Agriculture Technology as a Service Market Report by Service Type (Software-as-a-Service (SaaS), Equipment-as-a-Service (EaaS)), Technology (Guidance Technology, Data Analytics and Intelligence, Variable Rate Application Technology, Sensing Technology, and Others), Pricing (Pay-Per-Use, Subscription), Application (Yield Mapping and Monitoring, Soil Management and Testing, Crop Health Monitoring, Irrigation, and Others), and Region 2025-2033

Agriculture Technology as a Service Market Size:

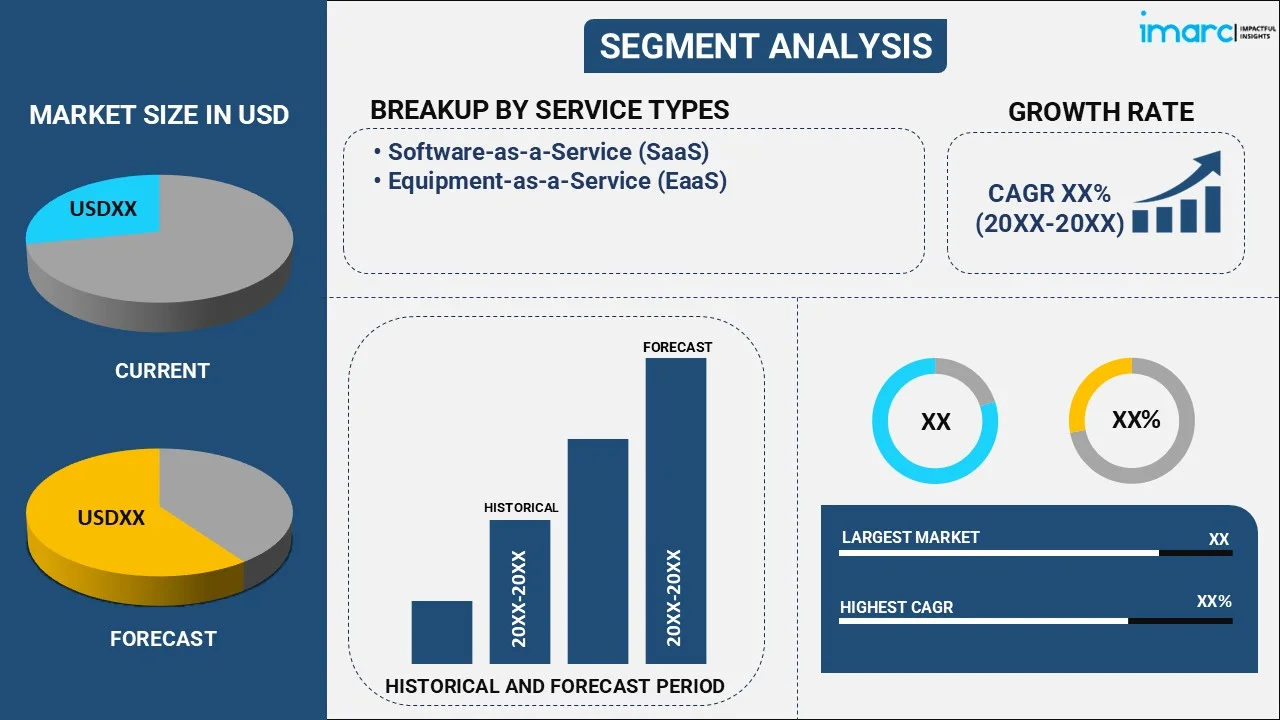

The global agriculture technology as a service market size reached USD 2.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.1 Billion by 2033, exhibiting a growth rate (CAGR) of 16.01% during 2025-2033. The market is experiencing steady growth driven by the increasing global demand for food due to population growth, the rising need for sustainable farming practices amidst rising environmental concerns, and the growing awareness among farmers of the benefits of integrating technology into their farming practices.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.3 Billion |

|

Market Forecast in 2033

|

USD 9.1 Billion |

| Market Growth Rate 2025-2033 | 16.01% |

Agriculture Technology as a Service Market Analysis:

- Market Growth and Size: The global market is experiencing rapid growth, fueled by the rising demand for precision agriculture and sustainable farming practices. With a growing global population and heightened environmental concerns, the market is poised for significant expansion, driven by the need for more efficient and productive agricultural methods.

