Antihyperlipidemic Drugs Market Size, Share, Trends and Forecast by Drug Class, Route of Administration, Distribution Channel, and Region, 2026-2034

Antihyperlipidemic Drugs Market Size and Share:

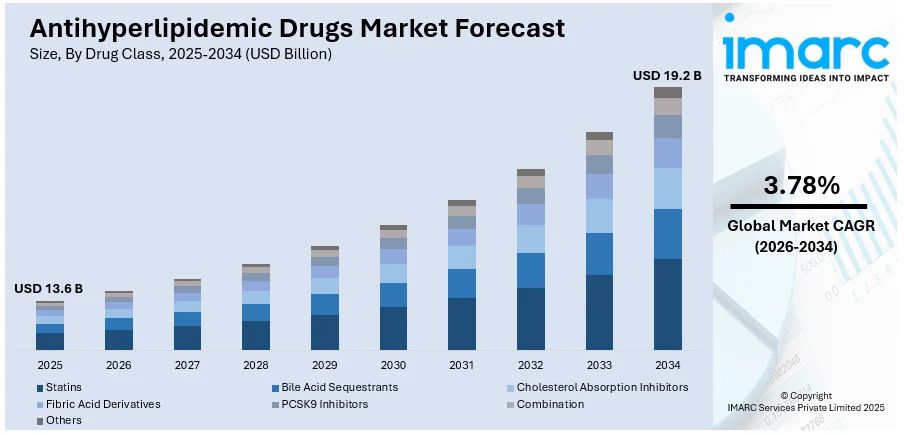

The global antihyperlipidemic drugs market size was valued at USD 13.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 19.2 Billion by 2034, exhibiting a CAGR of 3.78% during 2026-2034. North America currently dominates the market, holding a significant market share of over 32.7% in 2025. The market in North America is fueled by the high prevalence of hyperlipidemia and cardiovascular diseases, aging populations, obesity, sedentary lifestyles, and unhealthy diets. Strong R&D investments, advanced healthcare infrastructure, government initiatives, rising adoption of statins, PCSK9 inhibitors, and novel lipid-lowering drugs, along with insurance coverage, further fuel antihyperlipidemic drugs market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 13.6 Billion |

|

Market Forecast in 2034

|

USD 19.2 Billion |

| Market Growth Rate (2026-2034) | 3.78% |

The market is driven by the rising prevalence of hyperlipidemia and cardiovascular diseases, which remain the leading causes of mortality globally. Aging populations, obesity, and sedentary lifestyles contribute to increased cholesterol levels, fueling demand for lipid-lowering medications. The widespread use of statins, fibrates, bile acid sequestrants, and PCSK9 inhibitors, along with emerging therapies like bempedoic acid, is expanding treatment options. Government initiatives promoting cholesterol management, preventive healthcare, and reimbursement policies further support market growth. New approaches in drug delivery combine treatments and individual medical strategies to improve the results of treatments. Advanced healthcare awareness coupled with expanded insurance coverage and sustained research and development investments by pharmaceutical organizations promotes innovative solutions that drive the expansion of both developed and emerging economies markets.

To get more information on this market Request Sample

The market for antihyperlipidemic drugs in the United States is driven by the high prevalence of hyperlipidemia, obesity, and cardiovascular diseases, which remain the leading causes of morbidity and mortality. According to the American Journal of Preventive Medicine (AJPM), hyperlipidemia is frequent among the American population. In the United States, approximately 32.8% of adult men and 36.2% of adult females had total cholesterol levels of ≥200 mg/dL and low-density lipoprotein cholesterol levels of ≥130 mg/dL. Aging populations, sedentary lifestyles, and poor dietary habits contribute to rising cholesterol levels, increasing the demand for lipid-lowering medications. The widespread adoption of statins, PCSK9 inhibitors, and novel lipid-lowering therapies is supported by strong healthcare infrastructure, insurance coverage, and government initiatives promoting cardiovascular health. The FDA’s approval of new lipid-lowering drugs, continuous pharmaceutical R&D investments, and the expansion of personalized medicine and biologic therapies further accelerate market growth in the country.

