Anti Drone Market Size, Share, Trends and Forecast by Mitigation Type, Defense Type, End Use, and Region, 2026-2034

Anti Drone Market Size and Share:

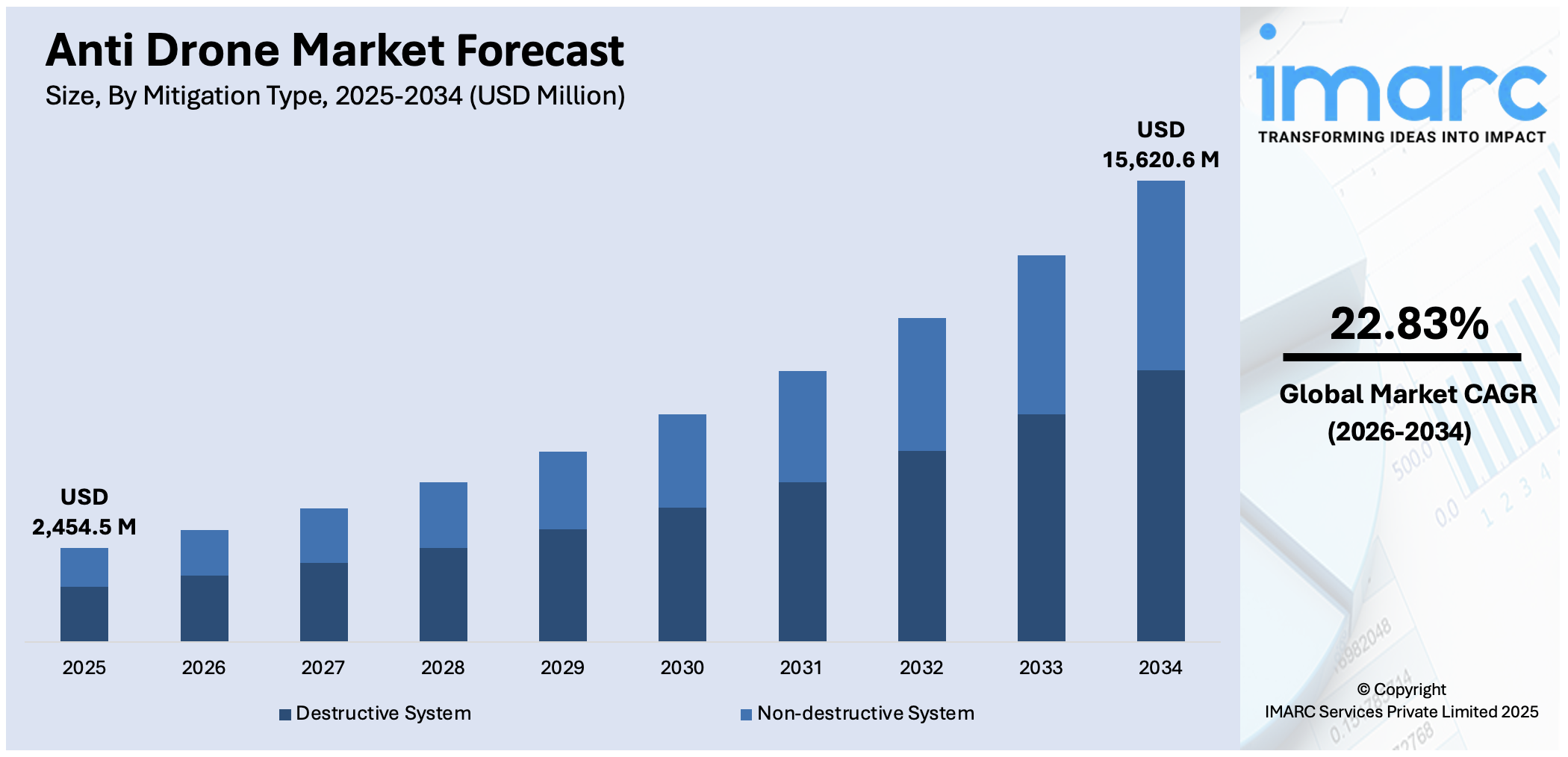

The global anti drone market size was valued at USD 2,454.5 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 15,620.6 Million by 2034, exhibiting a CAGR of 22.83% during 2026-2034. North America currently dominates the market, holding a significant market share of over 44.9% in 2025. The growing privacy concerns due to unauthorized drone surveillance, rising product demand to protect against the disruption of autonomous vehicles, and increasing application of drones in smuggling and contraband delivery are some of the factors propelling the market in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,454.5 Million |

