Application Delivery Controller Market Size, Share, Trends and Forecast by Type, Component, Organization Size, Vertical, and Region, 2025-2033

Application Delivery Controller Market Size and Share:

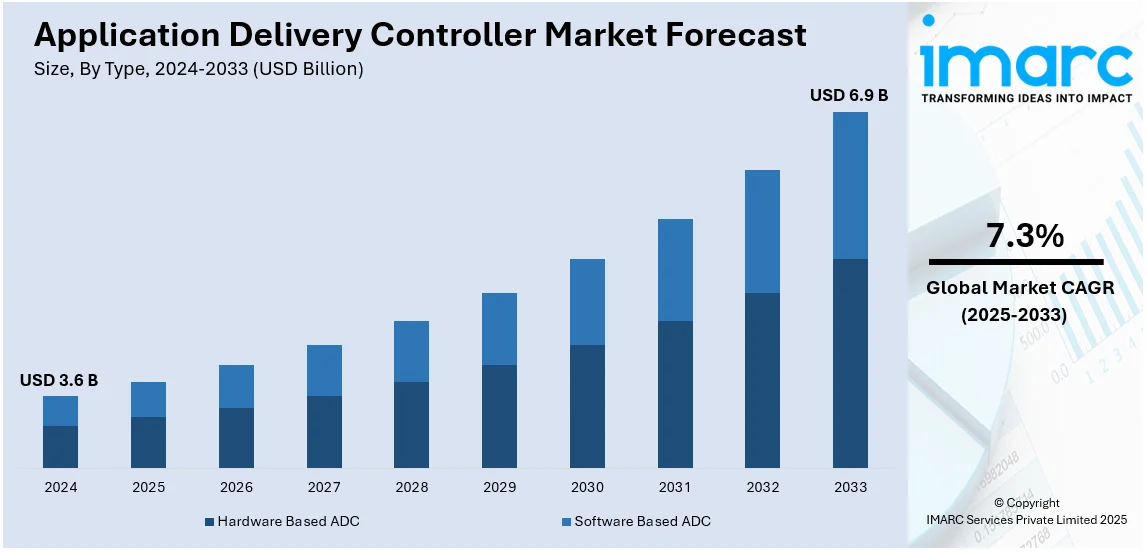

The global application delivery controller market size was valued at USD 3.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.9 Billion by 2033, exhibiting a CAGR of 7.3% from 2025-2033. North America currently dominates the market, holding a market share of over 34.6% in 2024. The heightened requirement for enhanced user performance and application deployment, increasing occurrence of cyber security breaches to access confidential information of businesses, and rising utilization of high speed uninterrupted communication channels represent some of the key factors propelling the application delivery controller market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.6 Billion |

|

Market Forecast in 2033

|

USD 6.9 Billion |

| Market Growth Rate (2025-2033) | 7.3% |

The growth of cloud computing has significantly impacted the application delivery controller market demand. As more companies move their workloads to the cloud or adopt hybrid cloud infrastructures, the demand for ADCs has risen to ensure efficient traffic management between cloud environments and on-premises systems. A recent forecast from the International Data Corporation (IDC) predicts that global expenditure on public cloud services will total $805 billion in 2024, with the market size set to double by 2028. This shift towards the cloud requires robust ADC solutions to manage traffic, ensure high availability, and secure applications. Additionally, recent data predicts that about 70% of enterprises will use multiple cloud providers by 2025, further driving the need for ADCs to enable seamless, high-performance application delivery across various cloud platforms. This growth in multi-cloud adoption is pushing organizations to seek advanced ADCs that can handle complex, dynamic traffic flows while maintaining optimal performance and security. The increasing reliance on cloud computing technologies for digital transformation initiatives underscores the importance of ADCs in managing the efficient delivery of cloud-hosted applications.

