Aluminium Foil Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition

Aluminium Foil Price Trend, Index and Forecast

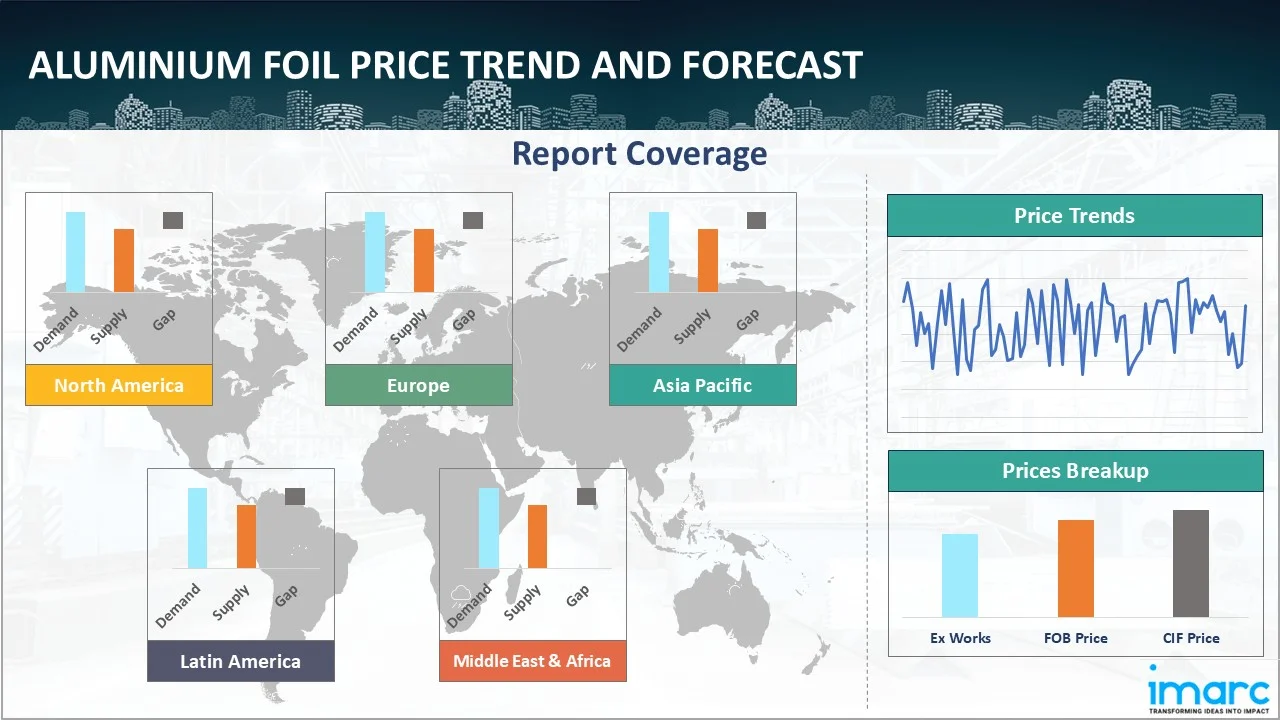

Track the latest insights on aluminium foil price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Aluminium Foil Prices Outlook Q4 2025

- USA: USD 5543/MT

- Germany: USD 5262/MT

- Japan: USD 4925/MT

- Turkey: USD 5035/MT

- Argentina: USD 6278/MT

Aluminium Foil Price Chart

Get real-time access to monthly/quarterly/yearly prices Request Sample

During the fourth quarter of 2025, aluminium foil prices in the USA reached 5543 USD/MT in December. Tighter domestic aluminium supply and ongoing purchases from the food packaging and pharmaceutical industries caused prices to rise. Conversion margins were pushed upward by increased energy input costs and limited rolling capacity. Due to suppliers' preference for regional contracts, import volumes were restricted, which decreased spot market liquidity.

During the fourth quarter of 2025, aluminium foil prices in Germany reached 5262 USD/MT in December. Due to rolling mills' cautious output tactics and limited raw aluminium supplies, the market saw strong pricing. Operating decisions were nevertheless influenced by high electricity costs, which forced producers to overcome cost pressures. There were no notable price adjustments because the demand from the food processing and industrial insulation categories was steady.

