Alpaca Fiber Market Report by Type (Suri Fiber, Huacaya Fiber), Grade (Ultra Fine, Superfine, Fine, Medium, Intermediate), Application (Flooring, Textile, Industrial Felting, and Others), and Region 2025-2033

Alpaca Fiber Market Size:

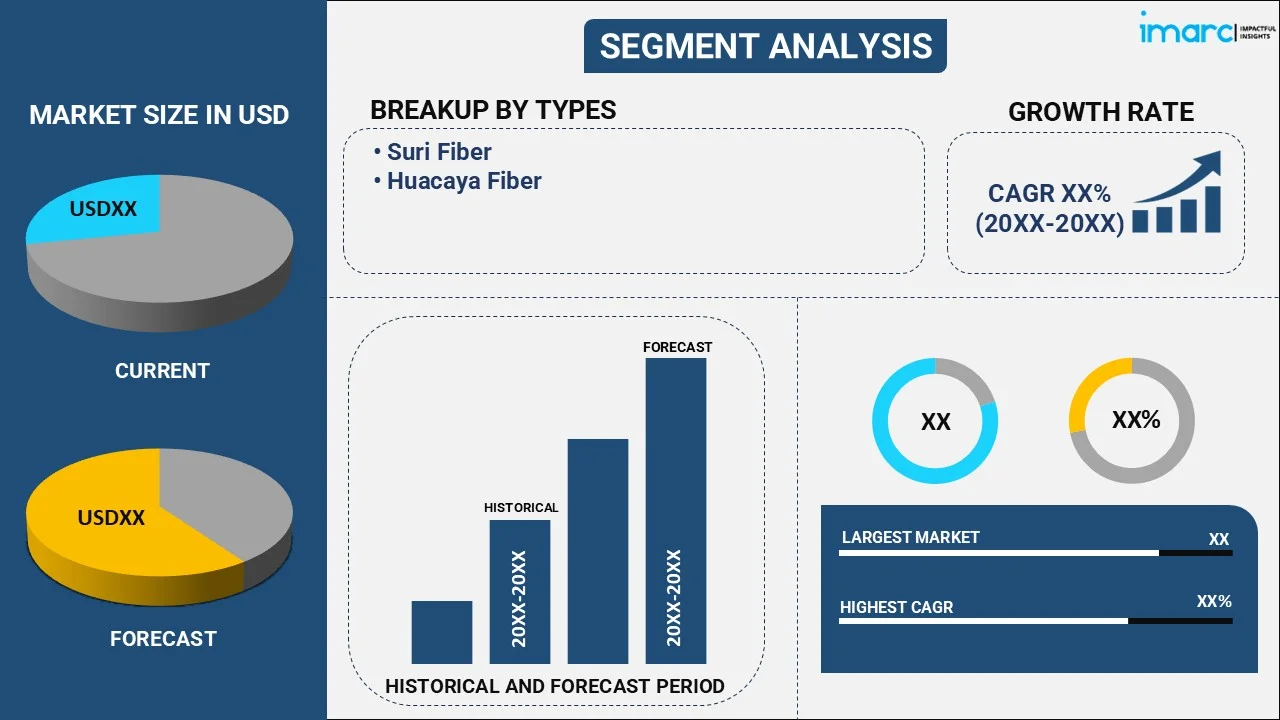

The global alpaca fiber market size reached USD 3.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3.81% during 2025-2033. The market is experiencing significant growth mainly due to the rising consumer demand for sustainable textiles, the growth of luxury fashion and rising awareness of eco-friendly products. Innovations in textile blends and the rise of e-commerce are further driving market growth by enhancing accessibility and product variety.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.4 Billion |

| Market Forecast in 2033 | USD 4.8 Billion |

| Market Growth Rate 2025-2033 |

3.81%

|

Alpaca Fiber Market Analysis:

- Major Market Drivers: The key drivers in the market include the increasing consumer preference for sustainable and eco-friendly textiles, as alpaca fiber offers a low environmental impact compared to synthetic alternatives. The luxury fashion segment’s growth is another significant driver, as alpaca's softness and durability make it a sought-after material for high-end apparel. Additionally, advancements in textile technology are creating innovative alpaca fiber blends, enhancing versatility and expanding its applications. The rise of e-commerce platforms also plays a crucial role by making alpaca products more accessible to global consumers and allowing smaller brands to reach niche markets effectively.