In the United States, several factors are driving the application delivery controller market growth. The increasing adoption of cloud computing is a primary catalyst, as businesses in the U.S. continue to move towards hybrid and multi-cloud environments. In addition, the surge in e-commerce and digital services across the U.S. has increased the need for dependable, fast, and secure application delivery solutions. According to the U.S. Department of Commerce, e-commerce sales hit $1.119 trillion in 2023, significantly fueling the adoption of ADC solutions to handle the growing volume of online traffic. Additionally, the growing focus on cybersecurity is pushing the need for ADCs, as they provide integrated security features like DDoS protection and secure application delivery. With cyberattacks becoming more frequent, the U.S. Department of Homeland Security (DHS) has emphasized the need for robust digital defense mechanisms, further driving ADC adoption to mitigate risks. Together, these factors make the ADC market in the United States a key area of growth in the global landscape.

Application Delivery Controller Market Trends:

Increasing Demand for Enhanced Application Performance and Availability

As companies are scaling and deploying complex application architectures, the requirement to ensure efficient performance and user satisfaction is becoming paramount. Application delivery controllers (ADCs), play a major part in the management and distribution of client traffic among servers, thereby optimizing resource usage, and maintaining app health. These equipment or software solutions reduce latency, improve load balancing capabilities, and upgrade overall user experience. Moreover, as businesses are focusing on cloud computing more in the recent times, the demand for robust solutions for managing high traffic loads is increasing. According to report, 42.5 percent of EU enterprises invested in cloud computing services in 2023.

Expansion of Data Center Infrastructure

The global data center expansion is boosting the application delivery controller market share. As companies are generating and processing humongous amounts of data, the need for larger and more efficient data centers is rising. These facilities require advanced network management tools to maintain optimal performance, reliability, and security of various applications. ADCs play a major part in the data center environment by encouraging efficient load balancing, ensuring fault tolerance, and presenting seamless application delivery throughout complex network infrastructures. As per the data provided by the IMARC Group, the global data center market is expected to grow and reach USD 461.8 Billion by 2032.

Cybersecurity Concerns and Compliance Requirements

According to a report presented by Forbes in 2024, 2365 cyberattack incidents happened in 2023, with 343,338,964 victims and data breaches of approximately USD 4.45 Million on average. Increasing cyber security concerns due to the sophistication of cyber security breaches are offering a favorable application delivery controller market outlook. Cyber-attacks are becoming more frequent and intense, businesses are compelled to invest in robust security solutions for safeguarding their networks and applications. ACDs serve an important part in an organization's security architecture by presenting application level security, blocking various types of attacks, and ensuring safe data transfer.

Application Delivery Controller Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global application delivery controller market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, component, organization size, and vertical.

Analysis by Type:

- Hardware Based ADC

- Software Based ADC

As per the latest application delivery controller market outlook, hardware-based ADCs exhibits a share of 60.2% to provide unique benefits that focus mainly on speed, dependability, and protection, which are crucial for demanding network setups. One advantage of hardware-based ADCs is their capacity to manage increased throughput and handle a higher number of transactions per second compared to software ADCs. This feature is highly beneficial in settings requiring quick responses and fast data handling, like financial trading platforms and large e-commerce websites. Furthermore, hardware ADCs offer specialized processing power for traffic management, resulting in more reliable and steady performance during heavy usage.

Analysis by Component:

- Products

- Services

ADCs products enhance application delivery by strategically distributing traffic across servers. Load balancing algorithms are utilized to prevent any one server from being overloaded, maintaining steady application performance during times of high traffic. Compression, caching, and secure sockets layer (SSL) offloading are methods that decrease the burden on application servers and accelerate response times, ultimately improving the user experience as a whole and increasing application delivery controller market revenue. In March 2024, Citrix announced the launch of its new high-value offerings created to empower companies in consolidating their application delivery infrastructure via the new Citrix Platform.

Analysis by Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

SMEs today rely heavily on web-based tools and services to function and communicate with clients. From e-commerce platforms to customer relationship management (CRM) systems, application performance and availability are critical to corporate success. ADCs ensure that these applications are provided efficiently and reliably, improving the user experience and ensuring ongoing business operations, which is critical for SMEs competing with larger organizations. According to a report presented by Forbes in 2024, around 33.3 million businesses in the United States qualify as small businesses, making 99.9% of all businesses in the country.

