Agro Textiles Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

Agro Textiles Market Size and Share:

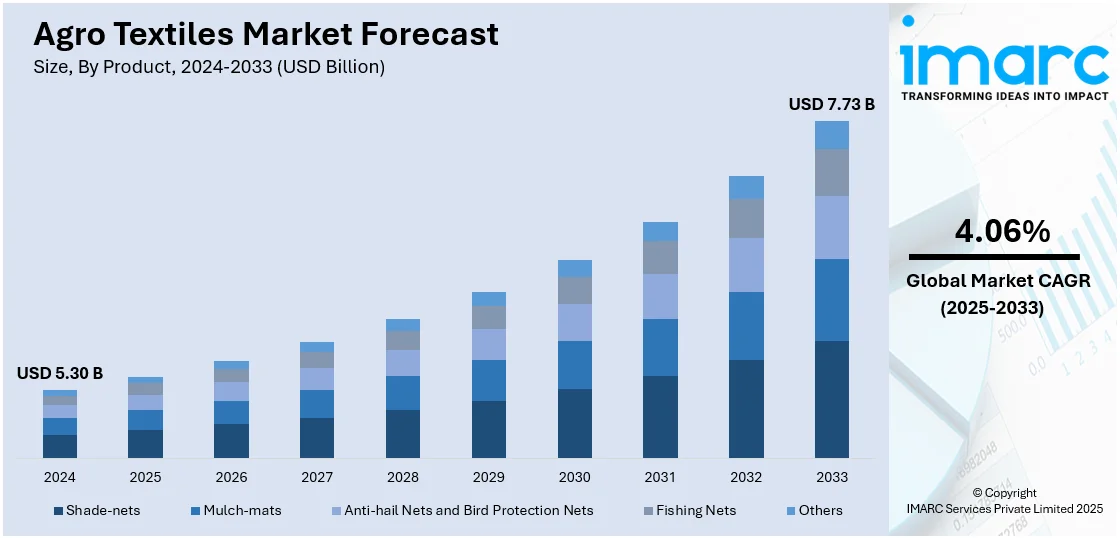

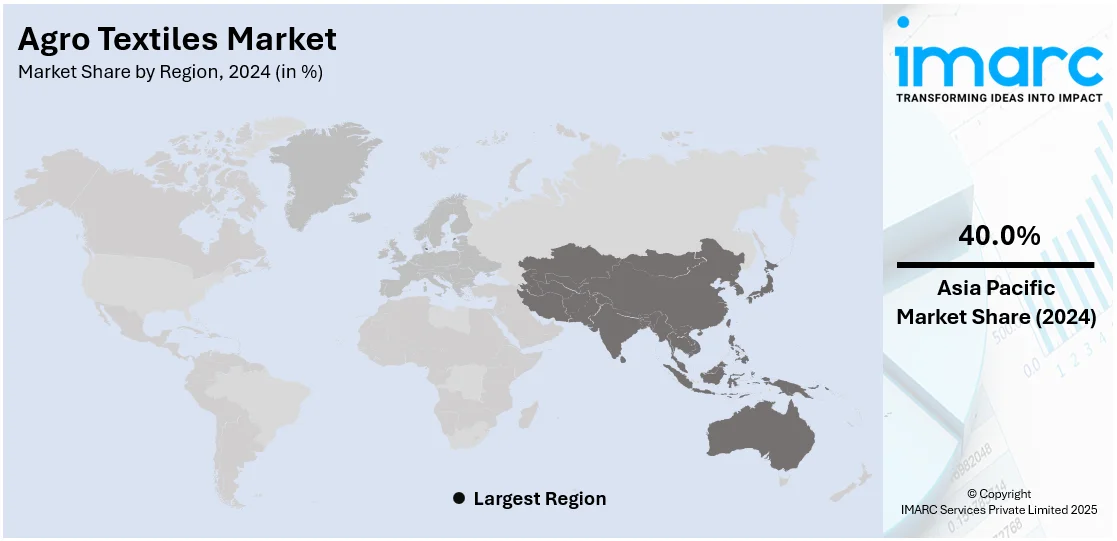

The global agro textiles market size was valued at USD 5.30 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 7.73 Billion by 2034, exhibiting a CAGR of 4.06% during 2026-2034. Asia-Pacific currently dominates the market, holding a significant market share of 40.0% in 2024. The rising global food demand, climate change challenges, increased adoption of greenhouse and vertical farming, government support for sustainable agriculture, and technological advancements in eco-friendly, durable, and efficient textile solutions are some of the major factors fueling the agro textiles market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 5.30 Billion |

