Application Performance Management Market Report by Platform Type (Software, Service), Deployment Mode (On-premises, Cloud, Hybrid), Enterprise Size (Small and Medium Business, Large Enterprises), Access Type (Web APM, Mobile APM), and Region 2025-2033

Application Performance Management Market Size:

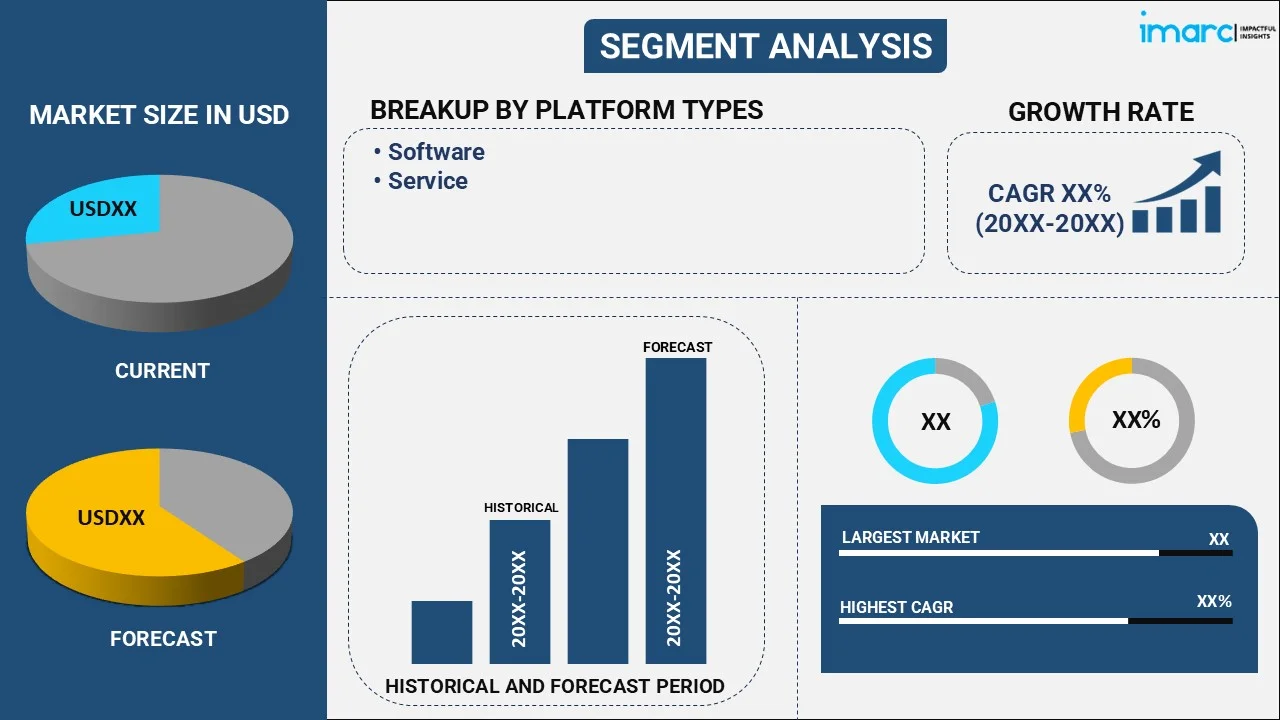

The global application performance management market size reached USD 7.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 20.0 Billion by 2033, exhibiting a growth rate (CAGR) of 10.55% during 2025-2033. The market is experiencing steady growth driven by the rising complexities of applications and the need to resolve performance issues, increasing focus on cloud computing, as it offers improved scalability, flexibility, and cost-efficiency, and the growing need for enhanced user experience.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.7 Billion |

| Market Forecast in 2033 | USD 20.0 Billion |

| Market Growth Rate (2025-2033) | 10.55% |

Application Performance Management Market Analysis:

- Market Growth and Size: The market is witnessing strong growth on account of the increasing remote work settings, along with the rising awareness about the importance of application performance management (APM) in development and operations (DevOps).

- Technological Advancements: The integration of artificial intelligence (AI) and machine learning (ML) enables predictive and proactive performance management.

- Industry Applications: APM is widely employed in the finance, healthcare, and manufacturing industries.

