Apheresis Equipment Market Size, Share, Trends and Forecast by Product, Application, Procedure, Technology, End User, and Region, 2025-2033

Apheresis Equipment Market Size and Share:

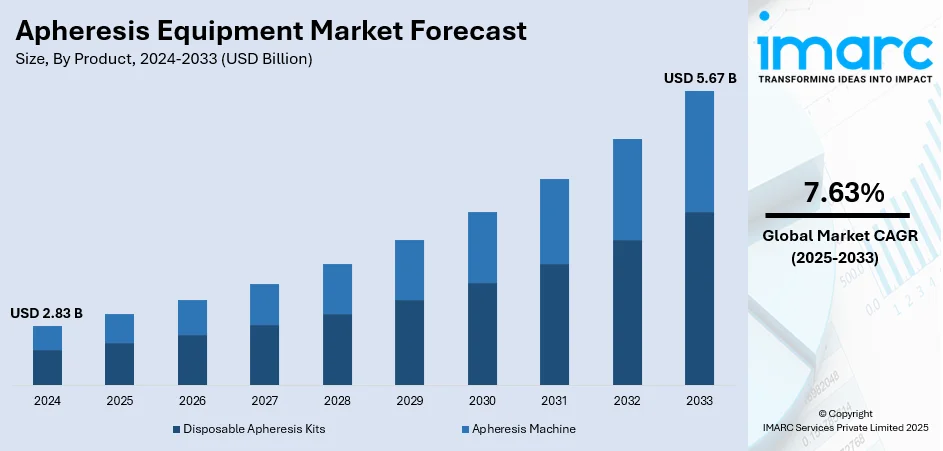

The global apheresis equipment market size was valued at USD 2.83 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.67 Billion by 2033, exhibiting a CAGR of 7.63% from 2025-2033. North America currently dominates the market, holding a market share of 35.0% in 2024. The increased incidence of autoimmune and chronic diseases among global populations is impelling the market growth. Moreover, continuous technological advancements that enhance procedure safety, efficiency, and accuracy are supporting the market growth. Additionally, the enhancements in blood component collection and in therapeutic procedures are expanding the apheresis equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.83 Billion |

|

Market Forecast in 2033

|

USD 5.67 Billion |

| Market Growth Rate 2025-2033 | 7.63% |

The market for apheresis equipment is growing strongly, driven by the demand for blood constituents and growing incidence of chronic illnesses like cancer, autoimmune diseases, and cardiovascular diseases. Medical practitioners are increasingly using apheresis techniques, as they are providing treatment with targeted benefits and fewer adverse effects. Technological advancements are making it possible for manufacturers to create automated, easy-to-use, and more efficient equipment, which is improving the speed and accuracy of procedures. Hospitals and blood centers are increasing the capabilities of their apheresis units, and governments and health agencies are promoting efforts to enhance blood management systems. The market is also experiencing increased investments in research and development (R&D), especially in therapeutic applications of apheresis.

To get more information on this market, Request Sample

The United States apheresis equipment market is experiencing steady growth, driven by the heightened adoption of advanced blood separation technology and demand for therapeutic apheresis procedures. Healthcare providers nationwide are adding apheresis to treatment protocols for autoimmune disorders, hematologic disorders, and cancer, further leading to steady market growth. Hospitals and specialty clinics are replacing older equipment with new units that can handle increasing patient loads and facilitate procedure efficiency. Medical device companies are funneling money into R&D, which is making it possible to create next-generation apheresis systems that have enhanced automation, safety, and monitoring of real-time data. The market is also witnessing increased use of apheresis in clinical trials, especially in cell and gene therapy, where the proper collection and processing of blood components are vital. Government and private payers are providing wider access to apheresis procedures by increasing reimbursement coverage, prompting healthcare facilities to deliver more specialized services. Professional education campaigns and ongoing medical education programs are keeping clinicians abreast of new uses of apheresis, which in turn is increasing demand. In 2024, The American Society for Apheresis (ASFA) declared 17th September as Apheresis Awareness Day. Apheresis Awareness Day aims to promote understanding of apheresis medicine and to recognize the numerous donors, patients, and practitioners who have committed their lives to saving others through evidence-based practices that further apheresis medicine.

