Aramid Fiber Market Report by Product Type (Meta-Aramid Fiber, Para-Aramid Fiber, and Others), Application (Protective Fabrics, Frictional Materials, Optical Fibers, Tire Reinforcement, Rubber Reinforcement, Composites, and Others), End-Use Industry (Aerospace and Defense, Automotive, Electronics and Telecommunication, Sports Goods, and Others), and Region 2025-2033

Market Overview:

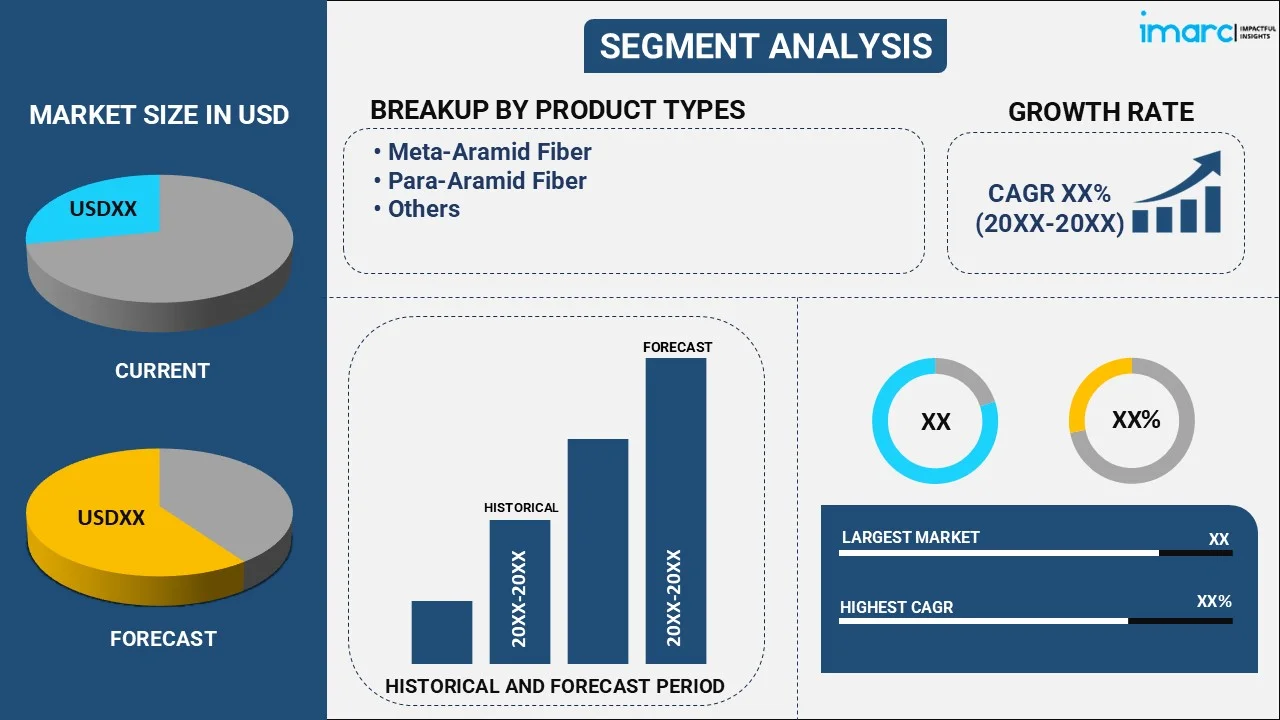

The global aramid fiber market size reached USD 4.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.1 Billion by 2033, exhibiting a growth rate (CAGR) of 2.7% during 2025-2033. The implementation of stringent regulatory standards and safety regulations, the widespread adoption of the product in the production of sporting goods, and the development of new fabrication techniques are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.0 Billion |

|

Market Forecast in 2033

|

USD 5.1 Billion |

| Market Growth Rate 2025-2033 | 2.7% |

Aramid fiber is a synthetic, heat-resistant, high-strength fiber widely used in various industrial applications. Composed of long-chain polyamide molecules, aramid fibers are renowned for their exceptional tensile strength, lightweight properties, and thermal stability. These attributes make aramid fibers essential in products that require advanced durability and resistance to wear and tear. They are commonly found in aerospace, automotive, and protective clothing industries, such as manufacturing bulletproof vests and fire-resistant garments. The fibers' resistance to chemicals, environmental degradation, and fatigue further amplifies their versatility and application in various fields. Aramid fiber is a vital material, contributing to safety, efficiency, and innovation in numerous sectors.

