Argentina Food Processing Equipment Market Size, Share, Trends and Forecast by Mode of Operation, Type, Application, and Region, 2026-2034

Argentina Food Processing Equipment Market Summary:

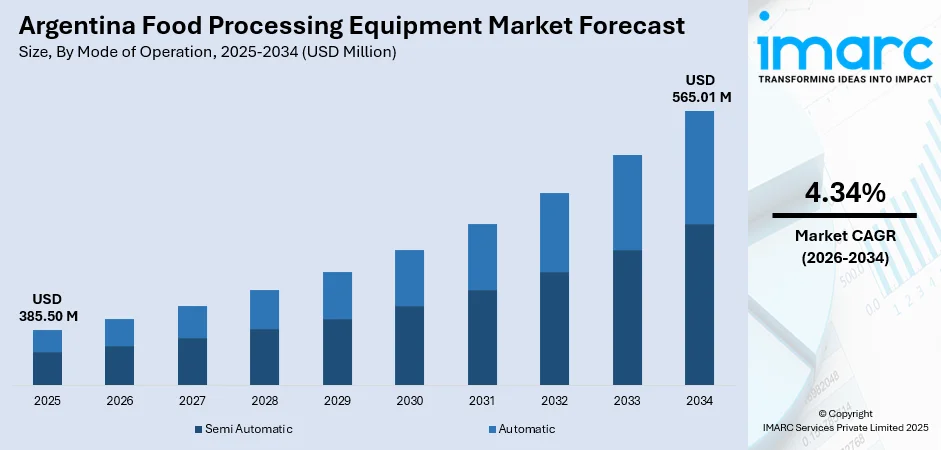

The Argentina food processing equipment market size was valued at USD 385.50 Million in 2025 and is projected to reach USD 565.01 Million by 2034, growing at a compound annual growth rate of 4.34% from 2026-2034.

The market is driven by increasing industrialization of the food sector, rising consumer demand for processed and packaged food products, and government initiatives supporting agricultural value addition. Expanding meat and dairy processing industries, coupled with growing investments in automation technologies, are accelerating equipment adoption across production facilities. The focus on enhancing food safety standards and extending product shelf life through advanced processing technologies continues to strengthen the Argentina food processing equipment market share.

Key Takeaways and Insights:

-

By Mode of Operation: Automatic dominates the market with a share of 62% in 2025, driven by efficiency gains, reduced labor costs, consistent quality, improved hygiene, and higher production capacity.

-

By Type: Processing leads the market with a share of 69% in 2025, owing to broad adoption across food industries, technological upgrades, and strict food safety regulations.

-

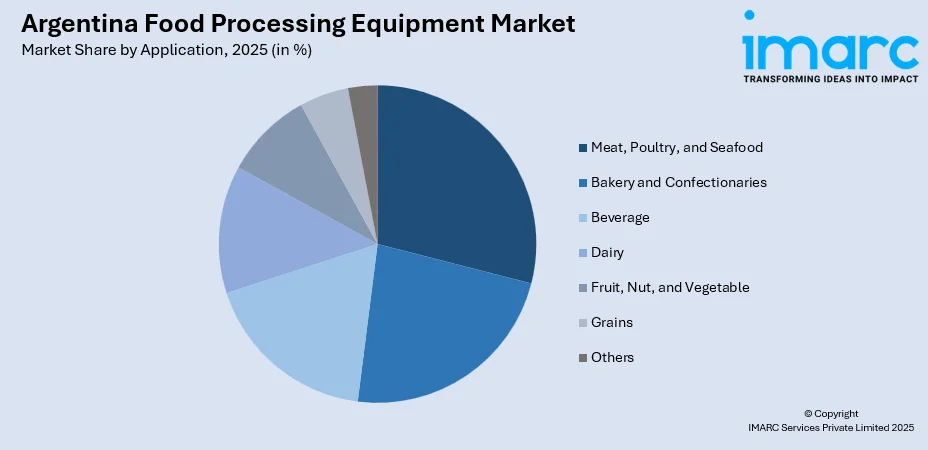

By Application: Meat, poultry, and seafood represents the largest segment with a market share of 24% in 2025, driven by export leadership, processing investments, and growing demand for value-added proteins.