Apheresis Equipment Market Trends:

Increased Incidence of Autoimmune and Chronic Diseases

The global apheresis equipment industry is experiencing steady growth with the increased incidence of autoimmune and chronic diseases among global populations. The healthcare systems are experiencing a sharp rise in diseases like multiple sclerosis, lupus, rheumatoid arthritis, and several forms of cancer, which are demanding modern treatment strategies. As per the American Cancer Society, in 2025, there are estimates of 2,041,910 new cancer cases and 618,120 cancer-related deaths happening in the United States. Apheresis is acting as an important therapeutic measure, particularly among patients who do not respond to regular treatments. Hospitals and specialty centers are using apheresis to take out pathogenic elements from blood, thus enhancing patient results and offering a favorable apheresis equipment market outlook. Doctors are prescribing therapeutic apheresis to treat symptoms and slow the course of chronic conditions. As disease-specific treatment protocols are becoming increasingly recognized, more patients are receiving apheresis procedures as part of individualized medicine treatment regimens. Clinical research organizations also examine the effectiveness of apheresis for the treatment of complicated diseases, further establishing its place in contemporary treatment protocols. This is what is compelling hospital systems to invest in next-generation apheresis technologies.

Technology Developments in Apheresis Devices

The market for apheresis devices is transforming dynamically with continuous technological advancements that enhance procedure safety, efficiency, and accuracy. Manufacturers are creating next-generation apheresis equipment that is providing greater automation, real-time monitoring, and intuitive interfaces. Sophisticated software integration is enabling healthcare professionals to personalize treatment parameters according to individual patient requirements, thereby impelling the apheresis equipment market growth. These advancements are enhancing clinical outcomes while keeping manual errors-related risks to a minimum. Besides, convenient and lightweight designs are facilitating the adoption of apheresis solutions by smaller healthcare centers and mobile blood donation units. Developments in sterile tubing systems and disposable kits ensure greater infection control standards and efficiency. Industry players and research centers are constantly working together to enhance device functionality, resulting in FDA clearances and business growth. While these hi-tech technologies are becoming increasingly accessible, clinics and hospitals are upgrading more of their equipment in order to remain in sync with contemporary standards. In 2024, AABB announced the release of two new publications including the Therapeutic Apheresis: A Handbook, which provides a comprehensive and accurate information about the vastly practiced apheresis procedures, their clinical indications, and treatment suggestions.

Widening Applications in Therapeutics and Blood Component Collection

One of the major apheresis equipment market trends is widening as the application of the procedure in blood component collection and in therapeutic procedures. Blood donation facilities are employing apheresis to separate plasma, platelets, and red blood cells selectively, which are urgently needed for multiple transfusion indications. Apheresis can enable donors to donate the selective components repeatedly, improving supply chain effectiveness compared to conventional whole blood donation. Therapeutic apheresis, on the other hand, is employed in hospitals to cure hyperviscosity syndrome, thrombotic thrombocytopenic purpura, and specific neurological disorders. Doctors are using apheresis to take out offending substances such as autoantibodies, immune complexes, and toxins from the blood. As clinical practices continue to evolve to incorporate apheresis as a first-line treatment modality, the number of procedures is on the increase. Regulator bodies are facilitating this growth by simplifying device approvals and promoting research, which is further enhancing the role apheresis in contemporary transfusion and therapy. In 2024, Terumo Blood and Cell Technologies (Terumo BCT), a company specializing in medical technology, revealed its new Global Therapy Innovations business unit, aimed at merging disease expertise through the various interactions the company has throughout the patient journey, encompassing cell collections, manufacturing, and therapy delivery. Under the leadership of Veerle d'Haenens, General Manager of Global Therapy Innovations, the initiative strives to enhance care standards throughout the patient journey and to establish a cohesive system of modalities in each disease area like progressing efforts on both therapeutic apheresis and cell and gene therapy to address sickle cell disease (SCD).

