Asia Pacific Biometrics Market Size, Share, Trends and Forecast by Technology, Functionality, Component, Authentication, End User, and Country, 2025-2033

Asia Pacific Biometrics Market Size and Share:

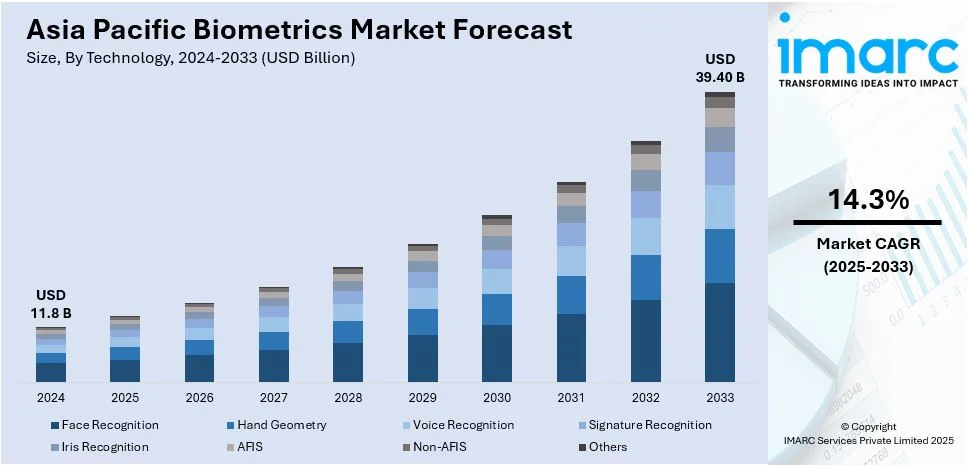

The Asia Pacific biometrics market size was valued at USD 11.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 39.40 Billion by 2033, exhibiting a CAGR of 14.3% from 2025-2033. The Asia Pacific biometrics market share is expanding, driven by the growing need for automated identity verification solutions, heightened requirement for enhanced security systems in various industries, and integration of biometric authentication into mobile payment apps and e-commerce platforms.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.8 Billion |

|

Market Forecast in 2033

|

USD 39.40 Billion |

| Market Growth Rate (2025-2033) | 14.3% |

Asia Pacific is experiencing significant growth for the biometric market, stimulated by a fusion of technological inventions, increased security concerns, and increasing demand for automated identity authentication tools. Traditional Biometric modalities like fingerprinting, facial identification, and iris scan are being reinvented with an influence of artificial intelligence (AI) and machine learning (ML). Their application is providing greater accuracy and speed in reliable biometric-based systems. For instance, AI algorithms can now process biometric data more efficiently, leading to faster and more accurate identification and verification processes. Facial recognition technology, in particular, has seen significant improvements in both its effectiveness and its application across various sectors.

To get more information on this market, Request Sample

The other significant reason driving the market is increased demand for enhanced security solutions. As there has been an increased concern about identity theft, fraud, and unauthorized access to sensitive information, more people have started using biometric systems for safeguarding their physical as well as digital assets. Governments, financial institutions, and enterprises need more secure methods for verifying identities and have identified biometric technology as a reliable method. In many countries where digital transactions and online activities are on the rise, biometric authentication is implemented widely in digital payment systems, mobile banking applications, and e-commerce platforms. With the integration of biometrics into smartphones and laptops, along with the proliferation of mobile payment systems, there has been a huge demand for biometric solutions.

Asia Pacific Biometrics Market Trends:

Expansion of Facial Recognition Technology Across Sectors

Facial recognition technology is rapidly gaining traction in Asia Pacific, becoming a central element in enhancing security, customer experience, and operational efficiency across various sectors. China, Japan, and India are leading the adoption, with facial recognition being widely integrated into public surveillance systems, retail environments, and transportation networks. Additionally, governments are increasingly adopting facial recognition for identity verification in national security, immigration control, and law enforcement. While privacy concerns persist, the growing application of facial recognition across industries, combined with regulatory efforts to ensure its responsible use, is expected to continue to drive market growth in the region. In December 2023, Mastercard, in collaboration with the Japanese technology firm NEC, aimed to introduce a checkout system utilizing facial recognition, beginning trials from 2024 in prospective markets such as Singapore, Indonesia, and other regions in Asia.

