Agrochemicals Market Size, Share, Trends and Forecast by Fertilizer Type, Pesticide Type, Crop Type, and Region, 2025-2033

Agrochemicals Market 2024, Size and Trends:

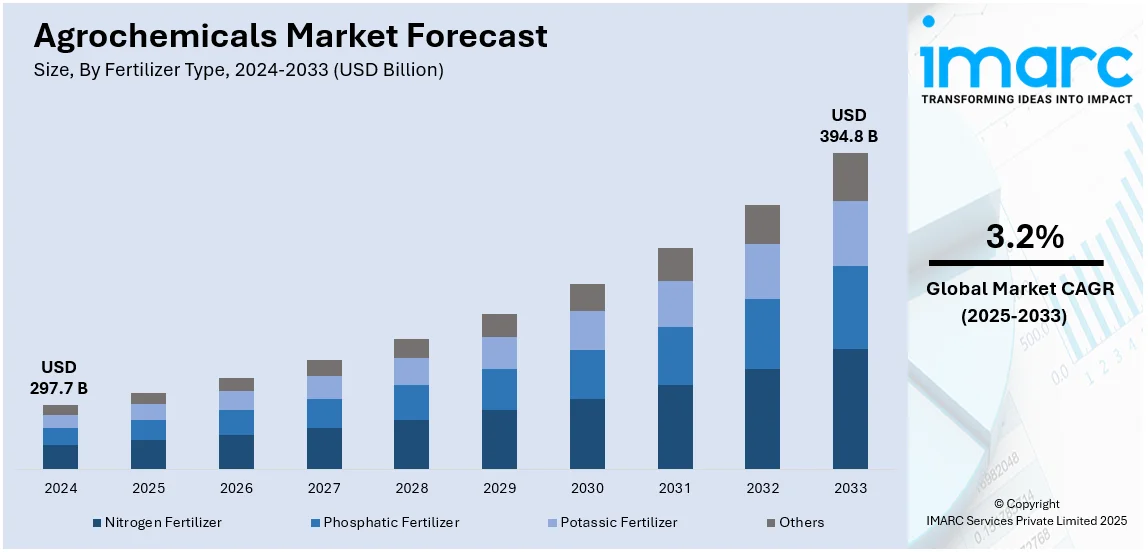

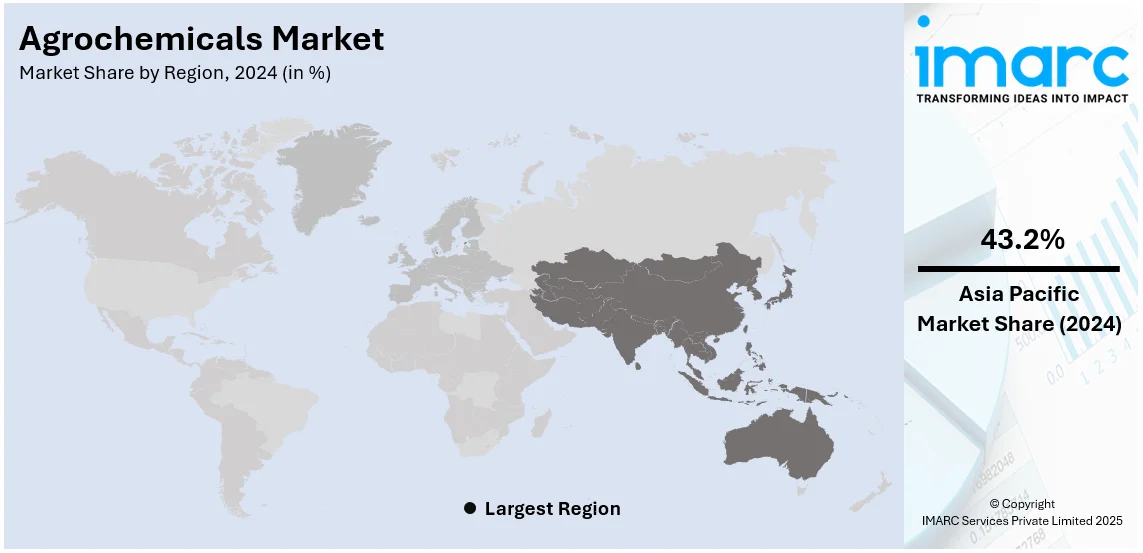

The global agrochemicals market size was valued at USD 297.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 394.8 Billion by 2033, exhibiting a CAGR of 3.2% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 43.2% in 2024. Asia pacific region is mainly driven by the increasing agricultural activities, rising food demand, and the adoption of advanced farming techniques to enhance productivity.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 297.7 Billion |