Apheresis Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global apheresis equipment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, procedure, technology, and end user.

Analysis by Product:

- Disposable Apheresis Kits

- Apheresis Machine

Disposable apheresis kits stand as the largest component in 2024, holding 72.2% of the market. They are offering significant benefits, contributing to the efficiency, safety, and convenience of apheresis procedures. Healthcare providers are increasingly using these single-use kits to reduce the risk of cross-contamination and ensure sterile conditions during each treatment session. Hospitals and clinics are minimizing infection risks by avoiding the need for reprocessing or sterilizing reusable components. These kits are also streamlining workflow by simplifying setup and cleanup processes, allowing medical staff to focus more on patient care. Manufacturers are designing these kits to be compatible with various apheresis machines, ensuring versatility across different clinical settings. Additionally, disposable kits are improving traceability and regulatory compliance by supporting standardized procedures and proper documentation. Blood centers are benefiting from faster donor turnaround times, while therapeutic facilities are optimizing treatment schedules. As the demand for safer and more efficient apheresis grows, the use of disposable kits is becoming a standard practice across healthcare systems.

Analysis by Application:

- Blood Collection

- Treatment

- Neurology

- Hematology

- Renal Diseases

- Others

Treatment leads the market as apheresis is emerging as a crucial treatment intervention in various medical specialties, conferring specific therapeutic advantages for patients with complicated conditions. Therapeutic plasma exchange is being employed by physicians to eliminate pathologic substances like autoantibodies, immune complexes, and toxins from the circulation, which is enhancing the quality of outcomes of autoimmune and neurological disorders. Hematologists are using apheresis to treat blood-related disorders, such as sickle cell disease and thrombotic thrombocytopenic purpura, where prompt treatment is avoiding complications. Cardiologists are adding LDL apheresis to decrease cholesterol levels in familial hypercholesterolemia patients, ensuring long-term cardiovascular wellness. Oncologists are using leukapheresis to decrease abnormal white blood cell counts in leukemia patients, thus controlling disease growth. In addition, transplant physicians are using apheresis to condition patients by removing antibodies that can lead to organ rejection. Clinical scientists are increasing treatment uses by combining apheresis with advanced therapies, including cell and gene therapies, thus expanding its utility in contemporary medicine.

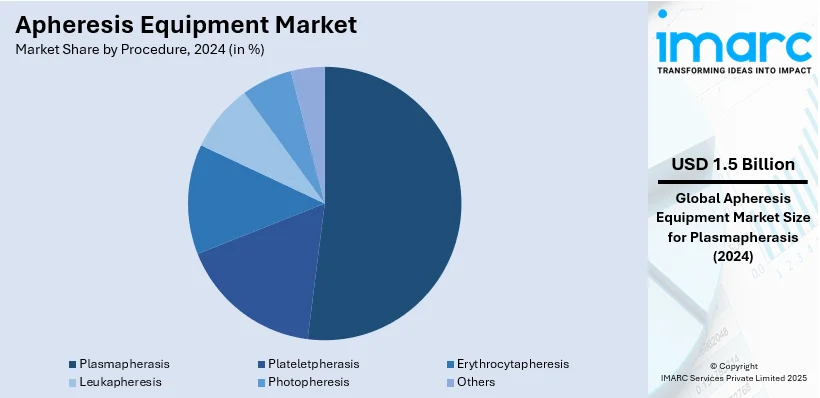

Analysis by Procedure:

- Plasmapherasis

- Plateletpherasis

- Erythrocytapheresis

- Leukapheresis

- Photopheresis

- Others

Plasmapherasis leads the market with 51.7% of market share in 2024. Plasmapheresis is providing multiple benefits by offering targeted removal of harmful substances from the bloodstream and supporting effective management of various medical conditions. Physicians are using this procedure to eliminate autoantibodies, immune complexes, and abnormal proteins that are contributing to disease progression in autoimmune and neurological disorders. Patients with conditions such as myasthenia gravis, Guillain-Barré syndrome, and lupus are experiencing symptom relief and improved quality of life through regular plasmapheresis sessions. The therapy is also helping in controlling hyperviscosity syndromes and certain hematologic disorders, where quick reduction of abnormal plasma components is preventing severe complications. Hospitals are increasingly incorporating plasmapheresis into treatment protocols because it is offering rapid therapeutic effects compared to conventional drug therapies.

Analysis by Technology:

- Membrane Filtration

- Centrifugation

Centrifugation leads the market in 2024. It is delivering significant benefits across medical, research, and industrial applications by enabling the efficient separation of biological components. In clinical laboratories, centrifugation is being used to separate plasma, serum, and cellular elements from blood samples, ensuring accurate diagnostic testing. Hospitals and research centers are relying on centrifugation to process samples quickly, which is improving turnaround times and supporting timely medical decisions. In therapeutic applications, centrifugation is facilitating apheresis procedures by efficiently isolating targeted blood components such as platelets, red blood cells, or plasma. Researchers are applying centrifugation to purify cells, proteins, and nucleic acids, thereby advancing biopharmaceutical development and molecular biology studies. The technique is reducing contamination risks by providing clean and reliable sample separation, while automation in modern centrifuge systems is enhancing precision and efficiency. As innovations in centrifuge technology are continuing to improve safety, speed, and capacity, the benefits of centrifugation are expanding across healthcare and research sectors.

Analysis by End User:

- Blood Collection Centers

- Hospitals and Clinics

- Others

Hospitals and clinics lead the market in 2024 as they are increasingly using apheresis equipment to provide advanced therapeutic and diagnostic solutions for patients with complex medical conditions. These healthcare facilities are incorporating apheresis into treatment protocols for autoimmune diseases, hematologic disorders, neurological conditions, and certain cancers, where traditional therapies are showing limited effectiveness. Physicians are performing plasma exchange, leukapheresis, and platelet apheresis to remove harmful components from blood, thereby improving patient outcomes and reducing complications. Clinics are relying on apheresis equipment to deliver personalized treatments, tailoring procedures to meet individual patient needs. Blood banks within hospitals are using apheresis systems to collect specific blood components such as plasma and platelets, ensuring a steady supply for transfusions. Healthcare providers are benefiting from advanced technologies that are enhancing accuracy, safety, and efficiency in procedures. As patient demand for specialized treatments is rising, hospitals and clinics are continuously upgrading their apheresis capabilities, making the technology an integral part of modern healthcare delivery.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 35.0%. The North America market is experiencing steady growth, supported by rising demand for advanced therapeutic procedures and increasing prevalence of chronic and autoimmune diseases. Healthcare facilities across the United States and Canada are adopting apheresis equipment to manage conditions such as leukemia, multiple sclerosis, and hypercholesterolemia, thereby expanding treatment applications. Blood donation centers are also utilizing apheresis systems to selectively collect plasma and platelets, addressing the region’s growing need for blood components in transfusion medicine. Technological advancements are further driving market adoption, with manufacturers introducing automated, user-friendly, and high-precision systems that improve procedural efficiency and patient safety. Favorable reimbursement policies and strong regulatory support are encouraging hospitals and clinics to expand their apheresis capabilities. In addition, ongoing investments in clinical research and cell-based therapies are increasing the use of apheresis in clinical trials. Overall, the North America market is progressing toward greater innovation, accessibility, and integration of apheresis technologies.