During the fourth quarter of 2025, aluminium foil prices in Japan reached 4925 USD/MT in December. Prices softened slightly as domestic demand from consumer electronics and packaging showed moderation. Higher inventory availability and stable import flows reduced urgency in procurement cycles. Producers faced competitive pressure amid cautious buying behavior from downstream converters. Additionally, currency stability limited export competitiveness, resulting in balanced supply conditions.

During the fourth quarter of 2025, aluminium foil prices in Turkey reached 5035 USD/MT in December. Prices strengthened as regional demand from flexible packaging and construction insulation improved. Supply-side constraints emerged due to controlled production rates and selective export commitments. Rising input costs and freight-related challenges added pressure on conversion economics.

During the fourth quarter of 2025, aluminium foil prices in Argentina reached 6278 USD/MT in December. Prices increased due to constrained domestic supply and higher reliance on imported raw materials. Logistics bottlenecks and currency-linked cost pressures influenced procurement strategies, leading to cautious inventory rebuilding. Demand from food packaging and pharmaceutical applications remained resilient, supporting firm pricing.

Aluminium Foil Prices Outlook Q3 2025

- USA: USD 5423/MT

- Germany: USD 5100/MT

- Japan: USD 5010/MT

- Turkey: USD 4915/MT

- Argentina: USD 6137/MT

During the third quarter of 2025, the aluminium foil prices in the USA reached 5423 USD/MT in September. The increase reflected sustained demand from packaging and food processing industries, driven by growth in consumer goods and e-commerce sectors. Supply-side constraints, including higher energy and raw aluminium costs, contributed to price pressures. Transportation and logistics challenges, particularly in port handling and inland freight, further influenced market dynamics. Additionally, regulatory compliance costs related to environmental standards and workplace safety added incremental financial pressures on manufacturers.

During the third quarter of 2025, the aluminium foil prices in Germany reached 5100 USD/MT in September. Price growth was impacted by strong demand from the food packaging and automotive sectors, which increased consumption requirements. Supply-side challenges, including energy price volatility and limited domestic aluminium availability, contributed to upward pressures. Additional factors such as port handling costs, transportation surcharges, and customs duties on imports influenced overall pricing. Compliance with European Union environmental regulations, along with labor and safety standards, added incremental costs to production.

During the third quarter of 2025, the aluminium foil prices in Japan reached 5010 USD/MT in September. Price trends were primarily driven by steady demand from the food packaging and electronics industries. Supply-side pressures, including high energy costs and constrained domestic aluminium output, influenced pricing. Additional costs emerged from logistics, port handling, and import tariffs on raw aluminium materials. Currency exchange rate movements between the Japanese Yen and the USD moderately affected import-dependent manufacturing costs. Compliance with national safety and environmental regulations contributed to incremental production costs.

During the third quarter of 2025, the aluminium foil prices in Turkey reached 4915 USD/MT in September. The market experienced price increases due to strong consumption from food packaging and industrial sectors. Rising costs of imported raw aluminium, energy price fluctuations, and supply chain delays contributed to higher production expenses. Domestic logistics, including road and port handling charges, further impacted final pricing. Currency volatility between the Turkish Lira and the USD added additional cost pressures for import-dependent manufacturers. Regulatory compliance with local environmental and safety standards imposed minor cost increments.

During the third quarter of 2025, the aluminium foil prices in Argentina reached 6137 USD/MT in September. Price growth was influenced by elevated demand from the food packaging and industrial processing sectors. Supply-side constraints, including limited domestic production capacity and dependence on imported raw materials, contributed to upward pressures. Logistics challenges, particularly port handling fees and inland transportation costs, added to the total market cost. Compliance with national environmental and occupational safety regulations added incremental costs.