| Market Forecast in 2033 | USD 394.8 Billion |

| Market Growth Rate 2025-2033 | 3.2% |

With the global population growing, the need for food production is also rising. Agrochemicals like fertilizer and pesticides serve as a crucial component in improving crop yield and ensuring food supply. Moreover, advancements in agrochemical formulations, such as bio-based pesticides and improved fertilizer mixes, are contributing to the market growth. Precision agriculture innovations also encourage the efficient usage of agrochemicals. Besides this, the growing emergence of pests and diseases due to climate change, requires efficient solutions to protect crops, thereby increasing the dependence on pesticides and herbicides. In addition, the growing emphasis on sustainable farming and adoption of integrated pest management systems is catalyzing the demand for environment-friendly agrochemicals.

The United States is a key region in the agrochemical market, driven by rising investments in research operations. These efforts lead to the introduction of novel products, including pest-resistant technologies and precision-targeted chemicals. Furthermore, the rising occurrence of fungal infections in crops like fruits, vegetables, and grains is encouraging the use of fungicides to ensure high-quality yields and prevent significant losses. In 2024, Sipcam Agro USA launched Mevalone biofungicide in California and 16 other states. Mevalone effectively manages bunch rot and powdery mildew in grapes with naturally derived active ingredients and a low resistance risk, fitting well into integrated disease management programs. Its unique Sustaine Technology improves efficacy and environmental safety, allowing vineyards to export without residue concerns.

Agrochemicals Market Trends:

Increasing Concerns About Food Security

Ensuring food security is emerging as a critical priority for the world, given the projection that the global population will reach 10.3 billion by the mid-2080s (as per a news article- The Sun). Agrochemicals, such as fertilizers and pesticides, play a crucial role in tackling this issue by greatly increasing crop productivity and providing protection from pests and diseases. For example, as per data in an industrial report, the worldwide usage of agrochemicals results in a 30–50% rise in agricultural productivity, enabling farmers to meet the increasing food requirements despite limited arable land. Urbanization and industrial expansion are further reducing farmland availability, and therefore, the efficient use of agrochemicals is becoming indispensable. Sophisticated fertilizers and pesticides enhance crop durability and maximize resource usage, guaranteeing long-term food production. Advancements in agrochemical formulations, such as delayed-release fertilizers and biological pesticides, align with environmental objectives while promoting increased crop yields. As the demand for agricultural products continues to grow, the agrochemical market is critical to ensuring a stable and abundant global food supply while encouraging sustainable farming practices around the world.

Rise in Adoption of High-yielding Crop Varieties

As global agricultural demands are on the rise, farmers are looking for ways to maximize their yields. According to the American Council on Science and Health, the use of high-yielding crop varieties (HYVs) has been an important strategy to meet this end and has accounted for a 40% increase in crop production from 1965 to 2010. However, these high-yielding crop varieties are often more prone to pests and diseases. Most recently, Indian Prime Minister Shri Narendra Modi released 109 high yielding, climate resilient and biofortified varieties of crops at India Agricultural Research Institute, New Delhi. The 109 varieties of 61 crops released by the Prime Minister included 34 field crops and 27 horticultural crops. Among the field crops, seeds of various cereals including millets, forage crops, oilseeds, pulses, sugarcane, cotton, fiber and other potential crops were released. Among the horticultural crops, different varieties of fruits, vegetable crops, plantation crops, tuber crops, spices, flowers and medicinal crops were released. Agrochemicals comprise insecticides, fungicides, and herbicides, but without them, these crops may face threats, either actual or potential, as far as their productivity is concerned. Nitrogen fertilizers that have been used globally across five decades have increased seven-fold with HYV cultivation driving the efficiency of agriculture. Demand for agrochemicals will increase further with the adoption of high-yielding crop varieties in response to the pursuit of higher production and profitability by farmers in order to solve the world's food security.

