Antimony Trioxide Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition

Antimony Trioxide Price Trend, Index and Forecast

Track the latest insights on antimony trioxide price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Antimony Trioxide Prices Outlook Q4 2025

- USA: USD 59,141/MT

- China: USD 34,734/MT

- Netherlands: USD 48,073/MT

- UK: USD 67,507/MT

- Japan: USD 55,081/MT

Antimony Trioxide Price Chart

Get real-time access to monthly/quarterly/yearly prices Request Sample

During the fourth quarter of 2025, the antimony trioxide prices in the USA reached 59,141 USD/MT in December. Prices edged lower as demand from flame retardant applications and polymer processing moderated. Additionally, sufficient availability across domestic supply chains reduced procurement urgency. Moreover, sourcing behavior reflected cautious inventory management aligned with softened downstream manufacturing activity.

During the fourth quarter of 2025, the antimony trioxide prices in China reached 34,734 USD/MT in December. Prices declined as demand from plastics, textiles, and electronics-related flame retardant applications weakened. Furthermore, adequate domestic supply and reduced export offtake eased buying pressure. In addition, procurement volumes were adjusted to align with near-term production requirements.

During the fourth quarter of 2025, the antimony trioxide prices in the Netherlands reached 48,073 USD/MT in December. Prices softened as consumption from polymer compounding and specialty chemical applications slowed. Additionally, comfortable inventory levels limited sourcing intensity. Moreover, procurement strategies emphasized inventory optimization and alignment with confirmed downstream orders.

During the fourth quarter of 2025, the antimony trioxide prices in the UK reached 67,507 USD/MT in December. Prices moved lower as demand from construction materials, plastics, and flame-retardant formulations moderated. Furthermore, reduced downstream operating rates influenced cautious procurement behavior. In addition, sourcing decisions focused on maintaining operational continuity rather than expanding stock positions.

During the fourth quarter of 2025, the antimony trioxide prices in Japan reached 55,081 USD/MT in December. Prices eased as demand from electronics manufacturing and specialty plastics applications softened. Moreover, sufficient supply availability supported balanced market conditions. Additionally, procurement activity reflected short-cycle purchasing aligned with measured downstream consumption.

Antimony Trioxide Prices Outlook Q3 2025

- USA: USD 62,385/MT

- China: USD 36,257/MT

- Netherlands: USD 54,691/MT

- UK: USD 71,587/MT

- Japan: USD 57,257/MT

During the third quarter of 2025, the antimony trioxide prices in the USA reached 62,385 USD/MT in September. The price increase was driven by the tightening supply of antimony raw material, increased demand from flame-retardant plastics in construction and electronics, and rising logistics and shipping costs for imports. Domestic production remained limited, forcing greater reliance on imports which elevated cost exposure to freight, port congestion and currency shifts. Compliance and environmental processing costs for handling antimony trioxide also rose, contributing to higher unit costs.

During the third quarter of 2025, the antimony trioxide prices in China reached 36,257 USD/MT in September. The domestic Chinese market saw stronger pricing as export restrictions tightened, feedstock availability was curtailed, and domestic demand remained robust in electronics, construction and flame-retardant applications. Though domestic production is significant, simplified internal logistics constraints and particularly smelting energy costs and environmental regulation compliance pushed cost structures upward.

During the third quarter of 2025, the antimony trioxide prices in the Netherlands reached 54,691 USD/MT in September. European demand for antimony trioxide in plastics, coatings and flame-retardant applications remained strong, while import reliance from Asia and freight cost variations elevated landed cost. Port handling and storage costs in chemical hubs such as Rotterdam increased, and supply chain disruptions in Asia reduced availability of surface offers.

During the third quarter of 2025, the antimony trioxide prices in the UK reached 71,587 USD/MT in September. UK pricing was buoyed by strong demand in fire-safety materials for construction, electronics and automotive sectors, and import dependencies meant exposure to global antimony trioxide market tightness. Customs and regulatory adjustments added incremental cost burdens, while shipping lead times and logistics inflation drove margins upward.

