Aerial Imaging Market Size, Share, Trends and Forecast by Aircraft Type, Camera Orientation, Application, End Use Sector, and Region, 2025-2033

Aerial Imaging Market Size and Share:

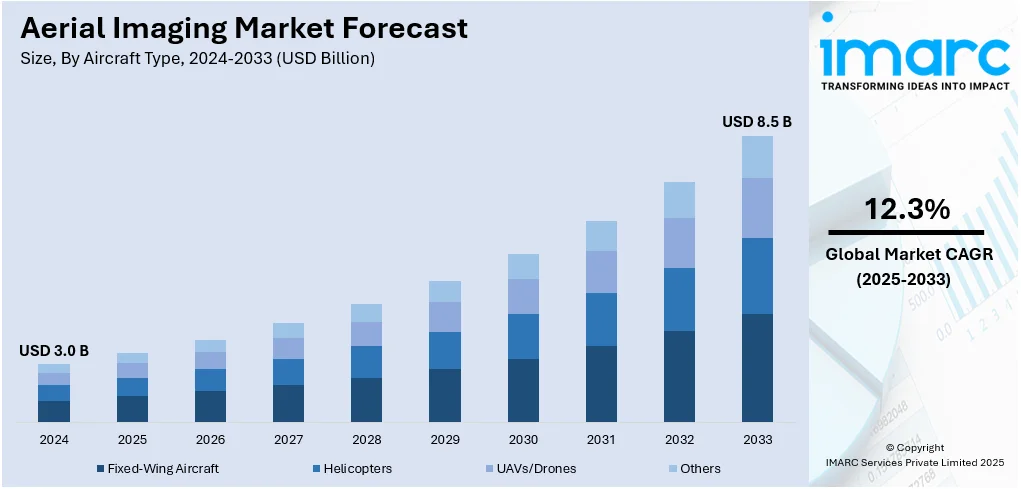

The global aerial imaging market size was valued at USD 3.0 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.5 Billion by 2033, exhibiting a CAGR of 12.3% from 2025-2033. North America currently dominates the market, holding a market share of 37.1% in 2024. The dominance of the region is because of strong investments in drone technology, advanced imaging systems, and widespread use across sectors like agriculture, defense, and infrastructure. Supportive government regulations, frequent natural disasters requiring monitoring, and high demand for precise geospatial data also contribute to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.0 Billion |

|

Market Forecast in 2033

|

USD 8.5 Billion |

| Market Growth Rate 2025-2033 | 12.3% |

The increasing use of unmanned aerial vehicles (UAVs) and drones is revolutionizing aerial imaging. These platforms offer cost-effective, flexible, and high-resolution imaging capabilities, making them ideal for applications in agriculture, surveillance, and infrastructure inspection. Their ability to access hard-to-reach areas enhances data collection efficiency. Besides this, technological progress in imaging sensors, including light detection and ranging (LiDAR), multispectral, and hyperspectral cameras, enhances the quality and scope of aerial imagery. These advancements enable more precise data collection for environmental monitoring, agriculture, and resource management, expanding the applications of aerial imaging. Furthermore, the synergy between aerial imaging and geographic information systems (GIS) platforms allows for sophisticated spatial analysis and visualization. This integration supports various sectors, including environmental studies, disaster management, and urban development, by providing comprehensive spatial insights.

To get more information on this market, Request Sample

The United States represents an essential part of the market, supported by significant investments in roads, railways, energy infrastructure, and city development, necessitating accurate mapping. Government entities and contractors utilize aerial photographs to design pathways, oversee advancements, verify adherence, and record alterations in land use for environmental permits. Moreover, US farmers utilize aerial imagery to oversee crops, control irrigation, and identify pests promptly. Drones and aircraft gather multispectral images that assist farmers in increasing yields, minimizing chemical usage, and making more informed planting choices each season. In 2025, Hylio, located in Texas, revealed its growth with a new 40,000 sq ft manufacturing facility aimed at increasing agricultural drone output to 5,000 units per year by 2028.

Aerial Imaging Market Trends:

Growing Use in the Construction Sector

The increasing development of residential and commercial structures globally emerges as a significant factor propelling the aerial imaging market growth. As cities grow and infrastructure initiatives increase, developers and builders require precise, current visuals to plan sites, monitor progress, and safely assess structures. An industry report indicates that the construction sector demonstrated strong performance in 2024, with a 10% increase in nominal value added and a 12% rise in gross output. Expenditure surpassed USD 2 trillion, maintaining robust momentum during the initial half of the year. This steady expansion is driving the need for drones and aerial assessments that provide high-resolution data more quickly and economically than conventional ground evaluations. Aerial imaging is evolving into a routine tool on construction sites of all sizes, assisting companies with mapping extensive areas, tracking safety compliance, adhering to deadlines, managing costs, and guaranteeing quality work in a more competitive building landscape.

