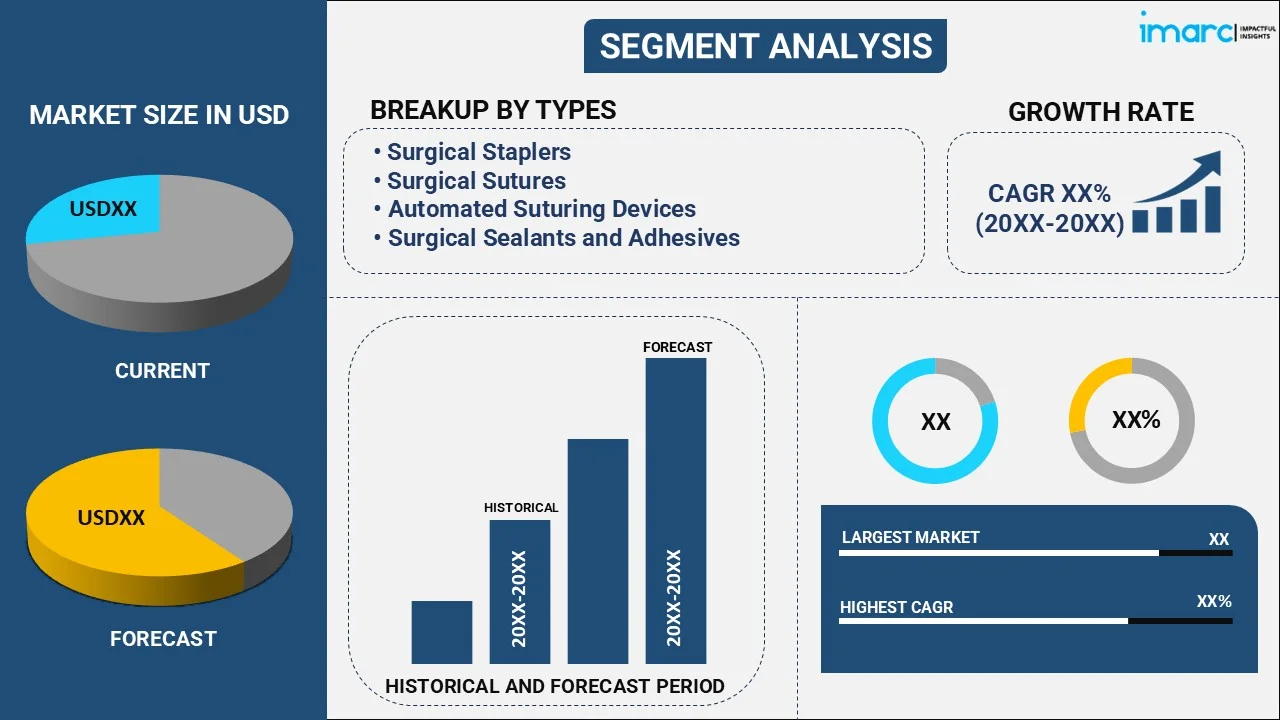

Anastomosis Devices Market Report by Type (Surgical Staplers, Surgical Sutures, Automated Suturing Devices, Surgical Sealants and Adhesives), Application (Gastrointestinal Surgeries, Cardiovascular and Thoracic Surgeries, and Others), End User (Hospitals, Ambulatory Surgical Centers and Clinics, and Others), and Region 2025-2033

Anastomosis Devices Market Size:

The global anastomosis devices market size reached USD 3.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.4 Billion by 2033, exhibiting a growth rate (CAGR) of 6% during 2025-2033. The market is primarily driven by rising incidences of cancer, the growing global geriatric population, rising prevalence of cardiovascular diseases, and the growing need for enhanced surgical outcomes and efficiency across the globe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.6 Billion |

| Market Forecast in 2033 | USD 6.4 Billion |

| Market Growth Rate (2025-2033) | 6% |

Anastomosis Devices Market Analysis:

- Major Market Drivers: The rising frequency of chronic illnesses necessitating surgical treatments, and developments in surgical methods and minimally invasive procedures, are driving anastomosis devices demand. Also, the growing global geriatric population are rising the need for surgical treatments such as anastomosis surgeries

- Key Market Trends: The emerging technical breakthroughs, such as the development of robotic-assisted anastomosis devices is improving accuracy while reducing surgery time. Besides, the increasing demand for bioabsorbable anastomosis devices lowers the risk of problems associated with permanent implants.

