Aluminum Composite Panels Market Size, Share, Trends, and Forecast by Base Coating Type, Panel Type, Composition, Application, Region, 2025-2033

Aluminum Composite Panels Market Size and Share:

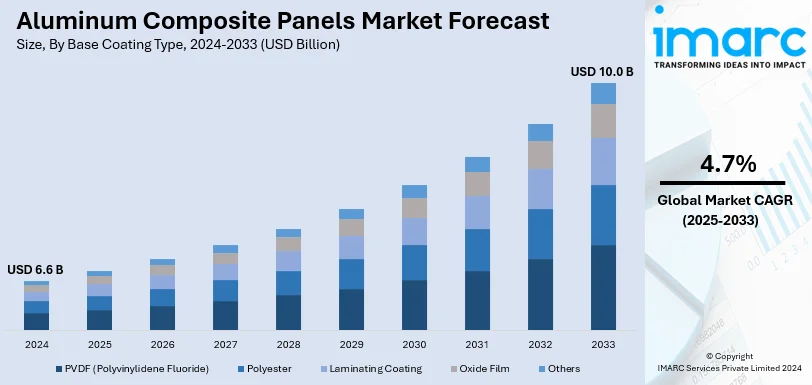

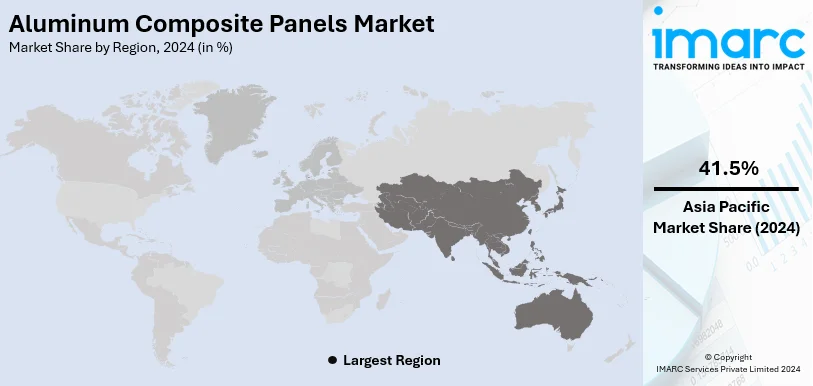

The global aluminum composite panels market size was valued at USD 6.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.0 Billion by 2033, exhibiting a CAGR of 4.7% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 41.5% in 2024. The market is propelled by rapid urbanization and infrastructure development, significant technological advancements, aesthetic and design flexibility offered by the materials. Furthermore, elevating disposable income levels and rapidly growing construction and renovation industries impact the market expansion in the region significantly.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.6 Billion |

|

Market Forecast in 2033

|

USD 10.0 Billion |

| Market Growth Rate 2025-2033 | 4.7% |

The global aluminum composite panels market is chiefly boosted by magnifying urbanization and proliferating infrastructure ventures, especially in developing nations. For instance, according to the United Nations Population Fund, more than 50% of the global population currently dwell in urban regions, and this number is expected to increase around 5 billion by 2030. Furthermore, the heightening requirement for aesthetically flexible, durable, and lightweight materials in architectural and construction applications significantly bolsters the market expansion. Technological advancements enable enhanced fire resistance, thermal insulation, and weatherproofing features, further boosting adoption. In addition, rising disposable income and population growth stimulate residential and commercial construction, while renovation activities also contribute significantly. Moreover, the notable inclination towards recyclable and sustainable building materials caters to the strict environmental policies, providing further growth prospects for aluminum composite panels in modern architectural designs.

The United States represent a robust market within the global aluminum composite panels industry, principally driven by resilient focus on energy-effective building solutions and increasing innovations in construction technology. Escalating requirement for visually adaptable, lightweight, and hard-wearing materials in commercial as well as residential construction industries fosters the market penetration. Moreover, heavy investments in renovation and infrastructure projects further fuel the utilization of aluminum composite panels. For instance, in October 2024, the U.S. government, under the Bipartisan Infrastructure Law, allocated over USD 4.2 billion through the INFRA and Mega grant programs to fund 44 transformative infrastructure projects nationwide. These initiatives focus on enhancing safety, mobility, and economic competitiveness by addressing critical needs, including bridge replacements, port expansions, and highway upgrades. Additionally, the rapid incorporation of environmentally friendly and fire-resistant materials addresses the transforming regulatory policies and customer choices, improving market expansion in the region. Strategic advancements and product modification also facilitate sustained market growth in the U.S.