Antihyperlipidemic Drugs Market Trends:

Rising Prevalence of Hyperlipidemia and Cardiovascular Diseases

The growing incidence of hyperlipidemia, obesity, and cardiovascular diseases (CVDs) is a primary driver of the antihyperlipidemic drugs market. For instance, in 2024, more than one billion people worldwide are estimated to be obese, including around 880 million adults and 159 million children and adolescents between the ages of 5 and 19, according to data released by the NCD Risk Factor Collaboration (NCD-RisC). According to data analyzed by the World Obesity Federation, around 3 billion people are overweight or obese and the majority of people on the planet reside in countries where being overweight or obese poses a greater health risk than being underweight. Unhealthy dietary habits, sedentary lifestyles, and genetic predisposition contribute to high cholesterol levels, increasing the demand for lipid-lowering drugs. Heart attacks, strokes, and atherosclerosis are leading causes of mortality worldwide, pushing healthcare providers to prescribe statins, PCSK9 inhibitors, and other lipid-lowering therapies. Governments and healthcare organizations are promoting cholesterol management programs, further fueling market growth. As CVDs remain a major public health concern, the demand for effective long-term cholesterol control solutions continues to rise.

Advancements in Lipid-Lowering Therapies and Drug Innovations

Continuous research and development (R&D) in antihyperlipidemic drugs has led to the development of novel drug classes such as PCSK9 inhibitors (evolocumab, alirocumab), bempedoic acid, and combination therapies. While statins dominate the market, newer therapies offer alternative treatment options for patients with statin intolerance or high-risk lipid profiles. Gene-based treatments and biologics are gaining traction, improving efficacy and patient compliance. FDA approvals for novel drugs and clinical trials exploring next-generation lipid-lowering agents are further driving competition. Pharmaceutical companies are investing in precision medicine, AI-driven drug discovery, and combination drug formulations to enhance cholesterol management solutions. For instance, in February 2025, the FDA authorized Ctexli (chenodiol) for the treatment of cerebrotendinous xanthomatosis (CTX) in adults. Ctexli is the first FDA-approved medication for CTX, a rare lipid storage syndrome.

Government Initiatives and Expanding Healthcare Coverage

Government-led preventive healthcare programs and awareness campaigns are driving demand for lipid-lowering medications. Many countries have established cholesterol screening guidelines, reimbursement policies, and public health initiatives to reduce the burden of CVDs. In regions like North America and Europe, strong insurance coverage and prescription drug plans ensure patient access to statins and advanced lipid-lowering therapies. Governments and regulatory bodies such as the FDA and EMA continue to approve cost-effective generics and encourage research in cardiovascular disease prevention, further creating a positive antihyperlipidemic drugs market outlook. For instance, in November 2024, Esperion stated that Otsuka Pharmaceutical Co., Ltd. (Otsuka) has filed a New Drug Application (NDA) with the Japanese Ministry of Health, Labour, and Welfare to manufacture and sell bempedoic acid in Japan for the treatment of hypercholesterolemia and familial hypercholesterolemia.

Antihyperlipidemic Drugs Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global antihyperlipidemic drugs market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on drug class, route of administration, and distribution channel.

Analysis by Drug Class:

- Statins

- Bile Acid Sequestrants

- Cholesterol Absorption Inhibitors

- Fibric Acid Derivatives

- PCSK9 Inhibitors

- Combination

- Others

Statins stand as the largest drug class in 2025, holding around 38.7% of the market due to their proven efficacy in lowering LDL cholesterol, reducing cardiovascular risks, and preventing heart attacks and strokes. They are the first-line therapy for hyperlipidemia and widely prescribed due to their cost-effectiveness, availability, and strong clinical backing. Statins like atorvastatin, rosuvastatin, and simvastatin dominate the market due to their long-term safety profile, widespread adoption, and inclusion in treatment guidelines. Additionally, expanding insurance coverage, generic drug availability, and increasing awareness of cholesterol management contribute to their dominance. Their role in primary and secondary prevention of cardiovascular diseases further solidifies their market leadership.

Analysis by Route of Administration:

- Oral

- Intravenous

Oral formulations hold a major share in the market due to their ease of administration, high patient compliance, and widespread availability. Statins, the most prescribed lipid-lowering drugs, are mostly taken orally, making them the dominant treatment option. Other oral drugs like ezetimibe, fibrates, and bile acid sequestrants further contribute to market share. The affordability of oral medications, combined with long-term cholesterol management needs and generic drug availability, strengthens their market presence in both developed and emerging economies.

