Asia Pacific Electric Vehicle Charging Station Market Size, Share, Trends and Forecast by Charging Station Type, Vehicle Type, Installation Type, Charging Level, Connector Type, Application, and Country 2025-2033

Asia Pacific Electric Vehicle Charging Station Market Size and Share:

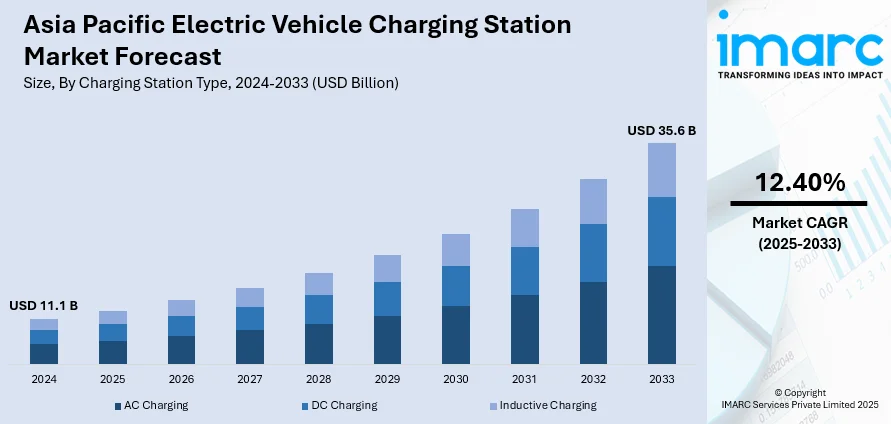

The Asia Pacific electric vehicle charging station market size was valued at USD 11.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 35.6 Billion by 2033, exhibiting a CAGR of 12.40% from 2025-2033. The market growth is driven by escalating environmental awareness, favorable government policies, and higher fuel prices that nudge the adoption of electric vehicles in Asia Pacific. Urbanization and consumer demand for eco-friendly modes of transportation increase the need for efficient charging points. Advancements in charging speed and compatibility raise the bar on consumer experience. High investments and subsidies from public and private sectors also boost market growth, together fortifying the Asia Pacific electric vehicle charging station market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 11.1 Billion |

|

Market Forecast in 2033

|

USD 35.6 Billion |

| Market Growth Rate 2025-2033 | 12.40% |

Growing environmental awareness and strict policies to curtail vehicular emissions are propelling the fast-paced uptake of electric vehicles in the Asia Pacific. Growing urban air pollution and concerns regarding climate change effects have pushed governments to adopt measures for promoting clean energy transport. Fuel price volatility is also encouraging consumers and fleets to move towards electric vehicles as they ensure long-term cost economies and eco-friendliness. Government incentives in the form of subsidies, tax rebates, and rebates for buying electric vehicles trigger demand and promote infrastructure creation. Urbanization and increasing disposable incomes are also enlarging the customer base for EVs, promoting greater penetration rates. Further, greater health concern about pollution-related issues motivates people to adopt cleaner modes of transport. Consequently, there is increased demand for charging points for electric vehicles to cater to this growing fleet of EVs, which leads to investments in public and private charging points to enable easy and convenient recharging throughout the region. According to the sources, in December 2023, TelioEV extended EV charging management solutions to five Asia Pacific and GCC nations, providing a full-fledged Charging Management System and collaborating with partners to develop EV charging infrastructure.

