Archery Equipment Market Size, Share, Trends and Forecast by Product, End User, Distribution Channel, and Region, 2025-2033

Archery Equipment Market Size and Share:

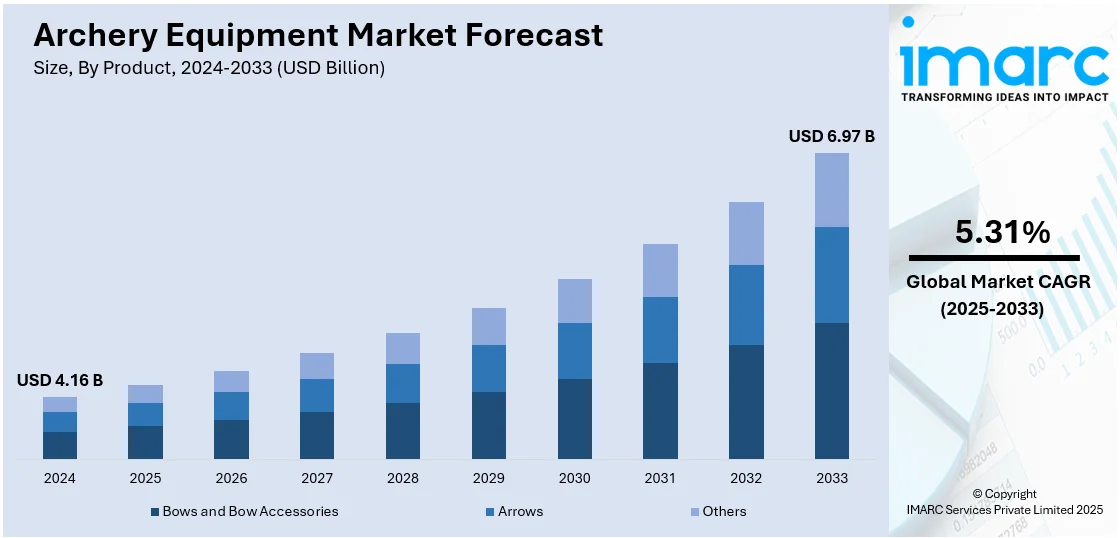

The global archery equipment market size was valued at USD 4.16 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.97 Billion by 2033, exhibiting a CAGR of 5.31% from 2025-2033. North America currently dominates the market, holding a market share of over 38.0% in 2024. The market is propelled by a deep-rooted tradition of hunting, extensive recreational and competitive archery participation, and institutional backing via schools and sports bodies. A strong presence of major manufacturers driven by innovation and an established network of retailers operating across both offline and online mediums amplified accessibility and product availability. All these in combination make North America the front-runner in the archery equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.16 Billion |

|

Market Forecast in 2033

|

USD 6.97 Billion |

| Market Growth Rate 2025-2033 | 5.31% |

Globally, the growing trend of archery as a recreational activity and competitive sport is a strong motivator for the archery equipment market. From various age groups, people are taking up archery for its physical, mental, and social advantages. The game is a mix of concentration, discipline, and accuracy that is attractive in a digital age with acceleration of pace where individuals are looking for substantive activities outdoors. Furthermore, recognition of archery across the world through international sporting competitions has helped to raise its profile, making more people engage and enroll in training. For example, in July 2024, Hyundai Motor introduced "The Path of An Archer," an interactive archery experience at Hyundai Motorstudio Goyang, with cutting-edge technology like a self-adjusting shooting robot and tailored 3D-printed bow grips. Furthermore, most nations are now adding archery to school and community programs, further broadening the number of active participants. This continued interest, along with the accessibility of varied equipment designed for beginners and experts alike, is helping drive greater global demand. Consequently, the market for archery equipment still enjoys increasing numbers of committed consumers around the globe.

In 2024, the United States held 89.50% share of the North American archery equipment market outlook, which was a testament to its leading role fueled by an entrenched cultural heritage of bowhunting and outdoor recreation. Bowhunting in America is not just a favored sport but also an ancient heritage activity that captures values of self-sufficiency, environmental conservation, and self-reliance. Many states have hunting seasons specifically for archery, creating steady demand for corresponding equipment and instruction. Additionally, archery is extensively marketed through schools, recreation programs, and organized competitive events, allowing widespread participation early in life and across diverse demographics. Extensive hunting areas, complemented by organized training facilities and community outreach programs, also increase accessibility and interest in the activity. This cultural consolidation, facilitated by benevolent infrastructure and policy environments, continues to spur archery equipment market growth, cementing the United States' dominance in the North American regional market. For instance, in January 2024, new bows like Hoyt's REDWRX Carbon RX-8, Mathews LIFT Series, and Bowtech Carbon One X were launched, providing improved speed, customization, and stability, fueling growth in the archery industry.