Intravenous (IV) formulations are expected to hold a significant share due to the rising demand for PCSK9 inhibitors and advanced lipid-lowering therapies. Patients with severe hypercholesterolemia or statin intolerance often receive IV-administered monoclonal antibodies like evolocumab and alirocumab, which offer rapid and effective cholesterol reduction. Hospitals and specialty clinics prefer IV therapies for high-risk patients requiring immediate lipid control. Increased adoption of targeted biologics, ongoing clinical trials, and physician preference for hospital-administered treatments further drive the IV segment’s market growth.

Analysis by Distribution Channel:

- Hospital Pharmacies

- Retail Stores

- Online Retailers

Hospital pharmacies hold the major share in the antihyperlipidemic drugs market due to the high volume of prescriptions for cardiovascular disease management in hospitals. Patients with acute coronary syndromes, strokes, and other cardiovascular conditions often receive statins and other lipid-lowering therapies as part of hospital treatment and post-discharge care. Hospitals ensure consistent drug availability, immediate access to critical medications, and adherence to treatment protocols. Additionally, physician-directed prescriptions, better patient monitoring, and integration with insurance and reimbursement systems make hospital pharmacies a preferred distribution channel. The increasing number of cardiovascular procedures, routine lipid screenings, and inpatient care facilities further drive their dominance.

Regional Analysis:

.jpeg)

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 32.7%. The market in North America is driven by the high prevalence of hyperlipidemia, obesity, and cardiovascular diseases, which are leading causes of mortality. The region has a well-established healthcare infrastructure, advanced lipid-lowering therapies, and strong R&D investments in drug development. Widespread adoption of statins, PCSK9 inhibitors, and novel therapies is supported by government initiatives, insurance coverage, and preventive healthcare programs. The aging population, sedentary lifestyles, and unhealthy dietary habits further fuel demand. Additionally, clinical advancements, FDA approvals for new lipid-lowering drugs, and strategic collaborations between pharmaceutical companies contribute to market expansion in the United States and Canada.

Key Regional Takeaways:

United States Antihyperlipidemic Drugs Market Analysis

In 2025, the United States accounted for over 90.00% of the antihyperlipidemic drugs market in North America. The United States is witnessing a growing antihyperlipidemic drugs adoption due to growing investment in pharmaceutical sectors, driving the expansion of drug manufacturing and research. According to reports, in the US pharmaceutical industry, there were 25 private equity deals announced in Q3 2024, worth a total value of USD 2.3 Billion. With pharmaceutical sectors focusing on innovation, the demand for advanced antihyperlipidemic drugs continues to rise. Increasing financial support for pharmaceutical sectors enhances the development of novel therapies, facilitating wider accessibility and improved treatment options. The commitment of pharmaceutical sectors to technological advancements contributes to the efficiency of antihyperlipidemic drugs, ensuring better patient adherence. Expanding pharmaceutical sectors encourage collaborations and clinical trials, further strengthening the market. The focus on research in pharmaceutical sectors leads to the introduction of enhanced formulations, catering to the rising demand. Investments in pharmaceutical sectors support the establishment of specialized healthcare units, ensuring effective drug distribution. The rising competition within pharmaceutical sectors results in cost-effective solutions, increasing affordability. Pharmaceutical sectors' efforts to develop targeted therapies enhance the effectiveness of antihyperlipidemic drugs, promoting their adoption. As pharmaceutical sectors integrate digital tools, accessibility and distribution channels improve, ensuring a wider reach.

Asia Pacific Antihyperlipidemic Drugs Market Analysis

Asia-Pacific is experiencing a growing antihyperlipidemic drugs adoption due to growing cholesterol related disease, increasing the demand for effective lipid-lowering treatments. According to survey, 31% of Indians struggle with high cholesterol, with Kerala topping the list with an alarming 63% prevalence. Rising cholesterol related disease prevalence has intensified the focus on preventive healthcare, driving antihyperlipidemic drugs demand. Increased awareness of cholesterol related disease encourages early diagnosis, leading to higher prescription rates. Growing dietary and lifestyle changes contribute to cholesterol related disease, necessitating medical intervention. Healthcare initiatives addressing cholesterol related disease emphasize the need for long-term antihyperlipidemic drugs therapy. The healthcare sector is integrating screening programs to detect cholesterol related disease early, facilitating wider drug adoption. With urbanization influencing dietary habits, cholesterol related disease cases continue to surge, strengthening market growth. The expansion of healthcare networks supports the accessibility of antihyperlipidemic drugs, mitigating cholesterol related disease risks. Medical advancements in cholesterol related disease management improve treatment efficacy, reinforcing antihyperlipidemic drugs' role. As cholesterol related disease becomes a significant concern, governments and private institutions invest in research, fostering pharmaceutical innovation.