Tourism and Scenic Imaging

The increase in international travel and tourism is significantly boosting the aerial imaging market growth, as travelers rush to discover new locations and photograph stunning landscapes from different perspectives. Numerous tour operators, resorts, and travel agencies currently utilize drones to provide breathtaking aerial images and marketing videos that draw in travelers looking for unforgettable experiences. UN Tourism's recent statistics indicate that approximately 300 million travelers went abroad in Q1 2025, which is roughly 14 million more than in the same quarter of 2024, underscoring a robust rebound and increasing desire for leisure travel. Luxury resorts providing drone tours and adventure activities like aerial safaris or coastal flyovers enhance the tourist experience through aerial imaging, while also creating new marketing content. Aerial photography and videos enhance destination visibility in a competitive market, increasing bookings and promoting the use of drones in tourism and hospitality.

Tech Integration Surge

Top firms in the aerial imaging sector are enhancing standards by incorporating advanced technologies, such as artificial intelligence (AI) and the Internet of Things (IoT) to create smarter and more adaptable imaging systems. Drones equipped with AI can instantly analyze large image datasets, recognize patterns, spot irregularities, and provide actionable insights more rapidly than before. Connectivity through IoT enables drones and sensors to connect with various devices, facilitating efficient data exchange and remote oversight for users in industries such as agriculture, construction, and security. A notable indication of this trend is Quantum Systems’ significant achievement in May 2025, when it obtained EUR 160 million in Series C funding to enhance AI-driven drone manufacturing, broaden its global reach, and fortify its defense and commercial activities throughout Europe and Asia-Pacific. This dedication to more intelligent, interconnected aerial systems is changing how sectors collect, analyze, and utilize visual information, strengthening the market growth.

Aerial Imaging Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global aerial imaging market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on aircraft type, camera orientation, application, and end use sector.

Analysis by Aircraft Type:

- Fixed-Wing Aircraft

- Helicopters

- UAVs/Drones

- Others

UAVs/drones lead the market with 53.5% market share, attributed to their unparalleled versatility, cost-effectiveness, and simplicity in deployment compared to piloted aircraft or satellites. Their capacity to fly at low heights allows them to obtain extremely detailed, close-range pictures that are ideal for accurate tasks in agriculture, construction, mining, and land assessments. Using drones eliminates the need for runways or large teams, making them suitable for remote and inaccessible locations. Farmers utilize drones to inspect their fields weekly, avoiding the costs of hiring pilots or renting aircraft. Construction firms monitor site advancement each day with little interference. Drones fitted with sophisticated sensors, such as thermal or multispectral cameras, collect extensive data instantly, enhancing their attractiveness in various industries. Regulatory structures in various nations currently endorse commercial drone activities, promoting broader usage. Due to their reduced operating expenses, fast completion times, and increasing automation features, UAVs continue to be the preferred option for many aerial imaging tasks.

Analysis by Camera Orientation:

- Vertical

- Oblique

- High Oblique

- Low Oblique

Vertical represents the largest segment, accounting 59.3% market share. The dominance of this segment is because of its tailored applications across industries like agriculture, construction, real estate, and environmental monitoring. These industries benefit from high-resolution aerial data to improve decision-making, optimize operations, and reduce costs. In agriculture, vertical integration allows for precise crop monitoring, yield prediction, and resource management. Construction projects use aerial imagery to track progress, assess risks, and plan logistics. Real estate and urban planning sectors rely on aerial data for property assessments, zoning, and planning. The technology's versatility makes it adaptable for various purposes, providing customized insights that cater to specific industry needs. As drone technology advances, these verticals continue to drive growth in the market, expanding the use of aerial imaging for both commercial and industrial purposes. The sector-specific benefits, such as increased efficiency, safety, and cost-effectiveness, make it dominant segment in shaping the aerial imaging industry.

Analysis by Application:

- Geospatial Mapping

- Infrastructure Planning

- Asset Inventory Management

- Environmental Monitoring

- National and Urban Mapping

- Surveillance and Monitoring

- Disaster Management

- Others

Geospatial mapping leads the market with 26.8% in 2024, as it is vital for delivering precise, real-time information for various applications. The capability to gather intricate spatial data from the air enables sectors such as agriculture, urban design, environmental oversight, and disaster response to make educated choices. Geospatial mapping improves land use planning, infrastructure development, and resource management by providing accurate topographic information and tracking changes over time. In farming, it enhances crop production and oversees soil conditions, whereas in city planning, it assists with zoning and building arrangements. Environmental organizations utilize it to monitor deforestation, aquatic areas, and animal habitats. The growing use of GPS and sophisticated sensors in aerial systems like drones is enhancing the accessibility and efficiency of geospatial mapping, reinforcing its leadership in the aerial imaging sector.

