Asia Pacific Aroma Chemicals Market Size, Share, Trends and Forecast by Type, Product, Application, and Country, 2025-2033

Asia Pacific Aroma Chemicals Market Size and Share:

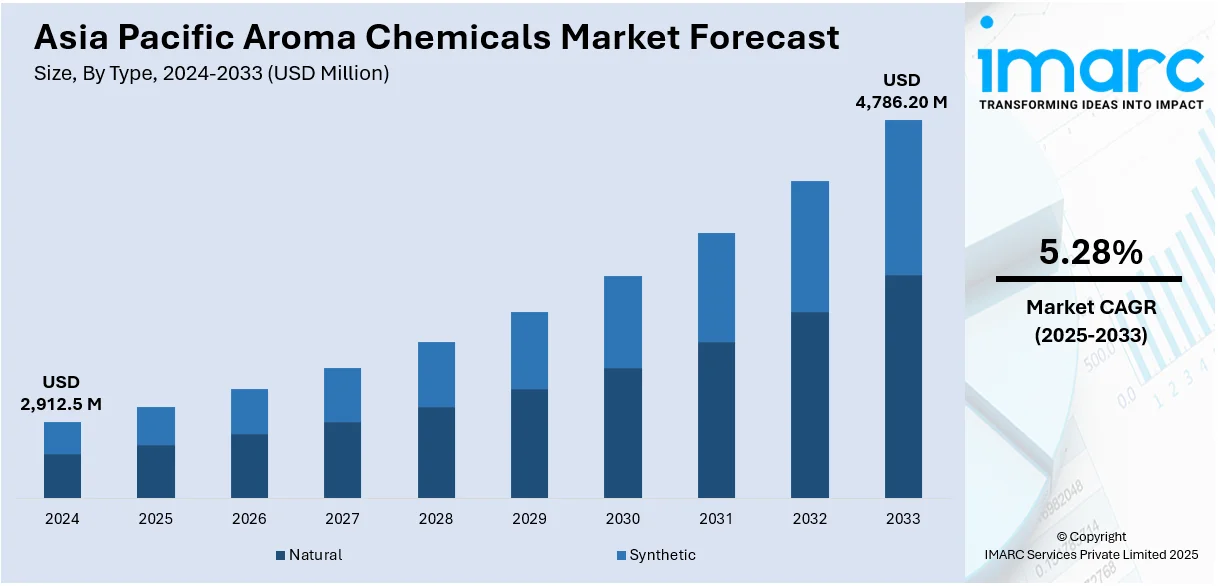

The Asia Pacific Aroma Chemicals market size was valued at USD 2,912.5 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 4,786.20 Million by 2033, exhibiting a CAGR of 5.28% from 2025-2033. China leads the market in 2024. The rising consumer demand for personal care and home care products, increasing preference for natural and sustainable ingredients, rapid urbanization, growing disposable incomes, expanding food and beverage applications, and advancements in fragrance innovation are some of the factors positively impacting the Asia Pacific aroma chemicals market share.nd for natural aroma chemicals derived from plants, and continual advancements in extraction techniques, synthesis processes, and fragrance-creation methods are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2,912.5 Million |

|

Market Forecast in 2033

|

USD 4,786.20 Million |

| Market Growth Rate (2025-2033) | 5.28% |

Main factors driving the market in the Asia Pacific region include the increasing demand for fragrances and flavors within different industries. The growing popularity of personal care and cosmetic products, which is influenced by greater consumer awareness of their grooming and self-care, also contributes considerably to the growth of the market. E-commerce platforms with robust growth are also making it easier to access a variety of products and improving the Asia Pacific aroma chemicals market outlook. Latest industry reports suggest that perfume markets in India have grown with the online segment witnessing a 25-30% increase year-over-year, raising the market value to approx. USD 5.21 Billion. In addition, rapid urbanization and growing middle-class populations are boosting consumption of processed foods and beverages that rely heavily on aroma chemicals for flavor enhancement, further supporting growth in the market.

