Artificial Intelligence Chip Market Size, Share, Trends and Forecast by Chip Type, Technology, Processing Type, Application, Industry Vertical, and Region 2025-2033

Artificial Intelligence Chip Market Size and Share:

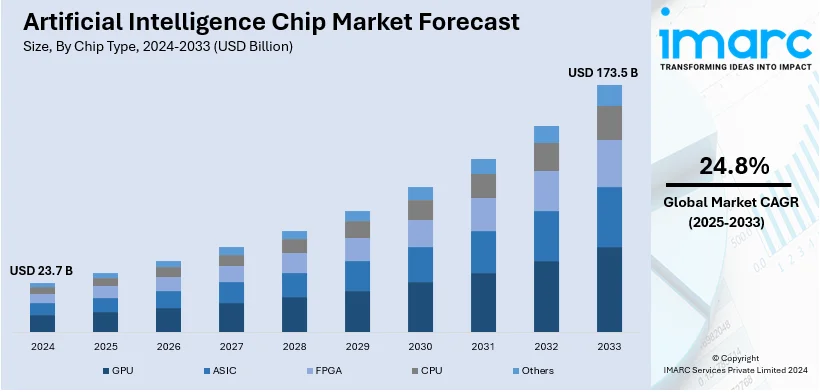

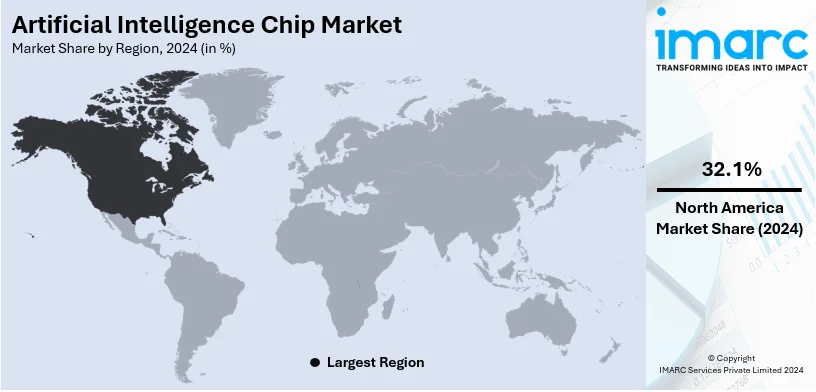

The global artificial intelligence chip market size was valued at USD 23.7 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 173.5 Billion by 2033, exhibiting a CAGR of 24.8% during 2025-2033. North America exhibits a clear dominance in the artificial intelligence chip market with 32.1% of the market share. This region is driven by rapid advancements in machine learning, high demand for cloud-based applications, growing investments in AI startups, and widespread adoption of these chips across various industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 23.7 Billion |

|

Market Forecast in 2033

|

USD 173.5 Billion |

| Market Growth Rate 2025-2033 | 24.8% |

The increasing usage of AI in the automobile industry has been the major demand puller for AI chips. These chips are powering all the advanced driver-assistant systems, autonomous driving features, and in-car infotainment systems. With an increasing interest in safety, efficiency, and connectivity by automakers, AI chips play an important role in enabling data processing in real time and object detection, which enhances navigation and supports the growth of the market. This trend is further fueled by developments in electric and autonomous vehicles, which highly depend on AI for optimized performance. Such development emphasizes the need for AI chips as the future of mobility and smart transportation systems. For instance, in 2024, Intel unveiled AI-enhanced SDV SoCs enabling scalable in-vehicleAI applications, with a demo featuring 12 advanced workloads showcasing generative AI, e-mirrors, video calls, and gaming, while consolidating ECUs to enhance efficiency, scalability, and automaker customization.