During the third quarter of 2025, the antimony trioxide prices in Japan reached 57,257 USD/MT in September. Japan’s pricing reflected heavy reliance on imports of antimony trioxide and concentrate, and the cost of energy-intensive processing and stringent environmental standards increased production cost. Meanwhile, stable downstream demand in electronics, flame-retardant plastics and automotive applications supported the price floor. Shipping delays and elevated port handling charges from overseas suppliers added further cost pressure.

Antimony Trioxide Prices Outlook Q2 2025

- USA: USD 56595/MT

- China: USD 31835/MT

- Netherlands: USD 49320/MT

- United Kingdom: USD 61670/MT

- Japan: USD 49780/MT

During the second quarter of 2025, the antimony trioxide prices in the USA reached 56595 USD/MT in June. In the USA, antimony trioxide prices were shaped by consistent demand from the flame retardant and plastics sectors, especially in construction materials and automotive applications. Limited domestic production meant reliance on imports, making the market sensitive to global shipping schedules and port congestion. Compliance costs linked to handling hazardous substances added to production overheads. The electronics sector also supported demand through fire-resistant components, while variations in labor availability and refining operations further influenced cost structures.

During the second quarter of 2025, antimony trioxide prices in China reached 31835 USD/MT in June. In China, antimony trioxide prices were influenced by its role as the dominant global producer. Government regulations on mining activity and smelting emissions significantly shaped supply availability. Strong domestic demand from the construction, plastics, and electronics sectors limited export availability, impacting international trade flows. Production expenses were also guided by fluctuations in power tariffs for energy-intensive smelting. Regional logistics bottlenecks within mining areas and policy adjustments on export monitoring added further complexity to price formation.

During the second quarter of 2025, the antimony trioxide prices in the Netherlands reached 49320 USD/MT in June. In the Netherlands, antimony trioxide prices reflected strong demand from the plastics and coatings sectors, especially for applications requiring flame retardancy. Heavy reliance on imports from Asian producers exposed the market to changes in freight costs and shipping schedules. Rotterdam’s role as a key chemical hub influenced inventory availability and redistribution costs within Europe. Environmental compliance requirements and high energy tariffs for chemical handling also added to overall operational expenditures for regional processors and distributors.

During the second quarter of 2025, the antimony trioxide prices in the United Kingdom reached 61670 USD/MT in June. In the UK, antimony trioxide prices were guided by steady consumption from the electronics and construction sectors, with strict fire safety standards maintaining demand. Post-Brexit trade complexities increased customs-related costs for imports, while reliance on Asian supply chains exposed the market to global freight variations. The chemicals sector faced additional expenses due to compliance with regulatory requirements for handling hazardous materials. Currency exchange rate fluctuations against major exporters’ currencies further shaped import cost structures this quarter.

During the second quarter of 2025, the antimony trioxide prices in Japan reached 49780 USD/MT in June. In Japan, antimony trioxide prices were driven by high demand from the electronics and plastics sectors, especially in flame-retardant applications for consumer devices and automotive parts. The country’s heavy dependence on imports from China and other Asian suppliers made the market sensitive to shipping costs and lead times. Energy-intensive downstream processing facilities were affected by fluctuating electricity costs. Environmental and safety standards in chemical processing further elevated operational expenses, influencing overall market pricing during the quarter.

Antimony Trioxide Prices Outlook Q1 2025

- USA: USD 45900/MT

- China: USD 23900/MT

- Netherlands: USD 39300/MT

- Europe: USD 23500/MT

- Japan: USD 36550/MT

During the first quarter of 2025, the antimony trioxide prices in the USA reached 45900 USD/MT in March. As per the antimony trioxide price chart, there was a price spike due to the ongoing trade conflict between the United States and China, which escalated tensions around key raw materials, including antimony. Besides, China's decision to halt the export of antimony metal to the USA has disrupted supply chains causing upward pressure on the prices.

During the first quarter of 2025, antimony trioxide prices in China reached 23900 USD/MT in March. The decision by China to impose an export ban on critical minerals like gallium, germanium, and antimony to the United States marked a significant shift in global supply chains, with far-reaching consequences for industries reliant on these materials. Antimony, in particular, saw prices hit record levels as consumers scrambled to secure alternative sources of supply in response to the ban.

