Argentina Baby Food Market Size, Share, Trends and Forecast by Product Type, Age Group, Distribution Channel and Region, 2026-2034

Argentina Baby Food Market Summary:

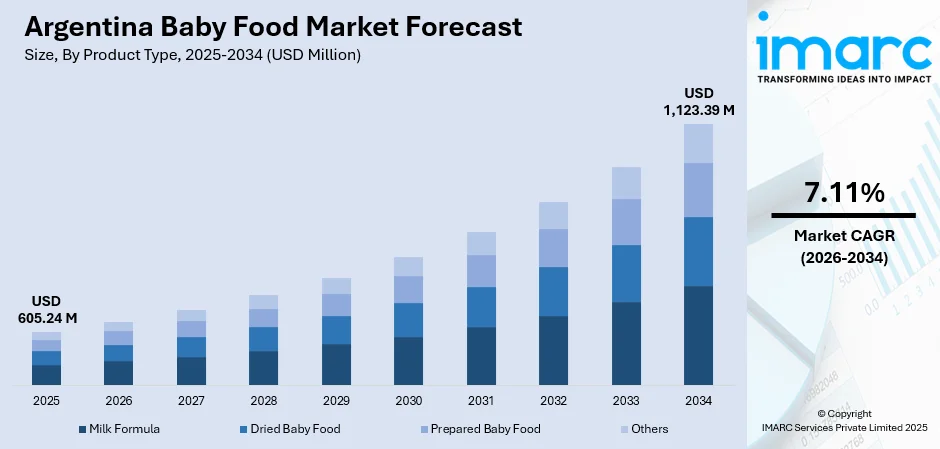

The Argentina baby food market size was valued at USD 605.24 Million in 2025 and is projected to reach USD 1,123.39 Million by 2034, growing at a compound annual growth rate of 7.11% from 2026-2034.

The Argentina baby food market is experiencing steady growth driven by increasing parental awareness regarding infant nutrition and the rising participation of women in the workforce. Growing urbanization and expanding middle-class demographics are elevating demand for convenient, nutritionally complete feeding solutions. The market demonstrates strong alignment with global trends toward premium, organic, and specialized infant nutrition products catering to health-conscious parents.

Key Takeaways and Insights:

-

By Product Type: Milk formula dominates the market with a share of 38% in 2025, driven by its essential role as a breast milk substitute and supplement for working mothers requiring convenient feeding alternatives.

-

By Age Group: 12-24 months leads the market with a share of 37% in 2025, reflecting the extended transition period from breast milk to solid foods and growing-up formula requirements during toddler development.

-

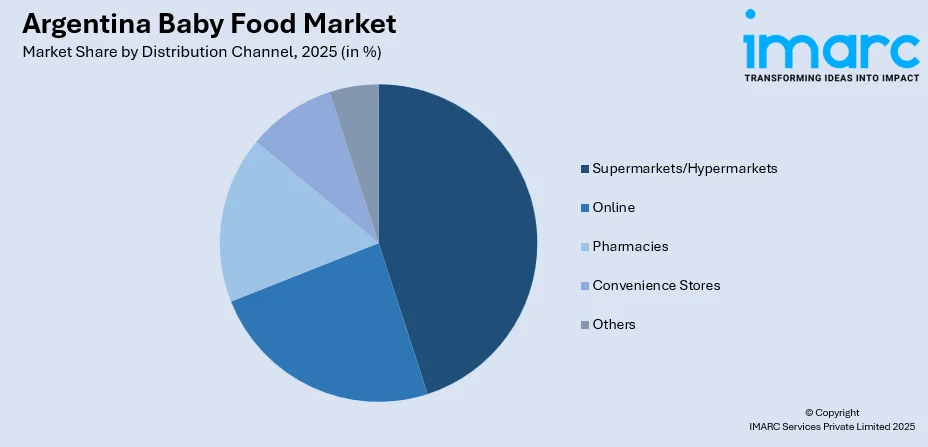

By Distribution Channel: Supermarkets/hypermarkets represent the largest segment with a market share of 44% in 2025, offering consumers comprehensive product selections, competitive pricing, and trusted retail environments for infant nutrition purchases.

-

Key Players: The Argentina baby food market features a competitive landscape with both global and regional infant nutrition manufacturers, offering diverse product portfolios to cater to a wide range of consumer segments.

