Aircraft Line Maintenance Market Size, Share, Trends and Forecast by Service, Type, Aircraft Type, Technology, and Region, 2026-2034

Aircraft Line Maintenance Market Size and Share:

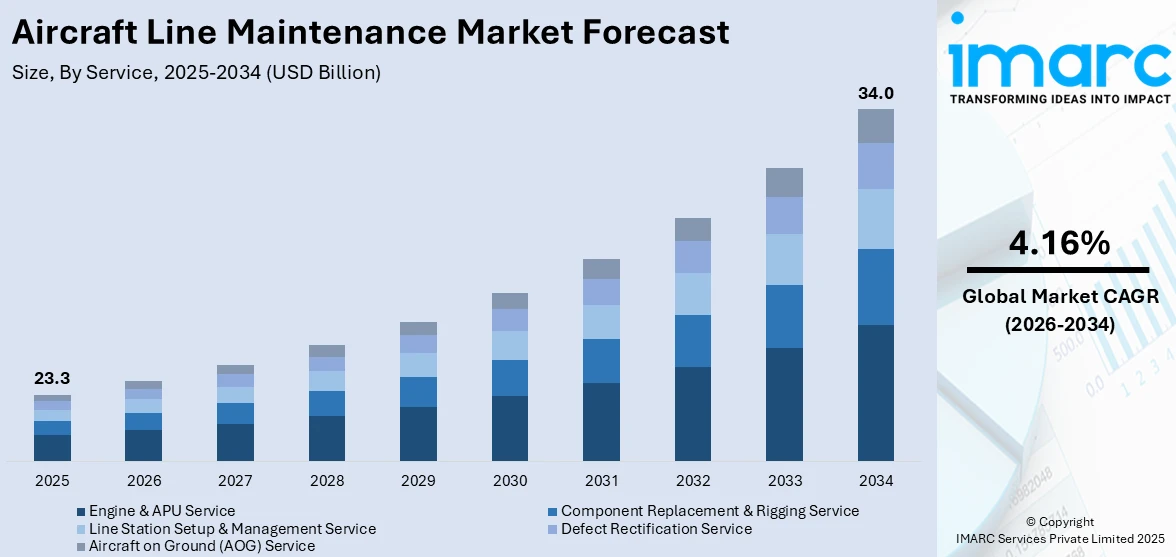

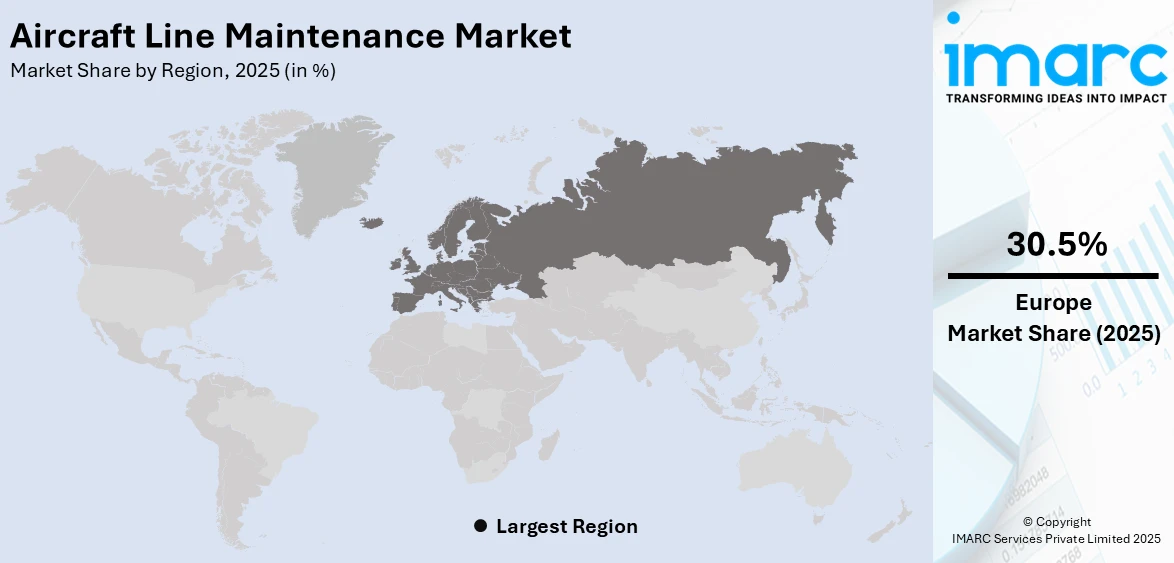

The global aircraft line maintenance market size reached USD 23.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 34.0 Billion by 2034, exhibiting a growth rate (CAGR) of 4.16% during 2026-2034. Europe currently dominates the market, holding a market share of over 30.5% in 2025. The rising air traffic, technological advancements, sustainability initiatives, and growing international routes are primarily driving the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 23.3 Billion |

|

Market Forecast in 2034

|

USD 34.0 Billion |

| Market Growth Rate (2026-2034) | 4.16% |

The increasing global air traffic and expanding airline fleets necessitate frequent maintenance to ensure operational efficiency and safety. Stringent aviation regulations mandate regular inspections and repairs, pushing airlines to invest in line maintenance services. Technological advancements, such as predictive maintenance and AI-driven diagnostics, enhance efficiency and reduce downtime, further driving market demand. The rise of low-cost carriers and increased outsourcing of maintenance services also contribute to market growth. Additionally, the growing demand for fuel-efficient and next-generation aircraft requires specialized maintenance expertise. Emerging markets, particularly in Asia-Pacific and the Middle East, are witnessing rapid aviation expansion, creating more opportunities for line maintenance providers and contributing to the aircraft line maintenance market growth across the globe.

To get more information on this market Request Sample

The aircraft line maintenance market in the United States is driven by several key factors. The country's high air traffic volume, with a large fleet of commercial and cargo aircraft, increases the demand for frequent maintenance. Stringent Federal Aviation Administration (FAA) regulations mandate regular inspections and repairs, ensuring compliance and safety. The presence of major