| Market Forecast in 2034 | USD 15,620.6 Million |

| Market Growth Rate 2026-2034 | 22.83% |

The global anti drone market is primarily driven by the increasing use of drones for malicious activities such as terrorism, smuggling, and espionage. Governments and military organizations are increasingly investing in anti drone technologies to protect vital infrastructure, borders, and public spaces. In addition, the rise in the commercial use of drones for applications such as delivery services and surveillance has heightened concerns about safety and privacy, prompting demand for countermeasures. According to the IMARC Group, the global commercial drones market size reached USD 32.0 Billion in 2024 and is forecasted to reach USD 189.2 Billion by 2033, exhibiting a CAGR of 19.45% during 2025-2033. Besides this, technological advancements in radar systems, signal jamming, and laser weapons have further enhanced anti-drone capabilities, facilitating overall industry expansion.

To get more information on this market Request Sample

The United States has emerged as a key regional market for anti drones, driven by growing security concerns regarding the potential misuse of drones for criminal and terrorist activities. With increasing threats to vital infrastructure, military installations, and public events, the United States government and defense agencies are investing heavily in anti drone systems to ensure national security. Additionally, the rapid proliferation of commercial drones for surveillance and delivery purposes has raised privacy and safety concerns, further driving demand for counter-drone technologies. Besides this, stringent regulations and policies around drone usage are encouraging more comprehensive countermeasures across various sectors, creating a positive industry outlook overall.

Anti Drone Market Trends:

Increasing integration of artificial intelligence and machine learning

The increasing integration of artificial intelligence (AI) and machine learning (ML) in anti-drone systems is contributing substantially to anti drone market share. AI and ML algorithms have revolutionized drone detection by enhancing the accuracy and efficiency of threat identification. According to reports, the worldwide market for AI in drone technology, expected to hit USD 84 Billion by 2030 with a CAGR of 28. 5%, is revolutionizing sectors via sophisticated features such as real-time data analysis, image recognition, and autonomous decision-making, improving uses in agriculture, construction, and security. These technologies can analyze vast amounts of data from various sensors, such as radar and cameras, to distinguish between legitimate and unauthorized drone activity. AI-powered anti-drone systems also adapt and learn from patterns, making them adept at identifying new or evolving threats. Their ability to differentiate drones from birds, detect low-altitude flying drones, and predict drone behavior contributes to robust and effective countermeasures. As the arms race between drone technology and anti-drone solutions intensifies, the integration of AI and ML is enabling security professionals to stay ahead of potential threats. This advancement boosts the effectiveness of anti-drone measures and also underscores the role of cutting-edge technology in ensuring airspace security.

Rapid innovations in jamming and electronic warfare technologies

Rapid innovations in jamming and electronic warfare technologies are one of the significant anti drone market growth drivers. As drones become more versatile and accessible, the need for sophisticated countermeasures has intensified. Jamming systems disrupt drone communication by interfering with their control signals and GPS navigation, rendering them ineffective. Moreover, electronic warfare technologies utilize advanced signal intelligence to detect and track unauthorized drone activities. For instance, in 2024, the United States dedicated USD 5 Billion to electronic warfare, comprising 45% of worldwide expenditure. However, increasing investments from Russia, China, and India are poised to contest this supremacy in the upcoming years. The continuous development of more precise and targeted jamming techniques and adaptive electronic warfare strategies equips security personnel with tools to neutralize drone threats effectively. These innovations are instrumental in safeguarding vital infrastructure, public spaces, and events from potential drone disruptions. The evolution of jamming and electronic warfare technologies demonstrates the commitment of the industry to staying ahead of drone technology advancements, ensuring airspace security in an era of growing drone adoption.