- Technological Advancements: Advances in IoT, AI, and remote sensing are key drivers in this market. The integration of these technologies facilitates real-time monitoring and management of agricultural activities, enhancing crop yields and efficiency. The adoption of big data and analytics in agriculture is also pivotal, enabling better decision-making through the analysis of diverse data sets.

- Industry Applications: This market finds applications across various agricultural sectors, including crop monitoring, farm management, and predictive analytics for yield optimization. The technology serves large-scale agribusinesses and small and medium-sized farms, helping to bridge technological gaps and improve overall agricultural productivity.

- Key Market Trends: A significant trend in this market is the shift towards service-based models, offering technology solutions on a subscription basis. This approach makes advanced technologies more accessible to a wider range of farmers. Additionally, the focus on sustainable and precision farming practices is a major trend, aligning with global environmental and food security goals.

- Geographical Trends: The market shows strong growth in regions such as North America and Europe, where there is high adoption of advanced technologies and supportive government policies. However, Asia-Pacific is emerging as a fast-growing market, due to its large agricultural sector and increasing technological adoption.

- Competitive Landscape: The market is characterized by a mix of established technology companies and emerging startups. Competition is centered around innovation and partnerships, with companies constantly striving to offer more efficient and cost-effective solutions.

- Challenges and Opportunities: One major challenge is the high initial cost and complexity of advanced agricultural technologies, which can be a barrier for small-scale farmers. However, this challenge presents an opportunity for service-based models and government subsidies to play a role in democratizing access to these technologies. There is also significant potential in developing regions, where technology adoption is just beginning to take off, offering vast opportunities for market expansion.

Agriculture Technology as a Service Market Trends:

Rising demand for precision agriculture

The global market is experiencing significant growth, primarily driven by the increasing adoption of precision agriculture techniques. This approach utilizes data-driven insights and advanced technologies such as IoT, AI, and remote sensing to optimize farm operations, leading to increased crop yields and efficiency. Additionally, the integration of these technologies helps in precise monitoring and management of farm activities, reducing resource wastage and enhancing overall productivity. This trend is further fueled by the growing need for sustainable farming practices amidst rising environmental concerns and the pressing challenge of feeding a rapidly growing global population. As farmers and agribusinesses seek more efficient and effective ways to manage their operations, the demand for technology solutions that can provide real-time, actionable insights is rising, thereby propelling the market.

Government initiatives and support

Another key factor driving the market is the proactive role of governments worldwide in promoting agricultural technology. Various governments are implementing policies and providing subsidies to encourage the adoption of advanced agricultural technologies. This support is essential in helping farmers overcome the high initial costs associated with these technologies. Initiatives such as grants for precision farming equipment, funding for research and development in agricultural technologies, and education programs for farmers on the benefits of technology adoption are instrumental in this growth. Such government interventions are enabling the modernization of agriculture and ensuring food security and sustainability. Consequently, these efforts are substantially contributing to the expansion of the market, as more farmers and agribusinesses gain access to and invest in advanced technological solutions.

Integration of Big Data and analytics

The integration of big data and analytics in agriculture is revolutionizing the sector and significantly contributing to the growth of the market. By harnessing the power of big data, farmers and agribusinesses can make more informed decisions, leading to improved crop yields and operational efficiencies. In addition, data analytics enables the analysis of a vast array of information, from soil health and weather patterns to crop health and market trends, allowing for precision in farming practices. This technology is pivotal in identifying patterns and predicting outcomes, thus reducing risks and uncertainties associated with farming. Moreover, the ability to analyze and interpret large volumes of data is becoming increasingly important in the agricultural sector, driving the demand for solutions that offer these capabilities. This trend reflects the growing recognition of data-driven decision-making as a critical component in modern agriculture.

Agriculture Technology as a Service Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on service type, technology, pricing, and application.

