Air-Cushion Vehicle Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Air-Cushion Vehicle Market Size and Share:

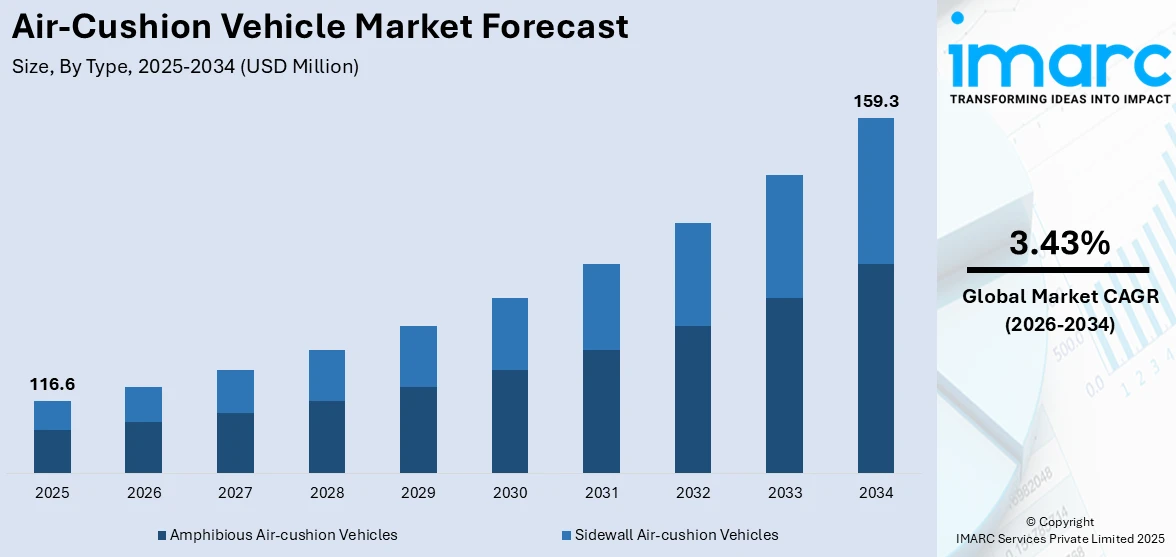

The global air-cushion vehicle market size was valued at USD 116.6 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 159.3 Million by 2034, exhibiting a CAGR of 3.43% during 2026-2034. North America currently dominates the market, holding a significant market share of over 39.6% in 2025. The rising demand for accessibility and versatility across the globe, the widespread adoption of air-cushion vehicles (ACV) to transport goods, and the growing environmental consciousness among the masses represent some of the key factors fueling the air-cushion vehicle market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 116.6 Million |

|

Market Forecast in 2034

|

USD 159.3 Million |

| Market Growth Rate (2026-2034) | 3.43% |

The market for air-cushion vehicles is driven by several factors, including the need for versatile transport solutions capable of navigating challenging terrains like water, ice, and swampy areas. The military sector serves as the primary market impetus because these amphibious vehicles enable coast-based military operations and provide instant military troop deployment and supply logistics to remote locations. Disaster response vehicles continue to experience growing demand, which boosts the market, especially for use in remote and flood-prone areas. The market benefits from advances in fuel conservation and lightweight components and propulsion elements that raise operational effectiveness and efficiency. Commercial activities such as tourism and cargo transport, and offshore oil exploration have led to accelerated market expansion. Environmental concerns and the need for specialized vehicles for environmental monitoring also contribute to the expanding market.

To get more information on this market Request Sample

Military applications, disaster response needs, Arctic exploration, and technological advancements primarily drive the air-cushion vehicle market growth in the United States. The U.S. military utilizes ACVs for amphibious operations, rapid deployment, and logistics in challenging terrains. For instance, in March 2023, the US Navy received its newest landing craft air cushion vessel (LCAC 105) for transporting weapon systems, equipment, and personnel. The transfer comes after a naval board examination and evaluation to finalize acceptance tests. The Navy assessed the LCAC 105’s performance and preparedness throughout the demonstration based on service standards. Additionally, ACVs are essential for disaster response in flood-prone areas and for Arctic exploration, where traditional vehicles are ineffective. Technological innovations in propulsion systems and materials have enhanced the performance and efficiency of ACVs. Furthermore, increasing interest in commercial applications, such as tourism and cargo transport, is contributing to market growth.