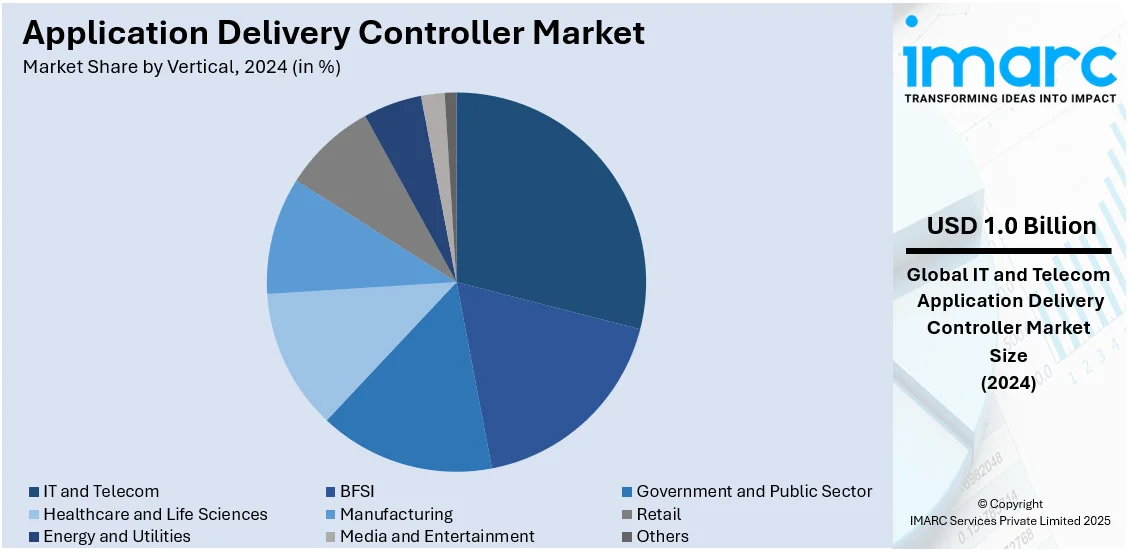

Analysis by Vertical:

- BFSI

- IT and Telecom

- Government and Public Sector

- Healthcare and Life Sciences

- Manufacturing

- Retail

- Energy and Utilities

- Media and Entertainment

- Others

IT and Telecom currently hold the highest market share of total 28.6% in the market. The high number of data transmission and communication activities handled by IT and telecom services results in massive traffic loads. ADCs optimize traffic allocation across network resources to avoid server overload and ensure smooth data flow. This capacity is critical for ensuring service quality and availability, especially during peak usage periods when the danger of network congestion and disruptions is much higher. As IT and telecom organizations adapt to cloud-based services and infrastructure virtualization, ADCs play an important role in this process. Virtual ADCs and cloud-native ADC solutions offer the flexibility required to expand and adapt to cloud settings, allowing for efficient management of dispersed and multi-cloud infrastructures.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds a total market share of 34.6%, this is due to the growing adoption of cloud computing for outsourcing processes and routine tasks has significantly contributed to the rise of the application delivery controller (ADC) market in the region. Companies in North America are increasingly investing in effective ADC solutions due to the rising frequency of cybersecurity breaches. According to AAG’s 2024 cybercrime statistics, nearly half of American internet users had their accounts hacked in 2021, and around one in 10 US organizations lack insurance against cyberattacks. Additionally, the rapid growth of IoT devices and the adoption of emerging technologies like 5G are shaping the ADC landscape in North America. ADCs will be essential in addressing the connectivity and security challenges brought about by the massive influx of connected IoT devices.

Key Regional Takeaways:

United States Application Delivery Controller Market Analysis

The Application Delivery Controller (ADC) market in the United States is experiencing robust growth, driven by several key factors. Reports indicate that 51% of businesses are currently using some type of cloud services, such as IaaS, PaaS, and SaaS. Among them, 21% rely on IaaS or PaaS either as a replacement for or a complement to their existing IT infrastructure. This growing reliance on cloud technologies is fueling the demand for advanced ADC solutions to ensure seamless application delivery, integration, and performance across diverse cloud environments. As organizations continue their digital transformation, the need for ADCs to enhance application performance, ensure high availability, and bolster security is intensifying. The proliferation of cloud-based services and the expansion of data centers further amplify the need for ADCs to manage escalating data traffic effectively. Additionally, the rise in cyber threats, such as Distributed Denial-of-Service (DDoS) attacks, has made robust security measures a priority, positioning ADCs as critical components in cybersecurity strategies. The presence of major technology companies and a competitive market landscape is also driving innovation, leading to the development of sophisticated ADC solutions tailored to specific industry requirements. Together, these factors are driving the expansion of the ADC market in the United States, establishing it as a crucial element of the country's digital infrastructure.