- Key Market Trends: Key trends in the market reflect a rise in the alpaca fiber demand, driven primarily by a growing preference for sustainable and eco-friendly textiles. Consumers increasingly value alpaca fiber for its minimal environmental impact and superior qualities, such as softness and warmth. The luxury fashion segment is embracing alpaca for high-end apparel, enhancing its market appeal. Additionally, innovations in textile technology are creating versatile alpaca fiber blends, broadening its applications. The expansion of e-commerce platforms is further boosting the market growth by increasing product accessibility and allowing brands to reach global consumers more effectively.

- Geographical Trends: Geographical trends in the market show significant growth in North America and Europe, driven by the luxury fashion industry and increasing consumer preference for sustainable textiles. Emerging markets in Asia-Pacific are experiencing growth due to rising disposable incomes and growing awareness of eco-friendly products. The expansion of e-commerce platforms is also facilitating broader market reach, allowing alpaca fiber products to access new regions and connect with global consumers more effectively, thus broadening the market’s geographical footprint.

- Competitive Landscape: Some of the major market players in the alpaca fiber industry include AHA Bolivia, Altifibers S.A., Berroco Inc., Cascade Yarns Inc., Laughing Hens, Lion Brand Yarn, Mary Maxim Inc., New Era Fiber LLC, Plymouth Yarn Company Inc., The Alpaca Yarn Company, The Natural Fibre Company, White Frost Farms (Kenny Ventures Inc.), etc., among many others.

- Challenges and Opportunities: Market faces various challenges such as fluctuating raw material prices and the need for consistent quality control, which can impact production costs and supply chain stability. Additionally, competition from synthetic fibers and other natural materials poses a threat. However, there are significant opportunities, including the growing demand for sustainable and eco-friendly textiles, which aligns well with alpaca fiber’s environmental benefits. Innovations in textile technology and the expansion of e-commerce channels offer avenues for market growth, enabling brands to reach global consumers more effectively. Emphasizing ethical sourcing and leveraging luxury fashion trends can further drive market expansion.

Alpaca Fiber Market Trends:

Growth of Luxury Fashion Segment

Alpaca fiber's exceptional softness, warmth, and durability have made it a highly sought-after material in the luxury fashion industry. Its unique qualities provide a superior experience, leading more brands to incorporate alpaca into their high-end product lines. The fiber's natural thermal properties, combined with its lightweight and breathable nature, make it ideal for creating premium garments and bedding. As consumers increasingly seek sustainable and luxurious materials, alpaca fiber stands out for its eco-friendly profile and refined texture. In February 2024, Kelly & Windsor launched the Alpaca Royale quilt collection for the 2024 winter season. This collection features premium pure alpaca fiber, providing unmatched luxury, superior warmth, breathability, and a silky-smooth finish with champagne-dyed Tencel fabric. The quilts are available in various weight options, ensuring year-round comfort and combining elegance with top-tier quality. The refined design of the collection, including royal red piping, sets a new standard in luxury bedding. This growing demand is driving the expansion of alpaca-based collections, solidifying its status as a staple in luxury fashion. Some of the key Alpaca Fiber market recent opportunities include the increasing consumer demand for sustainable luxury products, which is prompting brands to innovate with eco-friendly materials and explore new markets. Additionally, collaborations with high-end designers are creating exclusive collections, while advancements in textile technology are enhancing the quality and versatility of alpaca products.

Rising Demand for Sustainable and Eco-Friendly Textile

Consumers are increasingly focusing on sustainability, driving a surge in the demand for alpaca fiber, which stands out for its minimal environmental impact compared to synthetic alternatives. Alpaca fiber is naturally biodegradable, requiring fewer resources to produce, and it emits less greenhouse gas during its lifecycle. This makes it an attractive option for eco-conscious consumers seeking to reduce their carbon footprint. The fiber's production process is also more sustainable, as alpacas have a lower environmental impact than other livestock. As awareness of environmental issues grows, alpaca fiber is gaining popularity as a preferred choice for sustainable and eco-friendly textiles. For instance, in June 2023, Paka launched Paka Essentials, a collection of eco-friendly undergarments made from natural materials. The line includes men’s and women’s styles crafted from royal alpaca, eucalyptus pulp, and organic Pima cotton for moisture-wicking, breathability, and nontoxic properties. With a focus on health and comfort, the collection aims to minimize the impact of synthetic materials on the body. The launch expands Paka's offerings from alpaca apparel to essential underpinnings.

