Global Aerospace Foam Market Expected to Reach USD 9.4 Billion by 2033 - IMARC Group

Global Aerospace Foam Market Statistics, Outlook and Regional Analysis 2025-2033

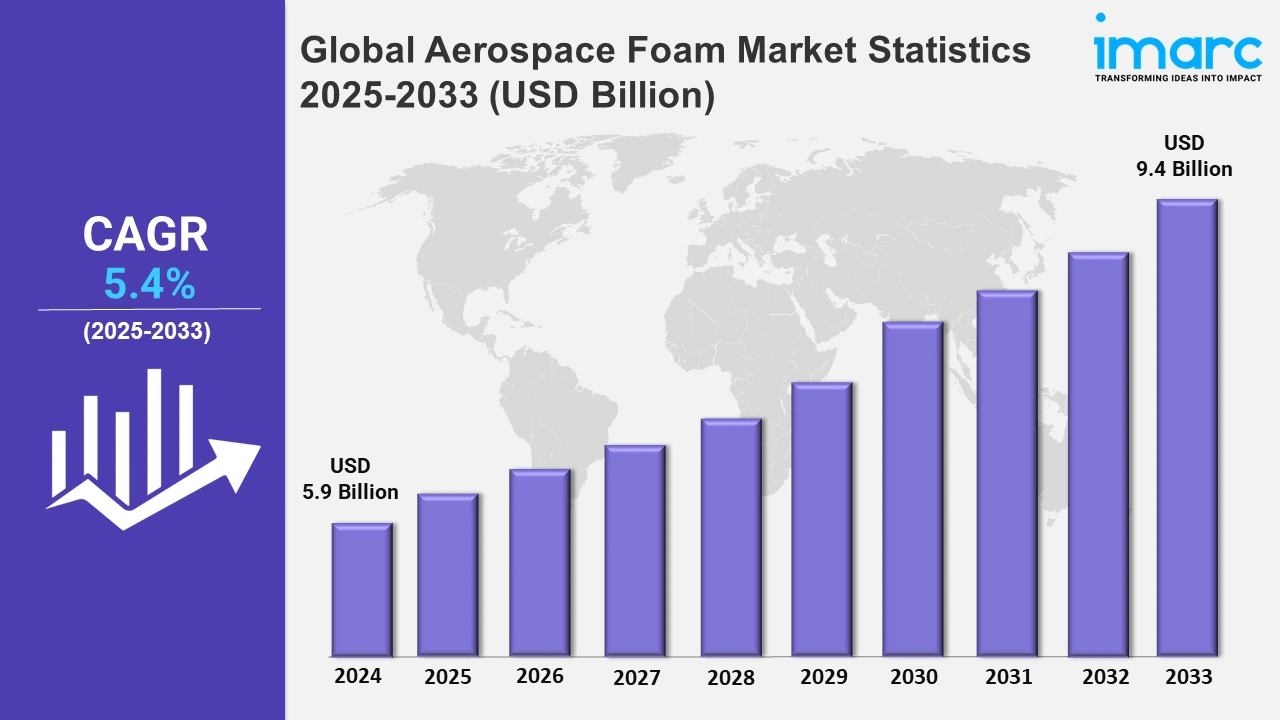

The global aerospace foam market size was valued at USD 5.9 Billion in 2024, and it is expected to reach USD 9.4 Billion by 2033, exhibiting a growth rate (CAGR) of 5.4% from 2025 to 2033.

To get more information on this market, Request Sample

The aerospace foam market is experiencing significant growth mainly driven by the growing demand for lightweight materials that enhances fuel efficiency and reduce aircraft operating costs. Manufacturers nowadays are increasingly adopting foam materials for interior components like seats, walls, and insulation due to their durability, soundproofing capabilities and thermal resistance. The expansion of commercial aviation across the world along with the growing air travel demand in developing economies further facilitates the market growth. According to the report published by Press Information Bureau (PIB), India's aviation sector transformed over the past decade with operational airports increasing from 74 to 157 in 2024 aiming for 350-400 by 2047. Domestic air passengers have more than doubled driven by government initiatives like the UDAN scheme enhancing connectivity and inclusivity in air travel. Technological advancements in foam production technologies including 3D printing and high-performance polymers are enabling the creation of customized and efficient materials tailored to meet the stringent standards of aerospace applications. Environmental regulations also push manufacturers toward ecofriendly and recyclable foam solutions, thereby boosting the adoption of sustainable practices.

In aerospace foam market, one of the prominent key trends is the growing shift towards renewable and recyclable materials. Companies nowadays are investing heavily in bio-based materials and green foam solutions in order to reduce their carbon footprints. For instance, in July 2024, Cambium and Checkerspot announced their partnership to develop PFAS-free high temperature and fire-resistant foam products for defense and commercial use. This partnership aims to leverage advanced materials and bioengineering to enhance performance in industries, such as aerospace, automotive, shipping, and construction. Technological advancements like integration of nano technology in foam materials are improving the performance of aerospace foam by enhancing its strength, thermal resistance, and lightweight properties. The growing use of polyurethane and polyamide foams mainly in noise reduction and thermal insulation reflects the industry demand for superior performance under extreme conditions. The widespread adoption of automation in foam manufacturing is streamlining production, reducing costs and enabling the scaling of innovative material solutions for aerospace applications.

Global Aerospace Foam Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share due to its advanced aerospace industry, high air traffic and significant defense investments.