- Geographical Trends: North America leads the market, driven by the presence of many technology hubs and major tech companies. However, Asia Pacific is emerging as a fast-growing market due to the increasing adoption of digital services.

- Competitive Landscape: Companies are developing and integrating cloud APM solutions to monitor applications hosted in cloud environments effectively.

- Challenges and Opportunities: While the market faces challenges, such as managing performance in hybrid and multi-cloud environments, it also encounters opportunities in optimizing conversion rates.

- Future Outlook: The future of the application performance management market looks promising, with the rising focus on enhanced sustainability. In addition, the increasing need to deliver seamless and responsive digital experiences is anticipated to bolster the market growth.

To get more information on this market, Request Sample

Application Performance Management Market Trends:

Rising complexity of applications

Modern applications have various complexities due to the incorporation of numerous components and third-party services. In addition, the rising adoption of microservices architecture, containerization, and the use of multiple application programming interfaces (APIs) is propelling the growth of the market. Apart from this, as applications span multiple platforms, devices, and networks, maintaining optimal performance is becoming a challenge. Moreover, APM solutions address this challenge by providing real-time monitoring, diagnostics, and analytics. They help organizations track and analyze every component of their applications, ranging from servers and databases to third-party integrations. APM tools enable organizations to proactively resolve issues, reduce downtime, and enhance user satisfaction by offering insights into performance and dependencies. Besides this, the increasing utilization of mobile and the Internet of Things (IoT) applications among the masses across the globe is supporting the market growth. Additionally, organizations are adopting integration and continuous deployment (CI/CD) practices to deliver updates and features rapidly. APM tools need to seamlessly integrate into CI/CD pipelines to monitor application performance throughout the development and release cycle.

Growing need for enhanced user experience

The rising need for enhanced user experience is contributing to the growth of the market. In line with this, people are increasingly focusing on seamless and responsive applications. Moreover, APM assists in monitoring the end-to-end journey of individuals. It provides visibility into user interactions, load times, and transaction performance. It also allows organizations to identify areas for improvement, ensuring that applications meet or exceed user expectations. Apart from this, APM tools help in tracking the impact of performance improvements on user satisfaction and business metrics. Furthermore, the increasing adoption of APM to deliver applications that not only function efficiently but also provide an engaging user experience is strengthening the market growth. Besides this, APM tools help organizations proactively identify and resolve performance issues, minimizing revenue loss due to application-related problems. In addition, APM solutions can assist client support teams by identifying and diagnosing performance-related issues. Resolving these issues can reduce support requests, leading to cost savings and improved relationships.

Increasing focus on cloud computing

The rising number of cloud-based applications is bolstering the growth of the market. In line with this, cloud computing offers improved scalability, flexibility, cost-efficiency, and introduces new challenges in terms of monitoring and managing application performance. Moreover, APM solutions are vital in cloud-based scenarios, as they allow organizations to monitor applications across various cloud platforms and ensure consistent performance. Besides this, APM tools provide insights into the performance of applications hosted on different cloud providers. It also helps in optimizing resource allocation, identifying cloud-related bottlenecks, and managing costs. Furthermore, various organizations are adopting multi-cloud strategies to avoid vendor lock-in and improve resilience. APM tools monitor applications hosted on different cloud platforms, providing unified insights while facilitating performance optimization across multiple cloud providers. In addition, cloud-based applications require robust security and compliance monitoring. APM solutions integrate security monitoring capabilities to help detect and respond to security threats that could impact application performance.

Application Performance Management Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on platform type, deployment mode, enterprise size, and access type.

Breakup by Platform Type:

- Software

- Service

- Deployment and Integration

- Training and Education

- Support and Maintenance

Software accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the platform type. This includes software and service (deployment and integration, training and education, and support and maintenance). According to the report, software represented the largest segment.

Software-based APM solutions are tools, applications, and platforms that organizations deploy to monitor and manage the performance of their applications. They include various software offerings, such as APM suites, application monitoring software, and performance analytics tools. They provide real-time insights into application performance, transaction tracing, code-level diagnostics, and user experience monitoring. They are designed to help businesses identify and resolve performance issues, optimize application performance, and enhance user satisfaction.

Service-based APM includes APM consulting, system integration, deployment, training, and ongoing support. Service-based APM offerings are crucial for organizations looking to adopt APM solutions but may lack the in-house expertise or resources for successful implementation.