To get more information on this market Request Sample

The Argentina baby food market is undergoing transformation as consumer preferences evolve toward premium, organic, and nutritionally enhanced infant feeding products. In 2025, the Argentine food regulator ANMAT issued an urgent public health alert advising against the use of the infant formula ByHeart Whole Nutrition after international cases of botulism were linked to the product, and coordinated with the manufacturer and FDA on a preventive recall, underscoring the importance of registered and safety‑verified formula products in the country. Rising disposable incomes in urban centers enable parents to invest in quality nutrition for their children while strict government regulations ensure food safety standards are maintained. The market demonstrates growing demand for specialized formulas addressing specific dietary needs including lactose intolerance, allergies, and developmental support requirements, positioning Argentina as a significant market within the broader South American infant nutrition landscape.

Argentina Baby Food Market Trends:

Growing Demand for Organic and Natural Baby Food Products

Argentine consumers demonstrate increasing preference for organic, natural, and clean-label baby food products free from artificial preservatives, additives, and chemical ingredients. According to reports, Argentine media highlighted the renewed market visibility of NutriBaby’s certified organic baby food line, originally launched by entrepreneur Valentina Peroni, positioning it as a domestically produced, organic alternative on supermarket shelves and reflecting growing local demand for clean-ingredient infant nutrition. Health-conscious parents prioritize products with transparent ingredient sourcing and certified organic certifications. Manufacturers are responding by expanding organic product lines incorporating locally sourced natural ingredients that resonate with consumer wellness priorities.

Rising Popularity of Specialized and Functional Infant Formulas

Specialized infant formulas addressing specific nutritional requirements are gaining traction across Argentina's baby food market. According to reports, Argentina’s Fortified Milk and Healthy Foods Program under Law 27.611 (“1000 Days Law”) provides fortified milk and infant formula for children up to three years through social benefits, improving access and early childhood nutrition. Products fortified with probiotics, prebiotics, human milk oligosaccharides, and essential fatty acids for cognitive development attract health-focused parents. Clinical recommendations from pediatricians and healthcare professionals further drive adoption of scientifically formulated products supporting optimal infant growth and immune system development.

Expansion of E-Commerce and Digital Retail Channels

Digital commerce is transforming Argentina's baby food distribution landscape as urban parents increasingly embrace online shopping convenience. In 2025, Argentina’s e-commerce sales grew 79% year on year, led by food and beverages, highlighting the shift of essential products such as baby food toward digital purchasing channels. E-commerce platforms offer doorstep delivery, subscription services, and expanded product selections unavailable in traditional retail. The growth of mobile commerce and digital payment adoption accelerates channel shift, particularly among younger, tech-savvy parents in metropolitan areas.

Market Outlook 2026-2034:

The Argentina baby food market is positioned for sustained expansion throughout the forecast period, supported by evolving consumer preferences, rising health consciousness, and increasing working mother population requiring convenient infant nutrition solutions. Product innovation focusing on organic ingredients, specialized nutritional formulations, and convenient packaging formats will drive premiumization trends. E-commerce growth and omnichannel distribution strategies will enhance market accessibility while regulatory frameworks ensure product safety and quality. The market generated a revenue of USD 605.24 Million in 2025 and is projected to reach a revenue of USD 1,123.39 Million by 2034, growing at a compound annual growth rate of 7.11% from 2026-2034.

Argentina Baby Food Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Milk Formula | 38% |

| Age Group | 12-24 Months | 37% |

| Distribution Channel | Supermarkets/Hypermarkets | 44% |

Product Type Insights:

- Milk Formula

- Dried Baby Food

- Prepared Baby Food

- Others

The milk formula dominates with a market share of 38% of the total Argentina baby food market in 2025.

Milk formula maintains market leadership, reflecting its essential role as a breast milk substitute and nutritional supplement for infants. The segment benefits from increasing workforce participation among mothers requiring reliable feeding alternatives that provide complete infant nutrition. In Argentina, the Secretariat for Health and Quality amended the national Codex Alimentarius for infant formula in 2024, updating the list of permitted additives and tightening labelling requirements to improve nutritional clarity and safety standards for formula products sold domestically.

Products range from starting formulas for newborns to follow-on and growing-up formulas that support key developmental stages. The milk formula segment continues to innovate by incorporating probiotics, prebiotics, and human milk oligosaccharides that replicate breast milk composition. Manufacturers are also investing in clinical research to substantiate nutritional benefits and cater to specific needs, including lactose intolerance and allergies, through specialized hydrolyzed protein formulas designed for sensitive infants, ensuring safe and complete nutrition across early childhood.

Age Group Insights:

- 0-6 Months

- 6-12 Months

- 12-24 Months

The 12-24 months leads with a share of 37% of the total Argentina baby food market in 2025.