Air-Cushion Vehicle Market Trends:

Military and Defense Applications

Military and defense requirements are the leading force behind the growth of the air-cushion vehicle market. ACVs offer unmatched mobility in amphibious warfare, allowing rapid deployment of troops, vehicles, and cargo across beaches, marshlands, and icy terrains. Nations like the U.S., Russia, and China continue investing in next-generation landing craft air cushion (LCAC) systems to strengthen their naval capabilities. Their versatility, load-bearing capacity, and resilience in extreme environments make ACVs indispensable to modern warfare. For instance, in December 2024, the most recent Ship to Shore Connector (SSC), LCAC 111, was handed over to the Navy by Textron Systems on November 27. The arrival of LCAC 111 follows the successful conclusion of Acceptance Trials carried out by the Navy’s Board of Inspection and Survey, which assessed the vessel's preparedness and ability to fulfill requirements effectively. This latest asset in the fleet boosts Navy amphibious abilities, offering an essential resource for swift deployment and logistical assistance. These vessels are critical for rapid deployment, tactical flexibility, and logistical support in amphibious operations, enabling transport of troops, equipment, and supplies from ship to shore, even in hostile or infrastructure-limited environments.

Technological Advancements

Rapid technological innovation is significantly enhancing the performance and appeal of air-cushion vehicles. Advancements in lightweight materials, hybrid propulsion systems, improved thrust efficiency, and digital navigation tools are making ACVs more fuel-efficient, durable, and easier to control. These developments are also expanding their payload capacity and operational range, making them more viable for commercial and military use. Additionally, automation and improved safety systems are reducing training requirements and operational risks. Innovation is helping manufacturers reduce production costs while increasing reliability, encouraging both government and private sector adoption. As technology continues to evolve, air-cushion vehicles are becoming more specialized and effective across a wide range of applications, thereby creating a positive air-cushion vehicle market outlook. For instance, in February 2025, Griffon Hoverwork received Approval in Principle (AiP) from Lloyd's Register (LR) for their new Wyvern class of Air Cushion Landing Craft (LCAC). Important aspects of the craft's design, including hull structure, stability, piping systems, lifting systems, and mechanical and electrical systems, are covered by this certification.

Commercial and Industrial Applications

While military use dominates the market, commercial and industrial sectors are increasingly adopting air-cushion vehicles. In oil and gas exploration, environmental surveying, and remote infrastructure development, ACVs offer unmatched mobility across waterlogged or undeveloped terrain. The tourism industry also uses them for scenic coastal and wetland tours due to their smooth, noise-reduced ride. Logistics companies explore their use in cargo transport to areas without port access. Their value in Arctic research, island connectivity, and even icebreaking operations is also gaining recognition. According to the air-cushion vehicle market forecast, as businesses seek alternatives to conventional transport for tough environments, the commercial potential of ACVs expands, creating opportunities for innovation and diversification in the market. For instance, in April 2025, Celerity Craft Inc. announced that three clients signed contracts to secure the first manufacturing slots for the Dynamic Air Cushion Vessel ("DACV"). These pledges, which come before the public reservation platform opens in May 2025, confirm the early market demand for highly efficient, emission-free marine transportation. As that date approaches, Celerity's website will disclose the complete allocation processes.

Air-Cushion Vehicle Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global air-cushion vehicle market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on type and application.

Analysis by Type:

- Amphibious Air-cushion Vehicles

- Sidewall Air-cushion Vehicles

Amphibious air-cushion vehicles stand as the largest type in 2025, holding around 68.7% of the market due to their unique ability to operate seamlessly on both land and water, making them highly versatile for multiple applications. Their adaptability is crucial for military, rescue, and commercial operations in areas with challenging terrain such as swamps, marshlands, icy surfaces, and coastal regions. These vehicles offer unmatched accessibility in disaster zones and remote areas, where conventional transport is ineffective. Their capability to perform in extreme conditions, combined with growing demand for flexible, multi-terrain mobility solutions, makes them the preferred choice across defense, emergency response, and specialized transport sectors.