APM service providers work closely with clients to assess their specific needs, customize APM solutions, and ensure their optimal performance. Service-based APM is valuable for organizations seeking to maximize the return on their APM investments by leveraging the expertise of experienced professionals.

Breakup by Deployment Mode:

- On-premises

- Cloud

- Hybrid

Cloud holds the largest market share

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises, cloud, and hybrid. According to the report, cloud accounted for the largest market share.

Cloud solutions are hosted and delivered through cloud infrastructure. Organizations access these solutions via the internet on a subscription basis. This segment includes APM tools and services that are entirely cloud-native, designed to monitor applications hosted in cloud environments, or offered as software as a service (SaaS). Cloud-based APM provides scalability, flexibility, and ease of deployment without the need for significant on-premises infrastructure. Organizations benefit from rapid deployment, automatic updates, and the ability to monitor applications across various cloud platforms and regions.

On-premises APM solutions are deployed within data centers or physical infrastructure of a company, rather than relying on cloud resources. They include traditional APM tools that are installed and managed on the hardware, servers, and network infrastructure of an organization. On-premises APM offers enhanced control and customization options for organizations that have specific security or compliance requirements. They are suitable for organizations with established on-premises information technology (IT) environments.

Hybrid APM solutions bridge the gap between cloud and on-premises deployments. They allow organizations to monitor applications that span both cloud and on-premises environments. They include APM solutions that offer flexibility in deployment, enabling organizations to monitor applications wherever they are hosted. They are valuable for companies that have a mix of cloud-hosted and on-premises applications, as they provide a unified view of application performance across all environments. They allow organizations to optimize performance, troubleshoot issues, and ensure consistent user experiences regardless of the deployment location.

Breakup by Enterprise Size:

- Small and Medium Business

- Large Enterprises

Large enterprises represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes small and medium business and large enterprises. According to the report, large enterprises represented the largest segment.

Large enterprises are organizations with extensive operations, large workforces, and huge revenue streams. They include comprehensive APM solutions that cater to the complex infrastructure and diverse application landscape of large enterprises. APM solutions for large enterprises offer advanced features, scalability, and customization options to meet the specific requirements of these organizations. They provide detailed insights into application performance, including transaction tracing, code-level diagnostics, and extensive analytics capabilities. Large enterprises rely on APM to support critical business applications, enhance user experience, and proactively manage performance across a broad range of applications and environments.

Small and medium businesses (SMBs) comprise businesses with a relatively smaller workforce and revenue as compared to large enterprises. They include APM solutions tailored to the needs and budgets of smaller organizations, making them accessible and cost-effective. SMBs are seeking APM solutions that are easy to deploy and manage, require fewer resources, and provide essential monitoring and diagnostic capabilities. These businesses rely on APM to ensure the performance of critical applications, optimize user experience, and address performance issues promptly.

Breakup by Access Type:

- Web APM

- Mobile APM

Web APM exhibits a clear dominance in the market

The report has provided a detailed breakup and analysis of the market based on the access type. This includes web APM and mobile APM. According to the report, web APM represented the largest segment.

Web APM solutions focus on monitoring and optimizing the performance of web-based applications, websites, and online services accessed through web browsers. They include APM tools and services designed to analyze and improve the performance of web applications, content delivery, and user interactions on websites. They track metrics, such as page load times, server response times, render performance, and user experience, to ensure fast and reliable web application delivery. Organizations rely on web APM to enhance the performance of their web-based services, reduce bounce rates, improve search engine optimization (SEO) rankings, and provide a seamless browsing experience to users.

Mobile APM solutions are specifically tailored to monitor and optimize the performance of mobile applications on smartphones, tablets, and other mobile devices. They include APM tools and services that capture data related to mobile app performance, including load times, responsiveness, crash reports, and user engagement metrics. Mobile APM is essential for organizations with mobile apps as it helps identify and resolve issues impacting app performance, ensuring a positive user experience.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest application performance management market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share due to the presence of various technology hubs and major tech companies. In addition, escalating demand for advanced APM solutions to ensure optimal performance in a firm is supporting the market growth. Besides this, the rising focus on enhancing the user experience is impelling the market growth.

Asia Pacific stands as another key region in the market, driven by the increasing adoption of digital services. In line with this, the presence of a strong IT infrastructure in the region is contributing to the growth of the market.