airlines, such as American Airlines, Delta, and United, further boosts the need for extensive line maintenance services. For instance, in September 2024, American Airlines announced the addition of more lines of heavy maintenance work and roughly 500 new aircraft maintenance positions at its maintenance bases in Tulsa, Oklahoma; Pittsburgh; and Charlotte, North Carolina. With more human resources, the airline intends to conduct more extensive maintenance checks at these locations. Advancements in predictive maintenance, AI-based diagnostics, and digital tracking systems enhance efficiency and reduce downtime. Additionally, the growing adoption of outsourcing by airlines to third-party maintenance providers, along with the rise in domestic and international travel, continues to drive the aircraft line maintenance market demand across the U.S. aviation sector.

Aircraft Line Maintenance Market Trends:

Rising Air Traffic

The rise in global air travel and the increasing number of airline passengers drive the demand for frequent and efficient line maintenance to ensure aircraft safety and reliability. For instance, from January to September 2023, local airlines served nearly 112 million passengers, a 29.10% increase from 87.42 million the previous year. Similarly, over these nine months, carriers moved approximately 45.99 million foreign consumers, which shows an incredible rise of 39.61% against the similar period of last year's 32.94 million passengers, as per reports. These factors are expected to propel the aircraft line maintenance market growth in the coming years.

Growing Investments in Airport Facilities

Investments in airport facilities and maintenance infrastructure, particularly across emerging economies, represents one of the key aircraft line maintenance market trends. For instance, according to the Press Information Bureau (PIB), the number of operational airports in India increased from 74 in 2014 to 157 in 2024. The government plans to expand the number of airports to 350-400 by 2047. The rising facilities enable more efficient and extensive maintenance operations. These factors further positively influence the aircraft line maintenance market forecast.