The United States is demonstrating robust growth in the artificial intelligence chip market due to its strong technology ecosystem, significant R&D investments, and early adoption of AI technologies across industries. Leading global companies further drive innovation in AI chip design and production, thus propelling its adoption. For instance, in 2024, AMD introduced advanced AI computing solutions, including 5th Gen EPYC CPUs, Instinct MI325X accelerators, Pensando DPUs, and AMD Ryzen AI PRO 300 series processors, showcasing scalable deployments and expanding the ROCm AI software ecosystem. Apart from this, various government initiatives supporting AI research and development further enhance market potential. The widespread integration of AI in sectors, such as healthcare, automotive, finance, and defense, accelerates demand for advanced AI chips. Additionally, the presence of a skilled workforce and extensive collaboration between academia and industry positions the U.S. as a global leader in AI chip advancements.

Artificial Intelligence Chip Market Trends:

Advancements in Energy-Efficient AI Chips

Growing complexity of AI workloads is forcing the need for energy-efficient chips. For instance, according to the Bain & Company Technology Report 2024 highlight, AI workloads are projected to grow 25-35% annually through 2027, driving a market expansion to USD 780-USD 990 Billion, while escalating infrastructure costs and demand surges present AI chip suppliers with a competitive edge amid potential global shortages. Chip manufacturers have aligned with their sustainability goals to design at low power levels with reduced operation costs and environmental impacts. Dynamic voltage scaling, cooling systems, and architectures that focus on specific usage have led the chips to handle intensive AI tasks without sacrificing energy efficiency. Especially in the context of a data center, power consumption forms a vital aspect, as with edge devices that are crucially reliant on battery life.

Growing Integration of AI Chips in Consumer Electronics

The integration of AI chips in consumer electronics is a growing trend that is changing the artificial intelligence chip market. Smartphones, smart home devices, wearables, and gaming consoles are increasingly relying on AI chips to improve performance and user experience. Features such as real-time voice recognition, advanced image processing, and personalized recommendations are powered by AI-enabled processors. According to the PIB, India's electronics sector has experienced rapid growth, reaching USD 155 Billion in FY23. Production nearly doubled from USD 48 Billion in FY17. This trend is further fueled by rising demand from consumers for intelligent and responsive devices. As consumer electronics continue to develop , the adoption of AI chips is expected to expand even more into this rapidly growing market.

Rapid Adoption of AI Across Industries

The major growth driver of the artificial intelligence chip market is the growing adoption of AI across industries such as healthcare, automotive, finance, and retail. According to IBM: 34% of companies currently use AI, and an additional 42% are exploring AI. AI chips allow for the faster processing of data, higher efficiency, and better decision-making, answering the growing needs for real-time analytics and automation. In the automotive sector, AI chips power advanced driver assistance systems and autonomous vehicles, while in healthcare, they facilitate diagnostic imaging and personalized medicine. The widespread adoption of AI-powered consumer devices, such as smart assistants and IoT devices, continues to fuel demand. Widespread integration underlines the critical role that AI chips play in transforming modern industries.

Artificial Intelligence Chip Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global artificial intelligence chip market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on chip type, technology, processing type, application, and industry vertical.

Analysis by Chip Type:

- GPU

- ASIC

- FPGA

- CPU

- Others

ASIC stand as the largest chip type in 2024, holding around 34.3% of the market. ASICs are specifically designed to handle targeted AI workloads, offering unparalleled performance, energy efficiency, and customization capabilities. Their dominance is driven by their widespread adoption in industries like autonomous vehicles, healthcare, and finance, where optimized processing and reliability are crucial. As AI applications become more specialized, the demand for ASICs continues to rise, solidifying their role as a cornerstone technology in the evolving artificial intelligence landscape.

Analysis by Technology:

- System-on-Chip (SoC)

- System-In-Package (SIP)

- Multi-Chip Module

- Others

System-on-chip (SoC) leads the market with around 48.8% of market share in 2024. SoCs integrate multiple components, including the processors, memory, and connectivity modules, onto one single chip, providing compact, efficient, and high-performance solutions. Their massive adoption in edge devices, smartphones, and IoT applications where space and power efficiency are critical fuels their dominance. The growing adoption of AI across industries and increased demand for multifunctional, energy-efficient computing solutions further reinforce SoCs as a pivotal technology in the artificial intelligence market.

