Antibody-Mediated Rejection Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035

Market Overview:

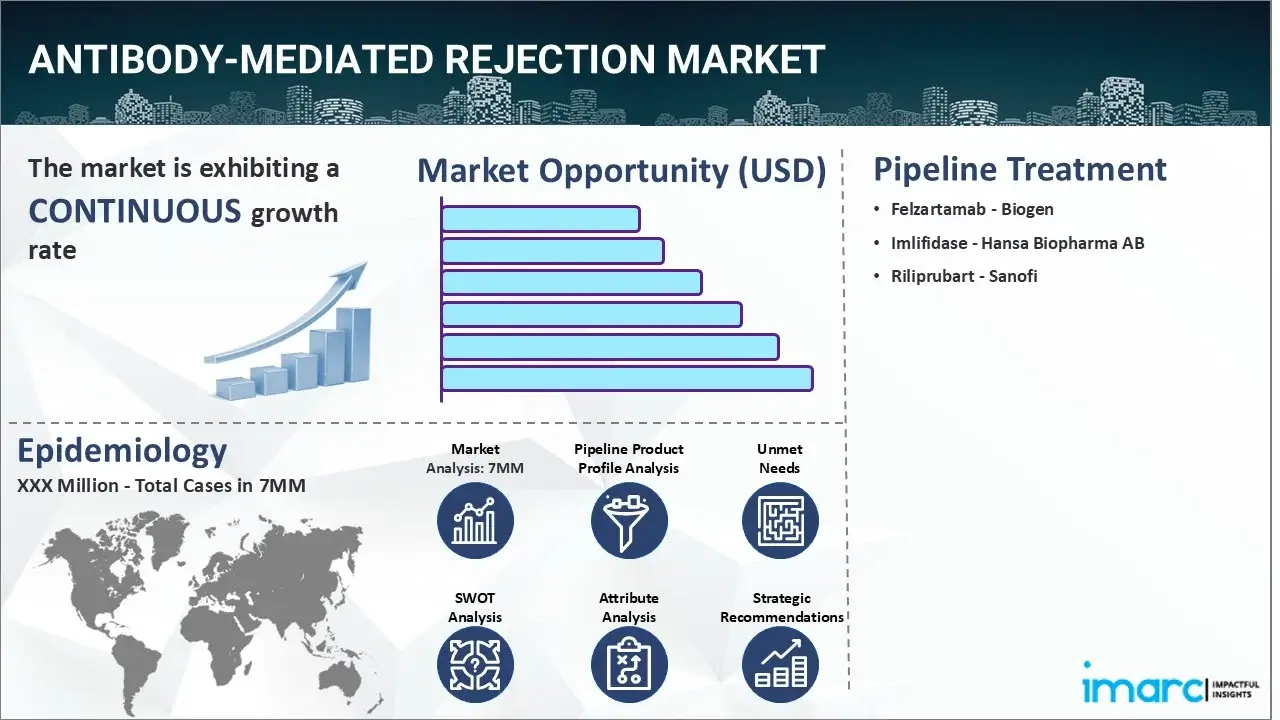

The antibody-mediated rejection market reached a value of USD 126.1 Million across the top 7 markets (US, EU4, UK, and Japan) in 2024. Looking forward, IMARC Group expects the top 7 major markets to reach USD 436.5 Million by 2035, exhibiting a growth rate (CAGR) of 11.92% during 2025-2035.

|

Report Attribute

|

Key Statistics

|

|---|---|

| Base Year |

2024

|

| Forecast Years | 2025-2035 |

| Historical Years |

2019-2024

|

|

Market Size in 2024

|

USD 126.1 Million |

|

Market Forecast in 2035

|

USD 436.5 Million |

|

Market Growth Rate (2025-2035)

|

11.92% |

The antibody-mediated rejection market has been comprehensively analyzed in IMARC's new report titled "Antibody-Mediated Rejection Market Size, Epidemiology, In-Market Drugs Sales, Pipeline Therapies, and Regional Outlook 2025-2035". Antibody-mediated rejection is a significant complication in organ transplantation, where the immune system of the recipient mounts an attack against the transplanted organ due to the presence of donor-specific antibodies. These antibodies recognize and target antigens on the donor organ's cells, leading to inflammation and damage. The symptoms of this ailment can vary depending on the affected organ, but common signs include fever, reduced organ function, and swelling or tenderness at the transplant site. In the case of kidney transplants, changes in urine output and elevated creatinine levels may also be observed. The diagnosis of this illness is usually based on the patient's clinical features and medical history. A healthcare provider will also conduct a biopsy of the transplanted organ to detect certain histological changes, serological testing to identify donor-specific antibodies and advanced imaging for cardiac transplants. Flow cytometry and various other molecular diagnostic methods are further utilized to confirm an early diagnosis.