Technological Advancements

Predictive maintenance utilizes data analytics and artificial intelligence (AI) to anticipate potential issues before they arise. By analyzing data from aircraft systems and components, airlines can predict failures and perform maintenance only when necessary, reducing unscheduled downtimes and optimizing resource usage. For instance, in February 2024, MITRE launched an open-source version of its Aviation Risk Identification and Assessment (ARIA) software package to the community. OpenARIA aims to improve aviation safety and efficiency through community participation. OpenARIA provides a publicly available method for detecting aerial aviation safety contacts using aircraft position data and aggregating such risks for bulk analysis, thereby boosting the aircraft line maintenance market revenue.

Aircraft Line Maintenance Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global aircraft line maintenance market report, along with forecasts at the global, regional, and country levels from 2026-2034. Our report has categorized the market based on service, type, aircraft type, and technology.

Analysis by Service:

- Component Replacement & Rigging Service

- Engine & APU Service

- Line Station Setup & Management Service

- Defect Rectification Service

- Aircraft on Ground (AOG) Service

Engine & APU service leads the market with around 30.2% of the market share in 2025. According to the aircraft line maintenance market outlook, engines and APUs are vital for aircraft operations. Regular maintenance ensures their reliability and safety, which is crucial for passenger and cargo transport. Moreover, the rise in global air travel leads to higher flight frequencies, increasing the demand for reliable engine and APU services to ensure aircraft are operational and safe. Furthermore, modern engines and APUs are equipped with advanced technologies that require specialized maintenance services. Ongoing developments in diagnostics and monitoring systems drive the need for skilled maintenance teams, further positively influencing the aircraft line maintenance market's recent price.

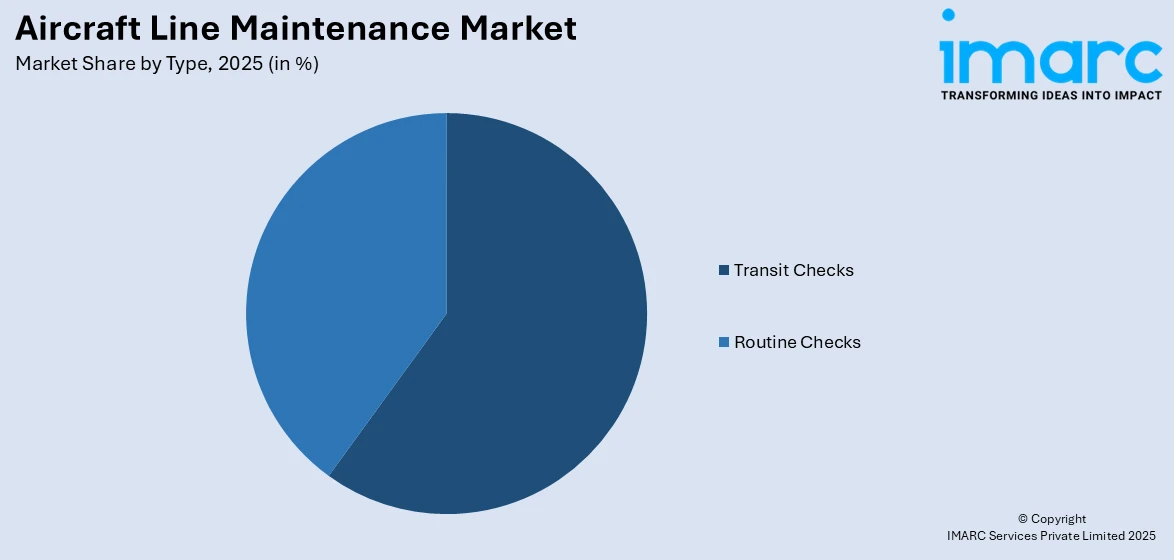

Analysis by Type:

Access the comprehensive market breakdown Request Sample

- Transit Checks

- Routine Checks

Transit checks leads the market with around 57.5% of market share in 2025. According to the aircraft line maintenance market overview, transit checks hold the largest share of the market due to their high frequency and critical role in ensuring flight safety. These checks are performed between flights to inspect essential systems like brakes, hydraulics, and avionics, minimizing operational disruptions. Airlines prioritize transit checks to comply with strict aviation regulations and prevent costly delays or cancellations. Given the high volume of daily flights worldwide, transit checks outnumber other types of line maintenance, such as overnight or A-checks. Their quick turnaround time and the necessity for maintaining flight schedules make them the dominant segment in the aircraft line maintenance market.