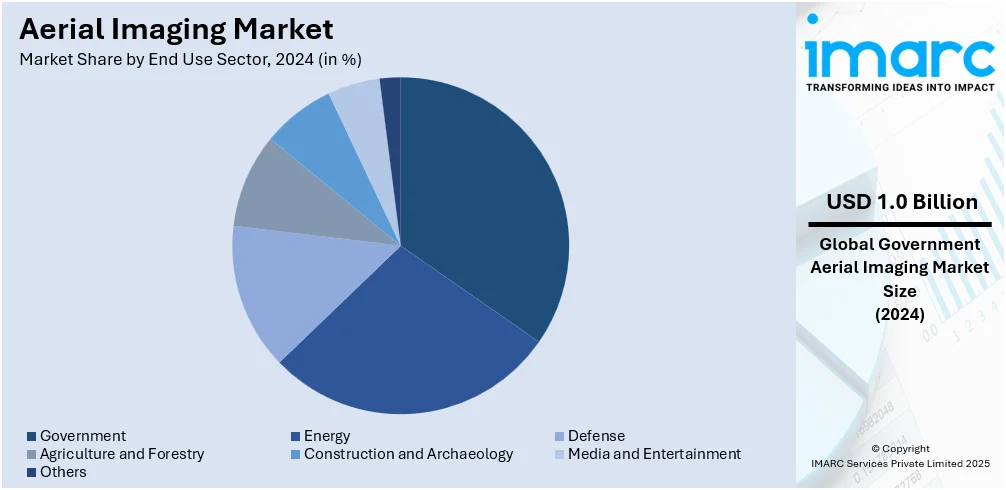

Analysis by End Use Sector:

- Government

- Energy

- Defense

- Agriculture and Forestry

- Construction and Archaeology

- Media and Entertainment

- Others

In 2024, government dominated the market accounting 24.3% market share because of its significant requirements for monitoring, infrastructure oversight, and emergency management. Aerial imaging allows government sector to efficiently and quickly oversee vast regions, assisting in responsibilities such as border security, law enforcement, and environmental conservation. Furthermore, it has a crucial impact on city planning, land use management, and the advancement of transportation systems. Government also depends on aerial imagery for monitoring agriculture, managing natural resources, and evaluating the impacts of climate change. Accessing high-resolution, current data facilitates improved decision-making, optimizes resource distribution, and bolsters public safety. Due to the rising need for precise mapping, monitoring, and regulation enforcement, government is emerging as the primary users of aerial imaging technology. Additionally, the increasing deployment of drones and satellite technology across different government sectors guarantees that their involvement in the aerial imaging market continues to expand considerably.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, holding 37.1% market share, owing to significant technological advancements, substantial investments in drone production, and widespread use in sectors, such as agriculture, construction, energy, and defense. The region's robust regulatory system promotes safe drone activities and fosters commercial applications. Businesses allocate significant resources to research for advancing high-resolution cameras, sensors, and AI-driven analytics that improve image precision and functionality. Regular natural disasters like hurricanes, floods, and wildfires elevate the need for aerial surveys and immediate data for disaster management and insurance evaluations. The growth of smart cities and extensive infrastructure initiatives catalyzes the demand for precise geospatial information. In 2025, Got Drones Aerial Photography, led by USAF veteran Walter Everett Jr., launched innovative aerial services in Tennessee, including 360° virtual tours and construction site imaging. The company supports safety and scheduling for builders while offering drone instruction and FAA Part 107 guidance.

Key Regional Takeaways:

United States Aerial Imaging Market Analysis

In North America, the market portion held by the United States was 81.20%, propelled by ongoing innovations in drone technology, which are enhancing image quality and increasing data capture effectiveness. The U.S. Department of Defense is shifting approximately USD 50 Billion from older programs to focus on drones and counter-drone technologies. Additionally, Hidden Level, a company focused on airspace safety and cloud-oriented drone management, recently raised USD 65 Million in a Series C funding round. Moreover, the growing need for aerial mapping and surveying in sectors like agriculture and construction is offering a favorable aerial imaging market outlook. The swift incorporation of AI and ML, which improves data handling abilities and allows for more precise insights, is propelling the market growth. Additionally, the rising demand for environmental oversight and disaster response solutions is heightening the dependence on aerial imagery. Government efforts that promote unmanned aerial vehicle (UAV) technology are further contributing to the market growth. Moreover, the increasing emphasis on infrastructure upkeep and assessment is speeding up the implementation of aerial imaging technologies.

