Ammonium Nitrate Market Size, Share, Trends and Forecast by Application, End User, and Region, 2025-2033

Ammonium Nitrate Market 2024, Size and Trends:

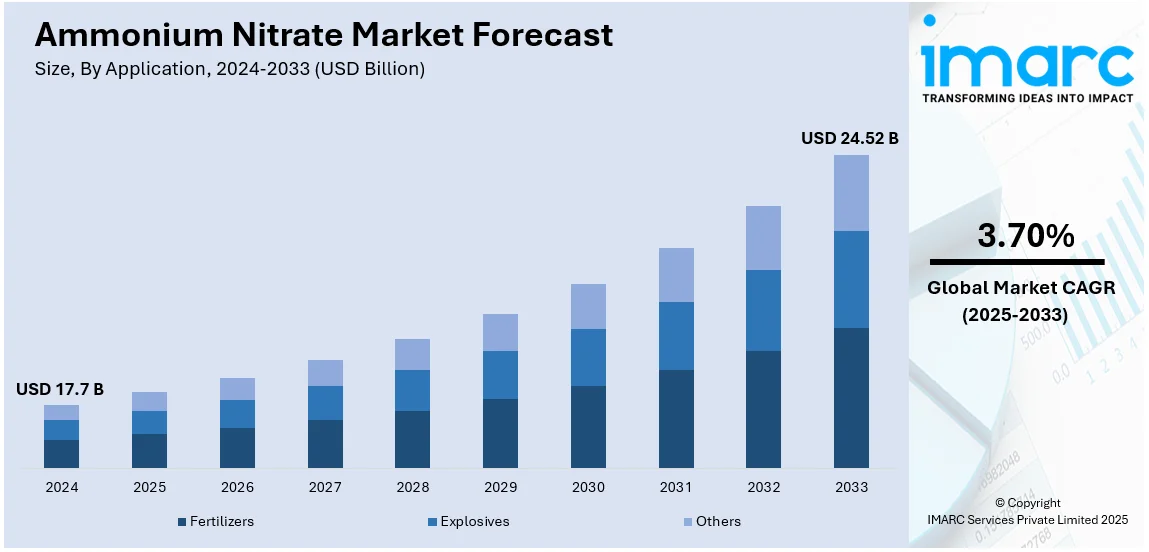

The global ammonium nitrate market size was valued at USD 17.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 24.52 Billion by 2033, exhibiting a CAGR of 3.70% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 38.7% in 2024. The significant growth in the agriculture industry, widespread product adoption in the mining sector, and extensive research and development (R&D) activities represent some of the key factors driving the ammonium nitrate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17.7 Billion |

| Market Forecast in 2033 | USD 24.52 Billion |

| Market Growth Rate (2025-2033) | 3.70% |

Significant growth in the agriculture industry across the globe is one of the key factors driving the ammonium nitrate market growth. Ammonium nitrate is widely used as a nitrogen fertilizer for crops such as corn, wheat, and barley, which helps to improve soil structure and nutrient content. In line with this, the widespread product adoption as a fertilizer used to enrich the growth of plants as it contains essential nutrients for plants, which provide healthy growth and keep them disease-free, is favoring the ammonium nitrate market growth. Moreover, the mining industry's growing demand for explosives with ammonium nitrate as a major component creates another key driver for market growth. Furthermore, the market expansion receives significant acceleration from ongoing research into improved ammonium nitrate production methods that use renewable energy sources to reduce manufacturing-related greenhouse gas emissions as well as produce environmentally friendly ammonium nitrate.

The United States plays a significant role in the global ammonium nitrate market share, driven by robust demand from the agriculture and mining industries. As one of the largest consumers and producers, the U.S. benefits from advanced manufacturing infrastructure and strong supply chain networks. Furthermore, leading companies maintain a dominant presence, supported by technological advancements and extensive distribution channels. Regulatory frameworks, particularly environmental and safety standards, influence production and usage trends. In addition, the U.S. market is shaped by fluctuating raw material costs and ongoing investments in sustainable and efficient ammonium nitrate production methods to meet domestic and export demands. For instance, in January 2025, Addis Energy, a U.S.-based firm, launched its new technology platform, which facilitates production of clean ammonia, a precursor of ammonia-based fertilizers like ammonium nitrate, at reduced costs. This platform blends next-gen chemical advancement with expertise from the oil and gas sector to develop economic prospects for domestic production of energy with zero emissions.