To get more information on this market, Request Sample

Technology improvements in charging facilities play an important role in market development by enhancing charging effectiveness and customer experience. As per the reports, in March 2024, VinFast founder established V-Green, an international EV charging network operator dedicated to serving VinFast vehicles, investing two years \\$404 million in developing charging infrastructure, having a crucial effect on the Asia Pacific electric vehicle charging station market. Furthermore, installing fast and ultra-fast charging points minimizes downtime, making EVs more convenient for use on a daily basis. Smart technology integration like telematics, wireless communication, and remote monitoring boosts network management and energy optimization, guaranteeing a consistent service. Governments and the private sector are heavily investing in high-capacity charging infrastructure for heavy-duty and commercial electric vehicles, in harmony with overall electrification targets. Electrification of public transportation projects is driving the demand for large-scale charging solutions in metropolitan cities at an accelerated rate. Further, increased focus on integrating renewable energy with charging stations promotes sustainability by lessening the carbon footprint of electricity usage. Joint cooperation between Asia Pacific nations to create unified, interoperable charging systems also boosts market growth by promoting compatibility and ease of use for EV owners.

Asia Pacific Electric Vehicle Charging Station Market Trends:

Green Imperatives and Policymaker Support Driving EV Infrastructure

Concerns for the environment, fueled by high vehicle emissions in Asia Pacific, have greatly boosted the need for electric vehicles (EVs) and the infrastructure that supports them. The continent is steadily leaning toward clean energy substitutes as pollution levels rise, fuel prices fluctuate, and electric and hybrid electric cars become more cost-effective to own. Governments are energetically pushing the uptake of EVs via subsidies and publicity campaigns to minimize carbon footprints. Of special interest, the International Energy Agency (IEA) calculates that India alone might save 5 Mt of CO₂ by 2030 through EV adoption, potentially up to 110 to 380 Mt by 2050, depending on mass uptake and integration with renewable energy. Government-supported programs to encourage purchases of EVs are driving demand for charging points. In addition, public sector electrification initiatives, notably the replacement of diesel buses and taxis, are surging, complementing regional momentum toward cleaner transportation systems and fuelling the expansion of EV charging infrastructure throughout APAC.

Infrastructure Spending and Regional Goals Transforming Market Growth

Strong government investments throughout Asia Pacific are driving the installation of high-capacity EV charging stations, especially for heavy-duty public transport fleets. Governments are initiating widespread electrification initiatives that demand massive infrastructure development. For example, the Asia-Pacific Economic Cooperation (APEC) puts the figure at USD 210 billion for Southeast Asia to hit net-zero emissions by 2050. This emphasizes the urgency and magnitude of investment required to deliver on sustainability objectives. Many APAC governments are pushing the development of charging infrastructures, with incentives, subsidies, and financial arrangements to attract private and public sector investment. In Japan, for instance, the Japan External Trade Organization is documenting a national goal to have installed 150,000 charging points by 2030, with 30,000 of these fast chargers. These ambitious national goals demonstrate a robust policy push toward an environmentally friendly mobility future. This acceleration in infrastructure is not merely facilitating ongoing EV rollout but laying the groundwork for future mass market adoption throughout the region.

Technology Integration and Charging Innovation Strengthening Market Dynamics

The Asia Pacific electric vehicle charging station market outlook is more and more dominated by speedy incorporation of sophisticated technologies into charging stations. Innovation in telematics, remote sensors, AI-analytics, and wireless connectivity is reforming the manner in which stations function and interact with EVs. Improved user experience, smart grid compatibility, and optimized energy consumption are currently major priorities. The area also sees increased adoption of high-end charging systems, including the Combined Charging System (CCS) and Tesla superchargers, for high-speed, standardized charging and greater vehicle coverage. These solutions mitigate range anxiety and downtime issues, encouraging user trust in electric mobility. Japan and South Korea are leading the implementation of such fast-charging networks, complemented further by indigenous manufacturing and R&D activity. As penetration of EVs goes deeper, the need for intelligent, scalable, and ultra-fast charging technologies will only intensify, making technology innovation a key trend in the evolving EV ecosystem of the region.

Asia Pacific Electric Vehicle Charging Station Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific electric vehicle charging station market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on charging station type, vehicle type, installation type, charging level, connector type, and application.

