Asia Pacific Ammonia Market Size, Share, Trends and Forecast by Type, Application, and Country, 2025-2033

Asia Pacific Ammonia Market Size and Share:

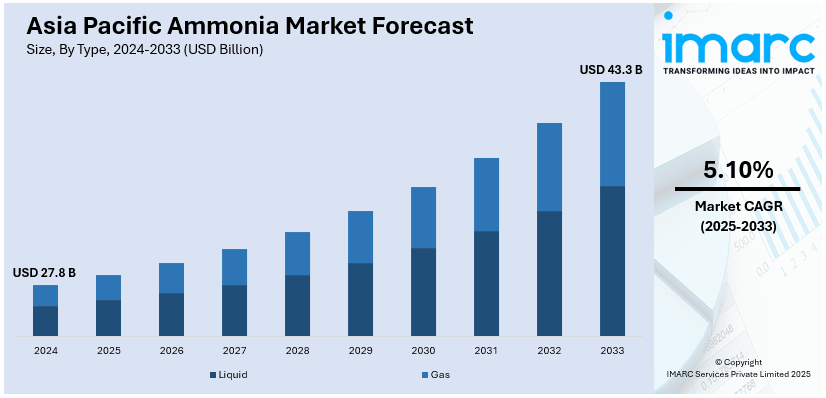

The Asia Pacific ammonia market size was valued at USD 27.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 43.3 Billion by 2033, exhibiting a CAGR of 5.10% from 2025-2033. The market is witnessing significant growth due to the escalating demand for fertilizers in agriculture and rising industrial applications and clean energy development. Moreover, the increasing adoption of green ammonia, expansion of ammonia as a hydrogen carrier, and growing adoption in the ammonia production capacity are expanding the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 27.8 Billion |

| Market Forecast in 2033 | USD 43.3 Billion |

| Market Growth Rate (2025-2033) | 5.10% |

Major demand from the Asia-Pacific region arises from rapid population growth, which, in turn, drives up food demand. Ammonia is a main constituent of nitrogen-based fertilizers, such as urea and ammonium nitrate, along with ammonium sulfate. These fertilizers are critical for increasing crop yield and soil fertility. India and China-invest significantly in fertilizer production because of their large agricultural sectors. For example, in 2024, TFC is driving industrial transformation through ammonia energy partnerships with both Japan and South Korea and is investing USD 91 Million into two new liquid ammonia storage tanks. Government policies also help pull ammonia demand to higher levels through subsidies on fertilizers and policies promoting sustainable agriculture. Long-term demand for ammonia will also be driven by various advances in precision farming and adoption of high-efficiency fertilizers.

To get more information on this market, Request Sample

Apart from agriculture, ammonia is widely used in industrial applications such as chemicals, refrigeration, and wastewater treatment. The growing chemical manufacturing sector in Asia-Pacific, particularly in China, Japan, and South Korea, significantly contributes to ammonia demand. Additionally, ammonia is gaining traction as a potential clean energy carrier, particularly in hydrogen transportation and fuel applications. For instance, in 2024, Yara and ACME signed a binding agreement for the long-term supply of 100,000 tons of renewable ammonia annually from ACME’s Oman project, reducing global CO₂ emissions by up to 5 million tons. With increasing government investments in renewable energy and carbon-neutral initiatives, ammonia’s role in green energy solutions is expected to grow. The development of ammonia-based fuel technologies, supported by strategic partnerships and research, positions ammonia as a key player in the region’s energy transition.

Asia Pacific Ammonia Market Trends:

Increasing Adoption of Green Ammonia

The Asia-Pacific ammonia market shows a major trend towards green ammonia production through renewable energy resources consisting of wind power and solar panels as well as hydropower systems. For instance, in October 2024, BASF and AM Green signed a Memorandum of Understanding (MoU) to explore low-carbon chemicals produced with renewable energy in India. The partnership includes feasibility studies for chemical production and a non-binding agreement to purchase 100,000 tons of green ammonia annually. AM Green, part of the Greenko Group, aims for 5 MTPA of green ammonia capacity by 2030, supporting India's decarbonization goals. The need to address carbon emissions and environmental change has driven the governments and industries across the Asia-Pacific to support sustainable ammonia manufacturing as they work to eliminate fossil fuel-based production systems. Japan together with Australia and South Korea currently take the lead in green ammonia project development through their use of hydrogen-based ammonia as an environmentally friendly energy carrier. Public-private sector alliances along with government support continue to advance green ammonia technology into the core elements of upcoming energy solutions.