Aluminum Composite Panels Market Trends:

Rapid Urbanization and Infrastructure Development

Rapid urbanization and infrastructure development worldwide is resulting in an optimistic aluminum composite panels market expansion. According to a report published by the World Health Organization (WHO), more than 55% of the global population dwell in urban areas, whereas this figure is anticipated to reach 68% by 2050. With the elevating number of new buildings actively being constructed globally, the requirement for modern, effective, and visually pleasing construction materials is steadily escalating. Furthermore, the comprehensive utilization of such materials in the urban development ventures can be attributed to their robustness, lightweight property, and adaptability. They are extensively leveraged transportation industry, exterior cladding, signage, and various interior applications. Another key factor boosting the market growth is the increase in the smart city ventures and notable shift towards green building practices. According to Deloitte's 2025 Engineering and Construction Industry Outlook, the construction sector demonstrated strong growth in 2024, with spending surpassing USD 2 Trillion in the first half of the year, maintaining a stable trajectory. Despite challenges posed by a widespread talent shortage, the industry achieved a remarkable employment milestone, reaching 8.3 Million workers in July 2024. This marks a significant recovery, surpassing the previous peak of 7.7 Million workers recorded in 2006, highlighting the sector’s resilience and continued expansion.

Significant Technological Advancements

Numerous technological advancements are leading to a positive impact on the aluminum composite panels market revenue. Numerous developments such as anti-bacterial coatings, fire-resistant panels, and better UV resistance are propelling the market growth. For instance, in November 2024, VIVA Composite Panel Pvt. Ltd., a prominent aluminum composite panel manufacturer, unveiled its innovative product line, including fire, weather, and UV resistance aluminum composite panels for automotive applications. Moreover, advanced manufacturing techniques are leasing to the production of good-quality panels with better performance characteristics, such as better acoustic properties and thermal insulation. Other than this, the introduction of sustainable and eco-friendly materials procured from recycled materials is catering to the rising population concerned about the environment.

Aesthetic and Design Flexibility

The aesthetic appeal and design flexibility provided by these materials are offering a lucrative aluminum composite panels (ACPs) market outlook. They are extensively available in a wide range of finishes, textures, and colors, facilitating both designers and architects to gain various creative design options. Owing to this flexibility, such materials are extensively employed for a broad variety of applications, like revamping historical buildings and modern high-rise buildings. Furthermore, ACPs also have the capability to replicate natural materials, including metal, stone, or wood, while providing excellent robustness and minimal need for maintenance. Besides this, with the accelerated expansion of the interior design sector, the aluminum composite panels demand is notably fueling. According to the IMARC Group, the India interior design market reached US$ 31.5 Billion in 2023, and is projected to reach US$ 67.4 Billion by 2032, exhibiting a CAGR of 8.81% during 2024-2032. Also, the surge in luxury residential sales, as highlighted by CBRE with a 37.8% year-on-year growth in properties priced above half a Million USD from January to September 2024 in India, is significantly driving demand for premium interior designing services. With 12,625 luxury units sold in the country, homeowners are increasingly investing in bespoke interiors that reflect modern aesthetics, functionality, and sophistication. This trend is particularly boosting the adoption of aluminum composite panels (ACPs) in interior design, as they offer a perfect blend of durability, sleek finishes, and versatility.

Aluminum Composite Panels Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global aluminum composite panels market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on base coating type, panel type, composition, application, and region.

Analysis by Base Coating Type:

- PVDF (Polyvinylidene Fluoride)

- Polyester

- Laminating Coating

- Oxide Film

- Others

PVDF (polyvinylidene fluoride) stand as the largest component in 2024, holding around 36.5% of the market. With exceptional resistance property against chemicals, weathering, and UV radiation, PVDF coatings provide durability and resilience, establishing them as a preferable option for exterior applications. In addition, PVDF coatings exhibit exceptional adhesion to substrates, guaranteeing lower maintenance demands and prolonged bonds. This versatility, together with its excellent protective attributes, positions PVDF as an ideal material for building owners, architects, and contractors alike, fueling its substantial market share expansion. This dominance is further fortified by the capability of PVDF to sustain both gloss and color over long-term periods, fostering the appeal and longevity of architectural structures.

Analysis by Panel Type:

- Fire-Resistant

- Antibacterial

- Antistatic

Fire-resistant leads the market with around 55.2% of market share in 2024. This dominance is attributed to the rising importance of safety and regulatory compliance across numerous industries. In order to comply with the stringent building codes and regulations globally, the demand for these fire-resistant ACPs is rapidly growing. They provide unmatched protection against fire hazards, thereby making them irreplaceable in high-risk environments including industrial facilities, residential complexes, and commercial buildings. With an increasing focus on preventing fire-related accidents and minimizing property damage, the adoption of fire-resistant ACPs has become a priority for architects, contractors, and building owners alike.

