Antimicrobial Textiles Market Size, Share, Trends and Forecast by Fabric, Active Agents, Application and Region, 2025-2033

Antimicrobial Textiles Market Size and Share:

The global antimicrobial textiles market size was valued at USD 11.76 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 19.18 Billion by 2033, exhibiting a CAGR of 5.31% from 2025-2033. North America currently dominates the market, holding a market share of 32.5% in 2024. At present, healthcare institutions are wagering on antimicrobial fabrics for uniforms, bed linens, surgical gowns, and drapes to reduce infection risks and uphold hygiene. In addition, increasing demand for athletic apparel is fueling the expansion of the antimicrobial textiles market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.76 Billion |

|

Market Forecast in 2033

|

USD 19.18 Billion |

| Market Growth Rate 2025-2033 | 5.31% |

At present, the market is expanding, as individuals are gaining greater awareness about health and hygiene. Individuals seek materials that inhibit bacteria, eliminate odors, and manage moisture, particularly in activewear and daily apparel. In addition to this, hospitals and healthcare facilities are employing antimicrobial fabrics for uniforms, bedding, and curtains to lower the risk of infections. The thriving sports and fitness sector is further creating the need for such fabrics to maintain freshness and cleanliness in clothing. Hotels and transportation services are utilizing antimicrobial materials to uphold elevated cleanliness standards. Additionally, improvements in textile technology are enabling the incorporation of antimicrobial properties without affecting comfort and durability.

The United States has emerged as a major region in the antimicrobial textiles market owing to many factors. The increasing focus on hygiene and rising health awareness are fueling the antimicrobial textiles market growth. Hospitals, clinics, and nursing facilities are using antimicrobial textiles in uniforms, bed linens, and curtains to minimize the transmission of infections. Rising demand for athleisure is strengthening the market, as individuals seek comfortable and fashionable apparel appropriate for both fitness activities and everyday utilization. According to the IMARC Group, the size of the athleisure market hit USD 95.2 Billion in 2024. Home textiles, such as towels, pillowcases, and upholstery featuring antimicrobial properties, are becoming popular due to their enhanced hygiene advantages. Technological innovations enable the seamless incorporation of antimicrobial substances into textiles without compromising comfort.

Antimicrobial Textiles Market Trends:

Rising investments in healthcare sector

Increasing expenditure on the healthcare sector is positively influencing the market. According to the World Economic Forum (WEF), worldwide spending on healthcare reached a record USD 9.8 Trillion in 2021, making up 10.3% of the total GDP. Healthcare facilities are investing in antimicrobial textiles for uniforms, bed linens, surgical gowns, and curtains to reduce the risk of infections and maintain cleanliness. Governments and private sectors are allocating funds to improve healthcare infrastructure, leading to higher adoption of advanced textile technologies. This investment is supporting research and development (R&D) activities related to the development of better antimicrobial fabrics that offer long-lasting protection and comfort. As healthcare awareness is growing, institutions are prioritizing infection control measures, creating the need for effective antimicrobial textiles. The expansion of hospitals and nursing homes is driving the demand for these specialized fabrics.

Growing demand for sportswear

Rising demand for sportswear is offering a favorable antimicrobial textiles market outlook. Antimicrobial textiles help prevent the growth of bacteria and fungi that cause unpleasant smells and skin infections. Sportswear brands are using these fabrics to offer better comfort, hygiene, and performance. The moisture-wicking and quick-drying properties of antimicrobial textiles also improve wearability during workouts. As more people are adopting active lifestyles, the need for durable and functional sports clothing is growing. Manufacturers focus on creating antimicrobial sportswear that maintains its protective qualities even after repeated washing. The rising preferences for hygienic and comfortable activewear are supporting the market expansion. Additionally, awareness about skin health and body odor is encouraging the utilization of antimicrobial fabrics in sportswear, bolstering the overall growth of the market. As per a report by the IMARC Group, the global sportswear market is set to reach USD 277 Billion by 2033, expanding at a CAGR of 3.8% during 2025-2033.