|

Market Forecast in 2034

|

USD 7.73 Billion |

| Market Growth Rate 2026-2034 | 4.06% |

The market for agro textiles is primarily driven by the rising global population and food demand, compelling farmers to adopt advanced agricultural practices that improve yield and crop protection. Climate change and unpredictable weather patterns have increased the need for protective solutions like shade nets, ground covers, and windbreaks. The growth of greenhouse and vertical farming further fuels demand for agro textiles, which help regulate temperature, moisture, and pest exposure. Numerous national governments provide financial aid as well as regulatory advantages for stimulating the adoption of sustainable farming approaches. Additionally, technological advancements have led to the development of UV-resistant, biodegradable, and durable textiles that align with environmental goals.

The agro textiles market in the United States is influenced by the increasing adoption of sustainable farming practices, which is further driving demand for agro textiles that enhance crop protection and yield. Technological advancements in materials, such as UV-resistant and biodegradable fabrics, are improving the efficiency and environmental impact of agricultural operations. Government policies and subsidies supporting sustainable agriculture further encourage the use of agro textiles. Additionally, the expansion of greenhouse and vertical farming necessitates specialized textiles to optimize growing conditions. For instance, in January 2024, leading food, feed, and fiber agribusiness Olam Agri announced the start of its regenerative agriculture initiative throughout the U.S. cotton belt to satisfy the rising demand for cotton that is traceable and sustainably cultivated.

Agro Textiles Market Trends:

Climate Change and Weather Variability

Climate change is one of the most significant challenges facing agriculture today. According to the Food and Agriculture Organization of the United Nations, in 2022, total pesticide use in agriculture was 3.70 million tonnes (Mt) of active ingredients, marking a 4% increase compared to 2021. Erratic weather patterns, extreme temperatures, and unpredictable rainfall are increasing the vulnerability of crops to damage. Agro textiles, including shade nets, windbreaks, and UV-resistant covers, provide essential protection against such conditions. These materials help mitigate the impact of harsh weather, ensuring better crop survival and productivity. As climate change accelerates, the demand for agro textiles designed to adapt to varying environmental conditions is expected to grow significantly, driving the market forward.

Government Support for Sustainable Agriculture

Governments worldwide are focusing on promoting sustainable farming practices, offering subsidies, grants, and policy incentives to support eco-friendly solutions. In many regions, agro textiles are integral to sustainable farming strategies, as they help reduce resource use, improve water retention, and protect crops from environmental stressors. With an emphasis on reducing carbon footprints and promoting biodiversity, governments are encouraging farmers to adopt agro textiles for more sustainable crop production. According to the agro textiles market forecast, this support is a key driver for the market, as it enables the widespread adoption of agricultural textiles across various farming systems. For instance, in October 2023, in collaboration with ITTA and SASMIRA, the Ministry of Textiles, through its flagship program, the National Technical Textiles Mission (NTTM), held a National Conclave on Agrotech, highlighting the significance of increasing the production of agricultural and horticultural goods in India.

Technological Advancements in Agro Textiles

Technological innovations are a major factor in the growth of the agro textiles market. Over the years, advancements in textile manufacturing have led to the development of more durable, efficient, and environmentally friendly agro textiles. UV-resistant fabrics, biodegradable materials, and smart textiles equipped with sensors for monitoring crop health are just some of the innovations that have improved the performance of agro textiles. These advancements enhance the functionality of textiles, making them more versatile for applications such as greenhouse farming, pest control, and soil management, which, in turn, creates a positive agro textiles market outlook. For instance, in September 2024, with the introduction of innovative crop protection and seed preservation techniques, the National Technical Textiles Mission (NTTM) is driving a revolutionary change in Indian agriculture through agrotextile innovation. The government's dedication to farmer welfare and sustainable agricultural expansion is demonstrated by this effort. NTTM is opening the door for higher agricultural yields, less environmental impact, and farmer empowerment throughout India by fusing cutting-edge textile technologies with conventional farming practices.

Agro Textiles Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global agro textiles market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on product and application.