Archery Equipment Market Trends:

Growing popularity of archery as a sport

The international archery equipment market is experiencing significant growth due to the growing popularity of archery as a sporting activity. In the 2024 NASP student survey, it was indicated that 23.5 million students were introduced to archery through the program, with a reported positive experience by 91%. With its origins firmly rooted in ancient customs, archery has developed into a contemporary, exciting sport that attracts people of all ages. The precision, concentration, and physical coordination of the sport have attracted universal attention, leading fans to look for good-quality archery equipment. As individuals seek rewarding means of spending their free time, archery provides a special combination of physical exercise and mental focus. This increasing interest has found expression in a rising demand for bows, arrows, targets, and accessories.

Rising awareness of the physical and mental well-being from archery

The worldwide market for archery equipment is witnessing a boom, fueled by rising awareness of the overall benefits of archery. Not only as a leisure activity, but also for its beneficial effect on physical health, mental well-being, and general stress relief, archery is being increasingly acknowledged. While people search for means of living healthy, well-balanced lives, archery presents a unique means of personal development. At the same time, the repetitive motions of archery help build muscular strength, hand-eye coordination, and posture. This twofold benefit of developing mental sharpness and physical well-being has seen a wide range of demographics, both veteran athletes and beginners, be drawn to it. Consequently, Flechas de Vida, introduced in May 2023 in Uruguay, aided breast cancer recovery using archery, which assisted in minimizing lymphedema and enhancing mental health. The free program has benefited 123 women, with 42 ongoing participants and more than 100 waiting to be included.

Rise of international sports events and inclusion in school curriculums

The international archery equipment market is witnessing upward movement as a result of the growth of international sports competitions based on archery and its introduction into school curricula. The visibility of archery in international competitions, including the Olympics and regional competitions, has raised the profile of the sport, attracting attention from fans and aspiring athletes globally. According to the Archery Trade Association, archery participation in the U.S. grew from 7 million in 2000 to over 19 million, as of April 2025, with youth ages 6–15 showing the highest engagement. This heightened exposure has not only cultivated a sense of admiration for archery but has also spurred demand for high-quality archery equipment to improve performance. In addition, the inclusion of archery in school curriculums has exposed the sport to a new generation of players, and thus the sport enjoys a steady demand for beginner kits. With schools and colleges increasingly appreciating the importance of offering a wide range of physical activities, archery is a skill that requires concentration, discipline, and coordination.

Archery Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global archery equipment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, end user, and distribution channel.

Analysis by Product:

- Bows and Bow Accessories

- Arrows

- Others

In 2024, bow and bow accessories dominated the global market for archery equipment with a share of 64.5% of total revenue. Their leading position is a result of ongoing improvement in design, which involves the use of light composite materials, improved ergonomics, and better durability. Compound bows have attracted widespread use by competitive archers and hunters because they are accurate and easy to use. Accessories like sights, stabilizers, and arrow rests have also seen robust demand since they greatly enhance shooting accuracy and comfort. Incorporation of intelligent technologies like laser-guided sights and modular grip systems has further driven consumer demands and increased the popularity of archery. Also, recreational archery programs and internet tutorials have helped make such products more popular among beginners, thus contributing to their mass adoption. The segment will continue to dominate as a result of innovation and sustained engagement in target shooting and bowhunting.

Analysis by End User:

- Individual Consumer

- Clubs and Gaming Zones

- Sports Organizers

Individual consumers were the largest end-use segment in the global archery equipment market growth during 2024, with 75.4% of overall demand. This share indicates growing popularity for archery as a hobby sport and recreational activity, particularly in Europe and North America. Most people seek archery for its psychological concentration, stress relief, and physical fitness benefits, which further makes it an attractive hobby. Availability of adjustable and ease-of-use equipment has facilitated increased entry by novices, and professional archers still dominate premium-grade equipment demand. Online markets have been most responsible for creating wider consumer exposure to broad collections of products with added support often through virtual demonstrations and forums. Furthermore, increased exposure through motion pictures, history reenactments, and survival shows has also fueled growing public interest. As disposable income continues to rise and consumers prefer spending money outside the home, individual consumers are likely to be the key growth driver.