Analysis by Charging Station Type:

- AC Charging

- DC Charging

- Inductive Charging

AC charging is an important part of the Asia Pacific electric vehicle (EV) charging station market because it is accessible, affordable, and right for everyday EV users. It is heavily used in residential, workplace, and commercial environments, which makes it suitable for overnight or long-duration charging. The relatively low cost of infrastructure and easy installation have helped make it popular in densely populated urban centers and upcoming smart cities in the region. AC chargers are compatible with a majority of electric vehicle models, and their scalability enables efficient support for growing EV fleets. Additionally, government initiatives in the Asia Pacific are promoting inclusion of AC charging into building codes and urban planning initiatives. With growing energy efficiency and improvements in onboard vehicle chargers, AC charging is now more reliable and convenient. Further growth of EVs, particularly in two- and three-wheeler segments, is likely to continue fueling demand for AC charging stations.

Analysis by Vehicle Type:

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

Battery Electric Vehicles (BEVs) are powered exclusively by electric energy contained within rechargeable battery packs and therefore are extremely reliant on effective charging facilities. Growth in high-capacity and rapid-charging facilities across the Asia Pacific region is leading to the mass adoption of BEVs as a clean and environmentally friendly transportation option.

Plug-in Hybrid Electric Vehicles (PHEVs) feature a regular internal combustion engine, an electric motor, and a rechargeable battery, providing higher flexibility in driving range. The increasing demand for PHEVs in urban and semi-urban locations is boosting the demand for compatible charging stations that cater to both electric and hybrid capabilities.

Hybrid Electric Vehicles (HEVs), which have no need for external charging but use regenerative braking and internal combustion to replenish the battery, benefit indirectly from the growth of EV charging infrastructure. Their presence helps contribute to the overall development of the ecosystem and consumer migration towards full electric vehicle technologies in the Asia Pacific region.

Analysis by Installation Type:

- Portable Charger

- Fixed Charger

Portable chargers provide flexible and convenient charging services for electric vehicle drivers, particularly in locations where there is limited established infrastructure. They are designed to be portable, simple to carry, and for emergency or on-the-move charging. Their increased use is in support of increasing consumer desire for mobility and charging convenience in diverse locations.

Fixed chargers are fixed at specific locations like homes, offices, and public charging points. They provide higher power delivery and more usage, thus suitable for frequent and long-term charging. They play an important role in developing a strong and reliable EV charging infrastructure across the Asia Pacific region.

Analysis by Charging Level:

- Level 1

- Level 2

- Level 3

Level 1 charging is the slowest and most rudimentary method, usually operating on the typical household power point. It is predominantly the overnight home charging choice and best suited for those with minimal daily usage requirement or in regions of low electricity infrastructure demand, contributing modestly towards the overall market growth.

Level 2 charging provides moderate speed and is used extensively in both residential and commercial markets. It accepts a wider variety of EV models and is best for frequent daily charging at homes, offices, and public parking facilities. Its cost, convenience, and speed balance in the middle makes it a favorite everywhere in the region.

Level 3 charging, which is otherwise referred to as DC fast charging, facilitates rapid energy transfer with much less than half the time spent charging. It is utilized mainly in commercial and highway environments for fleet operators and intercity travelers. Increasing deployment of Level 3 infrastructure is indispensable to facilitating high-volume EV uptake in Asia Pacific.

Analysis by Connector Type:

- Combines Charging Station (CCS)

- CHAdeMO

- Normal Charging

- Tesla Supercharger

- Type-2 (IEC 621196)

- Others

Combined Charging System (CCS) is picking up tremendous speed in the Asia Pacific electric vehicle charging station market forecast, driven by high compatibility and fast charging. CCS is compatible with both AC and DC charging, thus being a workable solution for manufacturers as well as users of EVs. It is highly acknowledged for providing ultra-fast charging, particularly for long-range and heavy-duty EVs, thus being most workable for intercity and highway charging facilities. The increasing demand for cross-country EV compatibility, coupled with standardization of charging interfaces, has resulted in mounting installations of CCS connectors in public and commercial charging stations. As the trend for fleet electrification picks up, particularly in logistics and public transport, CCS is finding favor as a go-to choice for high-throughput charging terminals. Its capacity for reducing downtime and improving operating efficiency is also drawing large-scale private and government investment, being a building block for the region's move toward quick, efficient, and future-proof EV infrastructure.