Key Regional Takeaways:

United States Apheresis Equipment Market Analysis

The United States holds 87.80% share in North America. The market has witnessed increasing demand for apheresis equipment adoption due to the rising prevalence of chronic diseases such as cancer, autoimmune conditions, and metabolic disorders. For instance, six out of 10 Americans have one chronic disease, and four out of 10 have two or more chronic diseases that account for ninety percent of the USD 4.5 Trillion annual health care costs in the nation. The consistent surge in patients requiring plasma exchange and red cell exchange procedures is contributing to the increased utilization of advanced apheresis systems. With healthcare providers seeking more effective and less invasive treatment options, the clinical relevance of apheresis equipment in managing chronic diseases has become more pronounced. Rising awareness among clinicians and the availability of skilled healthcare personnel are further enhancing integration of these systems into mainstream medical settings.

Asia Pacific Apheresis Equipment Market Analysis

Asia-Pacific is experiencing rapid growth in apheresis equipment adoption, primarily driven by the increasing number of blood donors. For instance, more than 3,800 blood center are registered on e-Raktkosh from 29 states and 8 UTs in India. The rise in voluntary and repeat blood donations has created a favourable environment for blood component separation technologies. As healthcare systems in the region place greater emphasis on ensuring the availability of safe and sufficient blood components, demand for efficient and high-throughput apheresis equipment is increasing. Technological advancements, along with national efforts to improve transfusion practices, are encouraging blood banks and hospitals to invest in automated and user-friendly apheresis systems. Regional healthcare authorities are also promoting blood donation through awareness programs, leading to improved donor participation.

Europe Apheresis Equipment Market Analysis

Europe is seeing growing adoption of apheresis equipment due to the increasing burden of neurological disorders such as multiple sclerosis, Guillain-Barré syndrome, and myasthenia gravis. For instance, GBS results in the hospitalization of more than 22,000 people annually in the U.S. and Europe. These conditions require therapeutic apheresis procedures for disease management and symptom relief, creating a continuous demand for advanced equipment. The region’s strong clinical research environment and adoption of evidence-based treatment protocols support the wider implementation of apheresis technologies. Healthcare institutions are increasingly integrating apheresis into neurology departments as part of comprehensive treatment plans. High standards in clinical care, well-developed healthcare reimbursement systems, and multidisciplinary treatment approaches are further driving the integration of apheresis equipment for managing neurological disorders.

Latin America Apheresis Equipment Market Analysis

Latin America is advancing in apheresis equipment adoption, spurred by growing healthcare infrastructure and increased privatization across the region. For instance, in Brazil, 25% of the population utilizes the private healthcare system. Investments in hospitals, diagnostic centers, and specialized treatment clinics are creating a favorable environment for installing modern apheresis systems. The involvement of private healthcare players has led to improved service delivery, better equipment availability, and higher patient outreach, boosting overall demand for apheresis technologies.

Middle East and Africa Apheresis Equipment Market Analysis

Middle East and Africa is witnessing a surge in apheresis equipment adoption due to growing healthcare facilities across urban and semi-urban areas. For instance, in 2025, the UAE is currently home to over 150 hospitals and has more than 5,000 healthcare facilities. Expanding hospital networks, specialty centers, and blood banks are increasingly integrating apheresis systems to meet growing clinical demands. These developments reflect the region’s broader focus on upgrading its healthcare delivery capacity.

Competitive Landscape:

Market players in the apheresis equipment industry are actively focusing on strategic partnerships, innovation, and expansion to strengthen their market presence. Leading companies are investing in research and development to introduce advanced devices with improved automation, safety, and efficiency, catering to the growing demand for therapeutic and donor apheresis procedures. Collaborations with hospitals, clinics, and blood banks are helping manufacturers enhance product adoption while addressing evolving clinical needs. Many players are expanding into emerging markets by establishing distribution networks and service support systems. Additionally, mergers and acquisitions (M&A) are being pursued to broaden product portfolios and technological capabilities. As per apheresis equipment market forecasts, through these activities, market participants are expected to shape the competitive landscape and support industry growth.

The report provides a comprehensive analysis of the competitive landscape in the apheresis equipment market with detailed profiles of all major companies, including:

- Asahi Kasei Corporation

- B. Braun Melsungen Aktiengesellschaft

- Baxter International Inc.