-

Key Players: The Argentina food processing equipment market exhibits a moderately consolidated competitive structure, featuring established international equipment manufacturers competing alongside regional suppliers. Market participants differentiate through technological innovation, after-sales service networks, customization capabilities, and financing solutions tailored to local processor requirements.

To get more information on this market Request Sample

The Argentina food processing equipment market is experiencing sustained growth momentum driven by fundamental shifts in the nation's food manufacturing landscape. The country's prominent position as a global agricultural powerhouse, particularly in beef, soy, and grain production, necessitates continuous modernization of processing infrastructure to meet international quality standards and export requirements. Domestic food manufacturers are increasingly investing in advanced equipment to enhance operational efficiency, reduce production costs, and comply with evolving food safety regulations. As per sources, in 2025, Lamb Weston opened a 430,000-sq-ft processing plant in Mar del Plata, Argentina, with 200 Million Pounds annual potato capacity, exporting about 80% of frozen products to Latin American markets. Moreover, the growing middle-class population is driving demand for convenience foods, ready-to-eat products, and processed dairy items, compelling processors to upgrade their manufacturing capabilities. Additionally, government policies promoting agricultural value addition and export diversification are encouraging investments in state-of-the-art food processing technologies across the country.

Argentina Food Processing Equipment Market Trends:

Automation and Smart Manufacturing Integration

The Argentina food processing equipment market is witnessing accelerated adoption of automated and smart manufacturing solutions as processors seek enhanced operational efficiency and product consistency. As per sources, in 2025, Argentina’s dairy sector reported over 400 robotic milking systems in operation, with more than 15% of dairies adopting automation through INTA–DeLaval collaboration, significantly improving efficiency and animal monitoring. Further, manufacturers are increasingly implementing programmable logic controllers, sensor-based monitoring systems, and integrated process control technologies throughout their production lines. This technological transformation enables real-time quality monitoring, predictive maintenance capabilities, and seamless integration across multiple processing stages. Food processors are prioritizing equipment featuring digital connectivity and data analytics capabilities to optimize resource utilization, minimize waste, and improve overall equipment effectiveness. The transition toward Industry 4.0 concepts is reshaping equipment procurement decisions, with buyers favoring suppliers offering comprehensive automation solutions.

Sustainability and Energy Efficiency Focus

Environmental sustainability considerations are increasingly influencing food processing equipment procurement decisions across Argentina. Processors are prioritizing equipment featuring energy-efficient motors, heat recovery systems, and reduced water consumption capabilities to minimize operational costs and environmental footprint. According to sources, Argentina launched a streamlined energy efficiency program providing low-interest loans for households and businesses, simplifying import of energy-efficient appliances, motors, and pumps, boosting technology adoption nationwide. Moreover, equipment manufacturers are responding by developing solutions incorporating renewable energy compatibility, reduced emissions profiles, and circular economy principles in their designs. The emphasis on sustainable manufacturing practices extends to packaging equipment, with growing demand for machinery compatible with biodegradable and recyclable packaging materials. This sustainability-driven transformation is accelerating equipment replacement cycles as processors modernize facilities to meet environmental compliance requirements.

Hygienic Design and Food Safety Enhancement

Rising food safety standards and export market requirements are driving significant investments in hygienic equipment design across Argentina's food processing sector. As per sources, in 2025, Argentina amended its Food Code to simplify export and import regulations, easing trade procedures for certified products, aligning with international standards, and supporting food safety compliance nationwide. Manufacturers are increasingly demanding equipment featuring sanitary construction materials, clean-in-place capabilities, and contamination prevention designs that facilitate compliance with international food safety certifications. The focus on traceability and quality assurance is propelling adoption of equipment incorporating automated inspection, metal detection, and quality control systems throughout production processes. Processing facilities are upgrading to equipment meeting stringent hygienic design principles to access premium export markets and satisfy increasingly quality-conscious domestic consumers seeking safe, high-quality processed food products.