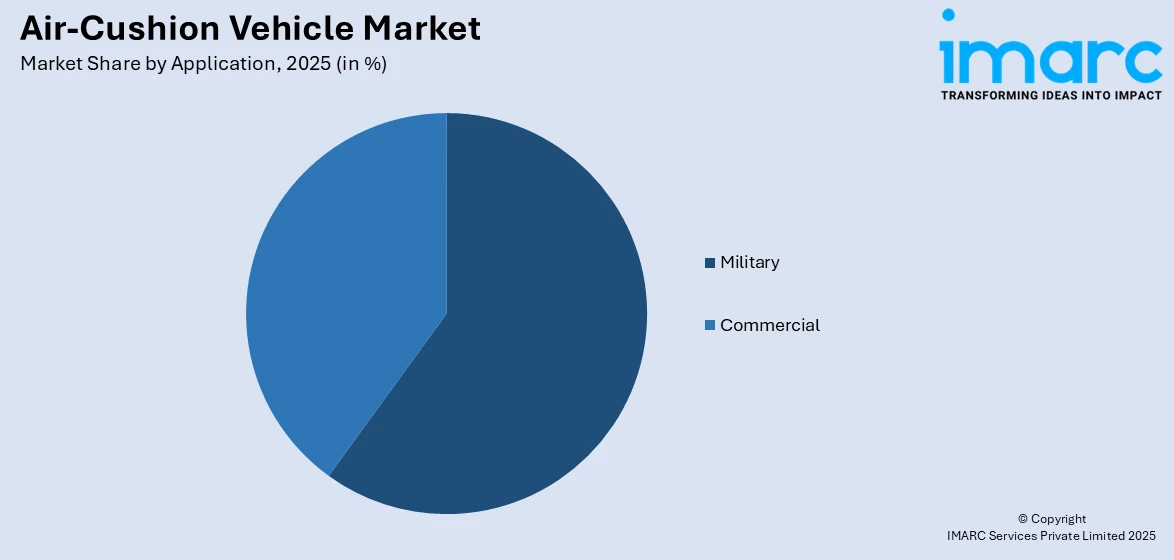

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Military

- Commercial

Military leads the market with around 59.8% of market share in 2025 due to its need for highly versatile, amphibious transport capable of operating across varied and hostile terrains. Air-cushion vehicles enable rapid deployment of troops, equipment, and supplies in regions where conventional vehicles struggle, such as swamps, beaches, ice, and shallow waters. Their strategic value in naval operations, border patrol, and humanitarian missions enhances their military utility. Additionally, continuous investments in defense modernization, particularly in the U.S. and other NATO countries, drive demand. Their durability, mobility, and ability to access remote or contested areas make them indispensable in modern military logistics and operations.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 39.6%. The air-cushion vehicle market demand in North America is driven by several key factors, primarily the strong demand from the military and defense sectors for amphibious and rapid-deployment capabilities across difficult terrains. These vehicles are essential for operations in coastal, swampy, and Arctic regions where traditional transport is limited. Additionally, increased investment in disaster response and rescue infrastructure, especially in flood-prone or hurricane-affected areas, has elevated their importance. Technological advancements in propulsion systems, fuel efficiency, and payload capacity further boost their adoption. North America's focus on border patrol, homeland security, and Arctic exploration also contributes significantly to the market's sustained growth and development.

