Argentina Beer Market Size, Share, Trends and Forecast by Product Type, Packaging, Production, Alcohol Content, Flavor, Distribution Channel, and Region, 2026-2034

Argentina Beer Market Overview:

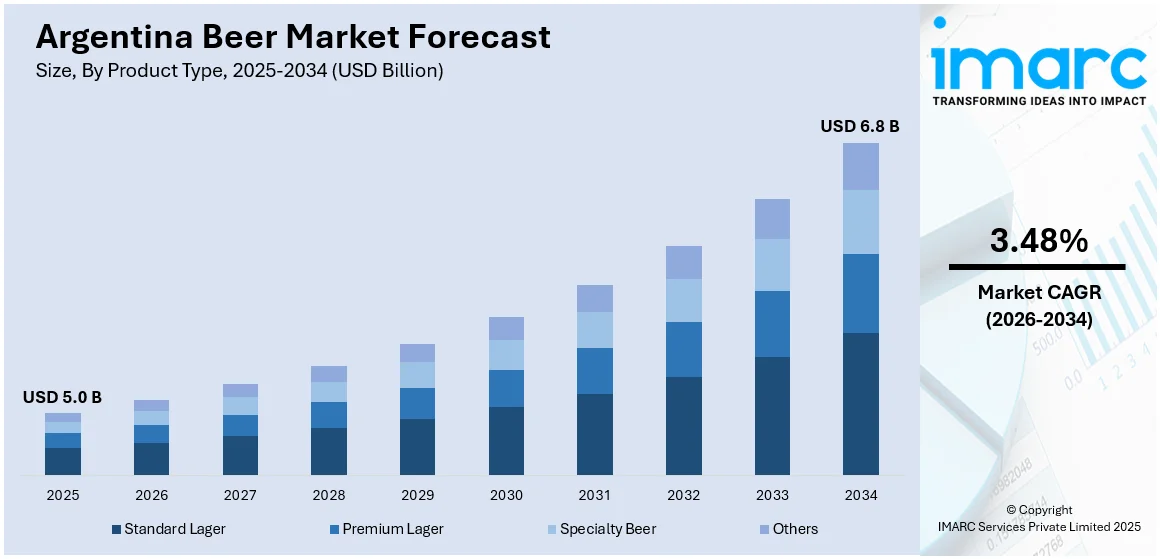

The Argentina beer market size reached USD 5.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 6.8 Billion by 2034, exhibiting a growth rate (CAGR) of 3.48% during 2026-2034. Rising disposable incomes, youthful demographics, and increasing urbanization are some of the factors contributing to the Argentina beer market share. Craft beer culture, premiumization trends, and diverse flavor innovations appeal to consumers. Expanding retail channels, tourism recovery, and social drinking occasions also drive growth, supported by marketing investments from multinational and local brewers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5.0 Billion |

| Market Forecast in 2034 | USD 6.8 Billion |

| Market Growth Rate 2026-2034 | 3.48% |

Argentina Beer Market Trends:

Premiumization and Craft Expansion

In Argentina, beer consumption is shifting toward premium and craft options. Consumers, especially younger urban drinkers, are moving away from traditional mass-market lagers and exploring locally brewed craft varieties. The rise of microbreweries in Buenos Aires, Córdoba, and Mendoza has made small-batch, artisanal beers more accessible. These breweries often highlight quality ingredients, experimental flavors, and a stronger connection to regional identity. Economic challenges in the country have not halted this trend; instead, they have pushed many local brewers to focus on affordable premium offerings that balance exclusivity with value. Imported beers from Europe and the United States also retain a presence, appealing to consumers who associate them with quality and status. Marketing has leaned heavily into authenticity and storytelling, which resonates with a generation of drinkers looking for more than just a commodity. This diversification of supply and demand indicates that Argentina’s beer market is becoming more sophisticated, with growing space for niche producers to thrive alongside established giants. These factors are intensifying the Argentina beer market growth.

To get more information on this market Request Sample

Rising Popularity of Low-Alcohol and Health-Focused Beers

Another clear trend in Argentina’s beer market is the rising demand for low-alcohol, alcohol-free, and health-conscious options. With more consumers paying attention to wellness and moderation, lighter beers are becoming popular in both supermarkets and bars. Big breweries have introduced 0.0% alcohol lines to appeal to people who want to enjoy social drinking without the effects of alcohol. Beyond alcohol content, some brands are experimenting with beers that are lower in calories or gluten-free, targeting health-conscious demographics. This reflects broader lifestyle changes in Argentina, where younger generations are increasingly embracing fitness culture and balanced diets. Seasonal campaigns during summer months often highlight refreshment and lighter drinking experiences, aligning with outdoor social gatherings. This movement is also supported by regulatory pressures and public health campaigns encouraging responsible consumption. The trend shows that beer in Argentina is no longer only about indulgence; it is adapting to a market where health, functionality, and moderation matter. Traditional strong lagers still hold space, but the growth trajectory favors lighter and alternative formats.

Argentina Beer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type, packaging, production, alcohol content, flavor, and distribution channel.

Product Type Insights:

- Standard Lager

- Premium Lager

- Specialty Beer

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes standard lager, premium lager, specialty beer, and others.