Breakup by Service Type:

- Software-as-a-Service (SaaS)

- Equipment-as-a-Service (EaaS)

Software-as-a-Service (SaaS) accounts for the majority of the market share

The report has provided a detailed breakup and analysis of agriculture technology as a service market based on the service type. This includes software-as-a-service (SaaS) and equipment-as-a-service (EaaS). According to the report, software-as-a-service (SaaS) represented the largest segment.

The Software-as-a-Service (SaaS) segment holds the largest share in the market. This dominance is attributed to the increasing preference for cloud-based solutions in agricultural operations. SaaS in agriculture typically includes farm management software, data analytics platforms, and decision support systems. These solutions offer farmers and agribusinesses the ability to access sophisticated tools for data management, crop health monitoring, weather forecasting, and market trend analysis, among other functionalities. The attractiveness of SaaS lies in its scalability, affordability, and ease of use, making advanced technologies accessible without the need for significant upfront investments in hardware. Moreover, continuous updates and improvements in SaaS offerings ensure that users have access to the latest technologies and data insights, crucial for making informed decisions in a rapidly changing agricultural landscape.

On the contrary, the Equipment-as-a-Service (EaaS) segment, while smaller than SaaS, is an essential component of the market. EaaS involves the provision of agricultural equipment on a rental or lease basis, which includes advanced machinery including autonomous tractors, drones, and sensor-equipped tools. This model is particularly beneficial for small and medium-sized farms that may find the upfront purchase of such equipment cost-prohibitive. EaaS allows for the flexible use of modern, high-tech farming equipment, enabling farmers to leverage the benefits of advanced technology without the burden of ownership and maintenance. This segment is growing in response to the increasing mechanization of farming and the need for more efficient, precision-based agricultural practices.

Breakup by Technology:

- Guidance Technology

- Data Analytics and Intelligence

- Variable Rate Application Technology

- Sensing Technology

- Others

Data analytics and intelligence holds the largest share in the industry

A detailed breakup and analysis of agriculture technology as a service market based on the technology has also been provided in the report. This includes guidance technology, data analytics and intelligence, variable rate application technology, sensing technology, and others. According to the report, data analytics and intelligence accounted for the largest market share.

The data analytics and intelligence segment holds the largest share of the market, underlining the critical role of data-driven decision-making in modern agriculture. This segment encompasses tools and platforms that analyze a wide range of agricultural data, from soil and weather conditions to crop health and market trends. The ability to process and interpret large datasets enables farmers and agribusinesses to make informed decisions, ultimately leading to increased productivity and profitability. This segment's growth is driven by the increasing availability of data from various sources and the growing recognition of analytics as essential in optimizing agricultural practices and outputs.

On the other hand, guidance technology in the market includes GPS and other navigation systems that assist in precise field mapping and machinery operations. This technology enables farmers to minimize overlaps and gaps in the field, ensuring efficient use of resources like seeds, fertilizers, and pesticides. Additionally, guidance technology is crucial for precision agriculture, as it facilitates optimized field layouts and mechanized operations with high accuracy.

Along with this, variable rate application technology allows for the precise application of inputs such as fertilizers, seeds, and pesticides based on specific field conditions. By adjusting application rates according to soil properties and crop requirements, VRA technology plays a significant role in enhancing crop yields and reducing environmental impact. This technology is fundamental in implementing site-specific crop management, a core aspect of precision agriculture. The segment is gaining traction as farmers seek more sustainable and cost-effective farming methods, driven by both economic incentives and environmental considerations.

In addition, sensing technology in agriculture involves various sensors used for soil, crop, and environmental monitoring. These sensors provide vital data on parameters including soil moisture, nutrient levels, and plant health, which are crucial for making timely and accurate farming decisions. This technology is essential for precision agriculture, as it facilitates the real-time monitoring and management of agricultural operations, leading to optimized resource use and improved crop management.

Breakup by Pricing:

- Pay-Per-Use

- Subscription

Pay-per-use represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the pricing. This includes pay-per-use and subscription. According to the report, pay-per-use accounted for the largest market share.