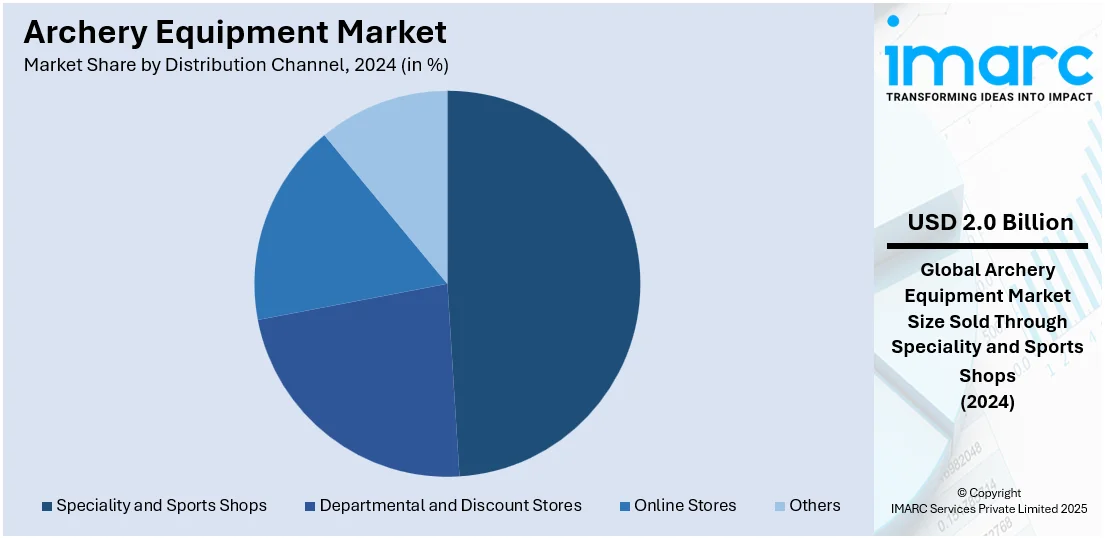

Analysis by Distribution Channel:

- Speciality and Sports Shops

- Departmental and Discount Stores

- Online Stores

- Others

In 2024, specialty and sporting shops were the primary distribution channel for archery equipment, capturing a 48.7% share of international sales. The specialty and sports shops provide an added value proposition with their expertise in products, personalized service, and hands-on equipment testing experience. Custom fittings, bow maintenance, and after-sales service are common among most shops, and these are highly relevant to high-performance consumers like hunters and tournament archers. The physical retail experience combined with employee knowledge instills trust and loyalty among consumers. Additionally, specialty shops tend to act as local centers for archery communities, where they host demonstrations, workshops, and casual competitions that encourage customer interaction and return business. Even as online venues continue to expand, especially among casual consumers, specialty retailers hold a benefit for consumers who value high-quality service and expert advice. Their ongoing investment in premium inventory and customer education makes them a key player in maintaining and growing the archery equipment market forecast.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America held on to its position as the largest regional market for archery equipment in 2024, accounting for 38.0% of global revenue. The United States, in specific, continues to be a focal point for recreational archery, competitive archery leagues, and hunting pursuits, with a strong support base of training facilities, associations, and public shooting ranges. Cultural influences, such as the popularity of bowhunting and archery media, have remained constant drivers of interest in the sport. Government and private programs focusing on youth engagement and outdoor skills training have contributed further to market development. Widespread access to high-quality equipment and an established retail base, including brick-and-mortar outlets and internet sites, supports the region. Additionally, innovations from North American producers tend to establish industry norms, supporting the region's dominance in technology and product innovation. Sustained consumer interest, an encouraging regulatory climate for hunting, and elevated disposable income levels are likely to drive continued market growth over the period to 2030.