Analysis by Processing Type:

- Edge

- Cloud

Edge leads the market with around 63.6% of the market share in 2024. Edge processing allows for near-source analysis of data, which reduces latency and improves the real-time decision-making capability. Its adoption is being fueled by IoT devices, autonomous systems, and industrial automation, which are highly demanding in terms of low-latency processing. Decentralized computing and energy efficiency further highlight the crucial role that edge processing will play in shaping the future of AI-driven technologies.

Analysis by Application:

- Natural Language Processing (NLP)

- Robotics

- Computer Vision

- Network Security

- Others

Natural Language Processing (NLP) leads the market with around 28.2% of the market share in 2024. Advanced language understanding, translation, and conversational AI systems are powered by NLP technologies, thereby driving demand across customer service, healthcare, and finance sectors. The rapid proliferation of virtual assistants, chatbots, and voice-activated technologies further fuel demand for AI chips optimized for NLP. As more businesses focus on enhanced communication and user engagement, NLP remains a core application in shaping the artificial intelligence chip market.

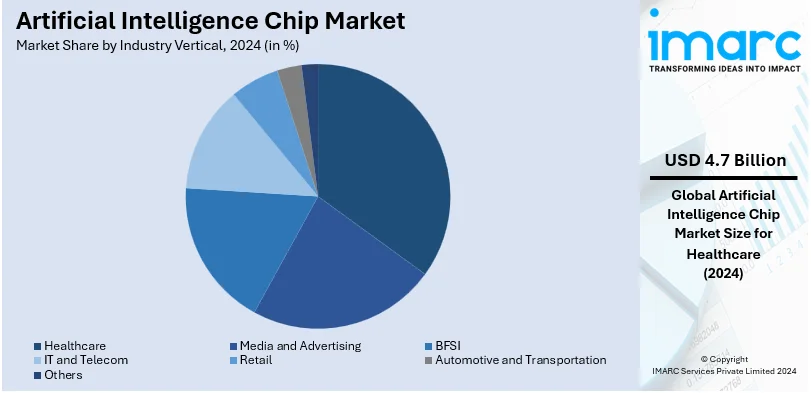

Analysis by Industry Vertical:

- Media and Advertising

- BFSI

- IT and Telecom

- Retail

- Healthcare

- Automotive and Transportation

- Others

Healthcare leads the market with around 19.9% of the market share in 2024. AI chips play a transformative role in healthcare as they are capable of powering advanced applications, including diagnostic imaging, personalized medicine, and drug discovery. They process enormous amounts of medical data with great efficiency and provide real-time decision-making, thereby encouraging adoption. Furthermore, the increased adoption of AI in wearable devices and telemedicine is crucial for determining the demand for AI chips in the global market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market with around 32.1% of the market share in 2024. North America is at the cutting edge of the AI chip market, driven by robust technology infrastructure, strong research and development capabilities, and leading semiconductor companies. The region has adopted advanced technologies early on, especially in sectors such as healthcare, automotive, and finance, where AI applications are emerging rapidly. The investment made in AI-focused startups as well as partnerships between technological firms and academia enhances the innovation. Also, government support through initiatives and funding for AI advancements solidifies North America's position as the global leader in the AI chip industry.