The pay-per-use model is the largest segment in the market, resonating with the industry's need for flexibility and scalability. This pricing model allows farmers and agribusinesses to pay only for the technology or services they use, which can vary depending on the season, crop cycle, or specific project needs. This approach is particularly appealing in agriculture, where operations can be highly variable and influenced by external factors like weather conditions and market prices. The pay-per-use model reduces the financial risk for farmers, as it aligns costs directly with usage and, ultimately, with the value received. This model is especially beneficial for smaller farms or those in regions with less predictable farming conditions, as it provides access to advanced technologies without the need for significant upfront investment or long-term financial commitments.

On the contrary, the subscription segment, while smaller than pay-per-use, is a crucial part of the market. This model offers a fixed pricing structure, typically on a monthly or annual basis, providing users with continuous access to agricultural technology services. Subscriptions are often preferred by users who require consistent and ongoing use of technology, such as large farms or agribusinesses with extensive operations. This model provides predictability in terms of costs and ensures uninterrupted access to services and technology updates. Subscription services often include customer support, training, and regular updates, adding value beyond just the technological solution.

Breakup by Application:

- Yield Mapping and Monitoring

- Soil Management and Testing

- Crop Health Monitoring

- Irrigation

- Others

Yield mapping and monitoring exhibits a clear dominance in the market

A detailed breakup and analysis of agriculture technology as a service market based on the application has also been provided in the report. This includes yield mapping and monitoring, soil management and testing, crop health monitoring, irrigation, and others. According to the report, yield mapping and monitoring accounted for the largest market share.

Yield mapping and monitoring holds the largest segment in the market. This application involves using various technologies to assess and record crop yield data across different parts of a field. This information is crucial for understanding spatial variability in crop production and enables farmers to make data-driven decisions about seeding fertilization, and other crop management practices. Additionally, the popularity of yield mapping and monitoring stems from its direct impact on enhancing crop yields and profitability. By identifying areas of a field that are underperforming, farmers can tailor their practices to specific field conditions, leading to more efficient use of resources and improved overall yields. As a result, yield mapping and monitoring technologies are in high demand, especially in precision agriculture, where maximizing productivity while minimizing waste is paramount.

On the other hand, soil management and testing are a significant segment in the market, focusing on analyzing soil properties to optimize growing conditions. This application includes technologies for testing soil composition, moisture levels, pH balance, and nutrient profiles. Understanding these soil characteristics is essential for effective crop management, as it guides decisions regarding irrigation, fertilization, and crop selection. The importance of soil management and testing lies in its ability to enhance soil health and fertility, which are critical for sustainable agriculture and long-term productivity.

Apart from this, crop health monitoring is a key application in the market, involving technologies that assess the health and condition of crops. This segment includes the use of remote sensing, drones, and other sensor-based technologies to detect issues like pest infestations, diseases, and nutrient deficiencies. Timely detection and diagnosis enable farmers to take corrective actions quickly, reducing potential yield losses. Crop health monitoring is crucial for maintaining high-quality produce and ensuring the efficient use of inputs, making it a valuable tool for farmers aiming to optimize their operations and output.

Furthermore, the irrigation segment involves technologies that assist in the efficient management and application of water in agricultural settings. This includes systems for monitoring soil moisture and automating irrigation schedules to optimize water usage. The significance of this segment lies in its contribution to water conservation and the enhancement of crop yields. Efficient irrigation technologies are particularly important in regions with water scarcity or where water management is a critical aspect of sustainable farming. By ensuring that crops receive the right amount of water at the right time, these technologies play a vital role in improving the productivity and sustainability of agricultural practices.