To get more information on this market, Request Sample

The increasing incidences of solid organ transplants that can stimulate the graft's generation of antibodies specific for foreign antigens, particularly major histocompatibility antigens, are primarily driving the antibody-mediated rejection market. In addition to this, the escalating utilization of effective medications, including immunosuppressants like calcineurin inhibitors and corticosteroids, to manage the disease and prevent graft rejection in patients is also creating a positive outlook for the market. These therapeutic agents work by suppressing the immune response and mitigating the antibody-mediated damage to the transplanted organ. Moreover, the widespread adoption of innovative diagnostic tools and assays for early detection of the ailment, which enable timely identification of the rejection process as well as allow for prompt intervention, is further bolstering the market growth. Apart from this, the inflating application of plasmapheresis procedures on account of their numerous advantages, such as reducing inflammation, improving the function of the transplanted organ, enhancing the treatment outcomes for patients, etc., is acting as another significant growth-inducing factor. Additionally, the emerging popularity of intravenous immunoglobulin therapy, since it helps to remove harmful antibodies from the recipient's bloodstream and modulate the immune response, thereby increasing graft survival rates, is expected to drive the antibody-mediated rejection market during the forecast period.

IMARC Group's new report provides an exhaustive analysis of the antibody-mediated rejection market in the United States, EU4 (Germany, Spain, Italy, and France), United Kingdom, and Japan. This includes treatment practices, in-market, and pipeline drugs, share of individual therapies, market performance across the seven major markets, market performance of key companies and their drugs, etc. The report also provides the current and future patient pool across the seven major markets. According to the report, the United States has the largest patient pool for antibody-mediated rejection and also represents the largest market for its treatment. Furthermore, the current treatment practice/algorithm, market drivers, challenges, opportunities, reimbursement scenario, unmet medical needs, etc., have also been provided in the report. This report is a must-read for manufacturers, investors, business strategists, researchers, consultants, and all those who have any kind of stake or are planning to foray into the antibody-mediated rejection market in any manner.

Time Period of the Study

- Base Year: 2024

- Historical Period: 2019-2024

- Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the antibody-mediated rejection market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the antibody-mediated rejection market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report also provides a detailed analysis of the current antibody-mediated rejection marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

| Drugs | Company Name |

|---|---|

| Felzartamab | Biogen |

| Imlifidase | Hansa Biopharma AB |

| Riliprubart | Sanofi |

*Kindly note that the drugs in the above table only represent a partial list of marketed/pipeline drugs, and the complete list has been provided in the report.

Key Questions Answered in this Report:

Market Insights

- How has the antibody-mediated rejection market performed so far and how will it perform in the coming years?

- What are the markets shares of various therapeutic segments in 2024 and how are they expected to perform till 2035?

- What was the country-wise size of the antibody-mediated rejection across the seven major markets in 2024 and what will it look like in 2035?

- What is the growth rate of the antibody-mediated rejection across the seven major markets and what will be the expected growth over the next ten years?

- What are the key unmet needs in the market?

Epidemiology Insights

- What is the number of incident cases (2019-2035) of antibody-mediated rejection across the seven major markets?

- What is the number of incident cases (2019-2035) of antibody-mediated rejection by age across the seven major markets?

- What is the number of incident cases (2019-2035) of antibody-mediated rejection by gender across the seven major markets?

- How many patients are diagnosed (2019-2035) with antibody-mediated rejection across the seven major markets?

- What is the size of the antibody-mediated rejection patient pool (2019-2024) across the seven major markets?

- What would be the forecasted patient pool (2025-2035) across the seven major markets?

- What are the key factors driving the epidemiological trend antibody-mediated rejection of?

- What will be the growth rate of patients across the seven major markets?

Antibody-Mediated Rejection: Current Treatment Scenario, Marketed Drugs and Emerging Therapies

- What are the current marketed drugs and what are their market performance?

- What are the key pipeline drugs and how are they expected to perform in the coming years?

- How safe are the current marketed drugs and what are their efficacies?

- How safe are the late-stage pipeline drugs and what are their efficacies?

- What are the current treatment guidelines for antibody-mediated rejection drugs across the seven major markets?

- Who are the key companies in the market and what are their market shares?

- What are the key mergers and acquisitions, licensing activities, collaborations, etc. related to the antibody-mediated rejection market?

- What are the key regulatory events related to the antibody-mediated rejection market?

- What is the structure of clinical trial landscape by status related to the antibody-mediated rejection market?

- What is the structure of clinical trial landscape by phase related to the antibody-mediated rejection market?

- What is the structure of clinical trial landscape by route of administration related to the antibody-mediated rejection market?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)