The 12-24 months age group dominates Argentina's baby food market, representing the critical toddler transition period requiring diverse nutritional products. This stage encompasses growing-up formulas, prepared meals, and finger foods supporting developmental milestones and emerging dietary preferences. In 2025, Argentina’s National Administration of Medicines, Food and Medical Technology (ANMAT) introduced modernized food control and import regulations to streamline the approval of packaged foods, including baby and toddler nutrition products, aligning with international health standards and potentially improving availability and safety.

Parents prioritize diverse nutrition during this formative period to establish healthy eating habits. The segment benefits from longer product usage than in earlier infant stages, fostering sustained consumption. Toddler-focused products highlight balanced macronutrients, essential vitamins, and minerals that support cognitive and physical development, while offering palatable flavors that encourage self-feeding and independence, ensuring nutritional needs are met during rapid growth and developmental transitions, and addressing evolving taste preferences alongside increasing parental focus on convenience and clean-label formulations.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets/Hypermarkets

- Online

- Pharmacies

- Convenience Stores

- Others

The supermarkets/hypermarkets dominate with a market share of 44% of the total Argentina baby food market in 2025.

Supermarkets and hypermarkets lead baby food distribution, holding the highest market share by offering extensive selections across multiple brands and price ranges within reliable retail environments. These channels benefit from high foot traffic and implement competitive pricing alongside targeted promotional campaigns, appealing to price-conscious parents. By combining convenience, variety, and trusted quality, they effectively cater to caregivers seeking both value and assurance in infant nutrition, driving consistent purchases and reinforcing brand loyalty across early childhood product categories.

The segment maintains a competitive edge through ample shelf space for product comparison, convenient one-stop shopping, and established consumer trust. Major retailers play a key role in baby food distribution, offering platforms for manufacturers to promote products and launch new offerings. This approach allows products to reach a wide consumer base, catering to diverse demographics while reinforcing brand visibility, encouraging trial, and supporting sustained growth in the infant nutrition market.

Regional Insights:

- Buenos Aires Region

- Litoral Region

- Northern Region

- Cordoba Region

- Cuyo Region

- Patagonia Region

Buenos Aires region dominates Argentina's baby food market, housing approximately one-third of the national population with concentrated urban demographics. The metropolitan area's high disposable incomes, extensive retail infrastructure, and sophisticated consumer preferences drive premium product demand. Working mothers and health-conscious parents fuel growth in organic, specialized infant nutrition categories through diverse supermarket and pharmacy distribution networks.

Litoral region represents a significant market encompassing Santa Fe, Entre Rios, and Corrientes provinces with established urban centers including Rosario. The region demonstrates strong supermarket penetration and growing middle-class demographics supporting consistent baby food consumption. Agricultural prosperity and European heritage influence consumer preferences toward quality nutrition products distributed through traditional retail channels.

Northern region comprising Tucuman, Salta, and Jujuy provinces presents emerging opportunities driven by expanding retail accessibility and rising healthcare awareness. The region demonstrates growing adoption of infant formula products as urbanization increases workforce participation among mothers. Value-oriented product positioning and pharmacy distribution channels serve developing consumer segments prioritizing affordable infant nutrition solutions.

Cordoba region anchored by Argentina's second-largest city demonstrates robust baby food market development supported by strong educational infrastructure and health-conscious population. The region's industrial base and expanding middle class drive demand for quality infant nutrition products. Modern retail formats and established supermarket chains provide comprehensive distribution coverage enabling diverse product accessibility across urban and suburban markets.

Cuyo region encompassing Mendoza, San Juan, and San Luis provinces represents a growing market driven by regional economic development and expanding retail infrastructure. Wine industry prosperity supports disposable income growth enabling premium baby food adoption. The region demonstrates increasing health consciousness among parents seeking quality infant nutrition through supermarket and pharmacy channels serving provincial urban centers.

Patagonia region presents emerging market potential with Argentina's fastest-growing population demographics despite lower population density. Oil, mining, and tourism industries generate elevated incomes supporting premium product demand. The region's remote geography emphasizes importance of established retail distribution and emerging e-commerce channels addressing logistical challenges while serving dispersed communities across southern Argentina.

Market Dynamics:

Growth Drivers:

Why is the Argentina Baby Food Market Growing?

Increasing Female Workforce Participation

Rising participation of women in Argentina's workforce creates sustained demand for convenient infant feeding solutions complementing or substituting breastfeeding. Working mothers require reliable, nutritionally complete products supporting infant development during extended work hours away from home. In 2023, Danish dairy cooperative Arla Foods announced a major investment to upgrade its Porteña facility in Argentina, adding a new drying tower to more than double production of high‑quality whey ingredients for infant formula and baby nutrition products, strategically serving both Latin American and global markets. This demographic shift drives consistent growth in milk formula and prepared baby food categories providing time-saving alternatives without compromising nutritional quality that health-conscious parents demand for their children.