North America Aerospace Foam Market Trends:

In the North American region aerospace foam market is witnessing trends like the widespread adoption of lightweight materials to enhance fuel efficiency and reduce emissions. Sustainability is gaining significant traction with manufacturers nowadays developing bio-based and recyclable foams in order to meet the strict environmental regulations. Technological advancements like integration of nanotechnology are also enhancing the thermal resistance and foam strength. The North America's robust aerospace sector mainly driven by high defense spending and commercial aviation growth is fostering innovation while automation in manufacturing is streamlining production and improving overall cost efficiency across the market. According to industry reports, United States airlines conduct over 26,000 flights carrying 2.6 million passengers to nearly 80 countries and transporting 61,000 tons of cargo to more than 220 countries. This increased air traffic is expected to facilitate the product demand significantly, thereby contributing to the market growth.

Asia-Pacific Aerospace Foam Market Trends:

In the Asia Pacific region, the market is experiencing significant growth mainly driven by the expanding air travel, rising aircraft manufacturing and regional economic development. Increase in investments in lightweight and fuel-efficient materials along with technological advancements in polyurethane and polyimide form technologies are shaping the market in the region. Sustainable practices and the growing demand for cost effective solutions are further propelling the adoption across both commercial and defense aviation sectors.

Europe Aerospace Foam Market Trends:

The aerospace foam market is witnessing a gradual shift towards ecofriendly and recyclable materials mainly driven by stringent environmental regulations across European region. Advanced manufacturing technologies including 3D printing are enabling lightweight and customized foam solutions. Increase in investments in green aviation and the region’s focus on reducing carbon emissions further propelled the demand for sustainable foam productions in commercial and defense aerospace sectors.

Latin America Aerospace Foam Market Trends:

The Latin America aerospace foam market is witnessing significant growth mainly driven by expansion regional aviation, rising demand for lightweight materials and increase in investments in aircraft maintenance and manufacturing. The market is experiencing a gradual shift towards ecofriendly foam solutions and advanced materials aligning with the global sustainability goals. Emerging economies across the region are fostering opportunities for commercial aviation, thereby boosting the demand for aerospace foam applications.

Middle East and Africa Aerospace Foam Market Trends:

The aerospace foam market in the Middle East and Africa region is witnessing significant growth mainly driven by the growing investments in aviation infrastructure and rising demand for commercial and military aircraft. Lightweight foam materials are being prioritized for fuel efficiency and enhanced performance of the aircrafts. Regional airlines are also adopting advanced foam for passenger comfort and safety aligning with the global trends in organic and high-performance materials.

Top Companies Leading in the Aerospace Foam Industry

Some of the leading aerospace foam market companies include Aerofoam Industries, LLC, Armacell, BASF SE, Boyd, DuPont de Nemours, Inc., Evonik Industries AG, General Plastics Manufacturing Company, Greiner AG, Huntsman International LLC, NCFI Polyurethanes, Rogers Corporation, SABIC and Zotefoams plc among many others. In September 2024, Evonik upgraded its ROHACELL® foam production in Darmstadt, Germany to utilize 100% renewable energy reducing annual CO2 emissions by 3,400 tons. This transition supports sustainability goals within the High-Performance Polymers business line enhancing eco-friendly material options for industries like aerospace and medical technology.

Global Aerospace Foam Market Segmentation Coverage

- On the basis of the type, the market has been categorized into polyurethane, polyimide, metal foams, melamine, polyethylene and others, wherein polyurethane represent the leading segment. Polyurethane foam leads the aerospace foam market due to its lightweight, durability and excellent insulation properties. Its versatility allows it to be used in various aerospace applications, including seats, insulation panels and cabin interiors providing superior comfort and performance. Its cost-effectiveness further cements its position as the top choice among manufacturers in the industry.

- Based on the application, the market is classified into aircraft seats, aircraft floor carpets, cabin walls and ceilings, flight deck pads, overhead stow bins and others, amongst which aircraft seats dominates the market. Aircraft seats dominate the application segment in the aerospace foam market driven by the demand for lightweight and ergonomic designs. The use of advanced foam materials ensures comfort, durability and compliance with stringent safety standards. This segment continues to grow as airlines prioritize passenger comfort and fuel efficiency.

- On the basis of the end user, the market has been divided into general aviation, military aircraft and commercial aviation. Among these, commercial aviation accounts for the majority of the market share. Commercial aviation accounts for the largest aerospace foam market share driven by the expansion of airline fleets and significant increase in air travel demand. The need for lightweight and high-performance materials to enhance the fuel efficiency and passenger comfort has made aerospace form a critical component for commercial aircraft manufacturers.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 5.9 Billion |

| Market Forecast in 2033 | USD 9.4 Billion |

| Market Growth Rate 2025-2033 | 5.4% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polyurethane, Polyimide, Metal Foams, Melamine, Polyethylene, Others |

| Applications Covered | Aircraft Seats, Aircraft Floor Carpets, Cabin Walls and Ceilings, Flight Deck Pads, Overhead Stow Bins, Others |

| End Users Covered | General Aviation, Military Aircraft, Commercial Aviation |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aerofoam Industries, LLC, Armacell, BASF SE, Boyd, DuPont de Nemours, Inc., Evonik Industries AG, General Plastics Manufacturing Company, Greiner AG, Huntsman International LLC, NCFI Polyurethanes, Rogers Corporation, SABIC, Zotefoams plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Aerospace Foam Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)