Europe maintains a strong presence in the market, with the rising need for cloud services in organizations. Additionally, the growing demand for APM solutions to ensure the seamless functioning of critical applications is offering a positive market outlook. Furthermore, the increasing focus on data protection is propelling the market growth.

Latin America exhibits growing potential in the application performance management market on account of the rising adoption of digital services in companies. Apart from this, the increasing development of APM solutions that address evolving performance challenges is bolstering the market growth.

The Middle East and Africa region shows a developing market for application performance management, primarily driven by the growing need for APM solutions to ensure the performance and reliability of digital services and applications. Moreover, the rising number of data centers in the region is impelling the market growth.

Leading Key Players in the Application Performance Management Industry:

Key players are investing in research and development (R&D) activities to enhance their solutions. They are working on improving features, such as real-time monitoring, diagnostics, analytics, and automation, to provide more comprehensive and effective APM tools. In line with this, companies are developing and integrating cloud native APM solutions to monitor applications hosted in cloud environments effectively. They are focusing on providing seamless coverage across on-premises and cloud deployments. Furthermore, they are incorporating artificial intelligence (AI) and machine learning (ML) capabilities into their tools. These technologies help predict and proactively address performance issues, reduce downtime, and improve efficiency. Besides this, major companies are incorporating security monitoring features into their solutions to help detect and respond to security threats.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Akamai Technologies Inc.

- AppDynamics (Cisco Systems Inc.)

- BMC Software Inc.

- Broadcom Inc.

- Datadog Inc.

- Dynatrace LLC

- IBM Corporation

- OpenText Corporation

- Microsoft Corporation

- New Relic Inc.

- Oracle Corporation

- Riverbed Technology

- Splunk Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- May 2, 2023: New Relic Inc announced New Relic AI, the generative AI assistant for observability. New Relic AI reduces the toil of manually sifting through data, makes observability accessible to all regardless of prior experience, and unlocks insights from any telemetry data source.

- April 29, 2021: IBM Corporation announced a definitive agreement to acquire Turbonomic, the acquisition will provide businesses with full stack application observability and management to assure performance and minimize costs using AI to optimize resources. This will ensure that they can dynamically and more efficiently assess and manage the performance of any application, anywhere.

- June 14, 2022: AppDynamics (Cisco Systems Inc.) launched AppDynamics Cloud at Cisco Live, the premiere networking and security event. AppDynamics Cloud enables delivery of exceptional digital experiences by correlating telemetry data from across any cloud environment at massive scale. It leverages cloud-native observability to remediate application performance issues with business context and insights-driven actions.

Application Performance Management Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platform Types Covered |

|

| Deployment Modes Covered | On-premises, Cloud, Hybrid |

| Enterprise Sizes Covered | Small and Medium Business, Large Enterprises |

| Access Types Covered | Web APM, Mobile APM |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Akamai Technologies Inc., AppDynamics (Cisco Systems Inc.), BMC Software Inc., Broadcom Inc., Datadog Inc., Dynatrace LLC, IBM Corporation, OpenText Corporation, Microsoft Corporation, New Relic Inc., Oracle Corporation, Riverbed Technology, Splunk Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the application performance management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global application performance management market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the application performance management industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The application performance management market was valued at USD 7.7 Billion in 2024.

The application performance management market is projected to exhibit a CAGR of 10.55% during 2025-2033, reaching a value of USD 20.0 Billion by 2033.

The application performance management market is expanding owing to the increasing complexity of IT environments, growing reliance on cloud-based services, and rising demand for seamless digital experiences. Businesses seek real-time monitoring, enhanced user satisfaction, and reduced downtime. Additionally, the need for data-driven insights and efficient resource utilization is accelerating adoption across various industries.

North America currently dominates the application performance management market, due to its sophisticated IT framework, extensive use of cloud technologies, and robust presence of leading companies. Additionally, the region benefits from increased digital transformation initiatives and growing demand for optimized user experiences.

Some of the major players in the application performance management market include Akamai Technologies Inc., AppDynamics (Cisco Systems Inc.), BMC Software Inc., Broadcom Inc., Datadog Inc., Dynatrace LLC, IBM Corporation, OpenText Corporation, Microsoft Corporation, New Relic Inc., Oracle Corporation, Riverbed Technology, Splunk Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)