Key Regional Takeaways:

United States Archery Equipment Market Analysis

The United States archery equipment market is primarily driven by growing youth participation in school-level archery programs supported by national bodies. According to NASP, by the 2022-23 school year, 78 colleges had archery programs registered with USA Archery, with at least 25 of these institutions offering scholarships for participation. In accordance with this, increased visibility of archery through media and film sparking recreational interest, especially among younger audiences, is propelling market growth. Furthermore, the rise in competitive archery tournaments and local leagues is gaining popularity, fueling market demand. The rising adoption of archery as a leisure activity in rural and suburban areas is contributing to sustained product sales. Similarly, the heightened influence of outdoor survivalist trends leading to heightened interest in traditional bows and accessories, is fostering market expansion. The continual advancements in lightweight composite materials enhancing user experience, especially for beginners and female archers, are impelling the market. Additionally, e-commerce penetration enabling access to specialized equipment across states, including remote regions, is stimulating market appeal. Moreover, numerous collaborations between sporting goods manufacturers and training academies are augmenting product awareness and encouraging entry-level participation, thereby providing an impetus to the market.

Europe Archery Equipment Market Analysis

The market in Europe is experiencing growth due to the increasing integration of archery into outdoor tourism packages, particularly in forested and rural destinations. In addition to this, growing interest in medieval sports reenactments and traditional festivals, reviving demand for heritage-style bows and equipment, is impelling the market. The expansion of archery clubs in urban centers facilitating access and skill development across age groups is supporting market expansion. The Turkish Traditional Archery Federation, with over 21,000 licensed athletes and 700+ registered clubs, ranks among the fastest-growing sports federations in Türkiye, reflecting rising national and international interest. Furthermore, the growth in government-supported sport inclusion programs encouraging school-level participation, especially in Northern and Western Europe, is enhancing market appeal. The rise of female participation in competitive archery is also influencing product design and marketing strategies. Additionally, ongoing technological refinement in tuning systems and release aids attracting precision-focused athletes, is strengthening market demand. Moreover, cross-border e-commerce enabling wider distribution of niche European brands, particularly to Eastern and Southern Europe, is driving growth in the market. Besides this, strong partnerships between regional federations and international tournaments augmenting visibility and inspiring emerging athletes and hobbyists, are expanding the market scope.

Asia Pacific Archery Equipment Market Analysis

The Asia Pacific archery equipment market is significantly advancing attributed to increased government investment in Olympic training programs, particularly in countries like South Korea and India. For instance, the Ministry of Youth Affairs and Sports reported that India allocated an unprecedented INR 470 Crore towards its journey to the Paris Olympics 2024. This substantial budget was strategically distributed across 16 sports disciplines to boost medal prospects. Similarly, the rise in cultural preservation efforts driving demand for traditional archery equipment in nations such as Mongolia and Bhutan, is impelling the market. The heightened influence of globally recognized athletes encouraging youth enrollment in archery academies is enhancing the market appeal. Furthermore, rapid urban retail expansion and the presence of branded outlets are improving product accessibility. Apart from this, favorable localized manufacturing initiatives in countries like China are supporting cost-effective production, stimulating regional supply chains and catering to both competitive and recreational segments with diversified offerings.

Latin America Archery Equipment Market Analysis

In Latin America, the market is gaining traction through the inclusion of archery in regional sports development programs, particularly in Brazil and Colombia. In addition to this, supportive community-led training initiatives and cultural festivals fostering local engagement with the sport, is propelling the market growth. The expansion of sports retail infrastructure in urban centers is improving access to specialized equipment in the market. Furthermore, increased collaboration between local sports federations and international bodies is facilitating knowledge exchange, coaching certifications, and standardized equipment adoption, supporting both recreational and competitive archery across diverse socioeconomic groups in the region. As such, in 2024, Brazil’s Olympic Committee received a record BRL 160 million (EUR 25 million) sponsorship from Caixa Econômica Federal and Loterias Caixa. The funds will support Olympic sport development and athlete preparation through the new TOP COB program ahead of LA 2028.

Middle East and Africa Archery Equipment Market Analysis

The archery equipment market in the Middle East and Africa is witnessing growth due to renewed interest in heritage sports, particularly traditional archery in countries like Türkiye and Saudi Arabia. Similarly, growth in national tourism campaigns incorporating archery as part of cultural experience packages, is enhancing product visibility. Furthermore, ongoing government-led sports diversification efforts under programs like Saudi Vision 2030 are fostering infrastructure development for niche sports in the market. Additionally, the rapid emergence of private archery clubs and training academies across urban hubs is expanding access and encouraging youth participation, contributing to a broader base of recreational and competitive archers. Accordingly, Namibia hosted the Region 5 archery tournament in August 2024, fielding 52 archers across three teams. Five countries, Namibia, South Africa, Botswana, Zambia, and Zimbabwe, competed in this biennial event, which also served as a qualifier.