- Geographical Trends: North America dominates the anastomosis devices market growth due to the rising prevalence of chronic diseases and advanced healthcare infrastructure. Besides, the Asia-Pacific area has substantial development potential due to rising healthcare expenditures, improved healthcare infrastructure, and increased knowledge of innovative surgical techniques.

- Competitive Landscape: Some of the major players in the anastomosis devices industry include Artivion Inc., B. Braun Melsungen AG (B. Braun Holding GmbH & Co. KG), Becton, Dickinson and Company, Getinge AB, Intuitive Surgical Inc., Johnson & Johnson, Meril Life Sciences Pvt. Ltd., Peters Surgical, and Synovis Micro Companies Alliance Inc. (Baxter International Inc.) among many others.

- Challenges and Opportunities: Companies worldwide have to comply with regulatory limits for product clearance, especially for novel technologies, and limited reimbursement rules for anastomosis therapies. The anastomosis devices market overview implies that potential exists in untapped regions such as emerging economies, and the development of next-generation anastomosis devices with increased safety and effectiveness.

Anastomosis Devices Market Trends:

Rising Incidence of Cancer

The rising number of cancers is increasing the demand for surgeries involving anastomosis devices. The World Health Organization's (WHO) cancer agency, the International Agency for Research on Cancer (IARC), released a report on the most recent numbers on the worldwide cancer burden. According to IARC's 2022 estimates, which use the most trustworthy data sources from various nations, the rising number of cancers particularly affects underserved populations. For instance, in 2022, it is estimated that there were 20 million new cancer diagnoses and 9.7 million deaths due to cancer. It is estimated that 53.5 million people will survive up to 5 years after being diagnosed with cancer. According to statistics, one in every five individuals will get cancer at some time in their life, with one in every nine men and one in every twelve women dying of it. As a result, this increases the need for surgical treatments utilizing anastomosis devices throughout the globe.

Growing Geriatric Population

The growing global geriatric population is also influencing the anastomosis devices market value. According to the United Nations’ assessment, the global geriatric population is projected to expand from 761 million in 2021 to 1.6 billion by 2050. Also, in 2021, approximately 1 out of every 10 people globally was 65 years old or older which is projected to increase by 2050 as 1 out of every 6 individuals worldwide. This demographic change results in a larger frequency of age-related illnesses, necessitating more surgical operations including anastomosis devices. Additionally, elderly people frequently experience health problems such as gastrointestinal disorders or cardiovascular ailments, which may necessitate surgical intervention. As a result, the market for anastomosis devices is expected to grow in unison with the aging population, thus positively affecting anastomosis devices market revenue.

Increasing Prevalence of Cardiovascular Diseases

The rising prevalence of cardiovascular diseases (CVDs) is escalating the demand for anastomosis devices used in cardiovascular surgery. According to British Heart Foundation research published in January 2024, around 7.6 million individuals in the United Kingdom (UK) suffer from heart and circulatory diseases. Currently, the gender distribution is roughly equal, with around 4 million men and 3.6 million women affected. Heart and circulation illnesses are a major cause of death, accounting for around 27% of all fatalities in the United Kingdom. This equates to more than 170,000 fatalities every year, or around 480 each day, or one fatality every 3 minutes. As a result, there is a rising need to treat these problems, necessitating surgical procedures that raise the need for anastomosis devices during cardiovascular surgery to restore blood flow and enhance heart function. As the prevalence of CVDs rises owing to sedentary lifestyles and poor eating habits, so will be the need for anastomosis devices for surgeries.

Anastomosis Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, application, and end user.