Market Outlook 2026-2034:

The Argentina food processing equipment market is projected to demonstrate steady revenue expansion throughout the forecast period, supported by continued industrialization of the food sector and export-oriented growth strategies. Market revenue is expected to benefit from sustained investments in processing infrastructure modernization, technological advancement in automation solutions, and expanding applications across emerging food categories. The market revenue trajectory will be influenced by government policies supporting agricultural value addition, foreign direct investment inflows, and evolving consumer preferences driving demand for processed food products. The market generated a revenue of USD 385.50 Million in 2025 and is projected to reach a revenue of USD 565.01 Million by 2034, growing at a compound annual growth rate of 4.34% from 2026-2034.

Argentina Food Processing Equipment Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Mode of Operation |

Automatic |

62% |

|

Type |

Processing |

69% |

|

Application |

Meat, Poultry, and Seafood |

24% |

Mode of Operation Insights:

- Semi Automatic

- Automatic

Automatic dominates with a market share of 62% of the total Argentina food processing equipment market in 2025.

Automatic commands the dominant position in the market, reflecting the industry's progressive shift toward mechanized and fully automated production systems. Large-scale food processors, particularly those serving export markets, are driving demand for automatic equipment that delivers consistent product quality, enhanced throughput capacity, and reduced reliance on manual labor. These systems enable processors to achieve operational efficiencies essential for maintaining competitive positioning in international markets while meeting stringent quality and safety requirements.

Automatic adoption is further accelerated by Argentina's labor market dynamics and the need for precise process control in high-volume production environments. Processors handling meat, dairy, and grain products increasingly favor fully automated lines that minimize human intervention, reduce contamination risks, and ensure batch-to-batch consistency. The segment benefits from ongoing technological advancements incorporating programmable controls, integrated quality monitoring, and connectivity features that facilitate data-driven operational optimization across processing facilities. According to sources, JBT opened its San Miguel de Tucumán Research & Technology Center in Argentina, offering automated fruit and vegetable processing, process audits, and quality optimization services for regional food processors.

Type Insights:

- Processing

- Pre-Processing

Processing leads with a share of 69% of the total Argentina food processing equipment market in 2025.

Processing maintains market leadership, encompassing essential machinery for thermal processing, mixing, separation, forming, and preservation operations across diverse food categories. Argentina's robust meat processing industry, combined with expanding dairy and grain processing sectors, generates substantial demand for specialized processing equipment capable of handling high volumes while maintaining product integrity. The segment's dominance reflects the central role processing equipment plays in transforming raw agricultural inputs into value-added food products meeting domestic and international market specifications.

Investments for processing equipment are driven by continuous technological evolution offering improved energy efficiency, enhanced sanitary design, and greater operational flexibility. As per sources, in September 2025, Milkaut invested US$ 30 Million to modernize and expand its Santa Fe dairy plants in Argentina, aiming to increase cheese and butter production capacity by 50%. Moreover, food manufacturers are increasingly adopting multipurpose processing systems that accommodate diverse product portfolios and facilitate rapid changeovers between production runs. The segment benefits from Argentina's export-oriented food industry requiring advanced processing capabilities to meet destination market requirements for product quality, safety certification, and extended shelf-life characteristics essential for international trade.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Bakery and Confectionaries

- Meat, Poultry, and Seafood

- Beverage

- Dairy

- Fruit, Nut, and Vegetable

- Grains

- Others

Meat, poultry, and seafood exhibits a clear dominance with a 24% share of the total Argentina food processing equipment market in 2025.

The meat, poultry, and seafood lead equipment demand, reflecting Argentina's global prominence in beef production and significant poultry industry expansion. Processing facilities serving both domestic consumption and lucrative export markets require sophisticated equipment for slaughtering, cutting, deboning, grinding, forming, and packaging operations. Further, the segment's leadership position stems from continuous infrastructure investments by major meat processors seeking to enhance capacity, improve product yield, and comply with increasingly stringent sanitary requirements from importing countries.