Europe Aerial Imaging Market Analysis

The European market for aerial imaging is expanding because of the rising application of drones in agricultural oversight, allowing for accurate crop evaluation and enhanced production. A market report emphasized the major influence of weatherproof drones and precision farming on farms in the UK. Farmers have indicated a 15% rise in crop production, a 30% decrease in pesticide application, 20-25% savings in water through improved irrigation, and up to 30% cuts in labor expenses because of the automation of monitoring activities. Correspondingly, the increased need for detailed satellite imagery for city planning and infrastructure growth is further supporting the market growth. Additionally, ongoing improvements in drone LiDAR technology are increasing the precision of topographic surveys and environmental monitoring, thus bolstering the aerial imaging market demand. The growing focus on environmental protection, especially in terms of climate change reduction and land-use examination, is promoting higher adoption. Moreover, the growing demand for aerial imagery in the energy sector, especially for examining power lines and wind turbines, is positively influencing the market. The increasing application of aerial imagery in media and entertainment, especially in cinematography, is further enhancing the market attractiveness. Additionally, supportive government policies and regulatory assistance that promote the incorporation of aerial imaging technologies are broadening the market potential.

Asia Pacific Aerial Imaging Market Analysis

The Asia Pacific market is primarily influenced by the swift growth of smart cities, which demands advanced imaging technologies for urban planning and infrastructure oversight. In accordance with this, the rising use of drones in disaster response and recovery efforts is fueling the market expansion. Besides this, the growth in commercial uses, especially in the real estate industry for property evaluations and land assessments, is driving the market demand. Additionally, the area's increased emphasis on environmental monitoring, particularly in pollution identification and wildlife protection, is further accelerating the market expansion. Moreover, the growing mining and energy industries in the Asia Pacific are boosting the need for remote sensing in resource exploration and infrastructure assessment, resulting in a favorable outlook for the market. As per information from the Ministry of Statistics and Programme Implementation (MOSPI), India's mining GDP rose from INR 76,877 Crore in Q3 FY23 to INR 82,680 Crore in Q3 FY24, emphasizing the growing need for aerial imaging in resource exploration and supervision.

Latin America Aerial Imaging Market Analysis

In Latin America, the aerial imaging industry is growing attributed to the rising use of precision agriculture technologies that enhance crop yield predictions and resource management. Furthermore, increasing investments in infrastructure enhancements, such as transport systems and city planning initiatives, are driving the need for high-resolution geospatial imagery. Cofco International therefore allocated BRL 1.2 Billion in Brazil's rail logistics to improve grain and sugar transportation, reduce emissions, and increase export capacity to 14.5 million tons by the year 2026. Additionally, the area's growing focus on forest protection and biodiversity tracking is encouraging the adoption of aerial imagery in environmental management. Moreover, the swift incorporation of aerial imaging with geospatial analytics for monitoring utility assets and land management is broadening its uses in both public and private sectors.

Middle East and Africa Aerial Imaging Market Analysis

The Middle East and Africa market is expanding as the use of geospatial technologies in oil and gas exploration rises, improving site assessment and pipeline monitoring abilities. Additionally, the growth of extensive infrastructure projects, such as smart cities and regional connectivity initiatives, is propelling the market growth. Furthermore, the area's increased emphasis on archaeological conservation and cultural heritage recording is broadening the market access. Besides this, rising security issues and the demand for border observation are leading to the incorporation of aerial imaging into defense and environmental monitoring systems. Consequently, the EDGE Group of the UAE purchased a 30% share in the Israeli drone technology company ThirdEye, investing USD 10 million to collaboratively create electro-optical object recognition systems, underscoring the increasing defense collaboration between the UAE and Israel, notwithstanding political strains.

Competitive Landscape:

Major participants in the industry emphasize broadening their service offerings, allocating resources towards research aimed at enhancing image clarity and data precision, and establishing strategic alliances to enhance market presence. Numerous companies are improving their functionalities by incorporating AI and ML for superior image processing and analysis. They prioritize compliance with regulations and data security to uphold client trust. Multiple companies dedicate resources to enhancing drone fleets and associated equipment to boost operational efficiency and expand coverage area. In December 2024, Nokia and Motorola Solutions launched an AI-powered, automated drone-in-a-box solution for public safety and mission-critical industries. Integrating Nokia Drone Networks with Motorola’s CAPE software, the system enhanced situational awareness, remote operations, and decision-making with real-time aerial imaging, supporting first responders and industrial safety.