Analysis by Product:

- Shade-nets

- Mulch-mats

- Anti-hail Nets and Bird Protection Nets

- Fishing Nets

- Others

Fishing nets hold the largest share in the agro textiles market, primarily due to the rapid expansion of aquaculture. The increasing global demand for seafood, driven by its applications in food, nutraceuticals, pharmaceuticals, and cosmetics, has significantly boosted aquaculture activities. Fishing nets are essential in these operations, serving as critical tools for harvesting and containment. Advancements in net materials, such as UV-resistant and biodegradable options, have enhanced durability and sustainability, further promoting their adoption. Additionally, the growing reliance on aquaculture to meet seafood demand, especially in developing regions, underscores the dominance of fishing nets in the agro textiles sector.

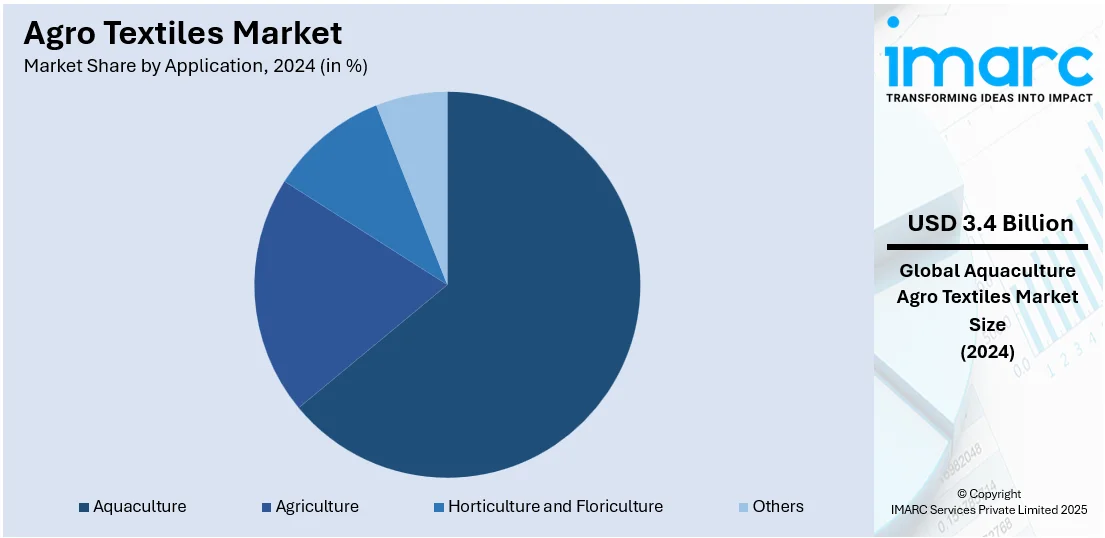

Analysis by Application:

- Agriculture

- Horticulture and Floriculture

- Aquaculture

- Others

Aquaculture leads the market with around 64.33% of market share in 2024 due to the extensive use of fishing nets. The rising global demand for seafood, driven by its utilization in nutraceuticals, pharmaceuticals, and cosmetics, has propelled the growth of aquaculture. Agro textiles such as shade nets, pond liners, and predator barriers are essential in aquaculture for creating controlled environments, protecting aquatic species, and enhancing yield. Additionally, advancements in fishing net materials, including UV-resistant and biodegradable options, have improved durability and sustainability, further boosting their adoption in aquaculture practices.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 40.0%. Asia-Pacific is experiencing an accelerating trend in agro textiles adoption due to growing investment in agri tech startups. For instance, in 2020, the Indian government invested approximately USD 4.32 Million in 346 agri tech startups, aiming to boost the growth of the agricultural sector. Surge in funding toward agri tech startups is fueling innovation in farming technologies, leading to increased utilization of agro textiles across multiple agricultural applications. Venture capital support and government initiatives aimed at boosting agricultural productivity are amplifying the importance of agro textiles in the region. Agri tech startups are introducing solutions that integrate agro textiles for enhanced crop protection and water management. Growing interest in sustainable agriculture, driven by tech innovations, is creating fertile ground for agro textiles to flourish. Investments in smart farming technologies are promoting the use of materials that help optimize resource use, reinforcing agro textiles as a strategic tool. Asia-Pacific continues to be a dynamic hub for advancing agro textiles.