Ammonium Nitrate Market Trends:

Increasing Demand from Agriculture

A chief driver impacting the growth of the ammonium nitrate market is its comprehensive utilization as a nitrogen-rich fertilizer, which exhibits a critical role in bolstering crop yields. As the global population continues to bolster, with projections indicating an elevation to 9.7 Billion by the year 2050, according to the reports, the requirement for food and agricultural productivity has surged. According to the U.S. Department of Agriculture (USDA), global agricultural output has magnified approximately fourfold, while the population increased 2.6 times, leading to a 53% elevation in agricultural output per capita. The increase in agricultural production stems from the widespread application of ammonium nitrate fertilizers to fulfill rising food requirements. Moreover, India and Brazil together with their high agricultural dependency represent key markets for market growth since these nations use nitrogen-based fertilizers to produce sufficient agricultural output for their citizens, thereby shaping a positive ammonium nitrate market outlook.

Rising Use in Mining and Explosives

Ammonium nitrate is one of the primary ingredients in making explosives for mining, quarrying, and construction operations. Its demand has grown steadily as there is an overall expansion of infrastructure projects globally, along with more mineral extraction activities. The growth in the requirement for metals, minerals, and other mineral products—driven by the energy transition to clean energy and the pace of rapid urbanization—also fuels demand. According to the World Bank, to cater to the escalating need for electric vehicle batteries and renewable energy technologies, the world will require to mine 6 to 13 times more crucial minerals by the year 2040. This rise in mineral extraction activities is expected to significantly boost the need for ammonium nitrate, as it is essential for the safe and efficient extraction of these resources.

Growth in Defense Applications

The growing ammonium nitrate demand is driven by the use of military-grade explosives that involve ammonium nitrate, crucial in ammunition and defense applications. Growing defense spending in the international context also calls for higher needs for ammonium nitrate in the national security context. In 2023, military expenditure of the United States amplified by 2.3%, reaching USD 916 Billion, which accounts for 68% of total NATO military spending, as per the Stockholm International Peace Research Institute (SIPRI). This heightened military investment has significantly boosted the demand for ammonium nitrate as a key component in the production of explosives for defense purposes.

Ammonium Nitrate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global ammonium nitrate market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on application and end user.

Analysis by Application:

- Fertilizers

- Explosives

- Others

Fertilizers lead the market with around 61.2% of market share in 2024. The high nitrogen content and water-soluble properties of ammonium nitrate make it an efficient and reliable nutrient source for crops, boosting soil fertility and ensuring optimal plant growth. This efficiency is critical for meeting the increasing agricultural demand driven by global population growth and the need for enhanced food security. Governments and private stakeholders worldwide continue to emphasize agricultural productivity, further propelling ammonium nitrate consumption. Its versatility, suitable for various crops and soil types, ensures broad applicability, particularly in regions where intensive farming practices are essential. Moreover, technological advancements in precision agriculture are optimizing ammonium nitrate use, reducing wastage, and improving crop yields, solidifying its position as a preferred choice in modern farming practices.