Breakup by Type:

- Surgical Staplers

- Manual

- Powered

- Surgical Sutures

- Absorbable Sutures

- Synthetic Sutures

- Natural Sutures

- Non-absorbable Sutures

- Polypropylene

- Nylon

- Stainless Steel

- Others

- Absorbable Sutures

- Automated Suturing Devices

- Disposable

- Reusable

- Surgical Sealants and Adhesives

- Natural/Biological

- Fibrin-based

- Collagen-based

- Albumin-based

- Synthetic and Semisynthetic

- PEG Hydrogel-based

- Cyanoacrylate-based

- Others

- Natural/Biological

Surgical staplers account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes surgical staplers (manual and powered), surgical sutures [absorbable sutures (synthetic sutures and natural sutures) and non-absorbable sutures (polypropylene, nylon, stainless steel, and others)], automated suturing devices (disposable and reusable), and surgical sealants and adhesives [natural/biological (fibrin-based, collagen-based, and albumin-based) and synthetic and semisynthetic (peg hydrogel-based, cyanoacrylate-based, others)]. According to the report, surgical staplers represented the largest segment.

Surgical staplers influence the segment due to their broad use in numerous surgical procedures. Surgical staplers are popular because they are efficient, precise, and can minimize operational time and postoperative difficulties when compared to conventional sutures. These devices enable rapid and secure anastomosis, which is critical in procedures including gastrointestinal, cardiac, and thoracic surgery. For example, on 27 May 2024, Ethicon, a Johnson & Johnson MedTech firm, introduced the ECHELON LINEAR Cutter in the United States. This is the industry's first linear cutter to use two unique technologies, including 3D-Stapling Technology and Gripping Surface Technology (GST). These methods have been shown to improve the security of staple lines, potentially lowering surgical complications and enhancing patient outcomes. The device is scientifically supported and has been shown to reduce leaks at the staple line by 47%, decreasing surgical risks. Its novel design allows surgeons to lock or detach the device halves, enabling flexibility in device placement based on each patient's specific anatomical requirements. Furthermore, it is extremely useful in colorectal procedures that create an anastomosis, the connecting section of two portions of the colon after a piece has been removed owing to injury or illness. A weak or improper anastomosis can result in an anastomotic leak, which can lead to prolonged hospital stays, higher medical costs, and in severe cases death. According to research, the mortality rate from anastomotic leaks is between 10% and 15%, with the risk of death increasing three to eightfold in the presence of a leak.

Breakup by Application:

- Gastrointestinal Surgeries

- Cardiovascular and Thoracic Surgeries

- Others

Cardiovascular and thoracic surgeries hold the largest share of the industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes gastrointestinal surgeries, cardiovascular and thoracic surgeries, and others. According to the report, cardiovascular and thoracic surgeries accounted for the largest market share.

As per the anastomosis devices market outlook, cardiovascular and thoracic surgeries dominate the market growth due to the high prevalence of cardiovascular diseases, such as coronary artery disease and heart failure, which necessitate surgical interventions. Cardiovascular and thoracic surgeries often require precise reconnection of blood vessels or other tubular structures, making anastomosis devices critical for successful outcomes. Innovations in device technology, such as the development of automated and minimally invasive anastomosis devices, further drive the adoption of these procedures. Additionally, the increasing aging population, which is more susceptible to cardiovascular conditions, contributes to the growing demand for these devices in cardiovascular and thoracic surgeries. As per the study released by the National Library of Medicine in August 2023, Coronary Artery Bypass Grafting (CABG) is the most common surgical procedure with approximately 400,000 CABG surgeries conducted annually. Additionally, the increasing frequency of organ transplants is likely to drive the demand for anastomosis devices in the coming years. Moreover, as per the United Network for Organ Sharing (UNOS) data, there were about 42,887 organ transplants in the U.S. in 2022, reaching a 3.7% increase from 2021.

Breakup by End User:

- Hospitals

- Ambulatory Surgical Centers and Clinics

- Others

Hospitals represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, ambulatory surgical centers and clinics, and others. According to the report, hospitals represented the largest segment.