To get more information on this market, Request Sample

In addition, significant expansion in the region's pharmaceutical and healthcare industries is raising the demand for aroma chemicals in medicinal and therapeutic formulations, which is also a critical growth-enabling factor for the market. Accordingly, the increasing penetration of Western lifestyles and the increasing disposable incomes of consumers are increasing the demand for premium perfumes and luxury products, thereby fueling the Asia Pacific aroma chemicals market growth. Besides this, the fast-growing chemical and chemical byproduct industries in countries like India and China are also putting the market in a position to sustain growth in the coming years. According to the International Trade Administration, the Indian chemicals sector is estimated to be at USD 220 billion and is expected to reach USD 300 Billion by 2026, growing at a rate of 9–12% annually. The specialized chemicals sector is anticipated to grow to USD 40 Billion by 2026.

Asia Pacific Aroma Chemicals Market Trends:

The Paradigm Shift Towards Natural and Sustainable Aroma Chemicals

The paradigm shift towards natural and sustainable ingredients is influencing the Asia Pacific aroma chemicals market share. With growing consumer awareness of environmental issues and health concerns, there is increasing demand for bio-based aroma chemicals derived from natural sources such as essential oils and plant extracts. Manufacturers are investing heavily in green chemistry to reduce carbon footprints and ensure eco-friendly production processes. Additionally, strategic partnerships between key market players to promote sustainability and limit synthetic chemical usage further drive this trend. For instance, on January 20, 2025, Vigon International announced an exclusive distribution agreement with Natara, a global manufacturer of flavor and fragrance ingredients. Vigon will distribute Natara's sustainable botanical extracts and specialty molecules. This partnership aligns with both companies' commitments to sustainability and aims to meet the increasing demand for environmentally conscious products in the flavor and fragrance market.

Rising Adoption of Advanced Biotechnological Processes

Advances in biotechnological processes for the production of aroma chemicals are expanding the Asia Pacific aroma chemicals market size. Biotechnology is now helping to synthesize complex and high-quality aroma compounds that were hard to produce by traditional methods. Fermentation-based processes and enzyme catalysis are increasingly being used due to their cost-effective, sustainable, and efficient nature compared to traditional chemical synthesis. These new technologies enable manufacturers to meet the high demand for specialty and exotic fragrances, especially in premium fragrances and niche applications. For example, on March 12, 2024, BASF Aroma Ingredients launched the Isobionics Natural beta-Caryophyllene 80, expanding its natural flavor portfolio. This new product, developed using advanced biotechnology, is free of clove oil-derived phenolic compounds and is suitable for various food and beverage applications.

Increasing Demand for Customized Fragrances and Flavors

The demand for customized fragrances and flavors is an emerging trend in the market. Consumers are seeking personalized experiences, pushing manufacturers to create bespoke solutions tailored to specific preferences and cultural nuances. This trend is particularly noticeable in the beauty, personal care, and food industries, where unique scents and flavors are becoming a key differentiator for brands. Companies are leveraging data analytics, artificial intelligence, and consumer behavior studies to design products that cater to local tastes and emerging trends. Also, favorable initiatives and programs for customization are enhancing the market appeal and contributing to the overall Asia Pacific aroma chemicals market demand. For example, on January 8, 2025, IFF announced the launch of its China Scent Exploration Program, aimed at driving the next generation of fragrance innovations. The program focuses on uncovering new scent profiles tailored to Chinese consumer preferences by leveraging regional insights and utilizing sustainable, cutting-edge fragrance technology.

Asia Pacific Aroma Chemicals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific aroma chemicals market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, product, and application.

Analysis by Type:

- Natural

- Synthetic

Synthetic represents the largest market share as it is affordable and versatile in comparison to its natural counterpart. Such compounds are manufactured to reproduce or enhance specific fragrances, and these can provide quality and supply consistently, often difficult with natural sources, where seasonal fluctuations and supply chain limitations occur. Synthetic aroma chemicals are widely used in the production of perfumes, cosmetics, personal care products, and household items, meeting the growing consumer demand for diverse and innovative scents. Their affordability and adaptability make them particularly valuable in emerging economies within the region, where cost considerations drive market choices. Moreover, the advancements in synthetic chemistry allow for the development of complex and unique fragrances, thus emphasizing their significance in the expansion of creative boundaries of the fragrance industry in Asia-Pacific.