To get more information on this market, Request Sample

The renewable energy sector, particularly wind energy, is experiencing substantial growth, contributing to the increased demand for aramid fibers. The fibers' strength and fatigue resistance make them ideal for manufacturing wind turbine blades, ensuring stability and long-term operation. Along with this, stringent regulatory standards and safety regulations are further driving the overall industry. Governments and regulatory bodies around the world are implementing policies that emphasize workplace safety, environmental protection, and energy efficiency. These regulations often necessitate the use of materials, such as aramid fibers, known for their strength, safety, and sustainability. In addition, aramid fibers are increasingly being customized for specific applications and niche markets. Tailoring the fibers to meet particular industrial needs and standards is positively influencing the market. Apart from this, the widespread adoption of aramid fibers in the production of sporting goods and recreation equipment is contributing to the market. Moreover, the development of new fabrication techniques allowing for higher-quality fibers with enhanced properties is creating a positive market outlook.

Aramid Fiber Market Trends/Drivers:

Increased Product Demand in Aerospace and Defense Sectors

The aramid fiber industry is witnessing significant growth due to the increased demand from aerospace and defense sectors. Aramid fibers possess exceptional strength-to-weight ratio, heat resistance, and durability, making them a preferred choice for manufacturing components in aircraft and military equipment. The development of new aircraft models and upgrading existing military technology necessitates advanced materials capable of withstanding extreme conditions. Aramid fibers meet these requirements, offering solutions that ensure safety, reliability, and performance. Governments around the world are investing heavily in modernizing their defense systems, which includes adopting materials. Additionally, the commercial aviation sector's expansion and focus on energy-efficient solutions drive the demand for aramid fibers. As more lightweight and robust materials are required for components, aramid fibers emerge as a critical solution, fueling the growth of the industry.

Rising Product Adoption in Automotive Industry

Another significant driver for the overall industry is its rising adoption within the automotive industry. The automotive manufacturers' focus on enhancing fuel efficiency, reducing emissions, and improving vehicle performance has led to the integration of the product in various automotive parts. These fibers' lightweight properties contribute to the overall weight reduction of vehicles, consequently improving fuel economy. Additionally, aramid fibers' thermal stability and resistance to wear are vital in manufacturing brake pads, tires, and other high-stress components, ensuring longevity and safety. As the global automotive industry continues to evolve towards more sustainable and efficient solutions, the demand for the product is anticipated to grow, providing ample opportunities for growth in the market.

Development of New Industrial Applications

The development of new industrial applications for aramid fibers is a key driver for the market. The versatile nature of the product variant has led to their use in various industries such as construction, oil and gas, and electronics. In the construction industry, aramid fibers are used to reinforce concrete, enhancing its strength and durability. In the oil and gas sector, their resistance to chemicals and environmental degradation makes them suitable for use in various exploration and extraction processes. The emergence of new technologies and innovations in different industries often leads to the creation of unique applications where aramid fibers' characteristics can be leveraged. This constant evolution of applications continues to expand the market for aramid fibers, driving growth.

Aramid Fiber Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global aramid fiber market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on product type, application and end-use industry.

Breakup by Product Type:

- Meta-Aramid Fiber

- Para-Aramid Fiber

- Others

Para-aramid fiber dominates the market

The report has provided a detailed breakup and analysis of the market based on the product type. This includes meta-aramid fiber, para-aramid fiber, and others. According to the report, para-aramid fiber represented the largest segment.

