Asia Pacific E-Bike Market Size, Share, Trends and Forecast by Mode, Motor Type, Battery Type, Class, Design, Application, and Country, 2025-2033

Market Overview:

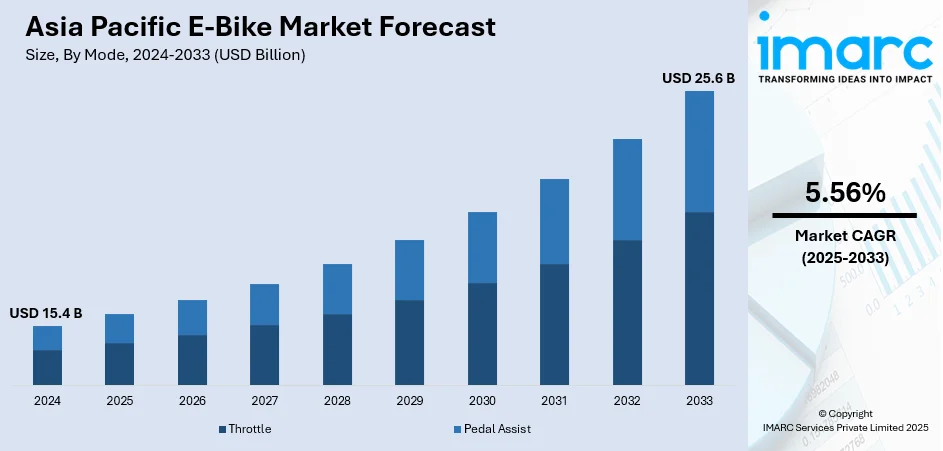

The Asia Pacific e-bike market size reached USD 15.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 25.6 Billion by 2033, exhibiting a growth rate (CAGR) of 5.56% during 2025-2033. The significant advancement in battery technology, the growing environmental concerns due to air pollution and carbon emissions, and the implementation of various government initiatives to promote clean energy are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15.4 Billion |

| Market Forecast in 2033 | USD 25.6 Billion |

| Market Growth Rate (2025-2033) |

5.56%

|

An e-bike, or electric bike, is a bicycle equipped with an electric motor that helps the individual's pedaling efforts. The motor is charged by a rechargeable battery, often mounted on the frame, which provides additional propulsion to the bike. It is available in numerous styles, including city, mountain, and foldable designs, catering to different preferences and purposes. The electric assistance allows riders to cover longer distances and conquer challenging terrains with reduced physical exertion. It typically offers several levels of assistance that can be adjusted based on the rider's preference and the desired level of effort. As a result, e-bike is gaining immense popularity as an eco-friendly and efficient mode of transportation across the region.

To get more information on this market, Request Sample

The market is primarily driven by the growing concerns about environmental sustainability. In addition, the widespread adoption of e-bikes, with their zero-emission electric propulsion, positions them as an eco-friendly and responsible mode of transportation, thus influencing the market growth. Moreover, several advancements in battery technology are improving the performance and range of e-bikes, addressing concerns about limited battery life and range anxiety, and improving consumer confidence in the reliability of e-bikes for daily commuting and leisure activities, which represents another major growth-inducing factor. Besides this, e-bikes allow commuters to navigate through congested areas and find parking more easily than traditional vehicles, which are well-suited to navigate narrow streets and crowded urban environments, thus accelerating market growth. Along with this, the cost savings associated with using e-bikes instead of conventional vehicles, such as fuel and maintenance expenses, appeal to budget-conscious consumers, thus propelling the market growth.

Asia Pacific E-Bike Market Trends/Drivers:

The significant advancement in battery technology

The market is experiencing robust growth due to the significant advancements in battery technology. In addition, battery innovations are transforming e-bikes from simple electric-assist bicycles to efficient and practical modes of transportation, thus contributing to the market growth. Lithium-ion batteries are gaining immense traction due to their remarkable progress in terms of energy density, charging speed, and performance. Moreover, modern e-bikes are equipped with advanced batteries that can cover longer distances on a single charge, making them suitable for short commutes and longer journeys representing another major growth-inducing factor. Besides this, faster charging times have made e-bikes more convenient and practical for daily use. Furthermore, the easy availability of e-bikes with various battery capacities and specifications allows consumers to choose models that align with their specific transportation needs, thus propelling the market growth.