Growth of E-Commerce Channels

The growth of e-commerce channels is transforming the alpaca fiber market by enabling brands to reach a global audience more effectively. Online platforms provide smaller brands and artisans with the opportunity to showcase their unique alpaca products to consumers worldwide, bypassing the limitations of traditional retail. This accessibility allows niche markets, which might have been difficult to target through brick-and-mortar stores, to flourish. Additionally, e-commerce facilitates direct-to-consumer sales, reducing costs and increasing profitability for producers. The convenience of online shopping, combined with targeted digital marketing, is driving the expansion of alpaca fiber products in the global market. According to industry reports, global B2B ecommerce sales will grow at a 14.5% annual rate through 2026, reaching a value of USD$36 trillion. APAC is projected to comprise 80% of the B2B market by 2026, with growth in smaller markets like Latin America and the Middle East. The B2C ecommerce market is expected to reach USD$5.5 trillion by 2027, with India's market currently valued at 63.17 billion US dollars. Leading sources for online product searches include ecommerce marketplaces, with 30% of consumers starting product searches there.

Alpaca Fiber Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, grade, and application.

Breakup by Type:

- Suri Fiber

- Huacaya Fiber

Huacaya Fiber accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes suri fiber and huacaya fiber. According to the report, huacaya fiber represented the largest segment.

According to alpaca fiber market report, huacaya fiber accounts for the majority of the market share due to its widespread availability and desirable qualities. This type of alpaca fiber is known for its softness, density, and crimp, which provide natural elasticity, making it ideal for producing a wide range of textile products, including clothing, blankets, and yarns. Huacaya alpacas are more common than the Suri breed, leading to a greater supply of this fiber in the market. Additionally, the versatility and durability of Huacaya fiber make it highly sought after in the fashion and textile industries, further solidifying its dominant market position.

Breakup by Grade:

- Ultra Fine

- Superfine

- Fine

- Medium

- Intermediate

Superfine holds the largest share of the industry

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This ultra fine, superfine, fine, medium, and intermediate. According to the report, superfine accounted for the largest market share.

Superfine alpaca fiber holds the largest share of the industry due to its exceptional softness, fineness, and luxurious feel, making it highly desirable in the premium textile market. This grade of fiber, typically measuring less than 20 microns in diameter, is favored for high-end garments such as scarves, sweaters, and baby clothing, where comfort and quality are paramount. The superior qualities of superfine alpaca fiber, including its hypoallergenic nature and excellent thermal insulation, further enhance its appeal among discerning consumers. The growing demand for sustainable and natural luxury fibers is further creating a positive alpaca fiber market outlook.

Breakup by Application:

- Flooring

- Textile

- Industrial Felting

- Others

Textile represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes flooring, textile, industrial felting, and others. According to the report, textile accounted for the largest market share.

The textile industry represents the leading segment in the Alpaca Fiber market, driven by the fiber's exceptional qualities such as softness, warmth, and durability. Alpaca fiber, particularly the superfine and Huacaya varieties, is highly valued for its use in luxury clothing, accessories, and home textiles. Its hypoallergenic nature and natural sheen make it a preferred choice for high-end garments like sweaters, scarves, and coats. According to alpaca fiber market overview, growing consumer preference for sustainable and eco-friendly materials further boosts demand for alpaca fiber in textiles, as it is a natural, biodegradable fiber with minimal environmental impact compared to synthetic alternatives. For instance, in June 2024, Marks & Spencer overturned its 2020 decision to ban alpaca wool, opting to reintroduce it into their clothing lines with the implementation of the Responsible Alpaca Standard (RAS) in supply chains. The company cited the quality and traditional expertise of alpaca wool production as reasons for the policy reversal. These shifts in corporate strategies, along with increased demand for sustainable luxury, are anticipated to significantly boost alpaca fiber market revenue in the coming future. Furthermore, the growing focus on transparency and ethical sourcing in the fashion industry is expected to further propel market growth. As consumer awareness increases, brands that adhere to rigorous standards for animal welfare and environmental impact will likely gain a competitive edge in the market.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest alpaca fiber market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for alpaca fiber.