Aluminium Foil Prices Outlook Q2 2025

- USA: USD 5180/MT

- Germany: USD 4903/MT

- Japan: USD 4845/MT

- Turkey: USD 4748/MT

- Argentina: USD 5987/MT

During the second quarter of 2025, the aluminium foil prices in the USA reached 5180 USD/MT in June. As per the aluminium foil price chart, prices were influenced by heightened trade enforcement activities, particularly the anti-circumvention investigations launched by the US Department of Commerce (DOC) targeting imports from Vietnam and Thailand. These actions were prompted by suspicions that Chinese-origin aluminium foil was being rerouted through these countries in processed form to bypass existing anti-dumping and countervailing duties. The investigations created considerable market uncertainty, as importers and downstream manufacturers became concerned about potential supply disruptions and retroactive duties.

During the second quarter of 2025, the aluminium foil prices in Germany reached 4903 USD/MT in June. Prices in Germany were shaped by a combination of supply chain disruptions, energy market volatility, and shifting trade dynamics within the European Union. The ongoing instability in energy prices, particularly electricity and natural gas, continued to impact aluminium smelters and downstream processors across Germany. As aluminium production is highly energy-intensive, these elevated input costs translated into higher production expenses for foil manufacturers, thereby exerting upward pressure on domestic prices. Furthermore, logistical challenges stemming from tighter EU environmental regulations and stricter transport controls added to operational burdens for producers and distributors.

During the second quarter of 2025, aluminium foil prices in Japan reached 4845 USD/MT in June. Japanese manufacturers experienced steady operational activity, but they also faced rising input costs due to fluctuating energy prices and increased procurement expenses for primary aluminium. This added cost pressure translated into elevated production costs, which, in turn, influenced foil pricing in the domestic market. On the trade front, regional developments significantly impacted pricing trends. With the United States initiating anti-circumvention investigations into aluminium foil products from Vietnam and Thailand, Japan emerged as a more stable and preferred export partner, which significantly influenced pricing trends.

During the second quarter of 2025, the aluminium foil prices in Turkey reached 4748 USD/MT in June. The Turkish market remained highly sensitive to global supply chain developments, particularly as it relied significantly on imported aluminium semi-finished products. Price movements were closely tied to volatility in international aluminium markets, especially due to shifting trade patterns caused by protective measures in key consuming regions such as North America and Europe. Moreover, demand from Turkey’s food packaging, pharmaceutical, and HVAC industries remained steady, offering some support to pricing.

During the second quarter of 2025, the aluminium foil prices in Argentina reached 5987 USD/MT in June. The country continued to grapple with inflationary pressures and currency volatility, which increased the cost of imported goods, including aluminium foil. As Argentina relies heavily on external sources for aluminium foil supply, fluctuations in the peso contributed to changed import costs, which were ultimately passed on to end-users.

Aluminium Foil Prices Outlook Q1 2025

- USA: USD 5064/MT

- Germany: USD 4747/MT

- Australia: USD 3684/MT

- Turkey: USD 4584/MT

- Argentina: USD 4904/MT

During the first quarter of 2025, the aluminium foil prices in the USA reached 5064 USD/MT in March. As per the aluminium foil price chart, the price of aluminium saw fluctuations, impacting the cost of producing aluminium foil. Besides, the implementation of tariffs on imported aluminium in the USA led to increased costs for manufacturers.

During the first quarter of 2025, aluminium foil prices in Germany reached 4747 USD/MT in March. Fluctuations in energy costs and the availability of scrap metal impacted the production costs for aluminum foil manufacturers, which in turn influenced the prices they charged.

During the first quarter of 2025, the aluminium foil prices in Australia reached 3684 USD/MT in March. Ongoing global supply chain issues, including shipping delays and raw material shortages, contributed to price fluctuations. Besides, strong demand for aluminium foil from various industries, such as packaging and battery foil production, further impacted prices.

During the first quarter of 2025, the aluminium foil prices in Turkey reached 4584 USD/MT in March. The price of raw aluminium increased due to tariff hikes and logistical challenges. Besides, supply pressures and energy fluctuations influenced upstream aluminium prices, which closely tracked the movement of aluminium foil prices.

During the first quarter of 2025, the aluminium foil prices in Argentina reached 4904 USD/MT in March. The changes in Argentine Peso against major currencies influenced the cost of imported aluminium foil, contributing to pressure on domestic prices. Besides, economic recovery initiatives, interest rate cuts, and stimulus measures further impacted prices.