Europe Antihyperlipidemic Drugs Market Analysis

Europe is experiencing a growing antihyperlipidemic drugs adoption due to growing coronary artery disease (CAD) cases, necessitating effective treatment options. According to reports, in 2021 there were 1.71 Million deaths in the EU resulting from diseases of the circulatory system, which was equivalent to 32.4% of all deaths. The increasing burden of coronary artery disease drives demand for long-term lipid management solutions, boosting antihyperlipidemic drugs usage. Healthcare policies addressing coronary artery disease prioritize early intervention, expanding prescription rates. The growing aging population is more susceptible to coronary artery disease, elevating antihyperlipidemic drugs demand. With healthcare systems implementing preventive measures for coronary artery disease, regular cholesterol monitoring is increasing. Research and development targeting coronary artery disease enhance antihyperlipidemic drugs' effectiveness, strengthening market growth. The rise in sedentary lifestyles and dietary habits contributes to coronary artery disease, emphasizing pharmaceutical intervention. Pharmaceutical advancements in coronary artery disease management introduce improved formulations, ensuring better patient adherence. Healthcare institutions are expanding coronary artery disease awareness programs, promoting antihyperlipidemic drugs usage. Government initiatives tackling coronary artery disease support antihyperlipidemic drugs accessibility, ensuring widespread adoption.

Latin America Antihyperlipidemic Drugs Market Analysis

Latin America is witnessing growing antihyperlipidemic drugs adoption due to growing online retailers. According to reports, the Latin America market currently boasts over 300 Million digital buyers. Expanding digital healthcare platforms are improving patient access to lipid-lowering medications, driving market penetration. The increasing convenience of online pharmacies is simplifying prescription fulfilment, encouraging higher adoption rates. Competitive pricing and discount offer on digital platforms are enhancing affordability, promoting sustained drug consumption. The rising presence of e-commerce in pharmaceutical distribution is streamlining product availability, ensuring widespread reach. The growing preference for digital healthcare solutions is strengthening consumer reliance on online pharmaceutical services, reinforcing antihyperlipidemic drug sales. Strengthening logistics networks are further improving drug delivery efficiency, boosting accessibility.

Middle East and Africa Antihyperlipidemic Drugs Market Analysis

Middle East and Africa are experiencing growing antihyperlipidemic drugs adoption due to growing healthcare facilities. According to Dubai Healthcare City Authority report, Dubai's healthcare sector saw rapid growth, with 4,482 private medical facilities and 55,208 licensed professionals by 2022, projected to expand further by 3-6% in facilities and 10-15% in professionals in 2023. Expanding hospital networks and specialty clinics are improving patient access to lipid-lowering treatments, fuelling market growth. Increasing government investment in healthcare infrastructure is strengthening antihyperlipidemic drug availability, ensuring widespread distribution. The rising number of cardiology centers is driving greater prescription rates, bolstering demand. Growing medical advancements are facilitating early diagnosis and cholesterol management, encouraging sustained drug utilization. Expanding pharmaceutical supply chains are enhancing distribution efficiency, ensuring consistent access to antihyperlipidemic medications.

Competitive Landscape:

The market is highly competitive, with key players focusing on drug innovation, strategic partnerships, and regulatory approvals. Leading pharmaceutical companies such as Pfizer, Merck & Co., AstraZeneca, Novartis, Amgen, and Sanofi dominate the market through extensive R&D and strong global distribution networks. Statins remain the largest drug class, with atorvastatin and rosuvastatin widely prescribed. The emergence of PCSK9 inhibitors like evolocumab (Repatha) and alirocumab (Praluent) has intensified competition, offering alternatives for statin-intolerant patients. Patent expirations of branded statins have led to an influx of generic competition, lowering costs. Companies are also investing in novel lipid-lowering drugs, combination therapies, and biologics to maintain market leadership amid evolving healthcare regulations and reimbursement policies.