Growing Need for Sustainable Farming Practices

Sustainability is an essential goal for global agriculture, and advances in agrochemical solutions support such a shift. Corteva indicates that hybrid wheat technology increases yield potential by 10% without using any more resources, making the productivity of resources efficient. These hybrid seeds are recognized for producing up to 20% greater yields in drought situations than elite varieties, providing durability against climate change. Covering 550 million acres worldwide and providing 20% of the world's calories, wheat has the potential to significantly enhance food security while maintaining a proper ecological balance. Biopesticides and organic fertilizers, which were worth USD 7.54 Billion in 2023 market value, support this change and help achieve sustainable farming objectives. Governments, particularly within initiatives like the EU Green Deal, have established goals to cut down pesticide usage by half by 2030, opening up possibilities for environmentally friendly agricultural chemical alternatives worldwide.

Agrochemicals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global agrochemicals market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on fertilizer type, pesticide type, crop type, and region.

Analysis by Fertilizer Type:

- Nitrogen Fertilizer

- Phosphatic Fertilizer

- Potassic Fertilizer

- Others

Nitrogen fertilizer dominates the market due to its critical role in enhancing crop productivity and ensuring high yields. Nitrogen is a vital nutrient for plant growth, playing a fundamental role in photosynthesis and protein synthesis. The widespread cultivation of cereals such as wheat, maize, and rice, which require substantial nitrogen inputs, contributes to the segment's prominence. Additionally, nitrogen fertilizers, including urea, ammonium nitrate, and ammonium sulfate, are cost-effective and readily available, further encouraging their adoption. Farmers prioritize these fertilizers to address soil nitrogen deficiencies, particularly in intensive agricultural systems. Innovations in nitrogen-based fertilizers, such as slow-release formulations, are enhancing their efficiency and reduced environmental impacts, encouraging their use. The dominance of the segment is also supported by government subsidies and initiatives aimed at ensuring food security.

Analysis by Pesticide Type:

- Fungicides

- Herbicides

- Insecticides

- Others

Herbicides represent the largest segment, primarily driven by their critical role in managing weed growth and enhancing crop yields. Herbicides are widely used across various crops, including cereals, oilseeds, and fruits, to control invasive weeds that compete for nutrients, water, and sunlight. The segment’s dominance is further supported by the adoption of herbicide-tolerant genetically modified (GM) crops. Farmers prefer herbicides for their efficiency in reducing manual labor and operational costs, especially in large-scale farming. The availability of diverse herbicide formulations tailored for specific weed types and climatic conditions also contributes to their widespread adoption. Technological advancements, including precision spraying techniques, are improving herbicide application efficiency, minimizing environmental impact. Additionally, government programs promoting sustainable agricultural practices emphasize integrated weed management solutions, reinforcing the herbicides growth trajectory. This segment remains pivotal to global agricultural productivity.