Breakup by Product:

- Benzenoids

- Musk Chemicals

- Terpenoids

- Others

Terpenoids dominate the market in product segment as they have diversified applications and a natural origin. Primarily extracted from plants, terpenoids are a main ingredient in essential oils, fragrances, and flavors. Their use is versatile, as they provide a wide variety of aromas, ranging from sweet and floral to woody and citrusy, to satisfy the diverse consumer preferences. Rising demand for natural and environmentally friendly products promotes terpenoids as a green substitute for synthetic chemicals in fragrances, cosmetics, and food flavoring. As the region has ample biodiversity and agricultural resources, it is one of the major bases for terpenoid production which further expands the representation of terpenoids in the market. Terpenoids further enhance the appeal of aroma chemicals in the health-conscious market by their functional benefits, which include antioxidant and antimicrobial properties.

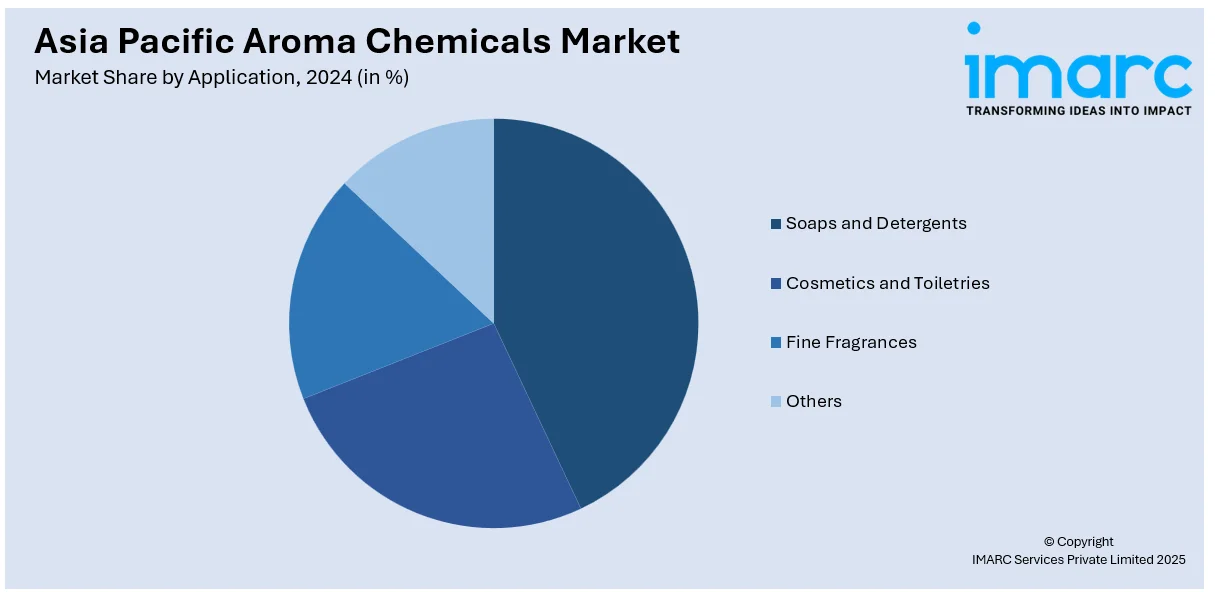

Analysis by Application:

- Soaps and Detergents

- Cosmetics and Toiletries

- Fine Fragrances

- Others

Soaps and detergents account for the majority of the market share. Soaps and detergents form a vital driver for the demand for aroma chemicals in the Asia-Pacific market. The increasing population, rapid urbanization, and relatively higher living standards are the factors that influence the market. Fragrance is a decisive factor for soaps and detergents; it effectively influences consumer preference and the selection of products. Aroma chemicals primarily find usage for imparting freshness and long-lasting fragrances that enhance the user experience and reinforce brand identity. In the Asia-Pacific region, where the demand for hygiene and cleaning products is consistently high, particularly in densely populated countries like India and China, aroma chemicals are essential to meeting consumer expectations for scented products.