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing aluminium foil prices.

Europe Aluminium Foil Price Trend

Q4 2025:

Aluminium foil price index in Europe reflected bullish conditions. Regional prices were supported by constrained aluminium availability and disciplined production strategies among rolling mills. Energy-related operating pressures influenced cost structures, encouraging producers to maintain elevated offers. Demand from food packaging, pharmaceuticals, and insulation applications remained consistent, preventing downside corrections. Import inflows stayed limited due to compliance requirements and logistical constraints, reinforcing domestic market stability.

Q3 2025:

The aluminium foil price index in Europe experienced a significant upward trend during Q3 2025, reflecting consistent demand from packaging, automotive, and industrial sectors. Supply-side pressures arose from rising energy costs, limited local aluminium production, and dependency on imported raw materials. Logistics and transportation challenges, including port handling and inland freight, contributed to incremental cost increases. Regulatory compliance with EU environmental and workplace safety standards added further expenses for manufacturers. Currency fluctuations of the Euro against the USD moderately influenced imported input costs.

Q2 2025:

In the second quarter of 2025, aluminium foil prices in Europe were shaped by a combination of regional supply challenges, shifting trade dynamics, and evolving demand conditions. One of the primary factors was the ongoing volatility in energy costs across the continent, particularly in countries heavily reliant on natural gas for industrial production. Elevated electricity prices continued to strain aluminium smelters, many of which operated at reduced capacity or passed higher input costs along the value chain. This exerted upward pressure on aluminium foil prices, especially for products requiring energy-intensive rolling and finishing processes. Additionally, the tightening of import supply contributed to market firmness. European buyers faced disruptions in sourcing aluminium foil from Asia due to trade policy uncertainty and longer lead times. With anti-dumping measures already in place against some Chinese-origin aluminium foil, importers became increasingly reliant on regional producers and alternative Asian sources like South Korea and Japan. However, limited availability and rising freight costs added further complexity to procurement strategies.

Q1 2025:

As per the aluminium foil price index, in the first quarter of 2025, demand for European aluminium foil rollers increased significantly. Besides, domestic deliveries in Europe, along with exports also experienced hikes. The export spike was largely due to anticipatory effects caused by existing trade policy, particularly in the USA. Moreover, restocking efforts played a part, as many consumers raised their stockpiles at the start of the year.

This analysis can be extended to include detailed aluminium foil price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Aluminium Foil Price Trend

Q4 2025:

Aluminium foil price index in North America remained strong. Pricing was supported by controlled production rates and steady demand from packaging and automotive-related applications. Logistics inefficiencies and longer lead times influenced procurement behavior, favoring local sourcing. Import competition remained moderate, allowing domestic producers to sustain pricing levels. Inventory optimization strategies among buyers reduced spot market liquidity, strengthening negotiated contract values. The regional market benefited from balanced supply-demand dynamics, supporting stable aluminium foil prices throughout the quarter.

Q3 2025:

The aluminium foil price index in North America increased markedly in Q3 2025, driven by strong consumption in packaging, industrial, and food processing applications. Supply constraints, including high energy prices and rising costs of raw aluminium, contributed to market pressures. Domestic transportation and port handling fees further influenced pricing. Regulatory compliance with environmental and occupational safety requirements added incremental production costs. USD exchange rate stability influenced import-related costs moderately.

Q2 2025:

As evident by the aluminium foil price index, prices in North America were influenced by a combination of trade policy developments, shifting import patterns, and supply-side concerns. The US Department of Commerce’s anti-circumvention investigations into aluminium foil containers and related products from Vietnam and Thailand created considerable uncertainty in the market. This regulatory scrutiny contributed to heightened caution among importers, who feared the potential imposition of retroactive duties or delays in customs clearance. Additionally, the broader trade environment also had a bearing on price trends. As inventories drawn ahead of the tariff were gradually depleted and fresh import flows remained subdued, buyers faced limited sourcing options.