As per the anastomosis devices market forecast, hospitals represent the largest segment due to the high volume of surgical procedures performed in hospitals, including cardiovascular, gastrointestinal, and other critical surgeries where anastomosis devices are essential. For instance, as per the American Hospital Association 6, 120 hospitals are there in the United States. Moreover, hospitals are equipped with advanced surgical facilities and skilled healthcare professionals who frequently utilize numerous devices for creating surgical connections between tissues and organs. Furthermore, the infrastructure in hospitals supports the use of sophisticated devices, which facilitates the efficient and effective handling of complex surgical tasks. As a result, the demand for anastomosis devices within hospital settings continues to grow due to the increasing number of surgeries and the ongoing advancements in surgical techniques and device innovation.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest anastomosis devices market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for anastomosis devices.

As per the anastomosis devices market research report, the North American region represents the largest segment due to advanced healthcare infrastructure, a high volume of surgical procedures, and a robust presence of leading medical device manufacturers contribute significantly to the market dominance. Additionally, the increasing prevalence of chronic diseases that require surgical interventions, such as heart diseases and cancer, further stimulates the demand for anastomosis devices in this region. For instance, the National Center for Biotechnology Information (NCBI) reported that between 40 and 50 million surgical operations took place in the U.S. in 2020. Thus, this rise in surgical activity is anticipated to escalate the need for anastomosis devices, thereby driving growth across the region.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global anastomosis devices market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include:

- Artivion Inc.

- B. Braun Melsungen AG (B. Braun Holding GmbH & Co. KG)

- Becton, Dickinson and Company

- Getinge AB

- Intuitive Surgical Inc.

- Johnson & Johnson

- Meril Life Sciences Pvt. Ltd.

- Peters Surgical

- Synovis Micro Companies Alliance Inc. (Baxter International Inc.)

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Key players in the anastomosis devices market are focusing on technological advancements, product innovations, and strategic collaborations to strengthen market growth. Companies are developing devices with enhanced precision and flexibility, suitable for minimally invasive surgeries, which reduce recovery time and complications. Additionally, mergers and acquisitions allow companies to expand their product portfolios and geographical reach. Moreover, significant investments in research and development are driving the creation of bioabsorbable and robotic anastomosis devices, catering to the rising demand for sophisticated surgical outcomes in complex procedures such as cardiovascular and gastrointestinal surgeries.

Anastomosis Devices Market News:

- January 2023: Lydus Medical has received clearance from the U.S. Food and Drug Administration (FDA) under the 510(k) process for its Vesseal microvascular anastomosis suture deployment system, designed for uniform omni-vessel anastomoses. Anastomosis is a critical and complex procedure in microvascular surgery, essential for successful outcomes. It is necessary for various medical procedures, including breast reconstruction, head and neck reconstruction, surgical lymphedema treatment through Lymphatic Venous Anastomosis (LVA), and creating vascular access for hemodialysis.

Anastomosis Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Applications Covered | Gastrointestinal Surgeries, Cardiovascular and Thoracic Surgeries, Others |

| End Users Covered | Hospitals, Ambulatory Surgical Centers and Clinics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Artivion Inc., B. Braun Melsungen AG (B. Braun Holding GmbH & Co. KG), Becton, Dickinson and Company, Getinge AB, Intuitive Surgical Inc., Johnson & Johnson, Meril Life Sciences Pvt. Ltd., Peters Surgical, Synovis Micro Companies Alliance Inc. (Baxter International Inc.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global anastomosis devices market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global anastomosis devices market?

- What is the impact of each driver, restraint, and opportunity on the global anastomosis devices market?

- What are the key regional markets?

- Which countries represent the most attractive anastomosis devices market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the anastomosis devices market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the anastomosis devices market?

- What is the breakup of the market based on the end user?

- Which is the most attractive end user in the anastomosis devices market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global anastomosis devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the anastomosis devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global anastomosis devices market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the anastomosis devices industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)