Regional Analysis:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

China holds the dominant position in the Asia-Pacific aroma chemicals market, serving as both a major producer and consumer. The country's robust industrial base, coupled with advancements in chemical manufacturing technologies, positions it as a global hub to produce a wide range of aroma chemicals. With its populous population and expanding disposable income level, China experiences a growing demand for fragrances and flavors for personal care, cosmetics, household products, and food and beverage. The upsurge in urbanization lifestyle among Chinese consumers is the driving reason behind the usage of scented products. Apart from this, China's natural resources, which are abundant for terpenoids and essential oil production, complement its synthetic chemical capabilities, underscoring its comprehensive role in shaping the growth and innovation of the aroma chemicals industry in Asia-Pacific.

Competitive Landscape:

The competitive landscape of the market is characterized by the presence of the major market players in the region. In this dynamic landscape, firms compete on innovation, product diversification, and sustainable solutions that cater to the growing demands for fragrances and flavors across cosmetics, personal care, and food & beverages industries. Major investments in research and development (R&D) activities characterize the market in the development of bio-based and eco-friendly aroma chemicals. In addition to this, strategic partnerships, mergers, and acquisitions are also widespread among players seeking to expand their market presence and enhance distribution networks. For example, on October 4, 2024, Givaudan announced a joint venture with Privi India to establish an aroma ingredients manufacturing facility in Mahad, India. With the joint venture named Prigiv, Givaudan will cater to the production of high-quality aroma chemicals, thus strengthening its position in India and the wider Asia Pacific region. This strategic alliance is expected to enhance the operational capabilities further and strengthen the supply chains of Givaudan while increasing regional demands.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific aroma chemicals market with detailed profiles of all major companies.

Latest News and Developments:

- February 12, 2024: Zeon Corporation announced the launch of full-scale production of aroma chemicals at expanded production facilities in Zeon Chemicals Yonezawa. The expansion seeks to double key products, such as green note chemicals, with the aim of meeting growing demand in the flavors and fragrances industry. It is part of Zeon's medium-term STAGE30 plan, which reinforces its competitive stance and supports projected sales growth for the aroma chemicals business by 2030.

- April 15, 2024: BASF appointed Rawji Fine Fragrances Pvt. Ltd. as its authorized distributor of aroma chemicals in India. The partnership is designed to expand BASF's presence and improve customer service in the Indian market, leveraging Rawji's extensive experience and distribution network. This collaboration will ensure the accessible and timely delivery of BASF products to customers across India.

- June 10, 2024: Karnataka Soaps and Detergents Ltd. (KSDL) reported a significant milestone, with its sales surpassing INR 1,500 crore, the highest in its 40-year history. This achievement reflects the company’s successful expansion and strengthened market presence, driven by increased demand for its products.

- July 4, 2024: Shiseido and Max Mara announced a long-term partnership on fragrances; Shiseido acquired an exclusive worldwide license to develop, produce, market, and distribute perfumes and aftershave products under the brand of Max Mara. The goal of the deal is to broaden both companies' international reach by taking advantage of each other's strengths in designing novel products.

- December 6, 2024: Eternis Fine Chemicals Ltd., the leading aroma chemical manufacturer from India acquired Sharon Personal Care (SPC). This acquisition enhances Eternis' portfolio, as the company can expand in the personal care segment in Europe and the US. The acquisition will fortify the companies' manufacturing and distribution networks in India, Europe, Asia, and the United States.

Asia Pacific Aroma Chemicals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

|

Scope of the Report

|

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Natural, Synthetic |

| Products Covered | Benzenoids, Musk Chemicals,Terpenoids, Others |

| Applications Covered | Soaps and Detergents, Cosmetics and Toiletries, Fine Fragrances, Others |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific aroma chemicals market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific aroma chemicals market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific aroma chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The aroma chemicals market in the Asia Pacific was valued at USD 2,912.5 Million in 2024.

The key factors driving the market by the rising demand for fragrances and flavors across personal care and household products. Growing consumer awareness, rapid urbanization, and the expansion of the cosmetics industry further contributes to market growth.

The aroma chemicals market in the Asia Pacific is projected to exhibit a CAGR of 5.28% during 2025-2033, reaching a value of USD 4,786.20 Million by 2033.

Synthetics dominate the market due to their cost-effectiveness, consistent quality, and wide application in fragrances, flavors, and industrial formulations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)