The growing environmental concerns

The market is driven by the increasing environmental concerns related to air pollution and carbon emissions. In addition, rapid urbanization and industrialization led to severe air quality issues and environmental degradation. In response, governments, communities, and individuals are seeking sustainable transportation alternatives to reduce the carbon footprint and mitigate air pollution, thus influencing market growth. Moreover, e-bikes, with their zero-emission electric propulsion, present an attractive solution and offer a cleaner and greener mode of transportation compared to conventional gasoline-powered vehicles which represents another major growth-inducing factor. Besides this, the growing awareness about the detrimental effects of air pollution is encouraging more consumers to adopt e-bikes as a means of commuting, thus augmenting the market growth. Furthermore, government initiatives promoting electric mobility, coupled with incentives and subsidies for e-bike adoption are propelling the market growth.

Asia Pacific E-Bike Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific E-bike market report, along with forecasts at the regional, and country levels for 2025-2033. Our report has categorized the market based on mode, motor type, battery type, class, design, and application.

Breakup by Mode:

- Throttle

- Pedal Assist

Pedal assist represents the most used mode

The report has provided a detailed breakup and analysis of the market based on the mode. This includes throttle, and pedal assist. According to the report, pedal assist accounted for the largest market share.

Pedal assist, also known as electric assist or power-assisted cycling, empowers riders with a seamless integration of human effort and electric propulsion. This mode enhances the riding experience by providing varying levels of motor assistance, making it easier to tackle challenging terrains and longer distances. The appeal of Pedal Assist lies in its versatility, catering to both casual riders seeking leisurely journeys and commuters aiming to reach their destinations swiftly.

Moreover, pedal assist mode offers an eco-friendly alternative for urban commuting, aligning with the region's growing emphasis on sustainable transportation solutions. Along with this, several advancements in battery technology led to increased range and efficiency, addressing concerns about range anxiety thus propelling the market growth.

Furthermore, robust research and development (R&D) efforts are resulting in sleek and ergonomic designs that seamlessly integrate the motor and battery coupled with the easy accessibility of pedal-assist technology across various price points are propelling the market growth.

Breakup by Motor Type:

- Hub Motor

- Mid Drive

- Others

Hub motor holds the largest share of the market

A detailed breakup and analysis of the market based on the motor type has also been provided in the report. This includes the hub motor, mid drive, and others. According to the report, hub motors accounted for the largest market share.

Hub motors offer a compact and integrated design, seamlessly incorporating the motor within the wheel hub itself which eliminates the need for a separate drivetrain, resulting in a sleek and uncluttered appearance while also enhancing efficiency. In addition, the simplicity of hub motors translates into reduced maintenance requirements, an appealing prospect for consumers seeking hassle-free ownership, thus propelling the market growth.

Moreover, hub motors facilitate a smooth and silent riding experience with the absence of external chains or gears eliminating noise and vibration, ensuring a quiet and enjoyable journey representing another major growth-inducing factor. Furthermore, the adaptability of hub motors across various e-bike models offering a versatile solution catering to diverse user preferences and terrain challenges is contributing to the market growth.

Breakup by Battery Type:

- Lead Acid

- Lithium Ion

- Nickel-Metal Hydride (NiMH)

- Others

Lithium-ion presently accounts for the largest market share

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lead acid, lithium ion, nickel-metal hydride (NiMH), and others. According to the report, lithium-ion accounted for the largest market share.

Lithium Ion batteries offer a compelling balance between energy density and weight, enabling E-Bikes to cover longer distances while maintaining a relatively lightweight profile that aligns with the several travel needs and varying terrains across the region.

Moreover, the prolonged lifespan of lithium-ion batteries provides users with a durable and sustainable power solution, enhancing the value proposition of e-bikes, with longevity and cost-effectiveness representing another major growth-inducing factor.

Along with this, several advancements in technology are contributing to a gradual reduction in the cost of lithium-ion batteries, making them accessible to a wider consumer base which is further driving the widespread adoption of e-bikes across the region. Furthermore, the growing environmental consciousness led to the adoption of lithium-ion batteries as a cleaner energy solution which is propelling the market growth.