Stringent regulations mandating drone countermeasure adoption

The implementation of stringent regulations mandating the adoption of drone countermeasures is creating a positive anti drone market outlook. As drone technology is adopted worldwide, regulatory bodies are recognizing the need to mitigate potential security risks posed by drones. These regulations compel industries to incorporate effective countermeasure solutions to protect sensitive areas, events, and vital infrastructure from unauthorized or malicious drone activities. Mandatory countermeasure adoption ensures a standardized approach to drone security, promoting airspace safety and public well-being. Compliance with these regulations prompts industries to invest in anti-drone systems, propelling the demand for advanced technologies that can effectively detect, track and neutralize drones. The role of regulatory requirements in shaping the anti-drone market underscores the collective effort to address emerging security challenges posed by drones, solidifying their presence as an essential tool in modern security strategies.

Anti Drone Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global anti drone market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on mitigation type, defense type, and end use.

Analysis by Mitigation Type:

- Destructive System

- Non-destructive System

Destructive system stands as the largest component in 2025, holding around 91.9% of the market. Destructive systems involve physically neutralizing drones by shooting them down or using nets, which is important for handling immediate threats. They offer a direct and reliable method for neutralizing hostile drones, ensuring immediate threat elimination. These systems, such as high-powered lasers, kinetic interceptors, and projectile-based solutions, are particularly effective in combat and high-risk environments where drones pose a serious security threat. Their ability to physically disable or destroy drones minimizes the risk of drone-based attacks, making them ideal for protecting military assets, vital infrastructure, and high-profile events. Additionally, destructive systems provide a higher level of certainty in neutralizing sophisticated drones that may bypass detection or disruption technologies.

Analysis by Defense Type:

- Drone Detection and Disruption Systems

- Drone Detection Systems

Drone detection and disruption systems lead the market with around 63.9% of market share in 2025. This is largely due to their ability to identify and mitigate threats without causing collateral damage. These systems, which include radar, radio frequency jammers, and GPS spoofing technologies, offer non-destructive solutions that are vital for protecting sensitive areas such as airports, government buildings, and large public events. Detection systems provide early warning, while disruption systems can neutralize drones by disabling their communication or navigation without physically damaging them. This makes them highly effective for non-lethal interventions, balancing security with minimal impact on the surrounding environment. As security concerns grow, these systems offer scalable, adaptable, and cost-effective solutions.

