatives to combat high electricity losses and improve billing accuracy. The smart grid market in Brazil reached USD 1.58 Billion in 2024 and is set to grow at a CAGR of 15.50% during 2025-2033, as per a report by the IMARC Group. Regulatory frameworks are also mandating digital meter deployment and providing financial incentives to facilitate upgrades. Besides this, technological advancements like the adoption of LTE-M and NB-IoT networks are enabling scalable AMI rollouts even in rural and remote locations.

Middle East and Africa Advanced Metering Infrastructure (AMI) Market Analysis

In the Middle East and Africa region, the market is significantly influenced by the rising integration of renewable energy across the region. According to industry reports, in 2024, the renewable energy market in the Middle East reached USD 42,509.51 Million. The market is anticipated to attain USD 1,27,586.49 Million by 2033, growing at a CAGR of 12.99% during 2025-2033. Energy sector privatization and utility restructuring are increasing the focus on modernization efforts, with AMI being viewed as a cornerstone for enhanced operational transparency and efficiency. The rapid rollout of solar and wind projects across the region is also catalyzing the demand for bidirectional metering to manage variable generation and grid stability. Other than this, strong regional collaborations on metering standards and data protocols are facilitating implementation and interoperability across borders, supporting the region’s shift towards smarter energy systems.

Competitive Landscape:

Key players are developing innovative technologies, expanding product portfolios, and offering end-to-end smart metering solutions. They are investing in research and development (R&D) activities to improve the accuracy, connectivity, and data handling capabilities of smart meters. These companies are also collaborating with utility providers to implement large-scale AMI projects, ensuring smooth deployment and integration with existing systems. Through partnerships with governments and energy agencies, key players are supporting policy implementation and grid modernization efforts. They provide advanced software platforms for data analytics, outage detection, and energy usage optimization. In addition, they offer training, maintenance, and customer support services to utilities, helping ensure long-term success of AMI systems. Their strong worldwide presence, technological expertise, and commitment to smart energy solutions make them central to the growth and adoption of AMI across various sectors and regions. For instance, in February 2025, EDF India and Actis created a joint venture (JV) to develop a dedicated platform business for advanced metering infrastructure service provider (AMISP) concessions in India. This partnership would merge Actis and EDF India’s worldwide expertise in energy solutions and infrastructure initiatives, enhancing their continuous commitment to aiding the power sector in India.

The report provides a comprehensive analysis of the competitive landscape in the advanced metering infrastructure (AMI) market with detailed profiles of all major companies, including:

- Cisco Systems, Inc.

- Eaton Corporation plc

- Hubbell Incorporated

- Itron Inc.

- Landis+Gyr

- Mueller Systems, LLC

- Schneider Electric

- Smarter Technologies Group

- Trilliant Holdings Inc.

- Xylem

Latest News and Developments:

- June 2025: Sense, a US-based startup specializing in grid edge intelligence solutions, launched EV Analytics, an innovative load management system available via AMI 2.0 meters that provided information regarding the transparency and reliability requirements of the grid. The new system enhanced intelligence and analytics on load management by identifying each EV that was charging on the electric grid.

- May 2025: Rhode Island Energy revealed plans to start implementing AMI technology and replace electric meters across the state, starting in Westerly. The implementation of AMI would enable customers to gain insights into their energy usage, enhancing service reliability and allowing faster identification of outages.

- April 2025: Landis+Gyr announced that the utility's AMI for electricity metering was enhanced, enabling smart meters to function as a communication link among the AMI network, EV chargers, battery storage, gas and water meters, and solar panel inverters. The initiative aimed to lower costs and foster innovations by enhancing the bandwidth and adaptability of the system. The developed product ecosystem would enhance the world's leading AMI/IoT platform and accelerate the shift towards a smart energy future.

- March 2025: In collaboration with SAMART Telcoms, Trilliant successfully finished installing AMI for industrial and commercial meters in Thailand, meeting the intricate standards set by the Provincial Electricity Authority (PEA). In this partnership, SAMART would employ Trilliant's device-agnostic UnitySuite Head End System (HES) to facilitate various meter brand installations and enhance the effectiveness of real-time data collection for customers.

Advanced Metering Infrastructure (AMI) Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Cisco Systems, Inc., Eaton Corporation plc, Hubbell Incorporated, Itron Inc., Landis+Gyr, Mueller Systems, LLC, Schneider Electric, Smarter Technologies Group, Trilliant Holdings Inc., Xylem, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the advanced metering infrastructure (AMI) market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global advanced metering infrastructure (AMI) market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the advanced metering infrastructure (AMI) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The advanced metering infrastructure (AMI) market was valued at USD 25.99 Billion in 2024.

The advanced metering infrastructure (AMI) market is projected to exhibit a CAGR of 11.23% during 2025-2033, reaching a value of USD 67.75 Billion by 2033.

The ongoing shift towards smart grids and the integration of renewable energy sources are promoting the use of advanced metering technologies that can support two-way communication and dynamic load balancing. Government initiatives and regulatory mandates aimed at encouraging energy conservation and smart city development, are further accelerating AMI deployment. Additionally, the rising utilization of IoT, cloud computing, and data analytics enhances the capabilities of AMI systems, making them more intelligent and responsive.

Asia-Pacific currently dominates the advanced metering infrastructure (AMI) market, accounting for a share of 38.0% in 2024, due to rapid urbanization, strong government support, rising energy demand, and large-scale smart grid projects. The region's focus on modernization and renewable integration is further accelerating the adoption of smart metering solutions.

Some of the major players in the advanced metering infrastructure (AMI) market include Cisco Systems, Inc., Eaton Corporation plc, Hubbell Incorporated, Itron Inc., Landis+Gyr, Mueller Systems, LLC, Schneider Electric, Smarter Technologies Group, Trilliant Holdings Inc., Xylem, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)