Increasing utilization of nanotechnology

Rising use of nanotechnology is propelling the market growth. Nanoparticles like silver, copper, and zinc oxide have strong antimicrobial properties and can be easily applied to fabrics at a very small scale. These nanoparticles create a protective layer that kills or inhibits the growth of bacteria, fungi, and viruses on textile surfaces. Nanotechnology allows better adhesion of antimicrobial agents to fibers, making the treatment last longer even after many washes. This technology also helps maintain fabric softness and breathability while adding antimicrobial protection. As individuals and industries are demanding higher-performance and safer textiles, manufacturers are adopting nanotechnology to meet these needs. Nanotechnology also supports eco-friendly and low-chemical solutions, which attract environmentally conscious buyers. Overall, the rising employment of nanotechnology is strengthening the market by enhancing product quality and expanding applications. According to the IMARC Group, the global nanotechnology market is set to reach USD 102.8 Billion by 2033, growing at a CAGR of 27.68% during 2025-2033.

Antimicrobial Textiles Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global antimicrobial textiles market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on fabric, active agents, and application.

Analysis by Fabric:

- Polyester

- Polyamide

- Cotton

- Others

Cotton held 46.4% of the market share in 2024. It is widely available, breathable, and comfortable for everyday use. People prefer cotton for clothing, bedding, and home textiles due to its soft texture and skin-friendly nature. When treated with antimicrobial agents, cotton effectively resists bacteria, odors, and moisture, making it suitable for hygiene-focused applications. Healthcare institutions are employing antimicrobial cotton in uniforms, bedsheets, and patient gowns because it offers both comfort and protection. The sportswear industry also favors antimicrobial cotton for its moisture-absorbing and odor-control properties. Cotton’s natural fibers easily absorb antimicrobial treatments, enhancing durability and washability. Manufacturers choose cotton because it is cost-effective, eco-friendly, and easy to process in large volumes. Its versatility supports wide usage across fashion, home, and medical textiles. As health awareness is growing and people are seeking hygienic and comfortable fabrics, antimicrobial cotton remains a preferred choice. According to the antimicrobial textiles market forecast, this strong demand will help cotton maintain a leading position in the industry.

Analysis by Active Agents:

- Metal and Metallic Salts

- Synthetic Organic Compounds

- Biobased Agents

Synthetic organic compounds account for 45.1% of the market share. They offer effective and long-lasting protection against a wide range of bacteria, fungi, and other microbes. These compounds are easy to apply to various types of fabrics and provide consistent antimicrobial performance even after multiple washes. Manufacturers prefer synthetic organic agents because they can be tailored to specific textile needs, ensuring strong durability and compatibility with different materials like cotton, polyester, and blends. They also aid in controlling odors and maintaining fabric freshness, which increases the appeal of antimicrobial textiles in healthcare, sportswear, and home applications. Synthetic organic compounds are cost-effective and allow large-scale production, making them ideal for meeting high demand. Additionally, ongoing R&D activities are improving their safety and environmental impact, further encouraging their employment. This combination of efficiency, versatility, and affordability makes synthetic organic compounds the leading choice as active agents in the market.