Q1 2025:

Shipping delays, energy costs, and raw material shortages continued to put pressure on supply chains, impacting aluminium foil production and prices. Besides, the USA implemented a 25% tariff on all aluminium imports, which increased costs for industries heavily reliant on imported aluminium. Moreover, fluctuations in energy prices, a major component of aluminum production costs, also played a role in price movements.

Specific aluminium foil prices and historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Aluminium Foil Price Trend

Q4 2025:

During the fourth quarter of 2025, aluminium foil prices across the Middle East and Africa showed an upward trend. Regional markets benefited from steady export demand and reliable primary aluminium availability. Infrastructure and packaging demand supported consistent offtake. Limited local competition in certain markets allowed suppliers to maintain firm pricing. Logistics constraints and extended delivery timelines further supported price stability across the region.

Q3 2025:

In Q3 2025, aluminium foil prices in the Middle East and Africa rose steadily due to demand growth in food packaging, construction, and industrial sectors. Supply-side pressures included high energy costs and limited regional production capacity. Logistics challenges, such as port handling and transportation fees, affected pricing. Compliance with environmental and safety regulations in several countries added incremental costs. Currency fluctuations also influenced import expenses. Overall, the region experienced a moderate increase in aluminium foil prices throughout the quarter.

Q2 2025:

As per the aluminium foil chart, the price of aluminium ingots and primary aluminium, key raw materials for foil production, remained volatile amid uncertain global market conditions and declining exports from major producers like Canada. This volatility translated into increased cost pressures for regional converters and foil manufacturers, many of whom operate with limited backward integration. Consequently, production costs rose, and the higher input prices were gradually passed on to downstream buyers. Additionally, infrastructure and packaging sectors in countries like the UAE and Saudi Arabia showed steady demand, offering some price stability. In contrast, weaker industrial activity and currency fluctuations in parts of North and Sub-Saharan Africa contributed to uneven purchasing patterns, leading to price variability across the region.

Q1 2025:

As per the aluminium foil price chart, the Middle East aluminium foil market saw increased demand from the food and beverage industry for packaging materials. Additionally, the growing demand for aluminium foil in the packaging, thermal insulation, and electronics sectors contributed to price fluctuations.

In addition to region-wise data, information on aluminium foil prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Aluminium Foil Price Trend

Q4 2025:

The Asia Pacific aluminium foil market experienced a downward pricing trend primarily driven by sufficient supply availability and restrained demand momentum. While consumption from packaging and electronics sectors remained present, it lacked the strength needed to absorb existing inventories fully. Producers operated at stable to high utilization rates, leading to comfortable material availability across key markets. Export-oriented suppliers faced weaker overseas buying interest, which limited order inflows and intensified regional competition.

Q3 2025:

During Q3 2025, aluminium foil prices in Asia Pacific markets increased moderately, driven by steady industrial and packaging sector demand. Supply-side limitations, including higher energy costs and reliance on imported raw materials, influenced prices. Transportation and port handling costs contributed to incremental market pressures. Compliance with environmental and industrial safety regulations added further production expenses. Currency volatility across regional markets moderately affected import pricing. These factors collectively supported moderate price growth in the Asia Pacific during the third quarter.

Q2 2025:

Prices in the Asia Pacific region, particularly in India, were notably impacted by the imposition of anti-dumping duties on imports from China, Taiwan, and Russia. The Indian government's decision to enforce these duties for a five-year term confirmed that these countries were exporting aluminium foil at unfairly low prices, undercutting local manufacturers and disrupting market equilibrium. This trade measure effectively curbed the influx of cheap aluminium foil into India, tightening the supply of low-cost material in the domestic market. As a result, Indian aluminium foil producers experienced an improvement in pricing power and profitability, while buyers faced elevated procurement costs due to the restricted availability of competitively priced imports. This led to a moderate upward shift in domestic aluminium foil prices during the quarter, as local producers capitalized on reduced import competition.

Q1 2025:

Aluminium foil prices in the Asia Pacific region were influenced by a combination of factors, including fluctuating base metal prices, regional industrial performance, and supply chain dynamics. Initial price increases were driven by firming base aluminum costs, tight smelter production, and robust demand from sectors like food and FMCG. However, mid-quarter softening in base metal prices and a slowdown in downstream activity led to a subsequent price decrease.