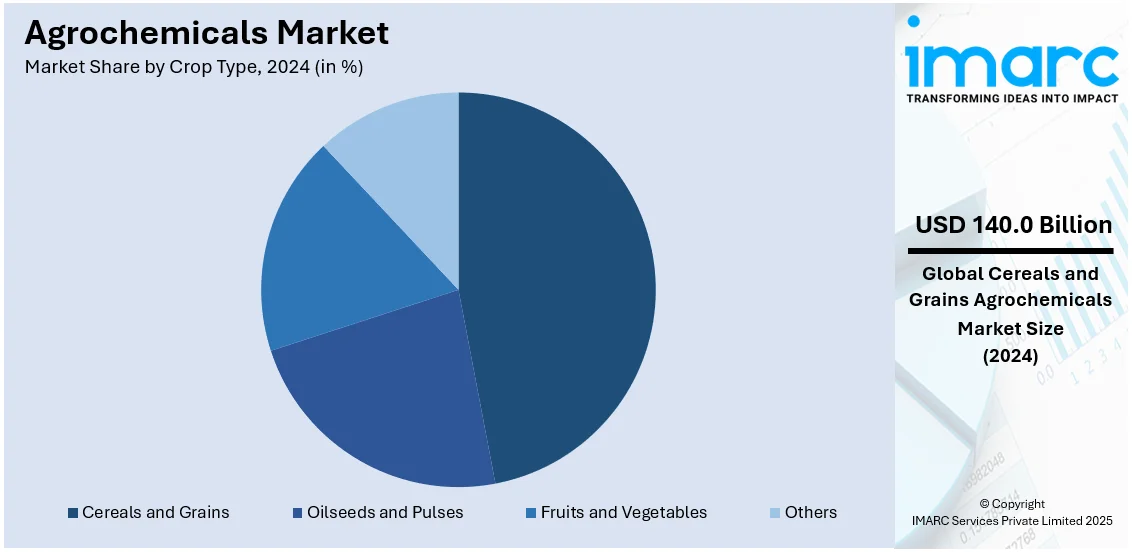

Analysis by Crop Type:

- Cereals and Grains

- Oilseeds and Pulses

- Fruits and Vegetables

- Others

Cereals and grains accounts for the majority of share market in 2024, accounting 47.02%. This is attributed to their central role in global food security and agricultural economies. Staples like wheat, rice, and maize dominate cultivation, driven by high consumption rates and demand for both human food and animal feed. These crops are particularly vulnerable to pests, diseases, and weeds, necessitating extensive use of fertilizers and pesticides to ensure optimal yields. The segment benefits from significant technological advancements, including high-yield seed varieties and targeted agrochemical solutions tailored to protect cereals and grains from biotic and abiotic stressors. Furthermore, government actions to improve food production, especially in areas with increasing populations, also contribute to the segment's dominance. The growing use of contemporary farming techniques like precision farming and integrated pest control highlights the importance of crop protection methods in maintaining consistent productivity in cereal and grain production.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific holds the largest market share of 43.2%. The Asia Pacific leads the market due to its extensive arable land, high population density, and dependence on agriculture for economic sustenance and food security. Nations like China, India, and Indonesia are making substantial investments in updating agricultural methods to keep up with the increasing need for food. The consumption of fertilizers, pesticides, and advanced agrochemical solutions is driven by the region's varied climate and assortment of crops. Rapid urbanization and shrinking arable land further encourage intensive farming practices, driving the need for yield-enhancing inputs. Government policies promoting sustainable agriculture and providing subsidies for agrochemicals also fuel market growth. Additionally, the growing focus on enhancing local production is offering a favorable market outlook in the region. For instance, in 2024, Ratnakar India Ltd. opened an advanced technical manufacturing facility in Dahej, Ankleshwar, to enhance agrochemical production and decrease reliance on imports. With an initial ₹60 crore investment in Phase 1 and intentions for Phase 2 by 2025, the site will serve both local and global markets, improving India's agrochemical distribution network.

Key Regional Takeaways:

United States Agrochemicals Market Analysis

In 2024, the US accounted for 74.6% of the total North America agrochemicals market. The United States agrochemicals market flourishes due to sophisticated farming technologies and increasing demand for greater crop productivity. According to Food and Agriculture Organization (FAO), in 2023, the total output of agriculture in the United States reached USD 448 Billion, of which agrochemical inputs were 15% of the total. A change toward bio-based fertilizers and pesticides is also becoming more prominent due to environmental sustainability objectives and consumer preferences for organic products. Precision farming is being adopted by 60% of large farms and increasing the demand for tailored agrochemical solutions like site-specific herbicides. The U.S. Environmental Protection Agency regulations are also promoting the industry towards safe and eco-friendly chemicals. Investment in R&D is quite high; for example, Corteva Agriscience committed USD 1.2 Billion to new agrochemical formulation innovation in 2023 aligned to environmental norms. Moreover, the growing incidences of extreme climatic conditions make it imperative for climate-resilient crop solutions, thus bringing a forward position of the US as a driver of advancement in the global agrochemicals market.