Key Regional Takeaways:

United States Artificial Intelligence Chip Market Analysis

In 2024, US accounted for around 92.3% of the total North America Artificial Intelligence Chip market. The United States is playing a pivotal role in fostering the integration of AI-focused technologies through significant advancements in chip design and development. With innovation hubs like Silicon Valley in California and Austin, Texas, the country supports groundbreaking progress in the field. For instance, a Pew Research Center survey reveals 52% of Americans are more concerned than excited about AI, yet 90% are aware of its presence, showcasing its potential in applications like healthcare and education. This growing familiarity underscores an opportunity for AI chip innovation to address concerns while enhancing trust and usability. Major companies such as NVIDIA and Intel are at the center of these efforts, delivering cutting-edge AI processors that enhance computational efficiency and scalability. NVIDIA’s GPUs are widely used for deep learning, driving progress in applications like autonomous vehicles and medical imaging. Similarly, Intel's advancements in neuromorphic computing, exemplified by its Loihi chips, enable real-time learning and adaptive AI. Strategic initiatives across the country are also accelerating adoption of AI in industries such as healthcare and automotive, setting a foundation for impactful AI applications worldwide.

Asia Pacific Artificial Intelligence Chip Market Analysis

Asia Pacific is experiencing significant progress in integrating advanced technologies, particularly artificial intelligence chips, driven by robust innovation and infrastructure development. Countries like China and Japan are actively fostering AI ecosystems through research and investment in semiconductor technology. In China, initiatives such as the establishment of dedicated AI research parks and collaborations between tech giants and universities are streamlining advancements in AI chip manufacturing. Japan, on the other hand, is leveraging its expertise in robotics and automation, integrating AI chips into industrial applications to enhance efficiency. A recent Digital Realty study reveals that 66% of South Korean enterprises and 46% of Singaporean businesses rate their AI adoption as mature, yet only 25% of the region finds AI use transformative, highlighting infrastructure gaps. Strategic data management and robust AI chip solutions emerge as key advantages to scaling AI workloads efficiently, meeting both performance and sustainability goals. Additionally, government-backed programs across the region are promoting cross-border collaborations, attracting investments, and facilitating knowledge exchange. With this dynamic environment, Asia Pacific stands as a pivotal region influencing the global semiconductor landscape, showcasing practical AI applications in diverse sectors such as healthcare and automotive.

Europe Artificial Intelligence Chip Market Analysis

Europe has emerged as a dynamic region fostering innovative developments in AI-related technologies, driven by its strong emphasis on research, collaboration, and investment. Countries like Germany and France are making significant strides by integrating cutting-edge semiconductor technologies to accelerate AI applications. Germany, with its advanced manufacturing sector, is leveraging AI-enhanced chips to optimize industrial automation and robotics. For instance, The European Chips Act aims to double the EU’s share in global microchip production from 10% to 20% by 2030, positioning the bloc as a resilient leader in AI-grade semiconductor supply amidst surging demand, projected to grow tenfold by 2033, and geopolitical disruptions. This strategic move strengthens Europe’s AI competitiveness by ensuring reliable access to cutting-edge chips. Meanwhile, France is focusing on AI-driven healthcare solutions, where chips with high computational power are enabling advancements in diagnostic imaging and personalized treatments. Collaborative initiatives, such as the European Processor Initiative (EPI), aim to develop energy-efficient, high-performance processors tailored for AI workloads, ensuring technological independence for the region. Additionally, the Netherlands is home to significant contributions in chip fabrication, with organizations like ASML innovating lithography machines critical for next-generation chip production. Such efforts showcase Europe's commitment to creating a thriving ecosystem supporting the global AI landscape.

Latin America Artificial Intelligence Chip Market Analysis

Latin America is emerging as a prominent region in driving advancements in AI technology, with countries like Brazil and Mexico leading progress. Investments in data centers and improved infrastructure in these nations are fostering faster integration of innovative technologies. For instance, Brazil is utilizing AI in smart agriculture, enhancing crop monitoring and productivity, while Mexico is leveraging it for urban mobility solutions to improve traffic management. For instance, in September 2024, Microsoft's USD 2.7 Billion investment in Brazil aims to bolster AI and cloud infrastructure, potentially driving a 4.2% GDP growth boost by 2030, while training 5 Million people in AI over three years, positioning AI chips as pivotal for economic and technological advancement. The region's strategic focus on education and partnerships is accelerating research and development, positioning it as a growing hub for cutting-edge AI applications across diverse sectors.