Biometric Authentication in Mobile Payments and E-Commerce

The integration of biometric authentication into mobile payment systems and e-commerce platforms is one of the most significant trends offering a favorable Asia Pacific biometrics market outlook. The region, with some of the world's most digitally connected and mobile-first economies, is witnessing rapid shifts toward biometric-based payment solutions. This includes fingerprint scanning, facial recognition, and even voice recognition, increasingly used to secure online transactions and digital wallets. Mobile payments are increasing in markets such as China, India, and South Korea, with biometric technology being the main driver for ensuring frictionless, secure transactions. UPI processed a significant INR 23.49 lakh crores across 16.58 billion financial transactions in October 2024. It was observed to be 45 percent higher year on year compared to 11.40 billion transactions recorded in October 2023.

Adoption of Biometrics in Healthcare for Patient Safety and Efficiency

Innumerable health care organizations in Asia Pacific are adopting biometric solutions to enhance patient safety, increase operational effectiveness, and protect sensitive medical information. Technologies involved include fingerprint, iris, and facial recognition to ascertain accurate identification of patients, which is important in preventing medical errors, correct treatment of patients, and retaining health-related information. In Japan and South Korea, hospitals and clinics use biometrics to control access. This allows only authorized staff members to have access to the records of patients, medication, and sensitive areas within the healthcare facilities. In addition, in 2024, the Korean regulators declared that they would be proposing a formal framework for biometric information to preserve privacy regulations because the use of biometrics is on the rise in healthcare and other industries as well.

Asia Pacific Biometrics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific biometrics market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on technology, functionality, component, authentication, and end user.

Analysis by Technology:

- Face Recognition

- Hand Geometry

- Voice Recognition

- Signature Recognition

- Iris Recognition

- AFIS

- Non-AFIS

- Others

Non-AFIS represents the largest segment. One of the most compelling benefits of non-AFIS biometric systems is their ability to offer seamless and non-intrusive methods of user identification. Unlike AFIS, which typically requires fingerprint scanning, non-AFIS systems such as facial recognition or iris scanning can operate without direct contact, enhancing user experience and convenience and impelling the Asia Pacific biometrics market growth. This is especially beneficial in environments where touchless interactions are preferred, such as public spaces, healthcare facilities, or mobile devices. Non-AFIS biometric systems are often more cost-effective to implement and maintain than AFIS systems. AFIS systems require high-resolution fingerprint scans and sophisticated databases to match prints against large records, which can be expensive and resource-intensive. Non-AFIS biometric technologies, such as facial recognition or voice biometrics, generally require fewer hardware components, which can reduce setup and operational costs.

Analysis by Functionality:

- Contact

- Non-contact

- Combined

Contact holds the biggest market share. Contact-based biometric systems, particularly fingerprint recognition, are known for their high accuracy and reliability. The process involves capturing detailed physical characteristics such as the ridges and valleys of a fingerprint, which are unique to each individual. This biometric modality has been widely used in security applications due to its robustness in identity verification, even under challenging conditions. One of the primary advantages of contact-based biometric systems is their speed and efficiency in processing identity verifications. For example, fingerprint recognition can authenticate a user in a matter of seconds, making it ideal for environments where quick access or transactions are required. The straightforward process involves the user simply placing a finger or hand on a sensor, which instantly compares the captured biometric data to stored templates, allowing for fast identification or authentication.

Analysis by Component:

- Hardware

- Software

Hardware represents the leading segment. The hardware segment encompasses all the physical devices and components used to capture and process biometric data. This includes fingerprint scanners, facial recognition cameras, iris scanners, palm and vein recognition devices, and voice recognition microphones. Each type of biometric hardware is designed to collect specific biometric data from individuals, such as fingerprints, facial features, iris patterns, or voiceprints, which are then used for identity verification and authentication. Hardware devices vary widely in terms of their capabilities, such as optical or capacitive fingerprint scanners, high-resolution cameras for facial recognition, and advanced infrared sensors for palm vein scanning. As biometric systems are increasingly integrated into a variety of applications ranging from security systems and financial transactions to mobile devices and healthcare, the demand for more advanced, accurate, and user-friendly hardware continues to rise.

