Aircraft Fuel Systems Market Report by Engine Type (Jet Engine, Helicopter Engine, Turboprop Engine, UAV Engine), Component (Piping, Inerting Systems, Pumps, Valves, Gauges, Fuel Control Monitoring Systems, Filters), Technology (Fuel Injection, Pump Feed, Gravity Feed), Application (Commercial, Military, UAV), and Region 2026-2034

Market Overview:

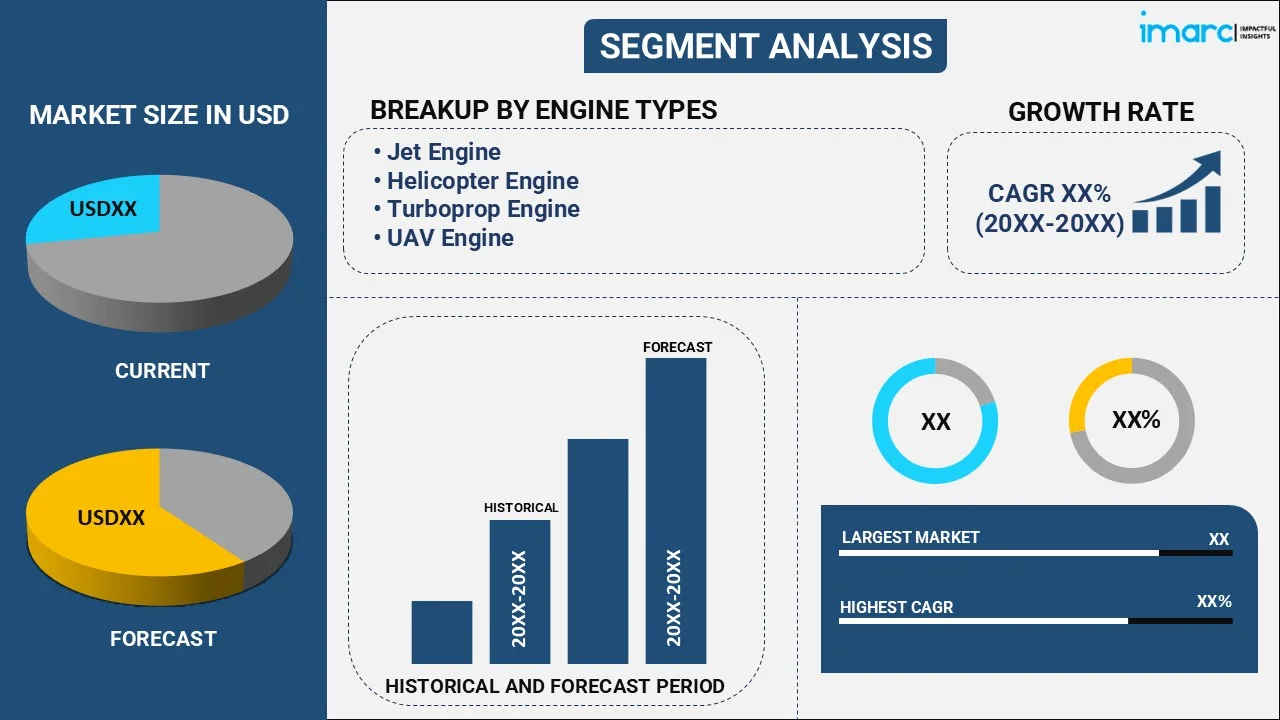

The global aircraft fuel systems market size reached USD 10.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 16.4 Billion by 2034, exhibiting a growth rate (CAGR) of 4.54% during 2026-2034.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 10.9 Billion |

|

Market Forecast in 2034

|

USD 16.4 Billion |

| Market Growth Rate 2026-2034 | 4.54% |

Aircraft fuel systems help in loading, storing, managing and delivering fuel to the propulsion system of an aircraft. They are also used for decreasing weight and optimizing the aircraft’s center of gravity (COG) by allowing fuel dumping. They comprise numerous components that ensure uniform flow of clean fuel in all operating conditions. Most aircraft fuel systems differ from each other depending on the size and type of the aircraft in which they are installed. Over the years, manufacturers have introduced pre-calibrated fuel systems that help to expedite installation for aircraft manufacturers, along with systems that do not require frequent maintenance and inspection.

To get more information on this market Request Sample

Nowadays, with an increasing focus on lowering the weight of the aircraft and improving fuel efficiency, aircraft manufacturers are incorporating advanced lightweight materials in both structural and semi-structural components, which is creating the demand for lightweight, safe and reliable fuel systems. Further, the rising passenger traffic, coupled with the growing global aircraft fleet, is impelling the market growth. Various government-funded organizations are also funding research and development (R&D) activities for creating fuel systems suited for the new generation aircraft. For instance, the EU-funded SAfer FUEL (SAFUEL) project is promoting the development of systems that can meet the constraints posed by electrical connectivity and highly flammable composite materials used in modern airplanes. Manufacturers are also working on reducing the amount of electricity required for reading fuel level as well as conductive metals in fuel tanks. Some of the other factors that are strengthening the growth of the market include technological advancements in military aircraft and development in the commercial aviation sector.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the global aircraft fuel systems market report, along with forecasts at the global and regional level from 2026-2034. Our report has categorized the market based on engine type, component, technology and application.

Breakup by Engine Type:

To get detailed segment analysis of this market Request Sample

- Jet Engine

- Helicopter Engine

- Turboprop Engine

- UAV Engine

Breakup by Component:

- Piping

- Inerting Systems

- Pumps

- Valves

- Gauges

- Fuel Control Monitoring Systems

- Filters

Breakup by Technology:

- Fuel Injection

- Pump Feed

- Gravity Feed

Breakup by Application:

- Commercial

- Military

- UAV

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

Competitive Landscape:

The report has also analysed the competitive landscape of the market with some of the key players being Eaton Corporation, Parker-Hannifin Corporation, Woodward, Inc., Honeywell International Inc., Triumph Group, Inc., Meggitt PLC, GKN plc., Safran SA, Crane Co., United Technologies Corporation, etc.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Segment Coverage | Engine Type, Component, Technology, Application, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Eaton Corporation, Parker-Hannifin Corporation, Woodward, Inc., Honeywell International Inc., Triumph Group, Inc., Meggitt PLC, GKN plc., Safran SA, Crane Co., United Technologies Corporation |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global aircraft fuel systems market performed so far and how will it perform in the coming years?

- What are the key regional markets in the global aircraft fuel systems industry?

- What has been the impact of COVID-19 on the global aircraft fuel systems industry?

- What is the breakup of the market based on the engine type?

- What is the breakup of the market based on the component?

- What is the breakup of the market based on the technology?

- What is the breakup of the market based on the application?

- What are the various stages in the value chain of the global aircraft fuel systems industry?

- What are the key driving factors and challenges in the global aircraft fuel systems industry?

- What is the structure of the global aircraft fuel systems industry and who are the key players?

- What is the degree of competition in the global aircraft fuel systems industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)