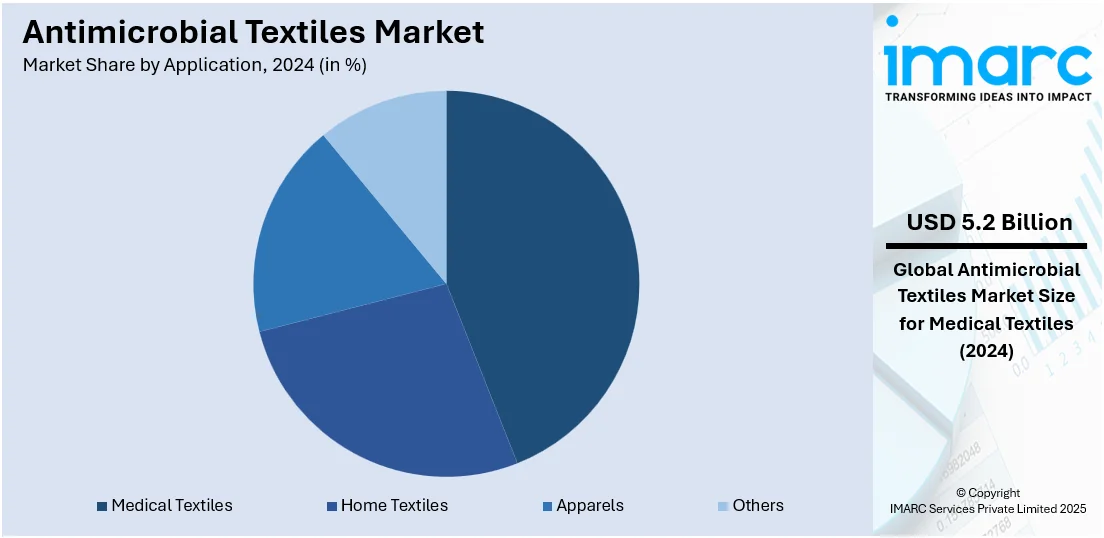

Analysis by Application:

- Medical Textiles

- Home Textiles

- Apparels

- Others

Medical textiles hold 43.8% of the market share. They help protect both patients and healthcare workers by minimizing the risk of cross-contamination. They play a significant role in infection control and hygiene maintenance in healthcare environments. Hospitals, clinics, and nursing homes are employing antimicrobial fabrics in uniforms, bed linens, surgical gowns, drapes, and curtains to reduce the spread of harmful bacteria and viruses. With rising concerns about hospital-acquired infections, the demand for reliable and hygienic fabric solutions continues to grow. Antimicrobial medical textiles offer durability, comfort, and repeated washability without losing their protective properties. Healthcare institutions also prefer them for their ability to maintain cleanliness in high-contact areas. As the worldwide healthcare sector is thriving and the focus on patient safety is increasing, the need for such specialized fabrics is rising steadily. This consistent demand makes medical textiles the dominant application area within the market, driving innovations and widespread adoption across medical facilities.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America, accounting for a share of 32.5%, enjoys the leading position in the market. The region is noted for its strong textile manufacturing capabilities and increasing awareness about health and hygiene. Countries like the United States and Canada are producing textiles on a large scale and adopting advanced technologies to integrate antimicrobial properties into fabrics. The rising demand for healthcare services in the region is promoting the use of antimicrobial textiles in hospitals and clinics for uniforms, bedding, and curtains. The fitness industry in the United States is also contributing to the market growth by demanding odor-resistant and moisture-wicking apparel. Additionally, increasing concerns about infection control in the burgeoning hotel industry are encouraging the employment of these fabrics. According to industry reports, the value of the hotel market in the US exceeded USD 106 Billion in 2024. By 2027, over 160 Million 'users' will participate in the hotel industry. Supportive government policies, low production costs, and rapid industrial growth are further strengthening the region’s position.

Key Regional Takeaways:

United States Antimicrobial Textiles Market Analysis

The United States holds 85.20% of the market share in North America. The United States antimicrobial textiles market is primarily driven by the rising focus on public health priorities, technological advancements, and evolving user preferences. The heightened awareness about antimicrobial resistance (AMR) is a major influencing factor, encouraging the implementation of government initiatives like the National Action Plan for Combating Antibiotic-Resistant Bacteria 2023–2028, which emphasizes infection prevention and the development of innovative antimicrobial solutions. According to the Centers for Disease Control and Prevention (CDC), over 2.8 Million infections resistant to antimicrobials were registered in the United States in 2024. The policy focus has heightened the demand for antimicrobial textiles in healthcare settings, where reducing hospital-acquired infections is paramount. Technological advancements are also contributing substantially to industry expansion, with the development of durable antimicrobial agents that withstand repeated washing, enhancing product longevity and appeal. Furthermore, the integration of antimicrobial properties into textiles aligns with the growing user emphasis on health and wellness, sustainability, and proactive hygiene measures.

Europe Antimicrobial Textiles Market Analysis

The Europe market is experiencing robust growth, fueled by heightened health awareness, regulatory support, and technological advancements. The healthcare sector remains a primary driver, with increasing demand for antimicrobial fabrics in hospitals and clinics to mitigate healthcare-associated infections. For instance, around 4.3 Million patients in hospitals across the EU/EEA were impacted by healthcare-associated infections in 2023, as per the European Centre for Disease Prevention and Control. This demand is further catalyzed by the growing geriatric population in Europe, necessitating enhanced infection control measures in medical settings. Regulatory frameworks are also promoting the adoption of antimicrobial textiles by ensuring product safety and efficacy. Concurrently, sustainability initiatives, such as the EU's Circular Economy Action Plan, are encouraging the development of eco-friendly antimicrobial solutions, aligning with user preferences for environmentally responsible products. Technological innovations, including the integration of nanotechnology and bio-based antimicrobial agents, have also enhanced the durability and effectiveness of these textiles, expanding their applications across various sectors like sportswear, home furnishings, and automotive interiors.