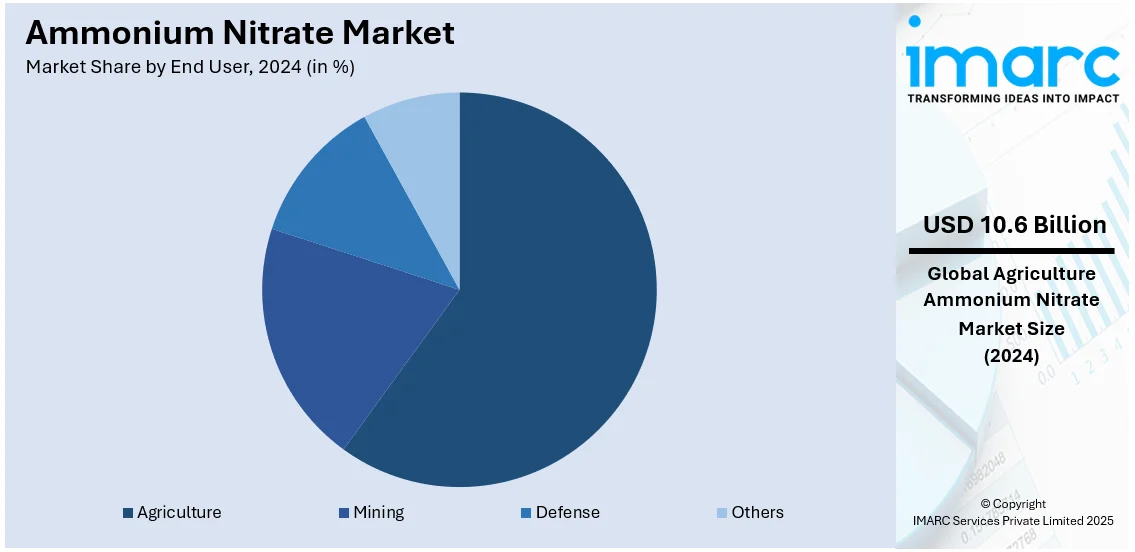

Analysis by End User:

- Agriculture

- Mining

- Defense

- Others

Based on the ammonium nitrate market forecast, agriculture holds the maximum market share of about 60.0% in 2024, largely due to its importance in boosting food production. Farmers across the world depend on ammonium nitrate-based fertilizers to overcome nutrient deficiencies in the ground, thus maintaining high crop productivity and resilience to the adverse impact of weather conditions. The growth of agricultural operations, mainly in emerging economies, has contributed much to this sector's growth. The increasing adoption of ammonium nitrate in mechanized and large-scale farming underscores its importance in achieving sustainable agriculture. Additionally, the segment benefits from policy support and subsidies encouraging fertilizer use to ensure food security. Rising demand for high-value crops, such as fruits and vegetables, also drives ammonium nitrate adoption due to its superior efficacy in improving crop quality and yield. These factors collectively make agriculture the dominant consumer of ammonium nitrate on a global scale.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 38.7%. Increase in demand for fertilizers, supported by agricultural exports from countries such as India, is a growth driver for the Asia Pacific ammonium nitrate market. According to the India Brand Equity Foundation (IBEF), agricultural product exports from India totaled USD 43.37 billion in FY22. Global demand for agricultural products continues to increase this fiscal year. Because more agricultural products are produced within the region to fulfill both national and international demands, more ammonium nitrate fertilizers are consumed. It simply follows that higher yields and proper growth require more fertilizers, such as ammonium nitrate, to be grown. This trend is especially high in the Asia Pacific region, where agricultural productivity is key to sustaining food security and economic growth. The growth of the agricultural export market in the region will further fuel the demand for ammonium nitrate fertilizers, hence propelling the growth of the market in Asia Pacific.

Key Regional Takeaways:

United States Ammonium Nitrate Market Analysis

A major growth driver for the United States ammonium nitrate market is the U.S. government's plan to boost domestically produced fertilizers due to high costs, partly due to the Ukraine war. The United States Department of Agriculture announced that the Biden-Harris administration has proposed initiatives to increase the production of U.S.-made fertilizers, aiming to assist farmers facing high input costs. In September 2022, the government introduced a USD 500 million grant to enhance domestic fertilizer production, including ammonium nitrate. The program falls in a larger context of encouraging greater competition in the agricultural sector, and it decreases dependency on imported fertilizers into the country. It would stabilize the supply and pricing of fertilizers to benefit farmers in the United States while boosting agricultural productivity. With these developments, it will be clear that the increase in ammonium nitrate production in the U.S. will play a very crucial role in assisting in meeting increased agricultural demands and furthering sustainable agriculture.