Argentina's meat processing industry continues modernizing equipment portfolios to maintain competitiveness in premium export markets, particularly for beef products commanding international recognition for quality. Equipment demand spans primary processing through value-added product manufacturing, including prepared meals, portion-controlled cuts, and convenience products gaining domestic popularity. The poultry sector's rapid expansion further strengthens segment demand as processors invest in integrated production lines featuring advanced automation, hygienic design principles, and quality monitoring systems essential for market access certification.

Regional Insights:

- Buenos Aires Region

- Litoral Region

- Northern Region

- Cordoba Region

- Cuyo Region

- Patagonia Region

Buenos Aires region dominates Argentina food processing equipment market, hosting the nation's largest concentration of food manufacturing facilities, distribution infrastructure, and industrial services. The region benefits from proximity to the primary port, skilled labor availability, established supplier networks, and comprehensive technical support services essential for advanced equipment operation and maintenance.

Litoral region represents a significant market driven by extensive agricultural production, particularly soy processing and dairy manufacturing activities concentrated in Santa Fe and Entre Ríos provinces. The region's strategic river transport access facilitates export-oriented processing operations, stimulating demand for equipment serving oilseed crushing, dairy processing, and meat packing facilities.

Northern region contributes to market demand through sugar processing, citrus packing, and regional agricultural processing activities serving both domestic and export markets. Equipment demand centers on specialized processing technologies for tropical and subtropical agricultural products, with growth opportunities emerging from agricultural diversification and processing infrastructure development initiatives.

Cordoba region maintains prominent market participation driven by extensive grain processing, dairy manufacturing, and meat packing operations serving Argentina's interior agricultural production zones. The region's industrial base supports equipment demand across multiple food categories, with processors investing in modernization to enhance efficiency and product quality standards.

Cuyo region generates equipment demand primarily through wine production infrastructure, fruit processing, and olive oil manufacturing concentrated in Mendoza and San Juan provinces. The region's specialized agricultural focus drives demand for processing equipment tailored to viticulture, horticultural products, and premium food manufacturing applications serving domestic and export markets.

Patagonia region represents an emerging market driven by seafood processing, fruit packing, and specialized agricultural operations leveraging the region's unique climatic conditions. Equipment demand focuses on fish processing, berry and apple packing technologies, and cold storage solutions supporting export-oriented production targeting premium international markets.

Market Dynamics:

Growth Drivers:

Why is the Argentina Food Processing Equipment Market Growing?

Expanding Export-Oriented Food Processing Industry

Argentina's strategic position as a global agricultural powerhouse continues driving substantial investments in food processing equipment to capture value from abundant raw material supplies. The country's beef, soy, and grain exports require sophisticated processing infrastructure capable of meeting rigorous international quality standards and sanitary requirements. Food processors are continuously upgrading equipment portfolios to access premium export markets demanding certified facilities, traceability systems, and advanced quality control capabilities. In May 2025, Argentina moved to boost poultry exports to the Philippines following a temporary Brazilian import ban, creating opportunities for Argentine meat processors supplying mechanically deboned meat. Moreover, this export-oriented growth strategy stimulates demand for cutting-edge processing technologies enabling Argentine manufacturers to compete effectively in international markets and maximize returns from agricultural commodities.

Rising Domestic Demand for Processed and Convenience Foods

Argentina's evolving consumer landscape is generating increased demand for processed, packaged, and convenience food products as urbanization trends and changing lifestyles reshape eating patterns. Growing middle-class populations with rising disposable incomes increasingly prefer ready-to-eat meals, processed dairy products, and value-added food items offering convenience without compromising quality. This consumption shift requires food manufacturers to expand processing capabilities and diversify product portfolios through investments in specialized equipment. As per sources, in 2025, Sueño Verde reported rapid growth in IV and V range ready-to-eat vegetables in Argentina, delivering products 24–48 hours post-harvest while ensuring full traceability and quality. Moreover, domestic market dynamics complementing export opportunities create sustained equipment demand across processing categories as manufacturers respond to consumer preferences for variety, convenience, and consistent product quality.