During the first quarter of 2025, the antimony trioxide prices in the Netherlands reached 39300 USD/MT in March. Antimony trioxide prices in the Netherlands were fluctuating due to a combination of factors, including rising demand from key industries like renewable energy storage and electric vehicles and supply chain disruptions.

During the first quarter of 2025, the antimony trioxide prices in Europe reached 23500 USD/MT in March. Prices in Europe fluctuated due to a combination of increased demand, particularly from the renewable energy and electric vehicle sectors, and supply-side constraints.

During the first quarter of 2025, the antimony trioxide prices in Japan reached 36550 USD/MT in March. The increased application of antimony trioxide in flame retardants for various materials, including plastics, textiles, and electronics, contributed to its overall demand and prices.

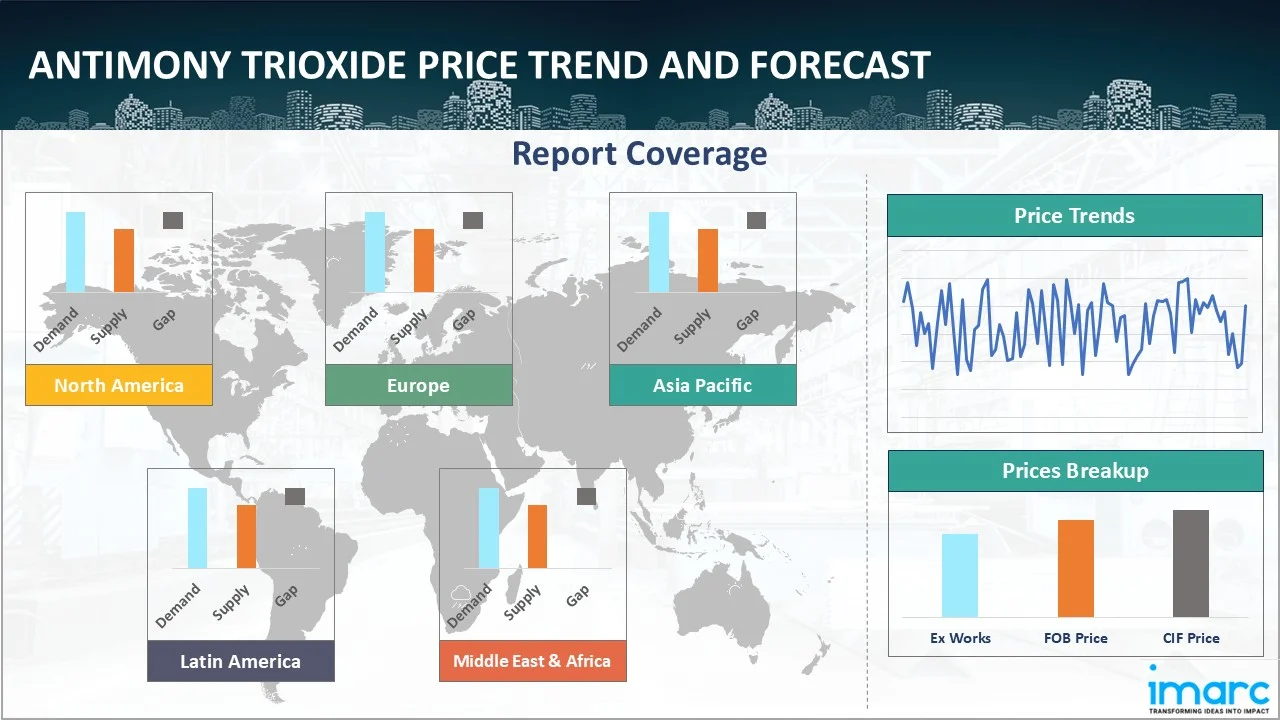

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing the antimony trioxide prices.