Europe Ammonium Nitrate Market Analysis

A key growth driver for the European ammonium nitrate market includes the steadily rising value of Russian agricultural production. This accounts for a large proportion of the demand for fertilizers in the region. According to the Russian Federal State Statistics Service, agricultural production in Russia has been steadily growing in recent years. In 2022, the sector's output reached approximately RUB 8.85 trillion (~USD 0.12 trillion), reflecting a 15% increase compared to the previous year's figures. This growth is mainly due to higher crop yields and greater demand for fertilizers, including ammonium nitrate, to maintain agricultural productivity. Russia is one of the largest agricultural producers in Europe, and the growth in its agricultural output has a real impact on the demand for ammonium nitrate in the region. Therefore, there is an ever-growing demand trend that will drive fertilizers up as the agriculture sector tries to produce more for an increasing food population in its growing territory that includes Russia as well as several neighbor European markets.

North America Ammonium Nitrate Market Analysis

As per the ammonium nitrate market trends, industrial demands and agricultural requirement in North American significantly boost the market demand. This demand typically pertains to the robust agricultural need for fertilizers across the United States and Canada. For instance, as per industry reports, Canada's fertilizer imports increased by 28.9%, rising from approximately USD 172.55 million to USD 222.61 million, highlighting intense requirement for fertilizers. Moreover, high-level yield targets for corn and wheat in the region require ammonia nitrate-based fertilizers to maximize production success. Furthermore, the market is currently witnessing notable expansion through industrial applications which include mining and explosives operations. In addition, the market is undergoing transformation through magnifying efforts to implement sustainable farming practices, combined with advancements in fertilizer production technology. As a result, the North American ammonium nitrate industry stands as a critical segment in global market because of its stable domestic product requirements and ongoing infrastructure expansion.

Latin America Ammonium Nitrate Market Analysis

A key growth driver for the Latin American ammonium nitrate market is Brazil's dominant position in global agriculture. Reports indicate that Brazil, with the largest arable land area and ranking among the top five producers of 34 agricultural commodities, plays a crucial role in driving fertilizer demand in the region. As cited by the United States Department of Agriculture, Brazil is also the biggest agricultural net exporter, adding further to the need for fertilizers such as ammonium nitrate. Brazilian agricultural production requires high-quality fertilizers that can make crops grow better and enhance yield, mainly in the form of soybeans, coffee, and sugarcane. As Brazil continues to expand its agricultural output to meet global demand, the demand for ammonium nitrate to optimize crop productivity is expected to increase. Henceforth, this causes a boost for the ammonium nitrate market in Latin America. Brazil alone accounts for considerable dominance in Latin American agriculture; the country thus acts as one of the predominant determinants toward shaping fertilizer demand dynamics in Latin America.

Middle East and Africa Ammonium Nitrate Market Analysis

A major growth catalyst for the ammonium nitrate market in the Middle East and Africa is the growing agricultural output of Morocco. The country is trying to fight hunger and poverty, according to the Food and Agriculture Organization, which claims that Morocco has succeeded in eradicating hunger through increased production in large-scale farms while helping small-scale farms through venture capital. This strategy has ensured that agriculture has grown continuously, especially with regards to cereals. FAOSTAT reports that cereal production in Morocco increased from 3.3 million metric tons in 2020 to over 3.5 million tons in 2023. This increase in agricultural production is directly related to the increased usage of fertilizers such as ammonium nitrate to optimize crop yields and ensure food security. Increased activity in agriculture is among the reasons the demand for ammonium nitrate is rising in the Middle East and Africa as most crops cultivated require enhanced applications of fertilizers. This is bound to push for higher use of ammonium nitrate fertilizers due to increased agriculture expansion.

Competitive Landscape:

The global ammonium nitrate market demonstrates intense competition because of increasing fertilizer and explosive requirements throughout agriculture and mining operations. Market domination by key players stems from their widespread distribution networks together with their superior production technologies. Furthermore, the rising number of competitors who produce ammonium nitrate locally and use cost-effective production methods successfully acquire substantial ammonium nitrate market share. Moreover, the market faces impacts from changing raw material costs, environmental restrictions, and geopolitical events. The competitive advantage of companies depends heavily on their investments into sustainable production approaches and novel product development methods. In addition to this, the market shows increasing trends toward strategic partnerships and mergers because entities use these tactics to attain more customers globally while increasing their profitability. For instance, in February 2024, Bharat Heavy Electricals Limited (BHEL) and Coal India Limited (CIL) formalized a partnership to establish a manufacturing plant for ammonium nitrate in Odisha, India. The plant will employ surface coal gasification technology and is expected to have an annual output capacity of 660,000 tons.