Growing Health Awareness and Parental Education

Elevated parental awareness regarding infant nutrition and its long-term developmental impact drives demand for premium, scientifically formulated baby food products. Healthcare professional recommendations, digital information accessibility, and social media influence shape purchasing decisions toward nutritionally optimized products. The Argentina healthcare market size reached USD 163.02 billion in 2024, with projections by IMARC Group indicating substantial expansion through the decade, reflecting broader investment in health and nutrition sectors that support the baby food market. Parents increasingly prioritize products containing functional ingredients supporting immune system development, cognitive growth, and digestive health in their children.

Urbanization and Rising Disposable Incomes

Rapid urbanization across Argentina has concentrated populations in metropolitan areas with well-developed retail infrastructure, creating efficient channels for widespread baby food distribution. Growing disposable incomes among the expanding middle-class population enable parents to invest in premium infant nutrition products, which are increasingly perceived as essential for supporting healthy growth and optimal child development. Urban lifestyles that prioritize convenience, safety, and high-quality offerings further reinforce market demand. Together, these factors are driving growth across various segments, including infant formulas, prepared foods, and specialty nutrition products, as caregivers seek both nutritional value and practical solutions for busy modern households.

Market Restraints:

What Challenges the Argentina Baby Food Market is Facing?

Economic Volatility and Currency Fluctuations

Argentina's economic uncertainty and currency volatility create pricing challenges affecting consumer purchasing power and import-dependent product costs. Inflation pressures may shift consumer preferences toward value-oriented alternatives or homemade feeding options, impacting premium segment performance and overall market growth trajectories, while prompting manufacturers to adopt localized sourcing, pricing flexibility, and cost-optimization strategies.

Strong Breastfeeding Advocacy and Cultural Preferences

Government breastfeeding promotion programs and cultural preferences favoring natural infant feeding may constrain formula market expansion. Healthcare policies emphasizing exclusive breastfeeding benefits and workplace accommodation requirements potentially reduce formula adoption among mothers with breastfeeding capability, especially in urban public hospitals and maternal health campaigns supported by NGOs and pediatric associations.

Stringent Regulatory Requirements

Argentina's strict food safety regulations governing infant nutrition products create compliance requirements potentially limiting market entry for new participants. Regulatory processes for product registration and advertising restrictions on infant formula marketing may constrain competitive dynamics and promotional activities, increasing time-to-market and compliance costs for both domestic and international manufacturers.

Competitive Landscape:

The Argentina baby food market demonstrates a moderately consolidated competitive landscape, with multinational infant nutrition companies holding strong market positions. These leading players compete through broad product portfolios, investment in clinical research, engagement with healthcare professionals, and well-established distribution networks. Regional manufacturers and private-label offerings focus on value-driven segments, while organic and specialty products cater to premium consumer niches. Companies differentiate themselves through continuous product innovation, advances in nutritional formulations, and marketing strategies that highlight quality, safety, and developmental benefits for infants. Overall, the market is shaped by a mix of global expertise and regional adaptation, with competition driven by innovation, brand trust, and the ability to meet diverse consumer preferences across economic and lifestyle segments.

Recent Developments:

-

In June 2025, Nestlé started rolling out its NAN Sinergity infant formula, featuring probiotics and six human milk oligosaccharides (HMOs), across Latin America, including Argentina, as part of its June 2025 regional expansion. The science-based product aims to support gut health and immunity in early life.

Argentina Baby Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Milk Formula, Dried Baby Food, Prepared Baby Food, Others |

| Age Groups Covered | 0-6 Months, 6-12 Months, 12-24 Months |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Online, Pharmacies, Convenience Stores, Others |

| Regions Covered | Buenos Aires Region, Litoral Region, Northern Region, Cordoba Region, Cuyo Region, Patagonia Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Argentina baby food market size was valued at USD 605.24 Million in 2025.

The Argentina baby food market is expected to grow at a compound annual growth rate of 7.11% from 2026-2034 to reach USD 1,123.39 Million by 2034.

Milk formula held the largest market share with 38%, driven by its essential role as a breast milk substitute for working mothers and its comprehensive nutritional formulation supporting infant development.

Key factors driving the Argentina baby food market include increasing female workforce participation, growing health awareness among parents, rising urbanization, expanding middle-class demographics, and demand for convenient, nutritionally complete infant feeding solutions.

Major challenges include economic volatility affecting consumer purchasing power, strong breastfeeding advocacy programs, stringent regulatory requirements for infant nutrition products, and competition from homemade feeding alternatives during economic downturns.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)