Europe Antimony Trioxide Price Trend

Q4 2025:

As per the antimony trioxide price index, prices across Europe weakened, influenced by reduced demand from polymer compounding, flame-retardant formulations, and construction-related applications. Additionally, slower activity across plastics processing and specialty chemical segments tempered procurement intensity. Moreover, sourcing strategies emphasized inventory discipline, regulatory compliance, and alignment with confirmed production schedules, with buyers relying on existing stocks rather than engaging in forward purchasing amid subdued downstream demand.

Q3 2025:

Prices in Europe reflected a further tightening environment. Supply constraints originating from Asian producers, particularly China, reduced inbound feedstock flows and pressured inventories at European chemical hubs. Domestic energy cost inflation and increased freight and port-handling charges in major gateways added cost burdens. Demand from construction, electronics and automotive sectors for flame-retardant materials remained firm, supporting pricing resilience. Compliance expenses for chemical importers and processors in Europe also rose amid stricter environmental regulation, and buyers observed limited new sourcing options, reinforcing the upward trend.

Q2 2025:

As per the antimony trioxide price index, European antimony trioxide prices were shaped by steady demand from the flame retardant and plastics sectors, particularly for use in construction and automotive applications. The electronics sector added pressure through requirements for fire-resistant components. Import dependency on Asian suppliers made the market sensitive to shipping delays and freight adjustments. Energy-intensive refining processes were influenced by fluctuating electricity costs, while environmental regulations on chemical production and emissions compliance elevated operating expenditures for regional processors.

Q1 2025:

As per the antimony trioxide price index, prices in Europe fluctuated due to a combination of increased demand, particularly from the renewable energy and electric vehicle sectors, and supply-side constraints. This created a volatile market where prices were driven both by heightened consumption and challenges in maintaining consistent supply.

This analysis can be extended to include detailed antimony trioxide price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Antimony Trioxide Price Trend

Q4 2025:

As per the antimony trioxide price index, prices in North America softened, reflecting moderated consumption from flame retardant applications, plastics manufacturing, and construction-related materials. Furthermore, adequate regional availability reduced buying urgency across downstream industries. In addition, sourcing strategies emphasized inventory optimization, logistics efficiency, and short-cycle procurement aligned with adjusted operating rates and cautious production planning.

Q3 2025:

Prices trended higher as supply-side bottlenecks and elevated input costs converged. Import dependency for antimony trioxide meant that shipping premiums, inland logistics surcharges and currency fluctuations all contributed to cost escalation. Meanwhile, downstream industries such as electronics, plastics and construction maintained robust demand for flame-retardant compounds, reinforcing procurement urgency. Domestic production remained constrained, giving importers and processors less buffer and increasing price sensitivity. Together, these factors supported a firm upward trend in regional pricing.

Q2 2025:

As per the antimony trioxide price index, in North America, antimony trioxide prices were affected by strong consumption from the construction and electronics sectors, where fire safety standards sustained demand. Limited domestic production capacity increased reliance on imported materials, making the market sensitive to global supply variations. Transportation costs from international suppliers impacted delivered pricing, especially for inland consumers. Regulatory compliance costs for handling hazardous materials, along with variations in labor availability and refinery operations, further influenced the cost environment this quarter.

Q1 2025:

Antimony trioxide prices in North America rose sharply due to China's export restrictions and increased demand for green technologies. China's ban on antimony exports to the USA, coupled with rising demand from sectors like electric vehicles and flame retardants, created significant supply chain disruptions and price volatility.

Specific antimony trioxide prices and historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Antimony Trioxide Price Trend

Q4 2025:

As per antimony trioxide price chart, the prices in the Middle East and Africa fluctuated due to a complex interplay of factors, primarily driven by supply chain disruptions, seasonal demand shifts, and geopolitical influences.

Q3 2025:

The report explores the antimony trioxide pricing trends and antimony trioxide price chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

In addition to region-wise data, information on antimony trioxide prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Antimony Trioxide Price Trend

Q4 2025:

Across Asia Pacific, antimony trioxide prices moved lower as demand from electronics manufacturing, plastics processing, and textile-related flame retardant applications moderated. Furthermore, sufficient domestic production and import availability reduced sourcing pressure. In addition, procurement strategies emphasized cost control, inventory visibility, and cautious purchasing aligned with subdued downstream activity across industrial sectors.