Analysis by Authentication:

- Single-Factor Authentication

- Multifactor Authentication

Single-factor authentication holds the biggest market share. Single-factor authentication is generally more cost-effective to implement than multi-factor authentication. The hardware and software requirements for single-factor authentication are minimal, typically involving just a password management system, a basic authentication platform, and user devices. No additional infrastructure is needed for things like biometric scanners, token generators, or SMS-based one-time passcodes. This makes single-factor authentication an attractive solution for small businesses, startups, and organizations with limited budgets or those looking for an affordable and quick way to secure their systems. The low setup and maintenance costs associated with single-factor authentication help organizations reduce their overall security infrastructure expenses while still offering a basic level of protection.

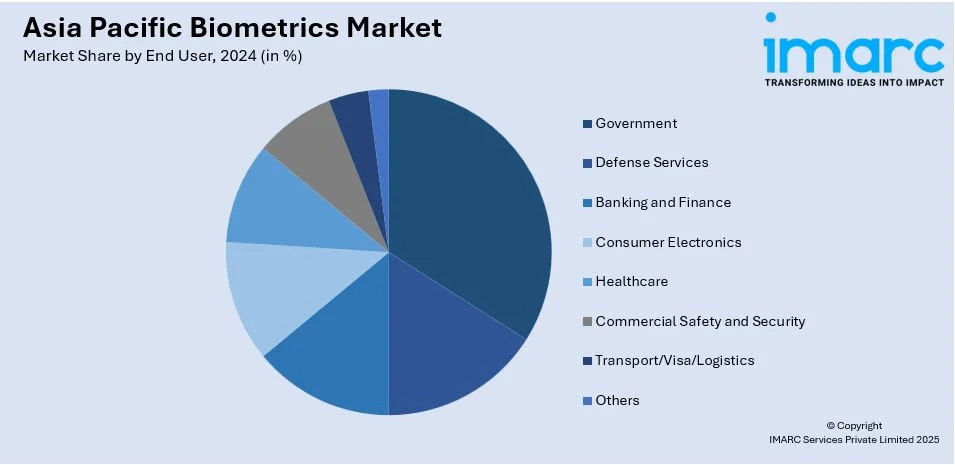

Analysis by End User:

- Government

- Defense Services

- Banking and Finance

- Consumer Electronics

- Healthcare

- Commercial Safety and Security

- Transport/Visa/Logistics

- Others

Government accounts for the majority of the market share. One of the most significant applications of biometrics in government functions is in border control and immigration management. Governments are increasingly utilizing biometric systems such as fingerprint recognition, facial recognition, and iris scanning to verify the identities of travelers at entry and exit points, including airports, seaports, and land borders. These biometric systems enhance security by ensuring that individuals are properly identified and preventing fraudulent activities, such as identity theft or the use of forged travel documents. Biometric technologies have revolutionized the development of national identification systems (NIS) across the globe. Governments are increasingly issuing biometric-based ID cards to citizens, which include fingerprints, iris scans, or facial recognition data to ensure that individuals are uniquely and accurately identified.

Country Analysis:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

Japan represents the leading country. As facial recognition systems become increasingly sophisticated, they are being deployed in a variety of sectors, including security, retail, healthcare, and even entertainment. Japan has emerged as one of the world leaders in this field, with major corporations and government agencies integrating facial recognition solutions into their operations. Facial recognition technology is also becoming a major requirement in public safety. Japanese authorities have begun using it for surveillance purposes in crowded places, such as train stations and public events, to enhance security and track suspicious activities. The widespread implementation of facial recognition is driven by Japan’s aging population, which has led to a demand for more seamless, convenient, and efficient methods of authentication that don’t require physical interaction, such as fingerprint scanning. Moreover, in 2024, NEC Corporation announced the launch of a new procedure employing biometric authentication technology that can spontaneously authenticate excessive numbers of people at one time, even while they are in motion. Japan is also witnessing an increasing integration of biometric authentication in consumer electronics, including smartphones, laptops, and wearables. Japan’s technology companies are incorporating biometric solutions, particularly fingerprint sensors and facial recognition, into their devices. These solutions offer a combination of convenience and security, allowing users to unlock their devices, authorize transactions, and access personal data with ease, thereby propelling the Asia Pacific biometrics market growth.