Analysis by Aircraft Type:

- Narrow Body Aircraft

- Wide-Body Aircraft

- Very Large Body Aircraft

- Others

Narrow-body aircraft lead the market with around 60.3% of market share in 2025. Narrow-body aircraft are a type of commercial airplane characterized by a single aisle and typically have a fuselage width of about 3 to 4 meters. They are commonly used for short to medium-haul flights and can seat anywhere from around 100 to 240 passengers, depending on the model and configuration. Moreover, narrow-body aircraft are typically used for short to medium-haul routes, which often experience higher flight frequencies. This leads to a corresponding increase in the need for line maintenance services to ensure safety and reliability.

Analysis by Technology:

- Traditional Line Maintenance

- Digital Line Maintenance

Traditional line maintenance leads the market with around 56.4% of the market share in 2025. Traditional line maintenance holds the largest share in the aircraft line maintenance market due to its continuous demand for routine inspections, repairs, and system checks between flights. Airlines rely on these essential services to ensure aircraft safety, compliance, and operational efficiency. Traditional line maintenance includes transit checks, daily inspections, and minor repairs, making it the most frequently performed maintenance type. With increasing global air traffic and strict regulatory requirements, airlines prioritize these regular checks to minimize delays and maintain reliability. Its high-frequency nature, necessity for flight operations, and cost-effectiveness contribute to traditional line maintenance dominating the aircraft maintenance market.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Europe accounted for the largest market share of over 30.5%. With over 2,000 airports and strong penetration of low-cost carriers such as Ryanair and EasyJet, Europe tops the list globally in terms of aircraft queue maintenance. The European Commission has recorded 6.3 million commercial flights in the EU for the year 2023. With this level of air traffic, the demand for queue maintenance is consistent. EASA imposes strict maintenance laws to ensure safety standards and scheduled maintenance checks. Heavy aircraft traffic at major hubs such as London Heathrow, Frankfurt, and Paris Charles de Gaulle calls for prompt and effective maintenance solutions. The use of next-generation aircraft, including the Airbus A350 and Boeing 737 MAX, requires more qualified specialists and advanced diagnostic equipment due to their complex system. In recent years, increasing attention to sustainable operations and reducing carbon emissions forces airlines to adopt environmentally friendly aircraft and maintenance technologies.

Key Regional Takeaways:

North America Aircraft Line Maintenance Market Analysis

The aircraft line maintenance market in North America is driven by several key factors. The region has one of the world’s largest commercial aviation sectors, with a high volume of domestic and international air traffic, necessitating frequent maintenance checks. Stringent regulatory requirements set by the Federal Aviation Administration (FAA) and Transport Canada mandate regular inspections, ensuring aircraft safety and operational efficiency. Technological advancements, including predictive maintenance, AI-driven diagnostics, and digital tracking systems, enhance efficiency and minimize downtime, further driving demand. Additionally, the rising adoption of outsourcing by airlines to third-party maintenance providers supports market growth. The presence of major airlines such as American Airlines, Delta, and United, along with extensive MRO (maintenance, repair, and overhaul) facilities, strengthens the industry. Moreover, the expansion of low-cost carriers and increasing investments in fleet modernization contribute to market expansion. Emerging trends like sustainable aviation practices and next-generation aircraft maintenance solutions are also shaping the market’s future.