Q3 2025:

In the Asia-Pacific region during Q3 2025, antimony trioxide pricing was shaped by strong demand growth, particularly in electronics, plastics and construction sectors, and tight supply from major producing nations. China’s production/export policies and domestic consumption absorbed available volumes, leaving limited feedstock for export markets. Energy and environmental regulation compliance in smelting operations increased cost bases. Shipping lead times from remote mining zones inland and port congestion contributed further to landed cost inflation. These dynamics combined to sustain upward pricing pressure.

Q2 2025:

In Asia Pacific, antimony trioxide prices were driven by dominant demand from the flame retardant, plastics, and textile sectors, supported by expanding urbanization and manufacturing activity. China, as the leading producer, shaped regional pricing through its export policies, mining output, and environmental restrictions on smelters. Shifts in domestic consumption for electronics and construction industries also redirected supply flows. Logistical costs within high-volume manufacturing hubs, alongside environmental compliance measures in mining regions, played a key role in determining production expenses.

Q1 2025:

China's export restrictions on antimony, implemented to prioritize domestic manufacturing and potentially due to geopolitical tensions, significantly impacted global supply. This created a sense of urgency among buyers, driving up prices. Besides, the demand for antimony trioxide, used in flame retardants, electronics, and other applications, continued to grow in the Asia Pacific region, particularly in emerging economies.

This antimony trioxide price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Antimony Trioxide Price Trend

Q4 2025:

Latin America's antimony trioxide market is predominantly influenced by its rich natural reserves, particularly in countries like Chile and Brazil. However, political instability and inconsistent regulatory frameworks can lead to significant volatility in antimony trioxide prices.

Q3 2025:

Infrastructure challenges and logistical inefficiencies often impact the supply chain, affecting Latin America’s ability to meet international demand consistently. Moreover, the antimony trioxide price index, economic fluctuations, and currency devaluation are critical factors that need to be considered when analyzing antimony trioxide pricing trends in this region.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin America countries. |

Antimony Trioxide Pricing Report, Market Analysis, and News

IMARC's latest publication, “Antimony Trioxide Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition,” presents a detailed examination of the antimony trioxide market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of antimony trioxide at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed antimony trioxide prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting antimony trioxide pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Antimony Trioxide Industry Analysis

The global antimony trioxide market size reached USD 1,027.82 Million in 2025. By 2034, IMARC Group expects the market to reach USD 1,748.32 Million, at a projected CAGR of 6.08% during 2026-2034. The market is primarily driven by the rising demand for flame-retardant plastics in electronics and construction, growth in electrical and automotive sectors requiring fire-safe materials and surge in PET packaging and polymer production.

Latest News and Developments:

- October 2025: United States Antimony Corporation officially launched exploration and bulk sampling operations at its Stibnite Hill property in Montana, representing a pivotal step toward establishing a domestic, fully integrated antimony supply chain within the United States. The Stibnite Hill initiative will allow the company to evaluate ore quality, grade, and volume through targeted geological mapping and large-scale sample extraction.

Product Description

Antimony trioxide (Sb₂O₃) is a white, odorless, crystalline powder that is the most commercially important compound of antimony. It is primarily produced through the oxidation of antimony metal or as a byproduct of smelting antimony-containing ore. Due to its chemical stability and flame-retardant properties, antimony trioxide is extensively used across various industries, especially as a synergist in halogenated flame-retardant systems. When combined with chlorine- or bromine-based flame retardants, it significantly enhances fire resistance in materials such as plastics, textiles, rubbers, and coatings.

Beyond its flame-retardant applications, antimony trioxide is utilized as a catalyst in the production of polyethylene terephthalate (PET), widely used in plastic bottles and synthetic fibers. It also serves in the manufacturing of glass, enamels, and pigments, providing opacity and improved durability. Despite its usefulness, concerns about antimony trioxide’s toxicity have prompted stricter regulations and spurred research into safer alternatives.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Antimony Trioxide |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Ammonium Perchlorate Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of antimony trioxide pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting antimony trioxide price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The antimony trioxide price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)