Europe Agrochemicals Market Analysis

Europe's agrochemical market is highly driven by stringent environmental policies, such as the European Union's Green Deal, which targets a 50% reduction in pesticide usage by 2030. The adoption of biopesticides and biofertilizers is witnessing rapid growth as farmers take cues from the EU drive for sustainable agriculture. For example, Horizon Europe committed USD 1 Billion to innovation in farming practices in 2023. That money is what kick-started the development of greener agrochemicals. The growth in organic farming, which increased by 20% in cultivated acres last year, is also giving more traction to natural agrochemicals. The leaders of the market, BASF and Syngenta, innovate. BASF recently launched two biopesticides for wheat and corn in 2024, which marks the beginning of a sustainable farm future for this region. All these developments are making Europe a world leader in sustainable agricultural practices.

Asia Pacific Agrochemicals Market Analysis

The two big players in agrochemicals industry are China and India, driving growth through large-scale agricultural activities and increasing food demands. As per the industry reports, agricultural exports from India touched USD 50 billion in 2023, a significant contribution to the global food supply. Asia's governing bodies are focusing on effective agrochemical use to increase yields, with the Indian USD 2 Billion fertilizer efficiency fund and China's "Zero Growth of Fertilizer Use by 2025" initiative setting the pace. Urbanization and shrinking arable land are driving the need for agrochemicals to ensure maximum productivity. The region is also experiencing rapid technology adoption in farming, such as smart irrigation and crop monitoring, which is further catalyzing the demand for agrochemicals. Major companies like UPL have reported a 15% revenue increase in 2023, with herbicides and insecticides driving the revenue. Local collaborations and innovations will continue to shape the future of Asia Pacific's agrochemical landscape.

Latin America Agrochemicals Market Analysis

Latin America has been the major driver for the global agrochemical market in 2023. As per industry reports, Brazil and Argentina are leading the race with their vast agricultural landscapes, producing record outputs, such as Brazil's 310 million tons of grains in 2023. There are specific challenges that only the region can face; for example, tropical pests and climate variability, driving the demand for agrochemicals such as pest-resistant fertilizers and herbicides. Government initiatives are important, such as Brazil's approval of 35 new agrochemical formulations in 2024 for combating soybean pests. Furthermore, agricultural tax incentives and subsidies help to decrease the cost burden on local farmers, leading to higher adoption rates of new products. The region's medical tourism push also drives sustainable farming to meet international safety standards. For example, companies like Bayer are expanding operations; one example is the USD 100 Million production facility they have set up in São Paulo. Agrochemical innovation and adoption now present a Latin American opportunity amid rising private sector investments into the region.

Middle East and Africa Agrochemicals Market Analysis

The Middle East and Africa agrochemical market is growing due to the increasing investment in agriculture and food security initiatives. The governing bodies are heavily investing in agricultural development; Saudi Arabia has allocated USD 500 Million under Vision 2030 for modernizing agriculture, while African Development Bank has pledged USD 10 Billion in 2023 to transform the sector. Increasing investments in countries such as Kenya, such as the establishment of Yara International's USD 20 million fertilizer plant in 2024. Higher adoption of eco-friendly pesticides and fertilizers also results from greater awareness about sustainable farming. The focus of the region on modernizing agriculture along with meeting food security demands makes the MEA a growing market for agrochemical innovations.

Competitive Landscape:

Key players in the market are investing in research operations to create innovative products that address challenges like pest resistance and environmental concerns. They are adopting digital technologies, including AI, to enhance product discovery and optimize supply chains. Strategic acquisitions and partnerships are pursued to expand market presence and diversify product portfolios. Companies are also focusing on sustainable solutions, such as bio-based agrochemicals, to meet regulatory requirements and consumer demand for environmentally friendly products. Additionally, they are strengthening distribution networks and providing comprehensive support services to farmers to ensure effective product utilization and client loyalty. In July 2024, Ingevity Corporation has expanded its Capa caprolactone distribution network by forming a partnership with Ultrapolymers Group as the distributor for Capa Bioplastics in Europe. This will increase the sales of Ingevity's biodegradable thermoplastics products throughout the region, in keeping with the company's strategic growth plans. Ultrapolymers Group, being experienced in sales and possessing technical expertise, will rely on its compounders and converters network to serve clients appropriately. This expansion reflects the commitment by Ingevity toward offering innovative and sustainable materials, including those products in various industries like agrochemicals, adhesives, and coatings.