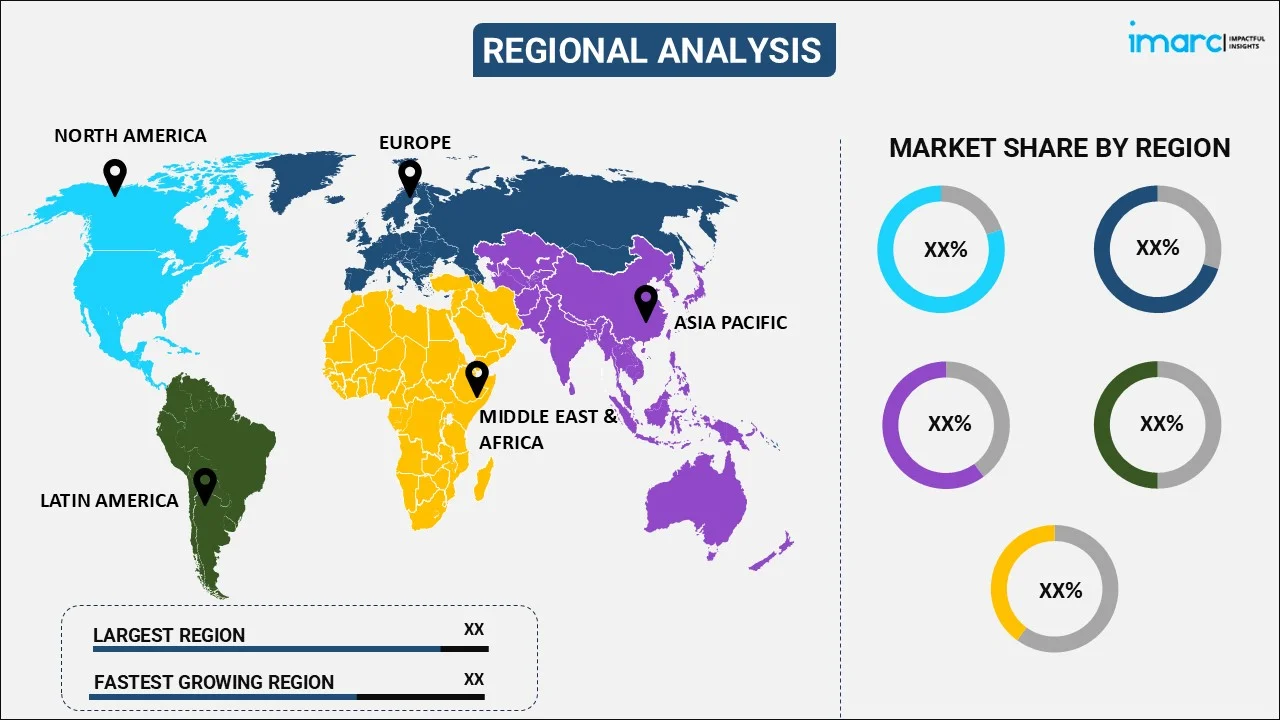

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest agriculture technology as a service market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

North America represents the largest segment in the market, attributed to its advanced agricultural infrastructure, high adoption of modern farming technologies, and supportive government policies. The region, particularly the United States and Canada, has been a pioneer in embracing technologies such as precision agriculture, data analytics, and IoT in farming practices. The presence of major technology companies and startups in this region, coupled with significant investments in agricultural technology research and development, further fuel the growth. North America's market dominance is also driven by a strong focus on sustainable agriculture and the need to enhance productivity to meet the demands of a growing population.

Along with this, the Asia Pacific region is experiencing rapid growth in the market, primarily due to the large agricultural sector and increasing technological adoption in countries such as China, India, and Australia. The region's market growth is driven by the need to improve agricultural productivity amidst challenges such as limited arable land, growing population, and climate change. Increasing government initiatives to modernize agriculture, along with rising awareness among farmers about the benefits of technology in farming, are key factors contributing to this growth.

In addition, Europe's market is characterized by high technology adoption rates and strong government support for sustainable farming practices. Countries such as Germany, France, and the Netherlands are leaders in integrating advanced technologies in agriculture, focusing on efficiency, sustainability, and reducing environmental impact. The European Union's Common Agricultural Policy and other initiatives provide a supportive framework for technology adoption, driving market growth. Europe's emphasis on precision agriculture and farm management systems to enhance productivity while minimizing ecological footprints plays a crucial role in the market dynamics.

Moreover, the market in Latin America is growing steadily, driven by the increasing adoption of technology in large agricultural countries such as Brazil and Argentina. The region is recognizing the potential of agricultural technologies to improve crop yields and compete more effectively in the global market.