Europe Application Delivery Controller Market Analysis

The Application Delivery Controller (ADC) market in Europe is steadily growing, fueled by the ongoing digital transformation of businesses and the growing emphasis on cybersecurity. An article from AAG reveals that in 2023, 32% of UK businesses reported experiencing a cyber attack or breach, with the numbers rising to 59% for medium-sized businesses and 69% for large enterprises. This surge in cyber threats has made businesses more reliant on advanced ADC solutions to ensure secure and efficient application delivery. Organizations are leveraging ADCs to enhance performance, ensure high availability, and mitigate security risks. The proliferation of cloud-based services and the expansion of data centers further intensify the need for ADC solutions to handle escalating data traffic. Moreover, Europe's stringent data privacy and compliance regulations are boosting the adoption of secure ADC solutions, helping businesses adhere to regulatory requirements. The competitive market landscape and the presence of major technology companies are also fostering innovation, leading to the development of sophisticated ADC solutions tailored to diverse industry requirements. Collectively, these factors are propelling the growth of the ADC market in Europe, positioning it as a critical element in the region's digital infrastructure.

Asia Pacific Application Delivery Controller Market Analysis

The application delivery controller (ADC) market in the Asia Pacific (APAC) region is witnessing significant growth, driven by rapid urbanization, increasing internet penetration, and the widespread adoption of digital technologies. According to the Microsoft IoT Signals report, Australia leads the region with the highest rate of Internet of Things (IoT) adoption at 96%, reflecting the broader trend of digital transformation across APAC. As businesses increasingly integrate IoT solutions, the demand for ADCs to ensure seamless application delivery, enhance performance, and maintain security is rising. The proliferation of cloud-based services and the expansion of data centers are further fueling the need for ADC solutions to handle the growing data traffic efficiently. Additionally, the surge in cyber threats, such as Distributed Denial-of-Service (DDoS) attacks, has highlighted the importance of robust security, positioning ADCs as vital tools in securing applications. The competitive market landscape and the presence of major technology companies are also driving innovation in the ADC sector, tailoring solutions to the specific needs of diverse industries across APAC.

Latin America Application Delivery Controller Market Analysis

The application delivery controller (ADC) market in Latin America is experiencing growth, driven by the region's expanding focus on cybersecurity. The Latin American cybersecurity market is expected to expand at a CAGR of 7.30% between 2024 and 2032, highlighting the growing emphasis on protecting digital infrastructures. As businesses across the region embrace digital transformation, the demand for ADC solutions to optimize application delivery while ensuring security is rising. ADCs are crucial in enhancing performance, ensuring availability, and providing protection against growing cyber threats, positioning them as vital components in the cybersecurity strategies of Latin American organizations.

Middle East and Africa Application Delivery Controller Market Analysis

The application delivery controller (ADC) market in the Middle East and Africa is being driven by the rising frequency of cybersecurity incidents. According to reports, 82% of organizations in the region, including Türkiye, reported experiencing at least one cybersecurity incident between 2022 and 2024, with the majority facing multiple attacks. This escalating threat landscape has made ADC solutions essential for ensuring secure application delivery. As businesses increasingly focus on security, ADCs play a pivotal role in protecting applications from cyber threats, driving the demand for robust and efficient delivery solutions across the region.

Competitive Landscape:

As per the recent application delivery controller market forecast, key players are concentrating on innovation and broadening their service portfolios to cater to the increasing demand for effective application delivery solutions. Many major companies are enhancing their ADC solutions by integrating advanced features such as artificial intelligence (AI), machine learning (ML), and automation to improve performance, scalability, and security. These technologies help ADCs predict traffic patterns, automatically adjust to traffic loads, and optimize application delivery in real-time. Furthermore, the major players are increasing investments in cloud-native solutions, with an emphasis on multi-cloud and hybrid-cloud compatibility. This allows enterprises to manage complex cloud environments seamlessly. Companies are also integrating advanced security features such as DDoS protection, SSL offloading, and built-in Web Application Firewall (WAF) capabilities to tackle the growing cybersecurity threats that businesses worldwide are facing.