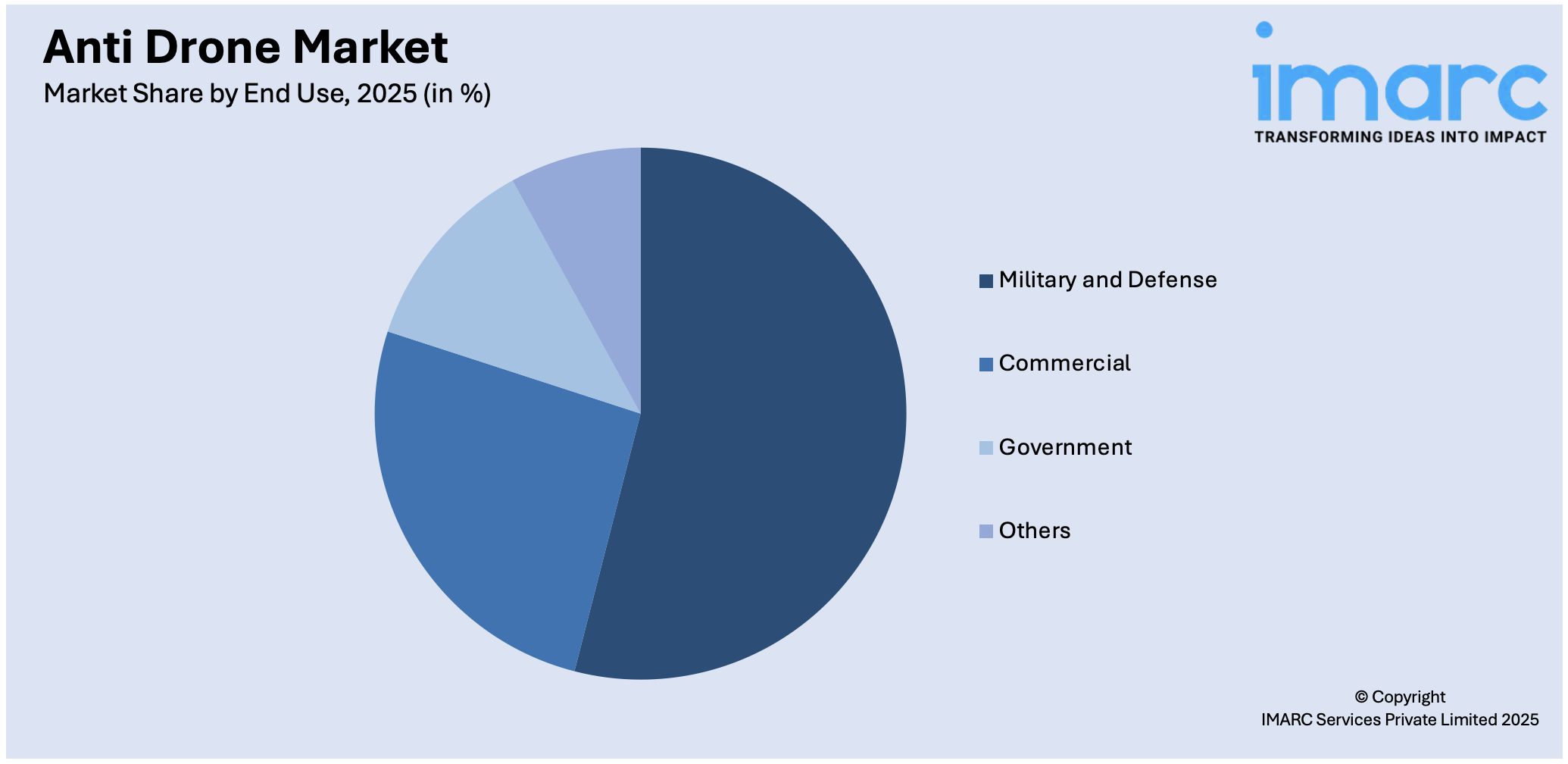

Analysis by End Use:

Access the comprehensive market breakdown Request Sample

- Military and Defense

- Commercial

- Government

- Others

Military and defense leads the market with around 53.4% of market share in 2025. The increasing utilization of drones in military operations for surveillance and potential threats has led to a corresponding need for robust anti-drone solutions. The military recognizes the importance of safeguarding its airspace against adversarial drones that could disrupt operations or compromise security. Anti-drone systems tailored for military applications encompass advanced detection and neutralization technologies, often integrating radar, electronic warfare, and interception methods. As drones become more sophisticated, the demand for equally advanced countermeasures within military contexts has risen. The emphasis of the military and defense sector on security and operational integrity is propelling market growth, prompting continuous innovation in anti-drone technologies that cater to the armed forces' specific challenges worldwide.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 44.9%. North America, characterized by its advanced technological landscape and diverse security concerns, is a significant adopter of anti-drone solutions, thus contributing significantly to the online trading platform market demand. The widespread use of drones for various purposes and the potential risks posed by unauthorized drone activities in this region have stimulated the demand for effective countermeasures. Stringent regulations, critical infrastructure protection, high-profile events, and military applications are driving the adoption of anti-drone technologies in North America. The region's proactive approach to security, combined with its investment in innovation, has resulted in developing and deploying cutting-edge anti-drone systems. The North American market's contribution to anti-drone technology advancements and its role in shaping global airspace security solutions position it as a pivotal driving force behind the anti drone market revenue.

Key Regional Takeaways:

United States Anti Drone Market Analysis

In 2024, the United States accounts for over 94.70% of the anti drone market in North America. Anti-drone systems in the United States greatly improve national security by reducing dangers from unauthorized or hostile drones. These systems safeguard critical infrastructure such as power plants, airports, and government buildings from possible surveillance or sabotage. According to reports by TSA, since 2021, over 2,000 drones were sighted near U.S. airports, including incidents at major airports nearly every day. Anti-drone technologies, employing detection systems such as radio frequencies and mitigation techniques such as jamming, offer essential protection against unauthorized drone activities and potential dangers. Furthermore, anti-drone technologies serve as an additional defense for large public gatherings and events, assuring safety from drone-related disturbances or attacks. In defense settings, these systems protect military installations, border regions, and sensitive locations from reconnaissance by adversarial forces. The versatility of anti-drone solutions, which range from radar and RF detection to neutralization methods such as jamming or laser-based interception, guarantees customized protection for various environments. In addition, the swift increase in drone activity and changing threats render anti-drone technology essential for law enforcement and homeland security. According to the anti drone industry insights, ongoing advancements in detection and interception techniques highlight the commitment of the United States to remaining proactive against emerging threats.