Analysis by Composition:

- Surface Coating

- Metal Skin

- Core Material

- Rear Skin

Core material leads the market with around 57.1% of market share in 2024. Core material represents the largest share as they serve as the structural backbone of ACPs, providing strength, durability, and insulation properties crucial for various applications. This essential function makes them indispensable in industries such as construction, where ACPs are extensively used for building facades, signage, and interior décor. Additionally, advancements in core material technology have led to the development of lightweight yet robust options, meeting the evolving demands of architects and engineers for energy-efficient and sustainable building materials. Moreover, stringent building regulations and standards emphasizing fire safety and environmental performance further drive the demand for high-quality core materials in ACPs.

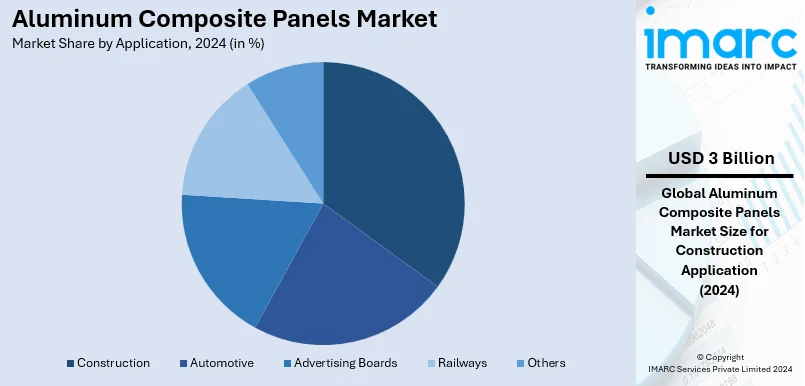

Analysis by Application:

- Construction

- Automotive

- Advertising Boards

- Railways

- Others

Construction leads the market with around 45.4% of market share in 2024. Construction dominates the aluminum composite panels industry on account of the versatile nature of the material, thereby making it an appropriate choice for a wide variety of building applications. According to industry reports, the global construction sector is expected to reach USD 16.14 Trillion by 2028. ACPs are renowned for their lightweight nature, durability, and resistance to weather and fire, which significantly enhance the structural integrity and aesthetic appeal of buildings. These panels are extensively used in exterior cladding, interior decoration, and signage, which are critical elements in modern construction projects. The demand for sustainable and energy-efficient building materials has further propelled the adoption of ACPs, as they contribute to better insulation and reduced energy consumption.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 41.5%. The Asia Pacific region holds the largest segment in the aluminum composite panels market due to its robust construction industry, rapid urbanization, and significant investments in infrastructure projects. Countries such as China, India, and Japan lead the demand surge, driven by their expanding commercial and residential building sectors. For instance, as per industry reports, India's construction output is projected to reach INR 36.58 trillion by 2028, highlighting significant growth potential in the sector. Moreover, the rising disposable incomes and improving living standards in these countries further boost the need for aesthetically appealing and durable construction materials, such as aluminum composite panels. Additionally, the favorable government policies promoting sustainable building practices and energy-efficient materials, are creating a positive aluminum composite panels market forecast.

Key Regional Takeaways:

United States Aluminum Composite Panels Market Analysis

The United States accounts for 87.5% of the market share in North America. The aluminum composite panel market in the United States is experiencing significant growth, driven by robust construction activity across the country. According to statistics released by the Economics and Statistics Division on June 3, 2024, U.S. construction spending increased by 10.7% during January–April 2024 compared to the same period in 2023. Furthermore, residential construction spending rose by 5.6%, while non-residential construction spending surged by 14.9%, showcasing strong demand in diverse applications. In addition, public sector construction spending increased by an impressive 18.9%, and private sector construction saw a rise of 8.5%, highlighting widespread investment in infrastructure projects. This growth momentum, combined with a focus on modern architectural designs, energy-efficient solutions, and lightweight materials, is fueling the adoption of aluminum composite panels in both residential and commercial construction across the United States. The increasing demand for durable, weather-resistant, and visually appealing building materials further strengthens the market's expansion trajectory.