The report provides a comprehensive analysis of the competitive landscape in the application delivery controller market with detailed profiles of all major companies, including:

- A10 Networks, Inc.

- Array Networks, Inc.

- Barracuda Networks Inc. (KKR & Co Inc.)

- Cisco Systems, Inc.

- Citrix Systems Inc. (Cloud Software Group Inc.)

- F5 Networks, Inc.

- Fortinet, Inc.

- Kemp Technologies (Progress Software Corporation)

- Piolink, Inc.

- Radware Ltd. (RAD Group)

- Total Uptime Technologies, LLC

Latest News and Developments:

- October 2024: HAProxy Technologies has introduced HAProxy Fusion 1.3, a control plane for managing and automating HAProxy Enterprise deployments. The update improves performance, observability, and user experience, featuring a modern GUI, API, and integrations with AWS, Kubernetes, Consul, and Prometheus. Enhanced by machine learning and threat intelligence from HAProxy Edge, it strengthens security across the platform.

- October 2024: F5 has launched BIG-IP Next for Kubernetes, an AI-driven application delivery and security solution designed for service providers and large enterprises. The solution utilizes NVIDIA BlueField-3 DPUs to optimize data center traffic for large-scale AI deployments. By providing a unified view of networking, traffic management, and security, it enhances infrastructure efficiency and accelerates AI inference, improving overall AI application performance and customer experience.

- November 2023: Radware Ltd., announced the expansion of its security and application delivery solutions for a leading Asia-Pacific government office that is chartered to oversee its nation’s information technology infrastructure and services.

- April 2023: A10 Networks has introduced a unified solution featuring its Thunder® Application Delivery Controller (ADC) and the A10 Next-Generation Web Application Firewall (WAF), powered by Fastly, to improve security and resilience in hybrid cloud environments. This integrated solution automates security, reduces false positives, and improves cloud economics by securing application ingress points.

- January 2023: Hillstone Networks has launched version 3.0 of its Application Delivery Controller (ADC), which, together with its Web Application Firewall (WAF), offers robust enterprise-level security for web servers, applications, and APIs. With the rapid growth of web applications and rising cybersecurity threats, Gartner reported that 84% of security breaches occurred in applications.

Application Delivery Controller Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hardware Based ADC, Software Based ADC |

| Components Covered | Products, Services |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises (SMEs) |

| Verticals Covered | BFSI, IT and Telecom, Government and Public Sector, Healthcare and Life Sciences, Manufacturing, Retail, Energy and Utilities, Media and Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A10 Networks, Inc., Array Networks, Inc., Barracuda Networks Inc. (KKR & Co Inc.), Cisco Systems, Inc., Citrix Systems Inc. (Cloud Software Group Inc.), F5 Networks, Inc., Fortinet, Inc., Kemp Technologies (Progress Software Corporation), Piolink, Inc., Radware Ltd. (RAD Group), Total Uptime Technologies, LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the application delivery controller market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global application delivery controller market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the application delivery controller industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The application delivery controller market was valued at USD 3.6 Billion in 2024.

IMARC estimates the application delivery controller market to exhibit a CAGR of 7.3% during 2025-2033, reaching USD 6.9 Billion by 2033.

The heightened requirement for enhanced user performance and application deployment, increasing occurrence of cyber security breaches to access confidential information of businesses, and rising utilization of high speed uninterrupted communication channels represent some of the key factors propelling the market growth.

North America currently dominates the market, driven by the increasing adoption of cloud computing activities among businesses to streamline operations and allocate routine tasks.

Some of the major players in the application delivery controller market include A10 Networks, Inc., Array Networks, Inc., Barracuda Networks Inc. (KKR & Co Inc.), Cisco Systems, Inc., Citrix Systems Inc. (Cloud Software Group Inc.), F5 Networks, Inc., Fortinet, Inc., Kemp Technologies (Progress Software Corporation), Piolink, Inc., Radware Ltd. (RAD Group), Total Uptime Technologies, LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)