Expansion of Ammonia as a Hydrogen Carrier

A growing number of countries in the Asia-Pacific region now view ammonia as an important method for transporting hydrogen throughout clean energy applications. Throughout the energy sector ammonia serves as an effective method for hydrogen storage and shipment which provides substantial advantages in energy security and decarbonization projects. The nations of Japan and South Korea have begun investing money into ammonia-based hydrogen fuel technology applications for power production and vehicle transportation. Various pilot operations and major investments proceed toward the development of ammonia cracking systems that extract hydrogen from ammonia to support its utilization in fuel cells and industrial applications. For instance, in 2024, Mitsubishi Heavy Industries Asia Pacific together with PTT formed an agreement through an MoU to evaluate the pre-feasibility of deploying 100% ammonia in gas turbine power generation systems in Thailand to help achieve its decarbonization objectives. The increasing use of ammonia for power generation matches worldwide initiatives to shift toward renewable energy systems.

Growing Investments in Ammonia Production Capacity

Amid rising demand from agriculture, industrial applications, and energy sectors, Asia-Pacific countries are expanding ammonia production capacities. Leading ammonia producers in China, India, and Indonesia are investing in new plants and upgrading existing facilities to enhance efficiency and output. Additionally, foreign investments and joint ventures are driving the establishment of large-scale ammonia production projects. Governments are also supporting ammonia manufacturing through policy incentives, infrastructure development, and favorable regulatory frameworks. For instance, in May 2024, Japan passed the Hydrogen Society Promotion Act, introducing two subsidy schemes: a CfD Scheme with JPY 3 trillion in funding and a Clusters Support Scheme for large-scale hydrogen/ammonia projects. This increasing production capacity is expected to ensure a stable supply of ammonia for both domestic and international markets.

Asia Pacific Ammonia Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific ammonia market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Liquid

- Gas

Liquid ammonia is widely used in fertilizers, chemicals, and refrigeration across the Asia-Pacific region. It serves as a key raw material for nitrogen-based fertilizers, supporting agricultural productivity. Additionally, it is utilized in industrial cooling systems and chemical synthesis, ensuring efficient operations in manufacturing and processing industries.

Gaseous ammonia plays a crucial role in industrial applications, including water treatment, pharmaceuticals, and semiconductor manufacturing. In the Asia-Pacific energy sector, it is increasingly explored as a hydrogen carrier for clean energy solutions. Its use in pollution control technologies also supports environmental sustainability efforts across the region.

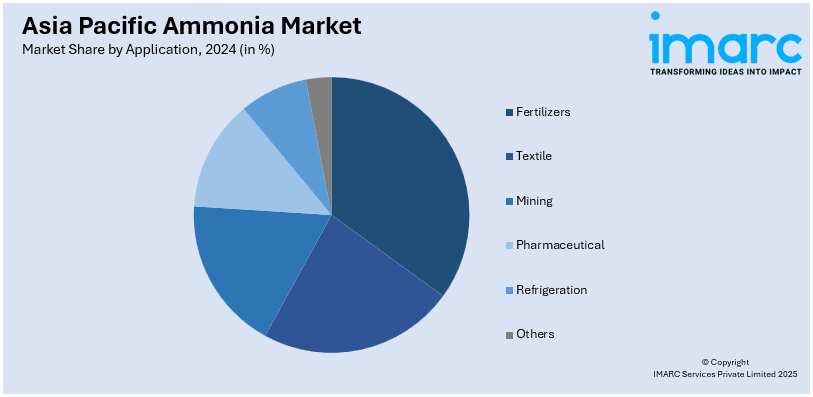

Analysis by Application:

- Fertilizers

- Textile

- Mining

- Pharmaceutical

- Refrigeration

- Others

The essential substance ammonia plays a key role in fertilizers because it boosts plant production and improves soil quality. The Asia-Pacific region depends on ammonia-based fertilizers for sustaining food security through agriculture. Governments support ammonia usage through subsidy programs and farmers choose high-performance fertilizers which leads to increasing ammonia consumption in agriculture.

Mercerization conducted in textile manufacturing utilizes ammonia as the main element to improve fabric functionality and structural strength. The three textile manufacturing giants of Asia-Pacific namely India, China and Bangladesh benefit from ammonia-based processes to achieve tougher materials and better dye-taking properties in their fabrics. Consumer demand from the textile sector rapidly increases because the industry expands.

Ammonium nitrate produced from ammonia functions as an essential ingredient which mining companies use for producing explosives to break rocks. The Asia-Pacific region, with extensive mining activities in Australia, China, and Indonesia, relies on ammonia-based explosives for efficient mineral extraction. Market expansion of mining operations and infrastructure projects increases the need for ammonia throughout the sector.