Middle East and Africa Artificial Intelligence Chip Market Analysis

The Middle East and Africa are witnessing significant advancements in technology integration, with countries like the UAE, Saudi Arabia, and South Africa making substantial progress in artificial intelligence applications. Dubai's Smart City initiatives and Saudi Arabia’s Vision 2030 are promoting innovative infrastructure powered by AI-driven solutions. For instance, in September 2024, Silicon Valley-based Groq plans to establish computing infrastructure in Saudi Arabia, marking a key milestone in advancing ultra-fast AI chip technology. With record-breaking speeds of 534 tokens per second and a developer base of 444,000, Groq's expansion highlights a strategic advantage for AI innovation in the region. South Africa's growing AI research hubs and partnerships further enhance regional capabilities. Strategic investments, such as AI-focused data centres in Egypt, bolster computational power, while initiatives in healthcare and agriculture improve local adoption. These developments demonstrate how diverse sectors across the region are embracing AI-powered chip technologies for transformative solutions.

Competitive Landscape:

The global artificial intelligence chip market features intense competition, driven by advancements in AI applications across industries. Leading players dominate with innovative GPU, CPU, and ASIC designs. Emerging companies focus on specialized AI accelerators and energy-efficient chips. Strategic collaborations, R&D investments, and acquisitions are reshaping the landscape, fostering innovation, and addressing the growing demand for high-performance, scalable, and cost-effective AI solutions in diverse sectors. For instance, in 2024, Intel introduced Arc Battlemage B580 ($250) and B570 ($220) gaming GPUs, which will launch on December 13 and January 16 respectively. These GPUs use Xe 2 architecture, thereby enhancing performance and affordability.

The report provides a comprehensive analysis of the competitive landscape in the global artificial intelligence chip market with detailed profiles of all major companies, including:

- Advanced Micro Devices Inc.

- Huawei Technologies Co. Ltd.

- Intel Corporation

- LG Electronics Inc. (LG Corporation)

- Mediatek Inc.

- Micron Technology Inc.

- Mythic Inc.

- Nvidia Corporation

- NXP Semiconductors N.V.

- Qualcomm Technologies Inc

- SK hynix Inc.

- Toshiba Corporation

Latest News and Developments:

- November 2024, Amazon is preparing to unveil its custom AI chips for cloud computing, offering a cost-effective solution for developers. The move addresses industry concerns about an AI chip supply crunch driven by surging demand. These DIY chips are expected to empower customers with efficient AI integration. By enhancing accessibility, Amazon aims to fortify its cloud services against growing competition. The chips reflect Amazon’s broader investment in vertical integration. Analysts predict this step will reshape the AI chip landscape in cloud computing.

- November 2024, Huawei targets early 2025 for mass production of its next-generation AI chip, defying U.S. trade restrictions. The chip will feature cutting-edge design optimized for AI-driven applications. Huawei’s advancements underscore its determination to maintain technological self-reliance amid geopolitical tensions. The project highlights the company’s commitment to innovation despite ongoing challenges.

- October 2024, OpenAI has partnered with Broadcom to produce its first proprietary AI chip, marking a significant shift in its strategy. Initially ambitious about becoming a foundry, OpenAI has scaled back plans, leveraging Taiwan Semiconductor Manufacturing Company (TSMC) for production. This collaboration underlines OpenAI’s efforts to optimize performance and reduce dependency on external hardware providers.

- September 2024, Intel launched its latest AI chips, aiming to solidify its position in the fast-growing AI hardware market. The chips boast advanced processing capabilities designed to cater to AI-driven applications. Meanwhile, rumors about a potential acquisition have intensified, reflecting the company's strategic interest in maintaining competitiveness. The new hardware highlights Intel’s push to deliver power-efficient and scalable AI solutions.