Key Regional Takeaways:

United States Air-Cushion Vehicle Market Analysis

In 2025, the United States accounted for over 88.70% of the air-cushion vehicle market in North America. The United States is witnessing a notable surge in air-cushion vehicle (ACV) demand, driven by growing investment in the marine military. For instance, for FY2025, the U.S. Navy has a proposed budget of about USD 203.87 Billion. Enhanced budgets for naval modernization and increased focus on amphibious capabilities are pushing defense agencies to adopt ACVs for rapid troop deployment and equipment transport in coastal and littoral zones. Their ability to traverse varied terrain, including marshes and beaches, enhances operational readiness in military scenarios. Advancements in ACV technology and emphasis on agile, mission-specific craft also contribute to rising defense acquisitions. With growing investment in marine military infrastructure and assets, ACVs are becoming integral to strategic mobility and tactical efficiency. The integration of ACVs into joint-force operations highlights their value in both routine patrols and emergency response, reinforcing defense preparedness across maritime environments.

Asia Pacific Air-Cushion Vehicle Market Analysis

Asia-Pacific is experiencing increasing traction in air-cushion vehicle (ACV) utilization due to large coastal areas that demand versatile maritime mobility. India has a coastline of 7,516.6 kilometers, stretching across nine states and four union territories. With extensive archipelagos and remote islands, ACVs serve as efficient connectors for passenger and cargo movement, bypassing traditional port dependencies. Their ability to operate in shallow waters, muddy coastlines, and low-infrastructure regions makes them ideal for both civilian and strategic uses. Growing economic interest in offshore logistics and inter-island transport further supports their deployment. The challenge of frequent natural disruptions in coastal zones also boosts ACV relevance for disaster response. Large coastal areas in this region continue to influence infrastructure development favoring flexible marine transportation systems, where ACVs offer critical value. Their scalability and amphibious nature are aligned with regional needs for resilient and accessible coastal operations.

Europe Air-Cushion Vehicle Market Analysis

Europe shows increasing adoption of air-cushion vehicle (ACV) technology, largely supported by growing coastal tourism that demands flexible and rapid marine mobility solutions. The GVA generated by the EU Coastal Tourism sector amounted to €49.9 billion, up from €28.6 billion registered in 2020. ACVs are gaining prominence for transporting tourists across islands, beaches, and shallow shorelines where conventional boats face limitations. Coastal regions are investing in low-environmental impact transportation, and ACVs offer efficient, versatile, and minimally invasive access to ecologically sensitive areas. As tourism expands to lesser-known destinations, these vehicles provide a strategic solution for improving visitor mobility while supporting environmental sustainability. Growing coastal tourism contributes to the development of high-performance ACVs that offer smooth travel experience and reduce pressure on traditional transport systems. This trend strengthens the integration of ACVs into tourism planning and infrastructure, enhancing travel convenience and coastal destination accessibility.

Latin America Air-Cushion Vehicle Market Analysis

Latin America is embracing air-cushion vehicle (ACV) applications in response to growing marine transportation needs. The Brazil waterway transport sector handled around 1.3 billion tons of goods in 2023, marking a new record. Diverse coastal landscapes and logistical challenges in water-based connectivity are driving adoption. ACVs help bridge gaps in transport routes by offering efficient travel across shallow waters, estuaries, and deltas. As marine transportation infrastructure expands, these vehicles support regional mobility and operational efficiency. Their capability to maneuver across difficult terrains makes them valuable assets in streamlining passenger and cargo flow along coastal zones.

Middle East and Africa Air-Cushion Vehicle Market Analysis

The Middle East and Africa are seeing increased interest in air-cushion vehicle (ACV) deployment aligned with growing oil and gas exploration projects. According to reports, during the period 2024-2028, a total of 668 oil and gas projects are expected to commence operations in the Middle East. ACVs enable safe and reliable access to offshore platforms and remote coastal zones where conventional vessels struggle. Their operational flexibility and amphibious performance make them suitable for supporting exploration activities. With oil and gas exploration expanding into more challenging marine areas, ACVs are becoming crucial tools in ensuring efficient and timely personnel and equipment transport.

Competitive Landscape:

The air-cushion vehicle market features a moderately competitive landscape with key players focusing on defense, commercial, and rescue applications. Prominent companies such as Griffon Hoverwork, Textron Systems, and Neoteric Hovercraft dominate the space, leveraging advanced design capabilities and global distribution networks. Innovation in propulsion systems, lightweight materials, and fuel efficiency is central to gaining market share. Strategic collaborations with defense agencies and technological partnerships are common, particularly in North America and Europe. Smaller players and startups are entering niche segments like recreational and survey hovercrafts, adding competitive pressure. The market also sees competition from conventional amphibious vehicles, pushing manufacturers to differentiate through performance, payload capacity, and adaptability to diverse terrains. Regulatory compliance and customization further shape the competitive dynamics.