United States Aircraft Line Maintenance Market Analysis

In 2025, the United States accounted for the largest market share of over 82.80% in North America. With over 40,000 airports and some of the world's biggest airlines such as American Airlines and Delta Air Lines, the US has a booming aviation sector that fuels aircraft line maintenance in the market. The Air Traffic Organisation (ATO) of the Federal Aviation Administration serves about 45,000 flights and 2.9 million airline passengers daily over more than 29 million square miles of airspace. The country currently boasts the biggest fleet of commercial aircraft in the world. With this, maintenance needs to be constant on these aircrafts for operational effectiveness and safety compliance. The complexity of line maintenance operations brought about by the growing use of fuel-efficient and sophisticated aircraft such as the Airbus A321neo and Boeing 787 has increased the need for specialized services. Furthermore, an increase in domestic flights, which accounted for more than 50% of all passenger traffic in 2023, led to frequent aircraft turnarounds that necessitate effective queue maintenance to reduce delays. Regular inspection and maintenance are necessary due to the strict Federal Aviation Administration standards. This ensures that there is always a steady requirement for qualified professionals and state-of-the-art tools. Moreover, with the investment of maintenance service providers and the airline operators, technological advancements like remote diagnostics and predictive maintenance have become more common.

Asia Pacific Aircraft Line Maintenance Market Analysis

The market for aircraft line maintenance is growing at one of the fastest rates in Asia-Pacific because of the rapid urbanization and growth of the middle-class population in the region. China and India are driving the aviation boom; by 2030, China is expected to have nearly 4,000 aircraft in operation, while India is expected to have 1,500 as per reports. The low-cost carriers present in the region, including AirAsia and IndiGo, are expanding their fleet size to answer the growing demand for air travel in the region. According to media reports, Asia-Pacific airlines lead the demand with a year-on-year growth of 32.1%. Load factor gained at 83.7% (+1.7ppt) from April 2023, capacity increased by 29.3% year over year. High traffic flows from the Middle East and Africa are seen towards Asia. Heavy aircraft traffic in major aviation hubs such as Beijing, Singapore, and Tokyo calls for effective line maintenance services. Additionally, the roll out of regional connectivity schemes, such as India's UDAN scheme, has increased air traffic in Tier 2 and Tier 3 cities, thus increasing the requirement for localized maintenance. Investments in advanced maintenance technology, such as automation and predictive analytics, are further enhancing the market environment.

Latin America Aircraft Line Maintenance Market Analysis

The growing aviation industry in Latin America, particularly in Brazil and Mexico, which together account for more than 50% of regional air traffic, according to reports, is driving the market for aircraft line maintenance. A report by the International Air Transport Association stated that air connectivity in Latin America is better in Mexico compared to Brazil and Colombia. Mexico's air connectivity has grown impressively by 70% within the last five years, outperforming not only the average globally but even countries like Chile (68%), Panama (58%), and Peru (51%) by far more than others. Short-haul flight frequency has grown due to the emergence of low-cost carriers like GOL and Viva Aerobus, which calls for routine line maintenance to guarantee speedy turnarounds. Air travel has increased due to the region's tourism-driven economy, particularly in nations like Colombia and Costa Rica. There is a requirement for skilled maintenance workers because of the high volumes of aircraft movements in major hubs such as São Paulo-Guarulhos and Mexico City International Airport. Partnerships between airlines and maintenance service providers have also improved access to effective maintenance solutions by developing local facilities.

Middle East and Africa Aircraft Line Maintenance Market Analysis

Major airlines such as Etihad Airways, Emirates, and Qatar Airways, who collectively operate nearly 700 aircraft according to reports, are driving the market expansion throughout the Middle East and Africa. The region's favorable position as a transit center that connects Europe, Asia, and Africa fuels high aviation traffic, with Dubai International Airport alone processing more than 88 million people a year. Investments in the Airbus A380 and Boeing 777, for example, have increased the demand for specialized maintenance services. Growth in the aviation sector is experienced in Africa with the help of expanding connectivity projects and economic development. The drivers of growth include South Africa, Nigeria, and Ethiopia. The government's incentive to localize the aviation service helps in growing MRO facilities. Additionally, with the increased adoption of digital technologies for real-time monitoring and diagnostics, maintenance efficiency in the region is on the rise.