- Fresenius Kabi Aktiengesellschaft (Fresenius SE & Co. KGaA)

- Haemonetics Corporation

- Hemacare Corporation (Charles River Laboratories Inc.)

- Kaneka Corporation

- Kawasumi Laboratories Inc.

- Medica SpA

- Nikkiso Co Ltd.

- Terumo BCT Inc. (Terumo Corporation)

Latest News and Developments:

- June 2025: ImmunityBio received FDA Expanded Access authorization for its Cancer BioShield™ platform using ANKTIVA® to treat lymphopenia in solid tumor patients post first-line therapies. The treatment leveraged apheresis-derived NK cells in combination with IL-15 superagonists, significantly improving survival in late-stage metastatic pancreatic cancer, as presented at ASCO 2025.

- June 2025: Mandaya Royal Puri Hospital launched apheresis services for treating blood cancer and autoimmune neurological diseases, aiming to reduce patients' symptoms. The procedure was conducted by internal medicine specialists in hematology-medical oncology.

- June 2025: CTC launched a collaboration with OptiCell Solutions to enhance cell and gene therapy research, leveraging advanced apheresis techniques for precise blood cell collection. The partnership supported clinical projects by streamlining regulatory planning and improving the efficiency of target cell isolation.

- May 2025: BBG Advanced Therapies launched the world’s first mobile leukapheresis center in San Antonio to expand access to cell and gene therapies, featuring onboard apheresis stations and a lab. It supported immune cell collection across a 63,000-square-mile region for personalized treatments.

- April 2025: Asahi Kasei began operations of Asahi Kasei Life Science, after transferring its apheresis and related businesses from Asahi Kasei Medical, aiming to support pharmaceutical manufacturing with enhanced safety and productivity. The company’s apheresis-linked products like Planova™ and THESYS™ columns gained strong demand, following facility expansions in the U.S. and Japan.

Apheresis Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Disposable Apheresis Kits, Apheresis Machine |

| Applications Covered |

|

| Procedures Covered | Plasmapherasis, Plateletpherasis, Erythrocytapheresis, Leukapheresis, Photopheresis, Others |

| Technologies Covered | Membrane Filtration, Centrifugation |

| End Users Covered | Blood Collection Centers, Hospitals and Clinics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Asahi Kasei Corporation, B. Braun Melsungen Aktiengesellschaft, Baxter International Inc., Fresenius Kabi Aktiengesellschaft (Fresenius SE & Co. KGaA), Haemonetics Corporation, Hemacare Corporation (Charles River Laboratories Inc.), Kaneka Corporation, Kawasumi Laboratories Inc., Medica SpA, Nikkiso Co Ltd. and Terumo BCT Inc. (Terumo Corporation) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the apheresis equipment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global apheresis equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the apheresis equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The apheresis equipment market was valued at USD 2.83 Billion in 2024.

The apheresis equipment market is projected to exhibit a CAGR of 7.63% during 2025-2033, reaching a value of USD 5.67 Billion by 2033.

The market is driven by the increasing incidence of chronic and autoimmune diseases, rising demand for blood components, and continuous technological advancements that enhance safety, efficiency, and accuracy of apheresis procedures.

North America currently dominates the apheresis equipment market, accounting for a share of 35.0% in 2024, driven by high disease prevalence, advanced healthcare infrastructure, and supportive reimbursement policies.

Some of the major players in the apheresis equipment market include Asahi Kasei Corporation, B. Braun Melsungen Aktiengesellschaft, Baxter International Inc., Fresenius Kabi Aktiengesellschaft (Fresenius SE & Co. KGaA), Haemonetics Corporation, Hemacare Corporation (Charles River Laboratories Inc.), Kaneka Corporation, Kawasumi Laboratories Inc., Medica SpA, Nikkiso Co Ltd., Terumo BCT Inc. (Terumo Corporation), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)