Asia-Pacific Antimicrobial Textiles Market Analysis

In the Asia-Pacific region, the market is expanding due to the region's large population and rising health consciousness, which have led to increased demand for antimicrobial textiles across various sectors, including healthcare, sportswear, and home furnishings. Moreover, the rise in the number of surgeries directly correlates with an elevated risk of healthcare-associated infections (HAIs), especially surgical site infections (SSIs). As per an ICMR report, approximately 15 Lakh patients in India suffered from Surgical Site Infections (SSIs) in 2024. The study also emphasized the role of post-discharge surveillance in identifying SSIs, with 66% of cases being detected after patients left the hospital, thereby creating the need for the adoption of antimicrobial textiles in the post-operation care. Countries, such as China, India, and Japan, are witnessing significant utilization of antimicrobial textiles because of the growing public health awareness and expanding healthcare infrastructure. Technological advancements like the integration of nanotechnology and bio-based antimicrobial agents have enhanced the durability and effectiveness of these textiles, making them more appealing to people. Additionally, the region's strong textile manufacturing base, particularly in countries, such as Bangladesh and Vietnam, positions Asia-Pacific as a crucial player in the antimicrobial textiles supply chain. Sustainability initiatives are also influencing the market, with manufacturers adopting eco-friendly materials to meet user preferences for environmentally responsible items.

Latin America Antimicrobial Textiles Market Analysis

The Latin America market is significantly influenced by the healthcare sector in the region. For instance, in 2023, 9.47% of the GDP of Brazil was spent on healthcare, equating to USD 161 Billion and making it the largest healthcare market in Latin America, as per the International Trade Administration (ITA). As awareness about hospital-acquired infections is rising in the region, the adoption of antimicrobial textiles in the healthcare sector is rapidly growing. Moreover, in Brazil, the combination of a humid climate and a well-established textile manufacturing industry is driving the demand for antimicrobial fabrics, particularly in apparel and home textiles. Technological advancements, including the development of bio-based antimicrobial agents and nanotechnology applications, have also enhanced the effectiveness and durability of these textiles, making them more appealing to users and supporting widespread adoption.

Middle East and Africa Antimicrobial Textiles Market Analysis

In the Middle East and Africa region, the market is growing, propelled by the region's hot and humid climate, which fosters bacterial and fungal proliferation, driving the demand for antimicrobial textiles to maintain hygiene in clothing and home furnishings. In healthcare, rising awareness about hospital-acquired infections (HAIs) has led to the adoption of antimicrobial fabrics in hospitals and clinics, particularly in countries, such as Saudi Arabia and the UAE. Government investments in healthcare infrastructure are further catalyzing this demand. For instance, the Government of Saudi Arabia allocated an amount of SR 86.25 Million for the Ministry of Health (MOH) in 2024, equating to 7% of the state budget. In 2025, this amount rose to SR 99.27 Million. Besides this, the growing geriatric population, which is more susceptible to infections, is creating the need for antimicrobial medical textiles.

Competitive Landscape:

Key players are working to develop advanced items to meet the high demand. They are investing in research to create fabrics that offer long-lasting protection against bacteria, odors, and moisture without compromising comfort or durability. These companies are introducing advanced technologies that integrate antimicrobial agents directly into fibers, making textiles more effective and washable. They are also collaborating with healthcare providers, sportswear brands, and home textile manufacturers to expand product use across sectors. Key players focus on eco-friendly and sustainable solutions, aligning with user demand for safe and green items. Through marketing and education, they are generating awareness about the benefits of antimicrobial fabrics. By improving performance, ensuring quality, and meeting regulatory standards, these companies help increase adoption and trust in antimicrobial textiles across both commercial and consumer markets. For instance, in November 2024, Noble Biomaterials teamed up with Coolcore to introduce COOLPRO fabric, an innovative textile technology that provided durable antimicrobial protection paired with improved cooling features. COOLPRO was said to be the first fabric to incorporate Coolcore Biomimetic Fiber Geometry along with Ionic+ Pro yarn technology.