Breakup by Class:

- Class I

- Class II

- Class III

Class I represents the most popular product type

The report has provided a detailed breakup and analysis of the market based on the class. This includes class I, class II, and class III. According to the report, class I accounted for the largest market share.

Class I e-bikes market is driven by the distinctive advantage it offers in terms of regulatory compliance. In addition, their pedal-assist functionality which engages only when the rider pedals, aligns seamlessly with the regulations governing electric bicycles in many Asia Pacific countries thus influencing the market growth. This compliance has engendered a sense of trust among consumers and regulatory bodies, paving the way for their widespread acceptance.

Additionally, the focus on sustainability and eco-friendliness is driving the class I e-bikes market. As these e-bikes prioritize human effort while providing a gentle electric assist, they resonate well with environmentally conscious consumers seeking eco-friendly commuting options.

Moreover, Class I e-bikes' accessibility and user-friendly design are essential due to their simple yet effective technology appeals to various riders, including those new to e-bikes which is expanding their consumer base and garnering a loyal following, thus augmenting the market growth.

Breakup by Design:

- Foldable

- Non-Foldable

Non-Foldable hold the largest share in the market

A detailed breakup and analysis of the market based on the design have also been provided in the report. This includes foldable and non-foldable. According to the report, non-foldable accounted for the largest market share.

The market is primarily driven by the increasing preference for non-foldable e-bikes. In addition, these e-bikes offer sturdy and robust construction, instilling a sense of reliability and longevity in consumers with their design allowing larger battery capacities, and enabling longer travel distances thus providing a positive thrust to the market growth. This aspect aligns with the diverse transportation needs across the Asia Pacific region, catering to both short commutes and extended rides.

Moreover, non-foldable e-bikes often offer enhanced features such as more powerful motors, advanced suspension systems, and larger storage compartments which contribute to a comfortable and versatile riding experience, further solidifying their appeal. The absence of folding mechanisms simplifies maintenance, potentially reducing long-term ownership costs.

Furthermore, players are capitalizing on this trend by focusing their research, development, and marketing efforts on non-foldable e-bikes through meticulous attention to design and innovation, manufacturers are effectively addressing consumer preferences and requirements, establishing non-foldable e-bikes as a staple in the Asia Pacific market.

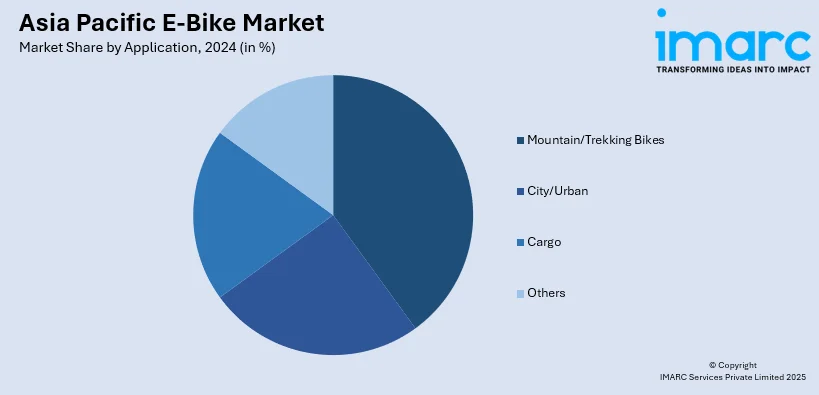

Breakup by Application:

- Mountain/Trekking Bikes

- City/Urban

- Cargo

- Others

City/urban presently accounts for the largest market share

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes mountain/trekking bikes, city/urban, cargo, and others. According to the report, city/urban accounted for the largest market share.

City/urban environments include shorter commuting distances, making e-bikes an attractive alternative to traditional vehicles. The rise in traffic congestion and the need to reduce carbon emissions are further propelling the adoption of e-bikes in these settings.

Additionally, government initiatives promoting cleaner transportation and the development of dedicated cycling infrastructure are fostering a conducive environment for e-bike market growth. Along with this, the compact design and maneuverability of e-bikes make them ideal for navigating through crowded city streets and congested areas, combined with advancements in battery technology and overall durability are improving consumer confidence in e-bikes, thus augmenting the market growth.