The report provides a comprehensive analysis of the competitive landscape in the ammonium nitrate market with detailed profiles of all major companies, including:

- Austin Powder Company

- CF Industries Holdings Inc.

- CSBP Limited (Wesfarmers Limited)

- Enaex SA (Sigdo Koppers SA)

- EuroChem Group AG

- Fertiberia S.A.

- MaxamCorp Holding S.L.

- Neochim PLC

- Orica Limited

- Sasol Limited

- Yara International ASA

Latest News and Developments:

- April 2024: Wesfarmers Chemicals, Energy and Fertilisers’ CSBP was awarded USD 32.9 million by the Federal Government to reduce greenhouse gas (GHG) emissions at its two Kwinana nitric acid ammonium nitrate (NAAN) plants. This funding will help install advanced catalysts to cut emissions by 64,000 tonnes annually and accelerate CSBP's decarbonisation efforts. The project supports Wesfarmers' goal of reducing nitrous oxide emissions by 98% by 2028 and cutting overall emissions by 30% by 2030.

- February 2024: Enaex S.A. and NYK Bulk & Projects Carriers Ltd. signed an MoU to explore supplying low-carbon ammonia for ammonia-fueled ships. NBP plans to build 10-15 ammonia-fueled bulkers for transporting copper from Chile to the Far East. The partnership will develop ammonia supply logistics from Enaex's terminal in Mejillones, Chile.

- January 2024: Incitec Pivot Limited's Dyno Nobel announced tactical cooperation with Saudi Chemical Company Limited (SCCL) for conducting a study associated to developing as well as operating a TAN production plant in Saudi Arabia. Project services, FEED stage services for the proposed 300,000 MTPA TAN plant will be covered through this alliance that is to be carried out in Ras Al-Khair, Saudi Arabia.

- January 2024: Ostchem Holding announced achieving a 20% increase in mineral fertilizer production in 2023, producing a total of 2.1 million tons. In addition, the company bolstered its ammonium nitrate output by 60%, reaching 835,900 tons during the same period.

- July 2023: Yara Clean Ammonia and Bunker Holding signed a MoU to endorse the utilization of ammonia as a fuel in the shipping sector. This agreement will aid the shift toward decarbonized maritime transportation by incentivizing ammonia use as a sustainable marine fuel.

Ammonium Nitrate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications | Fertilizers, Explosives, Others |

| End Users | Agriculture, Mining, Defense, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Austin Powder Company, CF Industries Holdings Inc., CSBP Limited (Wesfarmers Limited), Enaex SA (Sigdo Koppers SA), EuroChem Group AG, Fertiberia S.A., MaxamCorp Holding S.L., Neochim PLC, Orica Limited, Sasol Limited, Yara International ASA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the ammonium nitrate market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global ammonium nitrate market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the ammonium nitrate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ammonium nitrate market was valued at USD 17.7 Billion in 2024.

IMARC estimates the ammonium nitrate market to reach USD 24.52 Billion by 2033, exhibiting a CAGR of 3.70% during 2025-2033.

Key factors driving the market include the escalating need for fertilizers in agriculture, especially for high-yield crops, magnifying industrial applications in explosives and mining, and boosting global food production demands. In addition, government frameworks endorsing agricultural growth and infrastructure development play a critical role in market growth.

Asia Pacific currently dominates the ammonium nitrate market, accounting for a share exceeding 38.7%. This dominance is fueled by its magnified agricultural sector, elevated fertilizer requirement, and bolstering industrialization in nations like China and India.

Some of the major players in the ammonium nitrate market include Austin Powder Company, CF Industries Holdings Inc., CSBP Limited (Wesfarmers Limited), Enaex SA (Sigdo Koppers SA), EuroChem Group AG, Fertiberia S.A., MaxamCorp Holding S.L., Neochim PLC, Orica Limited, Sasol Limited, Yara International ASA, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)