Asia Pacific Anti Drone Market Analysis

In the Asia-Pacific region, anti-drone systems provide essential answers for tackling the increasing issues created by drones in urban and industrial regions. Nations in this region, with developing smart cities and rising drone usage, are increasingly utilizing anti-drone technologies to protect privacy and avoid unauthorized surveillance. Coastal and maritime security, important for commerce and territorial integrity, also uses these systems to track unauthorized aerial incursions. Moreover, anti-drone solutions are also vital in securing densely populated areas, reducing threats to civilian safety. Additionally, the defense industries in this region employ these technologies to counteract potential espionage and assaults on critical installations. For instance, according to official data, more than 260 drones have been knocked off by India over its Pakistan border in 2024 as compared to about 110 in 2023. India is also expected to create a comprehensive anti-drone unit to secure its borders from unmanned aerial vehicles, which is expected to drive market growth in the region. Besides this, the innovative use of AI-driven detection and response systems is improving operational efficiency, guaranteeing accurate and rapid counter-drone actions. As drone usage expands for commercial and recreational reasons, anti-drone technologies are assisting governments in creating robust aerial governance frameworks to ensure public safety.

Europe Anti Drone Market Analysis

The rising worries about the misuse of drones in both public and private areas is driving the anti drone market in Europe. As drones are increasingly utilized for commercial, recreational, and surveillance purposes, the need for effective counter-drone strategies has heightened. Systems that counter drones safeguard cultural heritage locations, essential infrastructure, and urban settings from unauthorized or harmful drone actions. Moreover, airports throughout Europe, which depend heavily on secure airspace for their functions, utilize these systems to avert flight interruptions caused by drones. Anti-drone technology also aids border security efforts, assisting countries in monitoring and intercepting drones employed for smuggling or espionage. By utilizing cutting-edge detection technologies, including AI-driven surveillance and electromagnetic jamming, Europe guarantees a secure airspace while accommodating the increasing use of drones. For instance, in March 2024, recent developments in electromagnetic jamming, specifically GPS disruption, have increased amidst geopolitical tensions, affecting over 1,600 aircraft in Eastern Europe. The European emphasis on privacy and data protection complements the implementation of anti-drone initiatives, promoting a regulated and safe drone environment that caters to both civilian and governmental requirements.

Latin America Anti Drone Market Analysis

In Latin America, anti-drone systems offer essential assistance in combatting the unauthorized deployment of drones, particularly in regions prone to surveillance and smuggling. These technologies play a vital role in securing key transportation centres, such as airports and seaports, guaranteeing efficient operations by reducing drone-related threats. For instance, the dramatic increase in air travel, with Latin America and the Caribbean accommodating over 270 Million passengers each year and a 25% rise in cargo, highlights the necessity for strong airport infrastructure. This uptick boosts the demand for anti-drone systems to protect increasingly intricate and essential airport operations. Additionally, anti-drone solutions improve security for agricultural areas where drones could be utilized for unauthorized information gathering. As nations in Latin America aim to enhance public safety in urban and rural environments, anti-drone strategies are assisting in safeguarding citizens during significant events and political assemblies. These systems also tackle issues regarding border security, where drones are employed for illegal purposes. The versatility of anti-drone technology guarantees that governments can customize these solutions to address unique security concerns, aiding in the creation of a safer setting for both commercial and civilian endeavors.

Middle East and Africa Anti Drone Market Analysis

Anti-drone systems in the Middle East and Africa region offer essential protection against drone-related risks in regions of strategic geopolitical importance. These technologies are essential for defending vital oil and gas facilities, guaranteeing smooth operations and safety against possible aerial sabotage. Moreover, anti-drone initiatives improve urban safety by tackling the inappropriate use of drones for surveillance or disruption. For instance, according to the United Nations Development Programme (UNDP), swift urbanization, with urban populations in the Middle East anticipated to grow from 55. 8% in 2015 to 58% by 2030, increases the demand for urban security measures. This development highlights the rising importance of anti-drone technologies to protect densely populated regions from new aerial dangers. Moreover, in regions facing political unrest, these systems protect sensitive sites, such as government structures and military areas, from drone intrusions. Anti-drone technologies are also utilized to secure large cultural and religious gatherings, ensuring participant safety from aerial threats. By incorporating advanced detection and interception methods, these areas are implementing proactive approaches to counter the rising use of drones in illegal or disruptive activities, thereby enhancing overall regional security and stability.