The report provides a comprehensive analysis of the competitive landscape in the antihyperlipidemic drugs market with detailed profiles of all major companies, including:

- Amgen Inc.

- AstraZeneca plc

- Daiichi Sankyo Company Limited

- Merck & Co. Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi S.A.

Latest News and Developments:

- February 2025: Hansoh Pharmaceutical and Shanghai Hansoh Biomedical have unveiled new PCSK9 inhibitors for lowering LDL cholesterol. These inhibitors target conditions like stroke, dyslipidemia, and coronary artery disease. The patent highlights their potential in metabolic syndrome and atherosclerosis treatment. PCSK9 inhibition remains a key approach in cardiovascular disease management.

- January 2025: Alirocumab and evolocumab are injectable medications that lower cholesterol by inhibiting PCSK9, increasing LDL receptors to clear cholesterol from the blood. These FDA-approved monoclonal antibodies have shown safety and cardiovascular benefits in clinical trials. Research on genetic mutations led to their development as effective cholesterol-lowering treatments. A third FDA-approved agent is under evaluation for its impact on clinical outcomes.

- November 2024: Innovent Biologics announced the inclusion of SINTBILO® (tafolecimab injection, an anti-PCSK9 monoclonal antibody) in China’s 2024 National Reimbursement Drug List for the first time. Additionally, a new indication for olverembatinib, a BCR-ABL inhibitor, has been added. The updated NRDL will take effect on January 1, 2025. This expansion enhances access to innovative treatments for cardiovascular and oncology patients.

- May 2024: NEXLETOL® (bempedoic acid) is an oral non-statin drug developed by Esperion Therapeutics to lower LDL-C in adults with heterozygous familial hypercholesterolemia (HeFH) or atherosclerotic cardiovascular disease (ASCVD). It is used alongside diet and maximally tolerated statin therapy for additional cholesterol reduction. Esperion also markets NEXLIZET®, a combination of bempedoic acid and ezetimibe, offering a complementary cholesterol-lowering mechanism.

- January 2024: A new cholesterol-lowering drug, Inclisiran, has been launched in India, requiring just two doses annually. Approved by the Drug Controller General of India, it reduces LDL-C by 50-60% and costs ₹1.2 lakh per dose. Already available in the US, UK, and Europe as Leqvio, it offers an alternative to statins. Experts hail it as a futuristic gene-silencing drug that also boosts good cholesterol (HDL).

Antihyperlipidemic Drugs Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Classes Covered | Statins, Bile Acid Sequestrants, Cholesterol Absorption Inhibitors, Fibric Acid Derivatives, PCSK9 Inhibitors, Combination, Others |

| Route of Administrations Covered | Oral, Intravenous |

| Distribution Channels Covered | Hospital Pharmacies, Retail Stores, Online Retailers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amgen Inc., AstraZeneca plc, Daiichi Sankyo Company Limited, Merck & Co. Inc., Novartis AG, Pfizer Inc., Sanofi S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the antihyperlipidemic drugs market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global antihyperlipidemic drugs market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the antihyperlipidemic drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The antihyperlipidemic drugs market was valued at USD 13.6 Billion in 2025.

The antihyperlipidemic drugs market is projected to exhibit a CAGR of 32.7% during 2026-2034, reaching a value of USD 19.2 Billion by 2034.

The antihyperlipidemic drugs market is driven by rising hyperlipidemia cases, increasing cardiovascular disease prevalence, aging populations, sedentary lifestyles, obesity, growing statin demand, advancements in lipid-lowering therapies, government healthcare initiatives, expanding insurance coverage, and increasing awareness of cholesterol management.

North America currently dominates the antihyperlipidemic drugs market, accounting for a share of 32.7%. The market in North America is driven by the high prevalence of cardiovascular diseases, obesity, aging populations, advanced healthcare infrastructure, strong R&D investments, and widespread adoption of statins and novel lipid-lowering therapies.

Some of the major players in the antihyperlipidemic drugs market include Amgen Inc., AstraZeneca plc, Daiichi Sankyo Company Limited, Merck & Co. Inc., Novartis AG, Pfizer Inc., and Sanofi S.A.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)