Asia Pacific Aluminum Composite Panels Market Analysis

Asia-Pacific is the fastest-growing region for aluminum composite panels, owing to the rapid urbanization, which continues to be a defining megatrend according to UN-Habitat. Currently, Asia is home to 54% of the global urban population, with more than 2.2 Billion people living in urban areas. Furthermore, this urban population is projected to grow by 50% by 2050, adding an additional 1.2 Billion people. This significant urban growth is creating a surge in demand for construction materials like aluminum composite panels, which are ideal for modern, sustainable, and durable infrastructure. Alongside this, industrialization, government initiatives and investments in urban infrastructure and smart city projects are further accelerating market expansion in the region. For instance, driven by government initiatives such as "Make in India," "Smart Cities Mission," and "Housing for All”, these programs aim to boost domestic manufacturing, urban development, and affordable housing, creating substantial opportunities for the ACP industry. By promoting local production and fostering large-scale construction activities, these initiatives are increasing demand for aluminum composite panels in residential, commercial, and infrastructure projects.

Europe Aluminum Composite Panels Market Analysis

The aluminum composite panel market in Europe is experiencing robust growth, driven by stringent environmental regulations and the widespread adoption of green building practices. EU's Green Building Pact, which aims to create climate-tolerant buildings through better insulation and energy efficiency. As part of this initiative, the EU targets a 60% reduction in buildings' greenhouse gas emissions by 2030 and aims to fully decarbonize the building sector by 2050. Furthermore, the Pact's goal of modernizing 35 Million buildings and doubling refurbishment rates by 2030 is driving the demand for innovative construction materials like ACPs, which are lightweight, energy-efficient, and sustainable. In addition, the rise of climate-focused startups, such as German climate tech company Purpose Green, highlights the increasing investment in green building technologies. With its recent USD 3.5 Million funding round, Purpose Green is expanding its presence and enhancing its expertise in ESG and climate-focused solutions, reflecting the growing focus on sustainable construction practices. This alignment of regulatory frameworks and private sector innovation is positioning ACPs as a key material in the transformation of Europe’s building industry.

Beyond construction, ACPs find extensive applications in advertising, with their lightweight and customizable properties making them ideal for signage and billboards. Furthermore, the automotive and railway sectors in Europe are increasingly utilizing ACPs for lightweight panels, enhancing fuel efficiency and durability. These diverse applications, coupled with environmental considerations, are positioning ACPs as a versatile and sustainable material choice across multiple industries in the region.

Latin America Aluminum Composite Panels Market Analysis

In Latin America, the aluminum composite panel market is driven by the increasing adoption of lightweight and cost-effective building materials in both residential and commercial construction. Moreover, countries like Brazil, Mexico, and Argentina are investing heavily in infrastructure development, which is creating lucrative opportunities for market players. Additionally, the rising trend of modernizing urban landscapes is contributing to the growing demand for aluminum composite panels. For instance, driven by significant infrastructure investment requirements outlined by the Development Bank of Latin America and the Caribbean (CAF). By 2030, the region needs to invest over USD 2.2 Trillion in sectors such as water and sanitation, energy, transportation, and telecommunications to meet the Sustainable Development Goals (SDGs). Of this investment, 59% will be directed toward new infrastructure development, while 41% will focus on maintaining and replacing aging assets. This extensive infrastructure activity creates substantial opportunities for ACP adoption, particularly in transportation projects and urban developments requiring lightweight, durable, and energy-efficient materials.

Middle East and Africa Aluminum Composite Panels Market Analysis

The aluminum composite panel market in the Middle East and Africa is boosted by extensive construction activities in the commercial and hospitality sectors. Furthermore, ongoing mega projects in countries like Saudi Arabia and the UAE, such as the development of smart cities and luxury buildings, are fueling the demand for aluminum composite panels. A recent report by McKinsey & Co. indicates that Saudi Arabia is set to invest more than $175 Billion annually on industrial and mega projects between 2025 and 2028. Spending is projected to peak at $180 Billion in 2026 and 2027. The report, which Bloomberg cited, estimates that $1.3 Trillion worth of projects are underway in Saudi Arabia, including the $500 Billion NEOM and Red Sea resorts. Coupled with this, the need for durable and weather-resistant materials in extreme climatic conditions is propelling the market growth in this region.

Competitive Landscape:

The global aluminum composite panels market is highly competitive, with key players focusing on product innovation, sustainability, and regional expansions to strengthen their market presence. Major companies dominate the industry through advanced product offerings, including fire-resistant and eco-friendly panels. Furthermore, emerging players are leveraging cost-effective solutions to capture market share in developing regions. Additionally, strategic collaborations, mergers, and acquisitions are common, enabling companies to enhance their production capacities and geographic reach. The growing demand for lightweight, durable, and aesthetically versatile materials in construction and automotive industries further intensifies competition, driving continuous advancements in technology and customization to meet diverse consumer needs.