- August 2024, Krutrim, the AI startup founded by Ola's Bhavish Aggarwal, announced plans to launch its first AI chip, Bodhi 1, by 2026. This chip is designed to handle complex AI workloads, aiming to enhance the efficiency of AI systems. Krutrim is also developing Bodhi 2, expected in 2028, capable of supporting models with over 10 Trillion parameters. The company has partnered with global semiconductor firms Arm and Untether AI to advance these developments. Additionally, Krutrim plans to scale its data center capacity to 1 GW by 2028 to support growing AI and cloud computing demands.

Artificial Intelligence Chip Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Chip Types Covered | GPU, ASIC, FPGA, CPU, Others |

| Technologies Covered | System-on-Chip (SoC), System-In-Package (SIP), Multi-Chip Module, Others |

| Processing Types Covered | Edge, Cloud |

| Applications Covered | Natural Language Processing (NLP), Robotics, Computer Vision, Network Security, Others |

| Industry Verticals Covered | Media and Advertising, BFSI, IT and Telecom, Retail, Healthcare, Automotive and Transportation, Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advanced Micro Devices Inc., Huawei Technologies Co. Ltd., Intel Corporation, LG Electronics Inc. (LG Corporation), Mediatek Inc., Micron Technology Inc., Mythic Inc., Nvidia Corporation, NXP Semiconductors N.V., Qualcomm Technologies Inc, SK hynix Inc. and Toshiba Corporation |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the artificial intelligence chip market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global artificial intelligence chip market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the artificial intelligence chip industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment.

Key Questions Answered in This Report

An artificial intelligence (AI) chip is a specialized semiconductor designed to optimize computing tasks associated with AI applications, such as machine learning, deep learning, and neural network processing. These chips enhance performance, speed, and energy efficiency in various devices, powering advancements in robotics, autonomous systems, and data analytics.

The artificial intelligence chip market was valued at USD 23.7 Billion in 2024.

IMARC estimates the global artificial intelligence chip market to exhibit a CAGR of 24.8% during 2025-2033.

Key factors driving the global artificial intelligence chip market include growing adoption of AI in industries like healthcare, automotive, and finance, rising demand for energy-efficient, high-performance processors, and advancements in edge computing. Increased investment in AI-driven technologies and expanding applications, such as robotics and IoT, further boost market growth.

According to the report, ASIC represented the largest segment by chip type, driven by its ability to deliver high performance, energy efficiency, and tailored solutions for specific AI applications, including autonomous vehicles, robotics, and data centers.

System-on-chip (SoC) leads the market by technology as it integrates multiple components, including processors, memory, and connectivity, onto a single chip, providing compact, efficient, and high-performance solutions for AI applications across industries such as consumer electronics, automotive, and IoT.

Edge holds the largest share in the processing type segment as it enables real-time data processing closer to the source, reducing latency and enhancing efficiency for applications like IoT devices, autonomous systems, and industrial automation, which require fast, localized decision-making capabilities.

Natural language processing leads the market in the application segment as it powers advanced AI-driven tools like chatbots, virtual assistants, and real-time language translation, addressing the growing demand for enhanced user engagement, communication, and automation across industries such as customer service, healthcare, and finance.

Healthcare leads the market in the industry vertical segment, driven by the adoption of AI for diagnostic imaging, personalized medicine, drug discovery, and telemedicine, as well as the increasing reliance on AI-powered tools to enhance patient care, streamline operations, and improve clinical decision-making.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global artificial intelligence chip market include Advanced Micro Devices Inc., Huawei Technologies Co. Ltd., Intel Corporation, LG Electronics Inc. (LG Corporation), Mediatek Inc., Micron Technology Inc., Mythic Inc., Nvidia Corporation, NXP Semiconductors N.V., Qualcomm Technologies Inc, SK hynix Inc., Toshiba Corporation,etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)