Key Regional Takeaways:

North America Agro Textiles Market Analysis

The agro textiles market demand in North America is expanding due to several key factors. The increasing adoption of sustainable farming practices is driving demand for eco-friendly agricultural textiles that enhance crop protection and yield. Furthermore, the rise of greenhouse farming and vertical agriculture necessitates specialized textiles like shade nets and insect-proof screens to regulate environmental conditions. Additionally, technological advancements have led to the development of UV-resistant and biodegradable materials, aligning with environmental regulations and consumer preferences. Government initiatives and subsidies supporting sustainable agriculture further bolster agro textiles market growth across the region. Moreover, the need for efficient land management and resource optimization in agriculture contributes to the increased utilization of agro textiles.

United States Agro Textiles Market Analysis

In 2024, the United States accounted for 77.80% of the agro textiles market in North America. The United States is witnessing significant momentum in agro textiles adoption due to growing farming and horticulture activities. According to the U.S. Department of Agriculture, horticultural products grew at a rate of 6% a year during the period and, at USD 97.2 Billion in value in 2022, accounted for 65% of the total growth in imports. Expansion in farming practices, coupled with an increasing focus on horticulture, is elevating the demand for specialized fabrics that enhance crop yield and protect produce. Agro textiles are becoming essential tools in modern farming, supporting initiatives that demand higher productivity and better resource management. As farming and horticulture sectors evolve, the adoption of agro textiles continues to strengthen, helping to address challenges related to climate conditions and pest management. Technological advancements in farming techniques are also encouraging greater use of agro textiles for improved operational efficiency. With farming and horticulture becoming increasingly technology-driven, agro textiles are set to become indispensable components of agricultural practices across the United States.

Europe Agro Textiles Market Analysis

Europe is embracing a heightened level of agro textiles adoption due to the emerging trend of sustainable farming. According to Eurostat, 16.9 million hectares of agricultural land were used for organic farming in the EU in 2022, and the number is still growing. The agricultural sector is pivoting toward practices that prioritize environmental stewardship, where agro textiles play a critical role. Sustainable farming methods emphasize reduced chemical usage, soil protection, and water conservation, all of which are supported by agro textiles solutions. Innovations in biodegradable and eco-friendly fabrics are aligning perfectly with sustainable farming goals. The drive to meet sustainability targets is encouraging farmers to integrate agro textiles into their operations for better yield with minimal ecological impact. Policy support for sustainable agriculture further boosts agro textiles deployment. As sustainable farming becomes the standard in Europe, agro textiles are establishing themselves as vital tools in achieving eco-conscious agricultural outcomes.

Latin America Agro Textiles Market Analysis

Latin America is observing increased agro textiles adoption due to the growing animal husbandry business. For instance, 28% of the world's cow population, beef production, and milk production are found in Latin America and the Caribbean. The need for protective coverings, feed storage, and livestock shading solutions is pushing the use of agro textiles across animal husbandry operations. Rising awareness about animal welfare and operational efficiency is encouraging businesses to incorporate agro textiles to create better living conditions for livestock. As the animal husbandry business expands in scale and sophistication, agro textiles are playing an essential role in supporting productivity and health standards across Latin America.

Middle East and Africa Agro Textiles Market Analysis

The Middle East and Africa are witnessing a significant rise in agro textiles adoption, fueled by increasing investments in the agricultural sector. Countries like Saudi Arabia, the UAE, and South Africa are prioritizing agricultural sustainability to enhance food security amid challenging climatic conditions. For instance, in October 2024, Saudi Arabia’s agriculture sector attracted USD 9.8 Billion in private investments. Agro textiles such as shade nets, mulch mats, and crop covers are being increasingly used to improve crop yield, protect against extreme weather, and conserve water. Government initiatives, foreign direct investments, and public-private partnerships are supporting the modernization of farming practices. This shift is also encouraging local manufacturing of agro textiles, boosting regional supply chains and creating new business opportunities in the agri-tech and textile sectors.