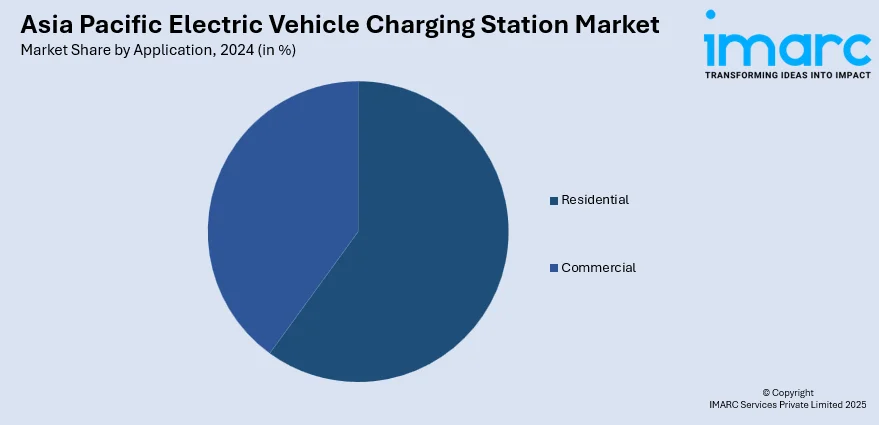

Analysis by Application:

- Residential

- Commercial

The Asia Pacific residential segment is experiencing growing installations of electric vehicle chargers, spurred by growing EV ownership and home-charging preferences. Government incentives, small AC chargers, and integration with smart home systems are facilitating adoption. Convenience and overnight charging ability further make the residential configuration more attractive.

Commercial deployments are quickly growing throughout office buildings, shopping malls, hotels, and public parking lots in the Asia Pacific. These installations serve high-traffic sites, providing accessible, quick, and revenue-generating charging facilities. Companies are using EV equipment to gain environmentally friendly customers and enable fleet electrification and staff convenience programs.

Analysis by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

China continues to lead the Asia Pacific electric vehicle charging station market growth due to robust policy support, massive infrastructure investments, and China's status as the world's largest EV market. In China, the government has introduced supportive policies, subsidies, and master plans like the New Energy Vehicle (NEV) roadmap to support EVs' penetration and charging infrastructure building. Urban areas and intercity highways are experiencing extensive rollout of AC and DC charging points to meet boosting consumer demand. In addition, China is also incorporating cutting-edge technologies like artificial intelligence (AI), Internet of Things (IoT), and intelligent grid solutions into its charging infrastructure to ensure real-time monitoring and optimal energy utilization. Public-private partnerships are also increasing the number of fast-charging stations available for residential, commercial, and transportation areas. Consequently, China is not only creating standards for EV charging infrastructure but is also emerging as a global exporter of charging solutions, affirming its leadership in the regional and global EV environment.

Competitive Landscape:

The competitive market dynamics of the Asia Pacific electric vehicle (EV) charging stations market are defined by fast-paced innovation, strategic partnerships, and a faster pace of infrastructure development. Players are putting greater priority on technological innovation and scalability to meet the growing EV uptake in the region. Strong emphasis is placed on the development of fast-charging corridors along urban and intercity corridors, backed by public-private partnerships and supportive regulatory environments. Firms are investing in the integration of smart features like app-based access, real-time monitoring, payment systems, and load management of energy to boost user convenience and operational efficiency. The market is seeing growing activity in installing high-capacity charging solutions for commercial fleets as well as public transport systems with the aim of electrification spurred on by government-supported efforts. Further, the emphasis on modular and interoperable systems is picking up pace to make them compatible with a variety of EV models and connectors. The competitive forces remain influenced by the drive towards localization and the development of battery charging technologies.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific electric vehicle charging station market with detailed profiles of all major companies, including:

- ABB

- BlueSG (Bolloré Group)

- Delta Electronics, Inc.