The report provides a comprehensive analysis of the competitive landscape in the air-cushion vehicle market with detailed profiles of all major companies, including:

- Aerohod Ltd.

- Airlift Hovercraft Pty Ltd

- Garden Reach Shipbuilders & Engineers Ltd.

- Griffon Hoverwork Ltd. (The Bland Group Ltd.)

- Hovertechnics LLC

- Neoteric Hovercraft Inc.

- The British Hovercraft Company

- Vanair Hovercraft

Latest News and Developments:

- April 2025: Indian and US forces executed a high-intensity amphibious assault off Kakinada’s coast during Exercise Tiger Triumph 2025. A key highlight was the deployment of US Navy Landing Craft Air Cushion (LCAC) vehicles, enabling rapid transport of troops and equipment across the beachhead. These air cushion vehicles, capable of high-speed over-water and over-land movement, demonstrated their effectiveness in enhancing joint operational capabilities.

- March 2025: The 11th Marine Expeditionary Unit and USS Somerset completed Amphibious Readiness Training 25.2 near Camp Pendleton. Air cushions from Assault Craft Unit 5 executed beach landings with HIMARS, showcasing long-range firepower capabilities.

- February 2025: Griffon Hoverwork's Wyvern class Landing Craft Air Cushion (LCAC) received Approval in Principle from Lloyd's Register. The certification covered key elements, including air cushions, lifting systems, stability, and mechanical and electrical components.

- January 2025: The Directorate General of Foreign Trade (DGFT) of India updated its import regulations, eliminating prohibitions on patrol and surveillance boats as well as air cushion vehicles.

- November 2024: Eurotech Pivot Solutions showcased its indigenous air cushions in the Seannovation area, positioning itself among select international start-ups. Through collaboration with IDEX and ADITI 2.0, Eurotech had advanced its large air cushion vehicle project, reinforcing efforts to reduce India’s reliance on foreign amphibious technology.

- October 2024: Chowgule & Company and the Indian Ministry of Defense inked an INR 387.44 crore agreement to buy six Air Cushion Vehicles (ACVs) for the Coast Guard. These would reportedly be India’s first indigenously built ACVs.

Air-Cushion Vehicle Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Amphibious Air-cushion Vehicles, Sidewall Air-cushion Vehicles |

| Applications Covered | Military, Commercial |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aerohod Ltd., Airlift Hovercraft Pty Ltd, Garden Reach Shipbuilders & Engineers Ltd., Griffon Hoverwork Ltd. (The Bland Group Ltd.), Hovertechnics LLC, Neoteric Hovercraft Inc., The British Hovercraft Company, Vanair Hovercraft, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the air-cushion vehicle market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global air-cushion vehicle market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the air-cushion vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The air-cushion vehicle market was valued at USD 116.6 Million in 2025.

The air-cushion vehicle market is projected to exhibit a CAGR of 3.43% during 2026-2034, reaching a value of USD 159.3 Million by 2034.

The air-cushion vehicle market is driven by demand for amphibious transport, military and rescue operations, and efficient access to remote or flood-prone areas. Technological advancements, defense sector investments, and increasing use in commercial tourism and cargo applications also contribute to market growth and diversification across various geographies.

North America currently dominates the air-cushion vehicle market due to Military applications, disaster response needs, Arctic accessibility, and technological innovation.

Some of the major players in the air-cushion vehicle market include Aerohod Ltd., Airlift Hovercraft Pty Ltd, Garden Reach Shipbuilders & Engineers Ltd., Griffon Hoverwork Ltd. (The Bland Group Ltd.), Hovertechnics LLC, Neoteric Hovercraft Inc., The British Hovercraft Company, Vanair Hovercraft, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)