The report provides a comprehensive analysis of the competitive landscape in the agrochemicals market with detailed profiles of all major companies, including:

- BASF SE

- Bayer AG

- Corteva Inc.

- Dow Inc.

- FMC Corporation

- Nufarm Ltd

- Nutrien Ltd

- Syngenta Group

- The Archer-Daniels-Midland Company

- Yara International ASA

Latest News and Developments:

- November 2024: Corteva announced a breakthrough in hybrid wheat technology, which brings 10% yield gains and drought resistance. It is a huge deal for the agrochemical industry as enhanced crop varieties may provide new opportunities for targeted applications of agrochemicals, such as specialized fertilizers and pesticides, to improve productivity and meet global food security challenges.

- October 2024: ASP Isotopes Inc. has revealed that its first isotope enrichment facility in South Africa will focus on enriching Carbon-14, intended for use in healthcare and agrochemicals. This is part of a larger strategy by ASP Isotopes to apply its advanced enrichment technologies to a range of industries. The facility will contribute to the supply of isotopes needed for agrochemical applications, which could play a significant role in enhancing agricultural productivity and safety. This initiative is part of ASP Isotopes' ongoing efforts to address global supply challenges in the isotope markets and to provide scalable, capital-efficient technology solutions.

- September 2024: AdvanSix received a USD 12 million USDA grant to expand its ammonium sulfate fertilizer production under the Sustainable US Sulfate to Accelerate Increased Nutrition (SUSTAIN) initiative. The grant supports increasing domestic fertilizer supply, improving logistics, and enhancing environmental sustainability. The expansion will add 200,000 tons of granular ammonium sulfate annually, meeting growing demand for sulfur nutrition in agriculture.

Agrochemicals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fertilizer Types Covered | Nitrogen Fertilizer, Phosphatic Fertilizer, Potassic Fertilizer, Others |

| Pesticide Types Covered | Fungicides, Herbicides, Insecticides, Others |

| Crop Types Covered | Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BASF SE, Bayer AG, Corteva Inc., Dow Inc., FMC Corporation, Nufarm Ltd, Nutrien Ltd, Syngenta Group, The Archer-Daniels-Midland Company, Yara International ASA etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the agrochemicals market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global agrochemicals market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the agrochemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Agrochemicals are chemical products used in agriculture to boost crop productivity and protect plants from pests and diseases. They include fertilizers for nutrient supply, pesticides for pest control, and plant growth regulators to enhance yield. They enable efficient large-scale farming, ensuring food security for growing populations.

The agrochemicals market was valued at USD 297.7 Billion in 2024.

IMARC estimates the global agrochemicals market to exhibit a CAGR of 3.2% during 2025-2033.

The global agrochemicals market is driven by rising demand for higher crop yields to meet the needs of a growing population, advancements in chemical formulations, and increasing awareness about sustainable farming practices. The adoption of modern agricultural techniques, coupled with the need to combat crop losses caused by pests and diseases, is further driving the demand for agrochemicals.

In 2024, nitrogen fertilizer represented the largest segment by fertilizer type, driven by its effectiveness in boosting crop growth, improving yields, and its essential role in replenishing nitrogen levels in nutrient-deficient soils.

Herbicides lead the market by pesticide type owing to their efficiency in controlling weed growth, reducing crop competition for nutrients, and supporting higher agricultural productivity across various farming practices globally.

Cereals and grains are the leading segment by crop type, driven by their high global demand as staple foods and the need for enhanced production to support growing population requirements.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global agrochemicals market include BASF SE, Bayer AG, Corteva Inc., Dow Inc., FMC Corporation, Nufarm Ltd, Nutrien Ltd, Syngenta Group, The Archer-Daniels-Midland Company, Yara International ASA etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)