- Eaton

- Schneider Electric

- Shell

- Siemens

- Tata Power (Tata Sons Private Limited)

- Tesla

- TGOOD Global Ltd

Latest News and Developments:

- May 2025: Mazda announced that it will include Tesla's North American Charging Standard (NACS) in its next-generation electric vehicles (EVs) in Japan from 2027. This move facilitates the development of Tesla's Supercharger network and will consolidate EV charging across the market, providing more extensive charging choices and greater convenience for buyers.

- May 2025: SM Prime Holdings also revealed that it would be installing 50 more EV charging stations on its properties within 2025, increasing its current total of 131 stations distributed throughout the Philippines. This move promotes sustainability and looks to aid in promoting the adoption of electric vehicles, as per the Philippines' EV development vision for 2030.

- May 2025: V-GREEN collaborated with Chargecore, Chargepoint, Amarta Group, and CVS to roll out more than 63,000 VinFast EV charging points in Indonesia with a USD 300 million investment. This partnership will quickly scale up EV infrastructure, driving VinFast's development and green sustainable transportation throughout Southeast Asia.

- March 2025: ESR Group opened its first combined EV charging facility in its Taloja Industrial Park, India, fueled by renewable energy through rooftop solar panels. The facility, accommodating up to 10 EVs at a time, supports ESR's ESG strategy and promotes improved sustainable logistics in India, furthering the nation's net-zero aspirations.

- January 2025: The Asian Development Bank (ADB) provided a USD 100 million loan to Ayala Corporation to finance the deployment of up to 1,700 EV charging points in the Philippines. The project, under Ayala's drive for electric mobility, is designed to further propel the country towards electric vehicles, minimize CO2 emissions, and support sustainable development.

Asia Pacific Electric Vehicle Charging Station Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Charging Station Types Covered | AC Charging, DC Charging, Inductive Charging |

| Vehicle Types Covered | Battery Electric Vehicle (BEV), Plug-in Hybrid Electric Vehicle (PHEV), Hybrid Electric Vehicle (HEV) |

| Installation Types Covered | Portable Charger, Fixed Charger |

| Charging Levels Covered | Level 1, Level 2, Level 3 |

| Connector Types Covered | Combined Charging System (CCS), CHAdeMO, Normal Charging, Tesla Supercharger, Type-2 (IEC 62196), Others |

| Applications Covered | Residential, Commercial |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Companies Covered | ABB, BlueSG (Bolloré Group), Delta Electronics, Inc., Eaton, Schneider Electric, Shell, Siemens, Tata Power (Tata Sons Private Limited), Tesla and TGOOD Global Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific electric vehicle charging station market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific electric vehicle charging station market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the electric vehicle charging station industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric vehicle charging station market in the Asia Pacific was valued at USD 11.1 Billion in 2024.

The Asia Pacific electric vehicle charging station market is projected to exhibit a CAGR of 12.40% during 2025-2033, reaching a value of USD 35.6 Billion by 2033.

Major drivers of the Asia Pacific electric vehicle charging station market are emerging environmental issues, government support, increasing adoption of EVs, fuel price volatility, electrification of public transport, infrastructure development, and developments in fast-charging technologies, all of which drive sustainable mobility and carbon emissions reduction in the region.

China leads the Asia Pacific electric vehicle charging station market with the largest market share. Its strong government backing, high EV adoption, and extensive infrastructure investments have made it the leading regional champion. The country's priority of increasing public and private charging networks fuels high market growth and segment leadership.

Some of the major players in the Asia Pacific electric vehicle charging station market include ABB, BlueSG (Bolloré Group), Delta Electronics, Inc., Eaton, Schneider Electric, Shell, Siemens, Tata Power (Tata Sons Private Limited), Tesla and TGOOD Global Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)