This aluminium foil price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Aluminium Foil Price Trend

Q4 2025:

In Latin America, aluminium foil prices remained bullish, supported by persistent supply-side limitations and structural import dependency. Limited domestic production capacity increased reliance on imported aluminium foil and semi-finished products, exposing the market to logistical complexities and extended lead times. These challenges constrained material availability and strengthened suppliers’ pricing positions. Demand from food processing, beverage packaging, and pharmaceutical sectors stayed resilient, underpinned by consistent consumer consumption patterns and regulatory-driven packaging requirements.

Q3 2025:

Aluminium foil prices in Latin America showed steady growth in Q3 2025, reflecting strong consumption from food packaging and industrial applications. Supply-side factors, including limited domestic production and import dependence, added upward pressure. Transportation and logistics costs, particularly port handling and inland freight, influenced market pricing. Currency fluctuations and compliance with national environmental and workplace safety regulations contributed incremental costs. Overall, these combined factors resulted in moderate upward trends in aluminium foil prices across Latin American markets during Q3 2025.

Q2 2025:

As per the aluminium foil price index, regional producers, already operating under cost pressures due to elevated energy and raw material costs, found limited flexibility to expand output rapidly. The lack of large-scale, integrated aluminium foil production facilities in many Latin American countries further deepened reliance on imports, particularly from Asia. However, the shifting global trade landscape and increased demand from US buyers led to logistical delays and longer lead times for shipments into Latin America, creating localized supply constraints. On the demand side, recovery in the food packaging and pharmaceutical sectors supported steady consumption, particularly in countries like Brazil and Mexico. Nevertheless, the construction and consumer electronics sectors showed signs of sluggishness, offering only partial support to price growth.

Q1 2025:

As per the aluminium foil price index, prices in Latin America were influenced by several factors, including global supply chain disruptions, energy price fluctuations, and regional industrial performance. The USA tariffs on aluminium imports also contributed to price volatility. Additionally, demand from key industries like construction, automotive, and packaging, also played a significant role.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin America countries. |

Aluminium Foil Pricing Report, Market Analysis, and News

IMARC's latest publication, “Aluminium Foil Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition,” presents a detailed examination of the aluminium foil market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of aluminium foil at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed aluminium foil prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting aluminium foil pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Aluminium Foil Industry Analysis

The global aluminium foil industry size reached USD 30.03 Billion in 2025. By 2034, IMARC Group expects the market to reach USD 47.82 Billion, at a projected CAGR of 5.04% during 2026-2034. Market expansion is supported by the increasing consumer goods production, expansion of e-commerce packaging, sustainability initiatives, and ongoing infrastructure developments. Continuous supply chain optimizations and adoption of lightweight materials for energy efficiency further contribute to market growth.

Latest News and Developments:

- June 2025: Hindalco’s Freshwrapp launched a nationwide campaign titled “Bacteria Ki Entry Ko Rokey,” featuring renowned chef and author Vikas Khanna. The campaign introduces Freshwrapp foil wrap’s “Freshlock Shield,” a feature designed to restrict bacteria’s entry into food, thereby promoting food safety, freshness, and hygiene.

Product Description

Aluminium foil is a thin, flexible sheet made from aluminium metal, widely used in various industries due to its exceptional barrier, insulation, and malleability properties. Typically manufactured by rolling aluminium slabs until they reach a thickness of less than 0.2 millimetres, aluminium foil is commonly employed in packaging, insulation, and household applications. One of its most notable characteristics is its ability to act as an effective barrier against moisture, oxygen, light, and bacteria, making it particularly suitable for preserving food and pharmaceuticals. In the food industry, aluminium foil is used to wrap and protect perishable goods, line baking trays, and create containers for ready-to-eat meals. Its non-toxic nature and resistance to high temperatures allow it to be safely used in cooking and freezing. In the pharmaceutical sector, aluminium foil is crucial for blister packs and sachets, helping maintain drug integrity.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Aluminium Foil |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Ammonium Perchlorate Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of aluminium foil pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting aluminium foil price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The aluminium foil price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)