Pharmaceutical industries employ Ammonia as a vital ingredient for developing essential drugs along with their respective intermediate compounds. Asia-Pacific countries such as India and China maintain the leading position as pharmaceutical producers supported by ammonia for bulk drug development. The refrigeration system based on ammonia maintains suitable preservation conditions for temperature-dependent pharmaceutical products throughout their storage and distribution process.

The food storage and dairy sectors along with beverage industries employ ammonia as their main refrigerant substance in large-scale cooling applications. The growing food processing and cold chain logistics sector in Asia-Pacific depends on ammonia-based refrigeration systems that serve as a green refrigeration technology by substituting high global warming potential synthetic refrigerants.

Country Analysis:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

As the largest ammonia producer and consumer in Asia-Pacific, China dominates the market with extensive fertilizer production and chemical manufacturing. Government policies supporting agriculture and industrial expansion drive ammonia demand. Additionally, China is investing in green ammonia and hydrogen projects, strengthening its role in the region’s energy transition.

Japan is a key player in ammonia-based clean energy solutions, investing heavily in green ammonia for hydrogen transportation and power generation. With limited domestic production, Japan relies on imports and strategic partnerships for ammonia supply. Its focus on decarbonization and ammonia fuel technology is shaping the region’s sustainable energy landscape.

India’s ammonia market is driven by its vast agricultural sector, with high demand for nitrogen-based fertilizers. Government subsidies and self-sufficiency initiatives in fertilizer production boost ammonia consumption. Additionally, India is expanding its industrial ammonia applications in chemicals and pharmaceuticals, while exploring green ammonia investments for long-term sustainability.

South Korea is advancing ammonia’s role in clean energy, particularly in hydrogen storage and transportation. The country is investing in ammonia-based fuel technologies for power generation and shipping. Its strong chemical and semiconductor industries also contribute to ammonia demand, positioning South Korea as a key innovator in sustainable ammonia applications.

Australia is becoming a significant exporter of ammonia, especially green ammonia, utilizing its plentiful renewable energy resources. Large-scale projects for hydrogen-based ammonia production are gaining traction, with exports targeting Asia-Pacific markets, including Japan and South Korea. Australia’s ammonia industry supports global decarbonization efforts and enhances regional supply security.

Indonesia’s ammonia market is driven by its growing fertilizer industry and mining sector. As a major producer and exporter of ammonia, Indonesia supplies domestic and international markets. Government initiatives to expand ammonia production capacity and explore sustainable ammonia projects are strengthening its role in the Asia-Pacific market.

Competitive Landscape:

The ammonia market in the Asia-Pacific region is extremely competitive, with main players concentrating on increasing capacity, advancing technology, and forming strategic alliances. Major producers dominate the market. Companies are investing in green ammonia projects and energy-efficient production methods to align with sustainability goals. For instance, in 2024, IHI Corporation and Yara Clean Ammonia signed an MoU to explore clean ammonia transportation, procurement from India, and developing an international supply system to manage fluctuations and support ammonia production. Additionally, regional manufacturers in China, India, and Indonesia are strengthening their presence through government-backed initiatives and increased production capabilities. Rising demand from agriculture, chemicals, and clean energy sectors is driving competition, prompting firms to enhance efficiency and explore new market opportunities.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific ammonia market with detailed profiles of all major companies.

Latest News and Developments:

- In May 2024, Yara Clean Ammonia signed a term sheet to source up to 50% of renewable ammonia from AM Green’s Kakinada plant in India, starting in 2027. AM Green aims to produce 5 million tonnes annually by 2030 and has partnered with John Cockerill for electrolyzer production in a joint venture.

- In April 2024, PT Pupuk Indonesia partnered with Brunei Fertilizer Industries to develop urea and ammonia, strengthening national and ASEAN food security. The Head of Agreement marks the first step, with plans to expand cooperation by involving other regional fertilizer producers to enhance agricultural sustainability and supply stability across ASEAN.

Asia Pacific Ammonia Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liquid, Gas |

| Applications Covered | Fertilizers, Textile, Mining, Pharmaceutical, Refrigeration, Others |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific ammonia market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific ammonia market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific ammonia industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ammonia market in the Asia Pacific was valued at USD 27.8 Billion in 2024.

The growth of the Asia-Pacific ammonia market is driven by increasing demand for fertilizers in agriculture, rising industrial applications in chemicals and energy, and the growing adoption of green ammonia for sustainable energy solutions. Additionally, government initiatives, technological advancements, and regional industrial expansion further support market growth.

The Asia Pacific ammonia market is projected to exhibit a CAGR of 5.10% during 2025-2033, reaching a value of USD 43.3 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)