Furthermore, the integration of smart features and connectivity options in modern e-bikes aligns with the tech-savvy nature of urban populations which is escalating the demand for e-bikes in the market.

Breakup by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

China exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include China, Japan, India, South Korea, Australia, Indonesia, and others. According to the report, China accounted for the largest market share.

China is driven by a robust manufacturing ecosystem with advanced production capabilities and a vast network of suppliers. This has enabled the country to produce a numerous range of e-bike models at competitive prices, catering to a wide spectrum of consumer preferences and budget ranges.

Moreover, favorable government policies and incentives aimed at promoting sustainable transportation are essential in fostering the growth of the e-bike market in China. These policies are encouraging consumers to embrace e-bikes as an eco-friendly alternative to conventional modes of transport.

Furthermore, China's well-established distribution channels and retail infrastructure are facilitating easy access to e-bikes for consumers across urban and rural areas, and the rapid adoption of e-bikes as a viable means of commuting is propelling market growth. Along with this, China's technological prowess and continuous innovation in e-bike design and functionality with the integration of smart features, enhanced battery efficiency, and sleek designs are creating a positive market outlook.

Competitive Landscape:

Nowadays, key players in the market are strategically implementing various measures to strengthen their positions and remain competitive in a dynamic and evolving industry. They are investing in research and development (R&D) to enhance e-bike performance, battery life, and overall user experience and focusing on creating sleek, lightweight, and aesthetically pleasing e-bike designs to attract a wider consumer base. Moreover, companies are providing options for customers to customize e-bikes based on preferences, such as color, features, and accessories while allowing consumers to choose from various power settings and modes to suit different riding needs. Besides this, key players are integrating smart technology into e-bikes, such as global positioning system (GPS) tracking, app connectivity, and remote diagnostics for enhanced user convenience and developing dedicated apps for riders to monitor battery status, track routes, and access real-time data.

The market research report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Asia Pacific E-Bike Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Modes Covered | Throttle, Pedal Assist |

| Motor Types Covered | Hub Motor, Mid Drive, Others |

| Battery Types Covered | Lead Acid, Lithium Ion, Nickel-Metal Hydride (NiMH), Others |

| Classes Covered | Class I, Class II, Class III |

| Designs Covered | Foldable, Non- Foldable |

| Applications Covered | Mountain/Trekking Bikes, City/Urban, Cargo, Others |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the consumables Asia Pacific E-Bike market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific E-bike market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific E-bike industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Asia Pacific e-bike market was valued at USD 15.4 Billion in 2024.

We expect the Asia Pacific e-bike market to exhibit a CAGR of 5.56% during 2025-2033.

The increasing environmental consciousness, along with the rising demand for e-bikes as they are energy-efficient and offer emission-free commuting option over fuel-powered cars and motorcycles, is primarily driving the Asia Pacific e-bike market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several Asia Pacific nations, resulting in the temporary closure of numerous manufacturing units for e-bikes.

Based on the mode, the Asia Pacific e-bike market has been bifurcated into throttle and pedal assist, where pedal assist currently exhibits a clear dominance in the market.

Based on the motor type, the Asia Pacific e-bike market can be segmented into hub motor, mid drive, and others. Currently, hub motor holds the majority of the total market share.

Based on the battery type, the Asia Pacific e-bike market has been divided into lead acid, lithium ion, Nickel-Metal Hydride (NiMH), and others. Among these, lithium ion currently exhibits a clear dominance in the market.

Based on the class, the Asia Pacific e-bike market can be categorized into class I, class II, and class III. Currently, class I accounts for the majority of the total market share.

Based on the design, the Asia Pacific e-bike market has been segregated into foldable and non-foldable, where non-foldable currently holds the largest market share.

Based on the application, the Asia Pacific e-bike market can be bifurcated into mountain/trekking bikes, city/urban, cargo, and others. Currently, city/urban exhibits a clear dominance in the market.

On a regional level, the market has been classified into China, Japan, India, South Korea, Australia, Indonesia, and others, where China currently dominates the Asia Pacific e-bike market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)