Competitive Landscape:

One of the primary strategies employed by key players in the biometrics market is heavy investment in research and development to enhance the accuracy, efficiency, and security of biometric solutions. Continuous innovation is critical to staying competitive in this fast-evolving market, and companies are working to integrate advanced technologies such as artificial intelligence (AI), machine learning (ML), and edge computing into their biometric systems. To cater to the diverse needs of various industries, market players are customizing their biometric solutions for specific applications. For instance, in 2024, The Airports of Thailand Public Company Limited (AOT) presented a new automated biometric identification system integrated with a faster, effective, and secure experience for passengers throughout 6 AOT airports.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific biometrics market with detailed profiles of all major companies.

Latest News and Developments:

- May 2024: IDEX Pay reached another milestone by launching a new market in South Asia alongside an innovative challenger bank. This marked the initial large-scale introduction of biometric payment cards in this nation.

- December 2024: The Commercial Taxes Department of Andhra Pradesh, in partnership with the Goods and Services Tax Network (GSTN), declared the introduction of a new Biometric Face Authentication feature via a mobile app.

- January 2025: NEXT Biometrics, NEXT, a worldwide leader in sophisticated Active Thermal® fingerprint sensing technology, has entered into a Memorandum of Understanding (MoU) with a new collaborator in India. Both parties will work together on a biometric module focused on liveness detection, aiming for ongoing growth in the evolving Aadhaar L1 and MOSIP markets as well as in various national ID initiatives.

- September 2024: SITA has collaborated with the Airports Authority of India (AAI) through the Digi Yatra initiative to upgrade the digital infrastructure with its biometric solutions. As part of this partnership, SITA will deploy its Smart Path, a system for managing passenger flow, along with Face Pods at nine airports across India, including Visakhapatnam, Ranchi, Bhubaneswar, Indore, Raipur, Bagdogra, Patna, Goa, and Coimbatore.

- December 2024: Raonsecure announced its plan to extend its cloud subscription service TouchEn OnePass, utilizing biometric authentication technology, to Sumishin SBI Net Bank of Japan and NeoBank Technologies. The agreement amounts to 3.57 billion won (USD2.48 million), representing roughly seven percent of Raosecure's overall revenue from the previous year.

Asia Pacific Biometrics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Face Recognition, Hand Geometry, Voice Recognition, Signature Recognition, Iris Recognition, AFIS, Non-AFIS, and Others |

| Functionalities Covered | Contact, Non-contact, Combined |

| Components Covered | Hardware, Software |

| Authentications Covered | Single-Factor Authentication, Multifactor Authentication |

| End Users Covered | Government, Defense Services, Banking and Finance, Consumer Electronics, Healthcare, Commercial Safety and Security, Transport/Visa/Logistics, and Others |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific biometrics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific biometrics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific biometrics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Asia Pacific biometrics market in the region was valued at USD 11.8 Billion in 2024.

Key factors include the growing need for automated identity verification solutions, heightened security requirements across industries, integration of biometrics into mobile payment and e-commerce platforms, and advancements in AI and ML for improved biometric accuracy and efficiency.

The Asia Pacific biometrics market is projected to exhibit a CAGR of 14.3% during 2025-2033, reaching a value of USD 39.40 Billion by 2033.

The non-AFIS segment accounted for the largest market share in the biometrics technology category.

The contact segment held the largest market share in the functionality category.

Hardware holds the biggest market share in the component category.

Single-factor authentication represents the leading segment in the authentication category.

The government holds the biggest market share in the end user category.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)