The report provides a comprehensive analysis of the competitive landscape in the aerial imaging market with detailed profiles of all major companies, including:

- Blom Norway (Terratec AS)

- Cooper Aerial Surveys Co.

- Digital Aerial Solutions LLC

- Eagle Aerial Solutions

- Eagle View Technologies Inc.

- Fugro N.V.

- GeoVantage Inc. (John Deere)

- Global UAV Technologies Ltd.

- Kucera International Inc.

- Landiscor Real Estate Mapping

Latest News and Developments:

- May 2025: Teledyne FLIR OEM and AerialOGI launched the AerialOGI-N, a dual-use optical gas imaging (OGI) camera module. Designed for both handheld and drone use, it enables real-time detection of harmful gas emissions like methane. The system integrates with seven industrial drones, enhancing gas inspection workflows with aerial imaging.

- April 2025: Optiemus Unmanned Systems unveiled four advanced defense drones at the Milipol India exhibition. These include the Marak VT100 for high-altitude surveillance with a 30x EO/IR camera, and the Vajra QC55 with AI analytics for real-time aerial imaging, enhancing India’s ISR and tactical operations capabilities.

- March 2025: JOUAV launched innovative low-altitude economy drone solutions, including the JOS-P200 and CW-20E drones, designed for versatile industrial use. These AI-powered UAVs, featuring real-time data analytics and precision imaging, are aimed at transforming sectors like smart cities, air traffic control, and emergency response with advanced aerial capabilities.

- January 2025: DJI launched the DJI Flip, a compact vlog camera drone with foldable propeller guards for enhanced safety. Featuring a 48MP camera with 4K video, AI tracking, and intelligent shooting modes, it supports aerial imaging for both beginners and professionals. The drone offers 31-minute flight time and advanced transmission features.

- January 2025: DroneAcharya Aerial Innovations and AVPL International announced a strategic merger to advance India’s drone tech sector. The collaboration combines DroneAcharya’s R&D expertise with AVPL’s infrastructure, aiming to enhance drone manufacturing and applications across industries like agriculture, logistics, defense, and aerial imaging.

- October 2024: India-based ideaForge launched the country's first app-based Drone-as-a-Service (DaaS) model, Flyght Franchise, for large enterprises. The service, offering on-demand UAV solutions for aerial imaging, has been deployed in states like Himachal Pradesh, Uttarakhand, Rajasthan, Orissa, and West Bengal.

Aerial Imaging Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Aircraft Types Covered | Fixed-Wing Aircraft, Helicopters, UAVs/Drones, Others |

| Camera Orientations Covered |

|

| Applications Covered | Geospatial Mapping, Infrastructure Planning, Asset Inventory Management, Environmental Monitoring, National and Urban Mapping, Surveillance and Monitoring, Disaster Management, Others |

| End Use Sectors Covered | Government, Energy, Defense, Agriculture and Forestry, Construction and Archaeology, Media and Entertainment, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Blom Norway (Terratec AS), Cooper Aerial Surveys Co., Digital Aerial Solutions LLC, Eagle Aerial Solutions, Eagle View Technologies Inc., Fugro N.V., GeoVantage Inc. (John Deere), Global UAV Technologies Ltd., Kucera International Inc., Landiscor Real Estate Mapping, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the aerial imaging market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global aerial imaging market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the aerial imaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aerial imaging market was valued at USD 3.0 Billion in 2024.

The aerial imaging market is projected to exhibit a CAGR of 12.3% during 2025-2033reaching a value of USD 8.5 Billion by 2033.

Demand for high-resolution data, advancements in UAV technology, government investments, and expansion of geospatial applications strongly influence the aerial imaging market outlook. These factors encourage wider adoption across industries needing precise mapping, surveillance, and infrastructure monitoring. Continuous improvements in camera systems and data analytics strengthen the market growth, with users seeking faster, cost-effective solutions for better decision-making and planning.

North America currently dominates the aerial imaging market, accounting for a share of 37.1%. The dominance of the market is attributed to strong technological adoption, significant investments in advanced imaging solutions, established infrastructure, supportive regulations, and high demand for geospatial data services.

Some of the major players in the aerial imaging market include Blom Norway (Terratec AS), Cooper Aerial Surveys Co., Digital Aerial Solutions LLC, Eagle Aerial Solutions, Eagle View Technologies Inc., Fugro N.V., GeoVantage Inc. (John Deere), Global UAV Technologies Ltd., Kucera International Inc., Landiscor Real Estate Mapping, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)