The report provides a comprehensive analysis of the competitive landscape in the aluminum composite panels market with detailed profiles of all major companies, including:

- 3A Composites (Schweiter Technologies)

- Alubond U.S.A. (Mulk Holdings Group)

- Alumax Industrial Co. Ltd.

- Changshu Kaidi Decoration Material Co. Ltd.

- Guangzhou Xinghe Aluminum Composite Panel Co. Ltd.

- Mitsubishi Chemical Corporation

- Shanghai Huayuan New Composite Materials Co. Ltd.

- Shyang Industrial Co. Ltd.

Latest News and Developments:

- November 2024: ALUCOBOND, a flagship brand of the Swiss-based 3A Composites, introduced "ALUCODUAL®," an innovative addition to its portfolio of high-quality aluminum composite materials. Designed to enhance the company's offering of technologically advanced cladding solutions, ALUCODUAL® is tailored for architectural applications where superior design and performance are essential. This new product launch reinforces ALUCOBOND's position as a global leader in cutting-edge cladding materials.

- October, 2024: Viva, in collaboration with Aloxide, launched the 'Pure Aura' range of anodized aluminium panels in India. This innovative product offers enhanced durability, corrosion resistance, and aesthetic appeal, marking a significant advancement in the aluminium composite panel (ACP) market by incorporating German technology.

- June 2023: Alumaze unveiled a new lineup of aluminum composite panel (ACP) sheets, manufactured at its newly established facility in the Vizianagaram district, India. Built in just eight months with an investment of USD 6 Million, the facility was launched to meet the growing demand for ACPs, particularly for interior design and signage applications.

- January 2021: Alucopanel, a UAE-based ACP manufacturer, introduced the country’s first government-approved non-combustible grade aluminum composite panel for building projects requiring high levels of fire protection. Certified as the first civil A1-grade ACP with defense certification, the product sets a new standard for safety in construction.

Aluminum Composite Panels Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Base Coating Types Covered | PVDF (Polyvinylidene Fluoride), Polyester, Laminating Coating, Oxide Film, Others |

| Panel Types Covered | Fire-Resistant, Antibacterial, Antistatic |

| Compositions Covered | Surface Coating, Metal Skin, Core Material, Rear Skin |

| Applications Covered | Construction, Automotive, Advertising Boards, Railways, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3A Composites (Schweiter Technologies), Alubond U.S.A. (Mulk Holdings Group), Alumax Industrial Co. Ltd., Changshu Kaidi Decoration Material Co. Ltd., Guangzhou Xinghe Aluminum Composite Panel Co. Ltd., Mitsubishi Chemical Corporation, Shanghai Huayuan New Composite Materials Co. Ltd. and Shyang Industrial Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the aluminum composite panels market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global aluminum composite panels market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the aluminum composite panels industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Aluminum composite panels (ACPs) are lightweight, durable materials composed of two aluminum sheets bonded to a non-aluminum core. Known for their strength, weather resistance, and design flexibility, ACPs are widely used in construction, signage, and automotive industries, offering aesthetic appeal and functional versatility for various applications.

The global Aluminum Composite Panels market was valued at USD 6.6 Billion in 2024.

IMARC estimates the global aluminum composite panels market to exhibit a CAGR of 4.7% during 2025-2033.

The market is majorly driven by increasing construction activities, rising demand for lightweight and durable materials, and advancements in fire-resistant and eco-friendly panel technologies. Growing urbanization, infrastructure development, and aesthetic design requirements further fuel market growth across residential, commercial, and industrial applications.

In 2024, PVDF (polyvinylidene fluoride) represented the largest segment by base coating type, driven by its superior durability, weather resistance, and aesthetic versatility.

Fire-resistant leads the market by panel type, driven by increasing safety regulations, demand for non-combustible materials, and rising adoption in high-rise buildings globally.

According to the report, core material represented the largest segment by composition, driven by its superior thermal insulation, lightweight properties, and cost-effectiveness.

Construction leads the market by application due to the rising infrastructure projects, urbanization, demand for energy-efficient materials, and aesthetic versatility in building design.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global Aluminum Composite Panels market include 3A Composites (Schweiter Technologies), Alubond U.S.A. (Mulk Holdings Group), Alumax Industrial Co. Ltd., Changshu Kaidi Decoration Material Co. Ltd., Guangzhou Xinghe Aluminum Composite Panel Co. Ltd., Mitsubishi Chemical Corporation, Shanghai Huayuan New Composite Materials Co. Ltd., Shyang Industrial Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)