Packaging Insights:

- Glass

- PET Bottle

- Metal Can

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging. This includes glass, PET bottle, metal can, and others.

Production Insights:

- Macro-Brewery

- Micro-Brewery

- Others

The report has provided a detailed breakup and analysis of the market based on the production. This includes macro-brewery, micro-brewery, and others.

Alcohol Content Insights:

- High

- Low

- Alcohol-Free

The report has provided a detailed breakup and analysis of the market based on the alcohol content. This includes high, low, and alcohol-free.

Flavor Insights:

- Flavored

- Unflavored

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes flavored and unflavored.

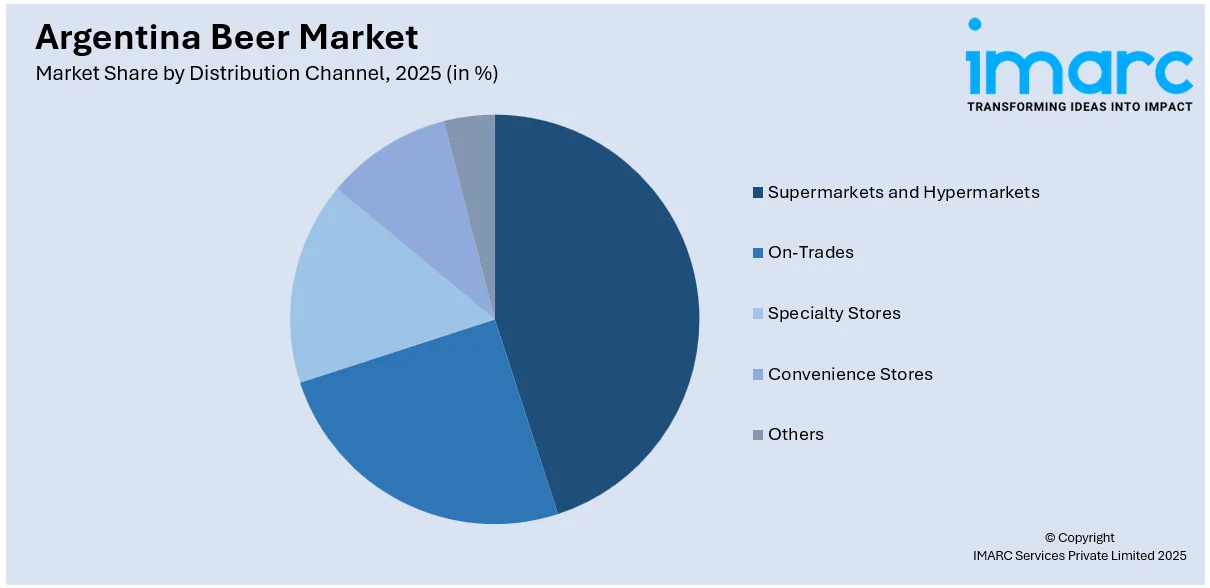

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- On-Trades

- Specialty Stores

- Convenience Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, on-trades, specialty stores, convenience stores, and others.

Regional Insights:

- Buenos Aires Region

- Litoral Region

- Northern Region

- Cordoba Region

- Cuyo Region

- Patagonia Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Buenos Aires Region, Litoral Region, Northern Region, Cordoba Region, Cuyo Region, and Patagonia Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Argentina Beer Market News:

- In February 2025, Heineken 0.0’s study revealed that social pressure still shapes drinking habits in Argentina’s beer market. While non-alcoholic options are gaining popularity, 21% of young adults (18–26) admit to hiding their choice due to judgment. More than a third feel pressured to drink in social settings. Among men, 38% would opt for alcohol-free beer only if friends did, with 29% feeling compelled to justify the decision.

Argentina Beer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Standard Lager, Premium Lager, Specialty Beer, Others |

| Packagings Covered | Glass, PET Bottle, Metal Can, Others |

| Productions Covered | Macro-Brewery, Micro-Brewery, Others |

| Alcohol Contents Covered | High, Low, Alcohol-Free |

| Flavors Covered | Flavored, Unflavored |

| Distribution Channels Covered | Supermarkets and Hypermarkets, On-Trades, Specialty Stores, Convenience Stores, Others |

| Regions Covered | Buenos Aires Region, Litoral Region, Northern Region, Cordoba Region, Cuyo Region, Patagonia Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Argentina beer market performed so far and how will it perform in the coming years?

- What is the breakup of the Argentina beer market on the basis of product type?

- What is the breakup of the Argentina beer market on the basis of packaging?

- What is the breakup of the Argentina beer market on the basis of production?

- What is the breakup of the Argentina beer market on the basis of alcohol content?

- What is the breakup of the Argentina beer market on the basis of flavor?

- What is the breakup of the Argentina beer market on the basis of distribution channel?

- What is the breakup of the Argentina beer market on the basis of region?

- What are the various stages in the value chain of the Argentina beer market?

- What are the key driving factors and challenges in the Argentina beer market?

- What is the structure of the Argentina beer market and who are the key players?

- What is the degree of competition in the Argentina beer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Argentina beer market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Argentina beer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Argentina beer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)