Government Initiatives Supporting Agricultural Value Addition

Argentine government policies promoting agricultural industrialization and export diversification provide favorable conditions for food processing equipment investments. Policy frameworks encouraging domestic value addition rather than raw commodity exports stimulate processing infrastructure development across agricultural sectors. Investment incentives, financing programs, and trade promotion initiatives support food processors seeking to modernize facilities and expand production capabilities. According to sources, in 2025, Argentina opened 31 new export markets, including China’s poultry market, and saw agro-industrial export volumes grow 11% in first quarter of 2025, supporting value-added processing opportunities. These policy drivers create conducive market conditions for equipment suppliers while enabling food manufacturers to access capital for technology upgrades essential for competitive positioning in both domestic and international markets.

Market Restraints:

What Challenges the Argentina Food Processing Equipment Market is Facing?

Economic Volatility and Currency Fluctuation Challenges

Argentina's macroeconomic environment presents significant challenges for food processing equipment investments, with currency volatility impacting import costs and procurement decisions. Exchange rate fluctuations increase uncertainty around equipment pricing, spare parts availability, and total cost of ownership calculations for imported machinery. Economic instability affects processor profitability and capital availability, potentially delaying equipment replacement and modernization investments despite operational necessity.

High Capital Requirements and Financing Constraints

Food processing equipment investments require substantial capital outlays that challenge smaller and medium-sized processors with limited financing access. Advanced automated systems commanding premium pricing create barriers for processors seeking to upgrade facilities and enhance capabilities. Limited availability of affordable equipment financing options restricts market expansion potential, particularly among processors serving domestic markets with lower margins than export-oriented operations.

Infrastructure and Logistics Limitations

Argentina's infrastructure challenges, including energy reliability concerns and transportation network limitations, constrain food processing equipment adoption and operational efficiency. Processors located outside major industrial centers face additional challenges securing reliable power supplies, skilled technical support, and timely spare parts delivery. These infrastructure limitations impact equipment utilization rates and influence procurement decisions, with processors prioritizing robust, service-friendly equipment designs suitable for operating environments with support constraints.

Competitive Landscape:

The Argentina food processing equipment market features a competitive structure comprising established international manufacturers and regional equipment suppliers serving diverse processor requirements across application segments. Market participants compete through technological differentiation, comprehensive service networks, customization capabilities, and financing solutions addressing local market conditions. International suppliers leverage global technology portfolios and application expertise while regional manufacturers offer competitive pricing, local service proximity, and equipment designs accommodating Argentine operating environments. The competitive landscape is characterized by ongoing consolidation activities, strategic partnerships between international and local suppliers, and increasing emphasis on after-sales service excellence as processors prioritize total cost of ownership considerations in procurement decisions.

Recent Developments:

-

In September 2024, Industries FAC and Castellini Foodtech showcased customized food processing machinery at Tecno Fidta in Buenos Aires, highlighting efficient and sustainable industrial solutions while strengthening their presence and client relationships in Argentina and the wider Latin American food technology market.

Argentina Food Processing Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mode of Operations Covered | Semi Automatic, Automatic |

| Types Covered | Processing, Pre-Processing |

| Applications Covered | Bakery and Confectionaries, Meat, Poultry, and Seafood, Beverage, Dairy, Fruit, Nut, and Vegetable, Grains, Others |

| Regions Covered | Buenos Aires Region, Litoral Region, Northern Region, Cordoba Region, Cuyo Region, Patagonia Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Argentina food processing equipment market size was valued at USD 385.50 Million in 2025.

The Argentina food processing equipment market is expected to grow at a compound annual growth rate of 4.34% from 2026-2034 to reach USD 565.01 Million by 2034.

Automatic held the largest market share in Argentina food processing equipment market, driven by efficiency gains, reduced labor costs, consistent product quality, improved hygiene, higher production capacity, and the industry's shift toward fully mechanized and automated processing systems.

Key factors driving the Argentina food processing equipment market include expanding export-oriented food processing industries, rising domestic demand for processed and convenience foods, government initiatives supporting agricultural value addition, and technological advancement in automation solutions.

Major challenges include economic volatility and currency fluctuation impacts on import costs, high capital requirements limiting equipment investments, financing constraints for smaller processors, infrastructure limitations in remote regions, and technical service availability outside major industrial centers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)