Competitive Landscape:

The global archery equipment market is characterized by a wide range of players, all contributing to the development of the industry. Such market players include manufacturers, distributors, and retailers who, in aggregate, stimulate innovation and address the growing need for archery equipment. The landscape is characterized by a blend of established industry stalwarts and emerging entrants, all vying to capture market share through product differentiation, technological advancements, and strategic partnerships. Furthermore, the competitive dynamics are influenced by factors such as pricing strategies, product quality, distribution reach, and customer service. As the market further grows and develops, competition is still a driving force for innovation, with participants constantly looking to meet changing needs of archers across the globe. The lack of monopoly players is evidence of the openness of the market, promoting an active ecosystem in which companies compete to be at the top by constantly updating their products and gaining a strong presence in the ever-changing world of archery equipment.

The report provides a comprehensive analysis of the competitive landscape in the archery equipment market with detailed profiles of all major companies, including:

- Apex Gear

- Bear Archery, Inc.

- Black Gold Bowsights

- Bowtech INC.

- Easton Technical Products, Inc.

- Gold Tip LLC

- Hoyt Archery

- Mathews Archery, Inc.

- New Archery Products, Inc.

- PSE Archery, LLC

- Southwest Archery

- The Bohning Company

- The Outdoor Group, LLC

Latest News and Developments:

- January 2025: Hoyt Archery's 2025 model lineup brought out the Carbon RX-9 and Alpha AX-2 hunting bows. The RX-9 provides superior speed and accuracy with HBX Gen 4 cams, and the compact AX-2 is perfect for tree stands and blinds. Both provide smooth shooting and are now available for demo and in-store purchase.

- December 2024: Easton introduced its 2025 arrows line, with the completely new 5MM Easton 5.0 for multi-duty configurations and upgraded 5MM FMJ MAX for greater speed and penetration. Both designs were available with Match Grade configurations, new Microlite Nocks, and high-performance components to provide superior performance and accuracy.

- November 2024: Mathews introduced its 2025 bow lineup, including the LIFT X series with new Limb Shift Technology, ARC7 limbs, and BOND Grips. Available models are the LIFT X 29.5, 33, RS, and XD, providing greater tuning, comfort, and performance for various draw lengths and hunting applications.

- September 2024: Bear Archery introduced its 2025 offering with six new compound bows, among them being the Persist 33, Whitetail INT, and Legend 30. The bows incorporated enhanced technologies such as the EKO and XR cam systems, Integrate Mounting System, and RTH packages, boosting performance and ease of use for every archer.

Archery Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bows and Bow Accessories, Arrows, Others |

| End Users Covered | Individual Consumer, Clubs and Gaming Zones, Sports Organizers |

| Distribution Channels Covered | Speciality and Sports Shops, Departmental and Discount Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Apex Gear, Bear Archery, Inc., Black Gold Bowsights, Bowtech INC., Easton Technical Products, Inc., Gold Tip LLC, Hoyt Archery, Mathews Archery, Inc., New Archery Products, Inc., PSE Archery, LLC, Southwest Archery, The Bohning Company, The Outdoor Group, LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the archery equipment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global archery equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the archery equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The archery equipment market was valued at USD 4.16 Billion in 2024.

The archery equipment market is projected to exhibit a CAGR of 5.31% during 2025-2033, reaching a value of USD 6.97 Billion by 2033.

The market for archery equipment is fueled by amplifying recreational and competitive archery participation, technological improvements in equipment, increasing health and fitness consciousness, and greater visibility through movies and media. Government programs, school programs, and growing e-commerce channels also fuel market growth by enhancing accessibility and awareness.

North America currently dominates the archery equipment market, accounting for a share of 38.0%, driven by robust hunting cultures, mass recreational involvement, advanced retail infrastructure, and facilitating sporting associations. Strong consumer expenditure, technological advancement, and healthy youth participation programs also drive regional market growth and equipment demand.

Some of the major players in the archery equipment market include Apex Gear, Bear Archery, Inc., Black Gold Bowsights, Bowtech INC., Easton Technical Products, Inc., Gold Tip LLC, Hoyt Archery, Mathews Archery, Inc., New Archery Products, Inc., PSE Archery, LLC, Southwest Archery, The Bohning Company, The Outdoor Group, LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)