Competitive Landscape:

The agro textiles market is characterized by a competitive and moderately fragmented landscape, featuring a mix of global leaders and regional specialists. Prominent companies such as SRF Limited (India), Garware Technical Fibres Ltd. (India), Beaulieu Technical Textiles (Belgium), Freudenberg Performance Materials (Germany), and TenCate Geosynthetics (Netherlands) dominate the market through extensive product portfolios and robust R&D capabilities. These firms focus on developing specialized fabrics like UV-resistant shading nets, anti-hail nets, and biodegradable ground covers to meet diverse agricultural needs. Regional players, including Hy-Tex (UK) Ltd. and Zhongshan Hongjun Nonwovens Co., Ltd. (China), contribute to market competitiveness by offering cost-effective, locally tailored solutions. The industry's growth is further propelled by technological innovations, such as advanced weaving techniques and smart textiles, enhancing efficiency and sustainability. Strategic partnerships, acquisitions, and mergers are common as companies aim to expand their global footprint and address the evolving demands of modern agriculture.

The report provides a comprehensive analysis of the competitive landscape in the agro textiles market with detailed profiles of all major companies, including:

- B&V Agro Irrigation Co.

- Beaulieu Technical Textiles

- Belton Industries, Inc.

- Capatex Ltd.

- Diatex

- Hy-Tex (U.K.) Ltd.

- Meyabond Industry & Trading (Beijing) Co. Ltd.

- Neo Corp International Limited

- SRF Limited

- Zhongshan Hongjun Nonwovens Co. Ltd.

Latest News and Developments:

- February 2025: GAIA Biomaterials, together with partners in South Africa, replaced harmful polyethylene fishing nets with biodegradable alternatives using Biodolomer®Ocean, a PBS-based polymer. The new nets, designed to match traditional performance, disintegrated into biomass without releasing toxins or micro-plastics. The initiative also emphasizes agro textile innovation to address plastic pollution and protect marine biodiversity.

- February 2025: The Tamil Nadu Pollution Control Board (TNPCB) is establishing a new fishnet collection centre at Kovalam, East Coast Road, as part of the Tamil Nadu Fishnet Initiative Project, to tackle marine litter.

- January 2025: The Climate Smart Agro Textile Demonstration Center was inaugurated in Navsari, India, by the Ministry of Textiles and SASMIRA. The center, covering 15,000 sq. meters, promoted sustainable farming practices through advanced agro textile solutions. Equipped with IoT-based systems, it showcases shade nets, ground covers, pond liners, and more to boost crop productivity.

- September 2024: Spain’s Fishing Confederation (Cepesca), National Federation of Fishermen's Guilds (FNCP), and the Galician Automotive Technology Centre (CTAG) announced that they would launch the ‘Redes de España’ project to recover over 100 tons of discarded fishing gear. Fishing net waste would also be converted into high-value materials for various sectors, including automotive, naval, and agro textiles.

Agro Textiles Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Shade-nets, Mulch-mats, Anti-hail Nets and Bird Protection Nets, Fishing Nets, Others |

| Applications Covered | Agriculture, Horticulture and Floriculture, Aquaculture, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | B&V Agro Irrigation Co., Beaulieu Technical Textiles, Belton Industries, Inc., Capatex Ltd., Diatex, Hy-Tex (U.K.) Ltd., Meyabond Industry & Trading (Beijing) Co. Ltd., Neo Corp International Limited, SRF Limited and Zhongshan Hongjun Nonwovens Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the agro textiles market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global agro textiles market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the agro textiles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The agro textiles market was valued at USD 5.30 Billion in 2024.

The agro textiles market is projected to exhibit a CAGR of 4.06% during 2025-2033, reaching a value of USD 7.73 Billion by 2033.

The agro textiles market is driven by increasing global food demand, necessitating enhanced crop yields and protection. Climate change and urbanization spur adoption of greenhouse and vertical farming, utilizing agro textiles for environmental control. Technological advancements yield durable, eco-friendly materials, aligning with sustainable agriculture trends. Government initiatives further bolster market growth.

Asia Pacific currently dominates the agro textiles market due to rising food demand, climate resilience needs, government support, precision agriculture adoption, and sustainable farming practices.

Some of the major players in the agro textiles market include B&V Agro Irrigation Co., Beaulieu Technical Textiles, Belton Industries, Inc., Capatex Ltd., Diatex, Hy-Tex (U.K.) Ltd., Meyabond Industry & Trading (Beijing) Co. Ltd., Neo Corp International Limited, SRF Limited and Zhongshan Hongjun Nonwovens Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)