North America dominates the alpaca fiber market, holding the largest share due to several factors. The region's well-established textile industry and high demand for luxury and sustainable fabrics drive the alpaca fiber market growth. For instance, in July 2024, the United States aims to strengthen its textile and apparel trade partnerships in Central and South America by addressing sustainability, forced labor concerns, and security issues. A proposed $45 billion Americas Act (Americas Trade and Investment Act) seeks to create a partnership among Western Hemisphere countries, with a $105 million annual investment over five years. Additionally, the Department of Homeland Security is implementing a plan to protect the American textile industry by expanding customs audits and screenings. The presence of numerous alpaca farms, particularly in the United States, ensures a steady supply of high-quality fiber. Additionally, North American consumers' growing preference for eco-friendly and ethically sourced products further boosts the product demand. According to the alpaca fiber market forecast, North America is expected to maintain its dominance due to ongoing investments in sustainable practices and increasing consumer awareness of eco-friendly textiles. The region's advanced distribution networks and strong consumer base also contribute to its leading position.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the alpaca fiber industry include AHA Bolivia, Altifibers S.A., Berroco Inc., Cascade Yarns Inc., Laughing Hens, Lion Brand Yarn, Mary Maxim Inc., New Era Fiber LLC, Plymouth Yarn Company Inc., The Alpaca Yarn Company, The Natural Fibre Company, White Frost Farms (Kenny Ventures Inc.), etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The Alpaca Fiber Market is characterized by strong competition among key players focusing on quality, sustainability, and innovation. Alpaca fiber companies are dominating the market by offering a wide range of premium alpaca products, leveraging their established supply chains in South America, particularly Peru. Smaller, niche companies differentiate themselves by emphasizing eco-friendly practices, ethical sourcing, and unique product offerings like hand-spun yarns and organic dyes. The market is also seeing increased competition from synthetic fibers, pushing alpaca fiber producers to highlight the natural benefits of alpaca, including its softness, warmth, and hypoallergenic properties. Moreover, the rising consumer demand for sustainable and ethically produced textiles is driving innovation and product diversification within the market. As a result, companies are increasingly investing in research and development (R&D) to create new alpaca fiber blends and sustainable processing techniques that cater to the growing eco-conscious market segment.

Alpaca Fiber Market Recent Developments:

- In December 2023, Paka, a leading innovator in alpaca apparel, introduced PAKACLOUD™️, a groundbreaking alpaca-based fleece that outperforms standard synthetic fleece in thermal efficiency. This innovative fleece is not only warmer but also more sustainable, as it is made from renewable and ethically sourced alpaca fiber. PAKACLOUD™️ is available in a unisex fit and comes in three different colors. Paka is known for its commitment to ethical sourcing, sustainable practices, and social impact.

- In August 2024, MGI Tech, UNALM, and Inca Tops announced their partnership to enhance alpaca fiber quality in Peru. A genetic sequencing project involving 1,500 alpacas from Puno aims to optimize fiber quality, fineness, and natural colors. This initiative will benefit breeders, promote industry growth, and support highland farming communities. The research, led by MGI Tech, will continue until March 2025 and takes place in the Melgar and Ñuñoa districts, below 4,000 meters above sea level.

Alpaca Fiber Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Suri Fiber, Huacaya Fiber |

| Grades Covered | Ultra Fine, Superfine, Fine, Medium, Intermediate |

| Applications Covered | Flooring, Textile, Industrial Felting, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AHA Bolivia, Altifibers S.A., Berroco Inc., Cascade Yarns Inc., Laughing Hens, Lion Brand Yarn, Mary Maxim Inc., New Era Fiber LLC, Plymouth Yarn Company Inc., The Alpaca Yarn Company, The Natural Fibre Company, White Frost Farms (Kenny Ventures Inc.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global alpaca fiber market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global alpaca fiber market?

- What is the impact of each driver, restraint, and opportunity on the global alpaca fiber market?

- What are the key regional markets?

- Which countries represent the most attractive alpaca fiber market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the alpaca fiber market?

- What is the breakup of the market based on the grade?

- Which is the most attractive grade in the alpaca fiber market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the alpaca fiber market?

- What is the breakup of the market based on the region?

- Which is the most attractive region in the alpaca fiber market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global alpaca fiber market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the alpaca fiber market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global alpaca fiber market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the alpaca fiber industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)