Anti Drone Market Key Players:

Key players in the anti drone market are driving growth through continuous innovation, strategic partnerships, and expanding product offerings. Companies are developing advanced detection and disruption technologies, such as radar systems, jammers, and counter-drone drones, to provide effective, non-lethal solutions. They are also investing in research and development (R&D) to enhance system accuracy and efficiency, while integrating artificial intelligence (AI) and machine learning (ML) to improve threat identification and response times. Moreover, major defense contractors are collaborating with governments to deploy anti-drone systems in critical infrastructure and military operations. Additionally, public-private partnerships and increased government spending on security solutions are further propelling the adoption of anti drone technologies worldwide.

The report provides a comprehensive analysis of the competitive landscape in the anti drone market with detailed profiles of all major companies, including:

- Blighter Surveillance Systems Ltd

- Dedrone GmbH

- DeTect Inc.

- Drone Major Limited

- DroneShield Ltd

- Israel Aerospace Industries Ltd.

- Liteye Systems Inc.

- Lockheed Martin Corporation

- Saab AB

- SRC Inc.

- Thales Group

- Raytheon Technologies Corporation

Latest News and Developments:

- September 2024: Thales Group has launched its cutting-edge GM200 Multi-Mission radar family at the MSPO fair in Kielce. These radars are engineered for air surveillance and defense, detecting targets up to 250 km in range and 24 km in altitude. Designed for mobility, they cater to diverse military needs with high precision. The technology highlights Thales' focus on advanced air defense solutions.

- June 2024: Dedrone has introduced its mobile counter-drone solution, DedroneOnTheMove (DedroneOTM), tailored for military use. This innovation enables real-time detection and neutralization of unauthorized drones, enhancing security in dynamic environments. Its portability makes it ideal for on-demand operations in critical zones. The solution underscores Dedrone's commitment to combat drone threats effectively.

- May 2024: Droneshield released DroneSentry C2 Next-Gen v1.00, a command-and-control system for counter-drone operations. It centralizes monitoring and control, enabling efficient management of multiple sensors and defense mechanisms. The system safeguards key areas such as infrastructure, events, and military sites. This advancement strengthens Droneshield’s position in anti-drone technology.

Anti Drone Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mitigation Types Covered | Destructive System, Non-destructive System |

| Defense Types Covered | Drone Detection and Disruption Systems, Drone Detection Systems |

| End Uses Covered | Military and Defense, Commercial, Government, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Blighter Surveillance Systems Ltd, Dedrone GmbH, DeTect Inc., Drone Major Limited, DroneShield Ltd, Israel Aerospace Industries Ltd., Liteye Systems Inc., Lockheed Martin Corporation, Saab AB, SRC Inc., Thales Group, Raytheon Technologies Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the anti drone market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global anti drone market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the anti drone industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The anti drone market was valued at USD 2,454.5 Million in 2025.

The anti drone market is projected to exhibit a CAGR of 22.83% during 2026-2034, reaching a value of USD 15,620.6 Million by 2034.

The market is driven by the increasing security concerns and threats from drones, growing adoption of drones in commercial and military sectors, advancements in anti-drone technology, rising incidents of drone-based terrorism and smuggling, and government regulations and initiatives for drone control and airspace safety.

North America currently dominates the anti drone market, accounting for a share of 44.9% in 2025. The dominance is fueled by increasing drone-related threats, advanced defense technologies, and strong government investments in counter-drone systems.

Some of the major players in the anti drone market include Blighter Surveillance Systems Ltd, Dedrone GmbH, DeTect Inc., Drone Major Limited, DroneShield Ltd, Israel Aerospace Industries Ltd., Liteye Systems Inc., Lockheed Martin Corporation, Saab AB, SRC Inc., Thales Group, and Raytheon Technologies Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)