The report provides a comprehensive analysis of the competitive landscape in the antimicrobial textiles market with detailed profiles of all major companies, including:

- BioCote Limited

- Herculite Products Inc.

- Kolon Industries Inc.

- Life Threads Global LLC

- Microban International Ltd. (W.M. Barr & Company Inc.)

- Milliken & Company

- PurThread Technologies Inc.

- Resil Chemicals Private Limited

- Response Fabrics (India) Pvt. Ltd

- Sanitized AG

- Sono-Tek Corporation

- Trevira GmbH (Indorama Ventures)

Latest News and Developments:

- April 2025: At IDEA® 2025 in Miami, organized by the Association of the Nonwoven Fabrics Industry (INDA), Americhem highlighted its knowledge in antimicrobial textiles, focusing on its nShield® additives. Designed for durability and safety, nShield® was perfect for hygiene, medical, and consumer items. The firm introduced cutting-edge nonwoven products, featuring moisture control, improved softness, and antimicrobial effectiveness, to address changing worldwide needs.

- February 2025: Polygiene Group launched StayCool™, a textile technology that provided moisture-activated cooling. This advancement enhanced their current antimicrobial offerings, improving comfort in functional fabrics. StayCool™ adhered to textile fibers and activated when it came into contact with moisture and heat, reducing fabric temperature by 2–3°C.

- February 2025: The German Institutes of Textile and Fiber Research (DITF) revealed a collaboration with Heraeus to develop fibers and fabrics that could enhance infection prevention measures. The partnership sought to integrate antimicrobial AGXX technology into fibers suitable for spinning and enhance its incorporation into textile coatings and finishes. It provided an enduring and highly effective defense against microbial infections for medical textiles.

- December 2024: Microban International launched Freshology, a sustainable solution for combating odors. This groundbreaking advancement offered enhanced efficiency and extended the freshness of fabrics by removing various odors.

Antimicrobial Textiles Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fabrics Covered | Polyester, Polyamide, Cotton, Others |

| Active Agents Covered | Metal and Metallic Salts, Synthetic Organic Compounds, Biobased Agents |

| Applications Covered | Medical Textiles, Home Textiles, Apparels, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BioCote Limited, Herculite Products Inc., Kolon Industries Inc., Life Threads Global LLC, Microban International Ltd. (W.M. Barr & Company Inc.), Milliken & Company, PurThread Technologies Inc., Resil Chemicals Private Limited, Response Fabrics (India) Pvt. Ltd, Sanitized AG, Sono-Tek Corporation, Trevira GmbH (Indorama Ventures) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the antimicrobial textiles market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global antimicrobial textiles market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the antimicrobial textiles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The antimicrobial textiles market was valued at USD 11.76 Billion in 2024.

The antimicrobial textiles market is projected to exhibit a CAGR of 5.31% during 2025-2033, reaching a value of USD 19.18 Billion by 2033.

Hospitals and clinics are adopting antimicrobial textiles for patient gowns, bedding, and staff uniforms to reduce the spread of infections. Besides this, the hospitality and transportation industries are also integrating such fabrics to improve cleanliness and customer safety. Moreover, technological advancements make it easier to embed antimicrobial properties in various textile types without affecting comfort and durability.

North America currently dominates the antimicrobial textiles market, accounting for a share of 32.5% in 2024, driven by its large textile manufacturing base, thriving healthcare sector, and rising user awareness about hygiene. Increasing demand for functional clothing and high investments in R&D activities are also supporting strong market growth in the region.

Some of the major players in the antimicrobial textiles market include BioCote Limited, Herculite Products Inc., Kolon Industries Inc., Life Threads Global LLC, Microban International Ltd. (W.M. Barr & Company Inc.), Milliken & Company, PurThread Technologies Inc., Resil Chemicals Private Limited, Response Fabrics (India) Pvt. Ltd, Sanitized AG, Sono-Tek Corporation, Trevira GmbH (Indorama Ventures), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)