Market drivers play a pivotal role in shaping the dynamics of the para-aramid fiber segment within the overall industry. The demand for para-aramid fibers is propelled by their exceptional mechanical properties, including high tensile strength and heat resistance, rendering them ideal for applications requiring robust materials. Industries such as aerospace, defense, automotive, and construction are increasingly integrating para-aramid fibers in various applications, contributing to the growth of the market. Furthermore, the rising emphasis on lightweight and durable materials to enhance fuel efficiency and safety standards further boosts the adoption of para-aramid fibers in manufacturing. As these fibers demonstrate exceptional resistance to chemicals and abrasion, they find utility in protective apparel and industrial equipment. These factors collectively underscore the substantial market drivers fueling the expansion of the para-aramid fiber product type in the aramid fiber industry, reflecting the evolving needs of diverse sectors seeking reliable and innovative solutions.

Breakup by Application:

- Protective Fabrics

- Frictional Materials

- Optical Fibers

- Tire Reinforcement

- Rubber Reinforcement

- Composites

- Others

Protective fabrics hold the largest share in the market

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes protective fabrics, frictional materials, optical fibers, tire reinforcement, rubber reinforcement, composites, and others. According to the report, protective fabrics accounted for the largest market share.

The market drivers for protective fabrics application within the overall industry are instrumental in shaping the industry's growth trajectory. The escalating demand for protective fabrics is primarily propelled by stringent safety regulations across various sectors, such as industrial, military, and firefighting. Aramid fibers, known for their exceptional flame resistance and high strength-to-weight ratio, have positioned themselves as an ideal choice for crafting protective fabrics that offer reliable shielding against thermal hazards and abrasion. Moreover, the increasing awareness regarding personal safety and the growing need for advanced protective gear in hazardous environments amplify the demand for aramid-based protective fabrics. Along with this, the continuous advancements in manufacturing technologies have enabled the production of lightweight yet robust fabrics, enhancing comfort without compromising on protection. This alignment of safety standards and technological innovations serves as a significant driver, propelling the adoption of protective fabrics within the overall industry.

Breakup by End-Use Industry:

- Aerospace and Defense

- Automotive

- Electronics and Telecommunication

- Sports Goods

- Others

Automotive industry dominates the market

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes aerospace and defense, automotive, electronics and telecommunication, sports goods and others. According to the report, automotive represented the largest segment.

The automotive end-use industry within the overall sector is driven by a confluence of compelling market drivers that are shaping its growth trajectory. The automotive sector's increasing emphasis on lightweighting to improve fuel efficiency and reduce emissions has stimulated the adoption of the product. These fibers possess remarkable tensile strength and rigidity, allowing them to replace traditional materials like steel or aluminum in various components, thereby reducing overall vehicle weight. Additionally, the automotive industry's growing focus on safety and crashworthiness has led to the incorporation of the product in critical components such as airbags, seat belts, and reinforced structural parts. The ability of the product to maintain their integrity under extreme conditions, coupled with their resistance to heat and impact, positions them as an indispensable material for enhancing vehicle safety standards. These factors, aligned with advancements in manufacturing techniques and a drive for sustainable materials, drive the adoption of the product in the automotive end-use industry, making it a significant contributor to the overall growth of the overall market.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe exhibits a clear dominance, accounting for the largest aramid fiber market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe represented the largest share.

The industry in Europe is propelled by the region's stringent regulations and standards regarding safety, especially in sectors, such as aerospace, automotive, and defense, where aramid fibers find extensive application due to their exceptional fire-resistant and high-strength properties. Additionally, the growing demand for lightweight materials to enhance fuel efficiency aligns with the product’s ability to provide structural integrity without adding excessive weight. The expanding market for protective clothing and equipment in industrial sectors further bolsters the demand for overall market. Technological advancements and research investments in material science contribute to the development of innovative aramid fiber applications, fostering the industry's expansion.

Furthermore, the emphasis on sustainable and eco-friendly materials amplifies the adoption of aramid fibers, given their recyclability and durability. These collective factors underscore the influential role of market drivers in propelling the overall industry's growth in Europe, positioning it as a resilient and transformative sector in the region's industrial landscape.