Competitive Landscape:

The aircraft line maintenance market is highly competitive, with key players striving for market dominance through technological advancements, service expansion, and strategic partnerships. Major companies like Lufthansa Technik, ST Engineering, Hong Kong Aircraft Engineering Company (HAECO), and SIA Engineering Company compete by offering comprehensive maintenance, repair, and overhaul (MRO) services. Airlines also rely on in-house maintenance teams or collaborate with third-party MRO providers for cost efficiency. Increasing air traffic, stringent safety regulations, and the growing demand for predictive maintenance solutions drive competition. Companies invest in digital tools, automation, and AI-driven diagnostics to enhance efficiency. Regional MRO providers also play a crucial role, catering to specific airline needs and regulatory requirements in different markets.

The global aircraft line maintenance market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AMECO

- ANA Line Maintenance Technics

- Avia Solutions Group

- BCT Aviation Maintenance

- British Airways

- Delta Air Lines

- HAECO

- Lufthansa

- Monarch Aircraft Engineering

- Nayak Group

- SAMCO Aircraft Maintenance

- SIA Engineering Company

- SR Technics

- STS Aviation Group

- Turkish Airlines

Recent Developments:

- August 2024: The Directorate General of Civil Aviation (DGCA) granted Air India and Vistara authorization to combine their aircraft line maintenance operations by CAR (Civil Aviation Requirement) 145.

- May 2024: The Cambodia State Secretariat of Civil Aviation (SSCA) certified Asia Digital Engineering ADE Cambodia Co Ltd (ADE Cambodia), a joint venture with Sivilai Asia Co Ltd, as an Approved Maintenance Organization (AMO).

- March 2024: SR Technics, a provider of MRO services, established "SR Technics Line Maintenance AG." Through its skilled workforce of more than 200 employees, the majority of whom are seasoned certified aircraft engineers, SR Technics Line Maintenance AG offers line and light base maintenance services to its clients.

Aircraft Line Maintenance Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Component Replacement & Rigging Service, Engine & APU Service, Line Station Setup & Management Service, Defect Rectification Service, Aircraft on Ground (AOG) Service |

| Types Covered | Transit Checks, Routine Checks |

| Aircraft Types Covered | Narrow Body Aircraft, Wide-Body Aircraft, Very Large Body Aircraft, Others |

| Technologies Covered | Traditional Line Maintenance, Digital Line Maintenance |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AMECO, ANA Line Maintenance Technics, Avia Solutions Group, BCT Aviation Maintenance, British Airways, Delta Air Lines, HAECO, Lufthansa, Monarch Aircraft Engineering, Nayak Group, SAMCO Aircraft Maintenance, SIA Engineering Company, SR Technics, STS Aviation Group, Turkish Airlines, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, aircraft line maintenance market forecast, and dynamics of the market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global aircraft line maintenance market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the aircraft line maintenance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aircraft line maintenance market was valued at USD 23.3 Billion in 2025.

The aircraft line maintenance market is projected to exhibit a CAGR of 4.16% during 2026-2034, reaching a value of USD 34.0 Billion by 2034.

The aircraft line maintenance market is driven by increasing air traffic, stringent aviation regulations, fleet expansion, and the rise of low-cost carriers. Technological advancements like predictive maintenance and AI-driven diagnostics enhance efficiency. Additionally, outsourcing maintenance services, growing MRO investments, and demand for next-generation aircraft maintenance solutions further propel market growth.

Europe currently dominates the aircraft line maintenance market, accounting for a share of 30.5%. Increasing air traffic, strict EASA regulations, fleet expansion, MRO outsourcing, technological advancements, sustainability initiatives, and growing low-cost carriers.

Some of the major players in the aircraft line maintenance market include AMECO, ANA Line Maintenance Technics, Avia Solutions Group, BCT Aviation Maintenance, British Airways, Delta Air Lines, HAECO, Lufthansa, Monarch Aircraft Engineering, Nayak Group, SAMCO Aircraft Maintenance, SIA Engineering Company, SR Technics, STS Aviation Group, Turkish Airlines, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)