Apart from this, the market in the Middle East and Africa is emerging, with a focus on addressing challenges such as water scarcity, limited arable land, and climate change impacts. Technology adoption is growing as countries in these regions seek to enhance agricultural productivity and sustainability. Initiatives by governments and international organizations to promote modern farming techniques and investments in agricultural technology infrastructure are key drivers of market growth in this region.

Leading Key Players in the Agriculture Technology as a Service Industry:

The key players in the market are actively engaged in a range of strategic activities to strengthen their market positions. These include investments in research and development to innovate and improve their technology offerings, particularly in areas such as AI, IoT, and big data analytics. Many are forming strategic partnerships and collaborations with other technology firms, agricultural businesses, and research institutions to expand their market reach and enhance their service capabilities. Additionally, these companies are increasingly focusing on customer-centric solutions, offering customizable and scalable services to cater to the diverse needs of farmers and agribusinesses. Efforts are also being made to increase market penetration, especially in developing regions where technology adoption in agriculture is still nascent. These activities are coupled with initiatives to enhance user awareness and education about the benefits and use of advanced agricultural technologies.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AGCO Corporation

- Agrivi Ltd.

- CLAAS KGaA mbH

- CropIn Technology Solutions Pvt. Ltd.

- Deere & Company

- Hexagon AB

- Naïo Technologies

- Raven Industries Inc. (CNH Industrial N.V.)

- SZ DJI Technology Co. Ltd. (iFlight Technology Company Limited)

- Topcon Corporation

- Trimble Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- July 26, 2023: Hexagon AB signed a significant deal with the diverse mining business Mineral Resources (MinRes) to supply an autonomous haulage system for a fleet of road trains operating at the Onslow iron ore project in Western Australia. According to the companies, this arrangement will revolutionize the region's sustainability, productivity, and safety.

- April 6, 2023: AGCO Corporation established a collaboration with Bosch BASF to jointly develop further innovative features and integrate and market Smart Spraying technology on Fendt Rogator sprayers.

- March 13, 2023: Raven Industries Inc. announced that following the purchase of the machine vision startup by CNH Industrial, Raven's parent company, it will start the strategic integration of Augmenta.

Agriculture Technology as a Service Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Software-as-a-Service (SaaS), Equipment-as-a-Service (EaaS) |

| Technologies Covered | Guidance Technology, Data Analytics and Intelligence, Variable Rate Application Technology, Sensing Technology, Others |

| Pricings Covered | Pay-Per-Use, Subscription |

| Applications Covered | Yield Mapping and Monitoring, Soil Management and Testing, Crop Health Monitoring, Irrigation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AGCO Corporation, Agrivi Ltd., CLAAS KGaA mbH, CropIn Technology Solutions Pvt. Ltd., Deere & Company, Hexagon AB, Naïo Technologies, Raven Industries Inc. (CNH Industrial N.V.), SZ DJI Technology Co. Ltd. (iFlight Technology Company Limited), Topcon Corporation, Trimble Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the agriculture technology as a service market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global agriculture technology as a service market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the agriculture technology as a service industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The agriculture technology as a service market was valued at USD 2.3 Billion in 2024.

The agriculture technology as a service market is projected to exhibit a CAGR of 16.01% during 2025-2033, reaching a value of USD 9.1 Billion by 2033.

Key factors driving the agriculture technology as a service market include rising adoption of precision farming, growing need for scalable farm management, increasing demand for data-driven insights, reduced capital burden through subscription models, and rising awareness of sustainable agricultural practices among small and large-scale farmers.

North America currently dominates the agriculture technology as a service market due to precision farming adoption, demand for data-driven solutions, subscription-based service models, and increased focus on sustainable and efficient agricultural practices.

Some of the major players in the agriculture technology as a service market include AGCO Corporation, Agrivi Ltd., CLAAS KGaA mbH, CropIn Technology Solutions Pvt. Ltd., Deere & Company, Hexagon AB, Naïo Technologies, Raven Industries Inc. (CNH Industrial N.V.), SZ DJI Technology Co. Ltd. (iFlight Technology Company Limited), Topcon Corporation, Trimble Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)