Competitive Landscape:

The global aramid fiber market is experiencing significant growth due to escalating strategies and initiatives to capitalize on the industry's potential and meet evolving demands. Along with this, the growing focus on research and development to enhance the performance characteristics of the product, seeking to innovate and create advanced materials suitable for diverse applications. These companies also invest in cutting-edge manufacturing technologies to optimize production processes, improve product quality, and ensure cost-effectiveness. In addition, market-leading companies are expanding their product portfolios to cater to a wider range of industries, such as automotive, aerospace, and protective gear manufacturing. They collaborate with end-users to develop tailored solutions that address specific needs, leveraging the inherent strength, heat resistance, and lightweight properties of aramid fibers. Apart from this, sustainability is another key area of focus. Companies are increasingly emphasizing environmentally friendly production methods, exploring ways to recycle and repurpose aramid fiber waste, and reducing their carbon footprint. These efforts align with the growing demand for sustainable materials across industries. Furthermore, strategic partnerships, mergers, and acquisitions are contributing to the market.

The report has provided a comprehensive analysis of the competitive landscape in the global aramid fiber market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- DuPont de Nemours, Inc.

- Huvis Corp.

- Hyosung Corporation

- Kolon Industries, Inc.

- Sinochem Holdings Corporation Ltd.

- Suzhou Zhaoda Specially Fiber Technical Co., Ltd.

- Taekwang Industrial Co., Ltd. (Taekwang Group)

- Tayho Advanced Materials Group Co., Ltd.

- Teijin Limited

- Toray Industries, Inc.

Recent Developments:

- In October 2021, Teijin accomplished yarn-to-yarn recycling for Twaron fibre, its main product. The objective of Teijin Aramid to provide entirely circular high-performance fibre has been advanced with this breakthrough.

- In April 2023, DuPont de Nemours Inc. released Kevlar EXO aramid fibre, the most important advancement in aramid fibre in more than 50 years. This brand-new technological platform was created to serve a wide range of applications where protection and performance are needed under difficult and demanding circumstances.

- In June 2023, Kolon Industries revealed plans to expand its Gumi factory to increase production of its para-aramid products by the end of this year in order to meet soaring demand.

Aramid Fiber Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Meta-Aramid Fiber, Para-Aramid Fiber, Others |

| Applications Covered | Protective Fabrics, Frictional Materials, Optical Fibers, Tire Reinforcement, Rubber Reinforcement, Composites, Others |

| End Use Industries Covered | Aerospace and Defense, Automotive, Electronics and Telecommunication, Sports Goods, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | DuPont de Nemours, Inc., Huvis Corp., Hyosung Corporation, Kolon Industries, Inc., Sinochem Holdings Corporation Ltd., Suzhou Zhaoda Specially Fiber Technical Co., Ltd., Taekwang Industrial Co., Ltd. (Taekwang Group), Tayho Advanced Materials Group Co., Ltd., Teijin Limited, Toray Industries, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the aramid fiber market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global aramid fiber market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the aramid fiber industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global aramid fiber market was valued at USD 4.0 Billion in 2024.

We expect the global aramid fiber market to exhibit a CAGR of 2.7% during 2025-2033.

The growing adoption of lightweight materials, across the automotive, aerospace, construction, and defense sectors, is primarily driving the global aramid fiber market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary closure of numerous end-use industries for aramid fibers.

Based on the product type, the global aramid fiber market can be segmented into meta-aramid fiber, para-aramid fiber, and others. Currently, para-aramid fiber holds the majority of the total market share.

Based on the application, the global aramid fiber market has been divided into protective fabrics, frictional materials, optical fibers, tire reinforcement, rubber reinforcement, composites, and others. Among these, protective fabrics exhibit a clear dominance in the market.

Based on the end-use industry, the global aramid fiber market can be categorized into aerospace and defense, automotive, electronics and telecommunication, sports goods, and others. Currently, the automotive industry accounts for the largest market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where Europe currently dominates the global market.

Some of the major players in the global aramid fiber market include DuPont de Nemours, Inc., Huvis Corp., Hyosung Corporation, Kolon Industries, Inc., Sinochem Holdings Corporation Ltd., Suzhou Zhaoda Specially Fiber Technical Co., Ltd., Taekwang Industrial Co., Ltd. (Taekwang Group), Tayho Advanced Materials Group Co., Ltd., Teijin Limited, Toray Industries, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)