Asia Pacific Exterior Sheathing Market Size, Share, Trends and Forecast by Sheathing Type, Product Type, Application, End Use Sector, and Country, 2026-2034

Market Overview:

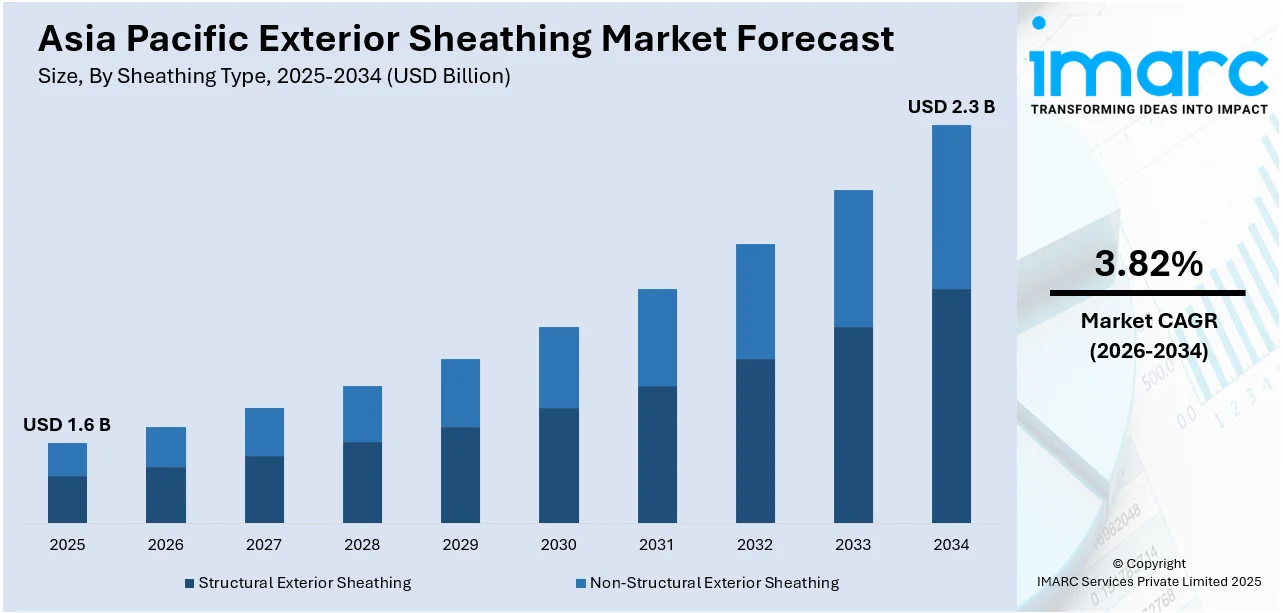

The Asia Pacific exterior sheathing market size reached USD 1.6 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.3 Billion by 2034, exhibiting a growth rate (CAGR) of 3.82% during 2026-2034.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1.6 Billion |

|

Market Forecast in 2034

|

USD 2.3 Billion |

| Market Growth Rate 2026-2034 | 3.82% |

Exterior sheathing refers to panels or board materials that are used to strengthen walls, roofs, and floors of buildings. These boards are attached to external frames as an underlayment of exterior siding materials like wood, vinyl, metal, masonry, shingles, and stucco. Exterior sheathing offers strength, rigidity, shear resistance and also forms a nailing base for siding. With the advancements in technology, the demand for advanced sheathing materials has escalated as it protects the building from severe weather conditions and maximizes space for cavity insulation.

To get more information on this market Request Sample

The Asia Pacific represents one of the leading exterior sheathing markets, which is primarily driven by the rising construction activities in the region. As exterior sheathing materials, such as foam and wood fiber panels, are durable, cost-efficient and meet the energy code requirements, they are increasingly being used in the construction industry for commercial and aesthetic purposes. As a result, governments of various countries are taking initiatives to promote green or environment-friendly exterior sheathing products to ensure sustainability and reduce carbon footprint. Moreover, the development of efficient building technologies, such as automated production and installation processes, has directly impacted the exterior sheathing market.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific exterior sheathing market report, along with forecasts at the regional and country levels from 2026-2034. Our report has categorized the market based on sheathing type, product type, application and end use sector.

Breakup by Sheathing Type:

- Structural Exterior Sheathing

- Non-Structural Exterior Sheathing

Breakup by Product Type:

- OSB (Oriented-Strand Board)

- Plywood

- Particle Board

- Medium Density Fibreboard (MDF)

- Others

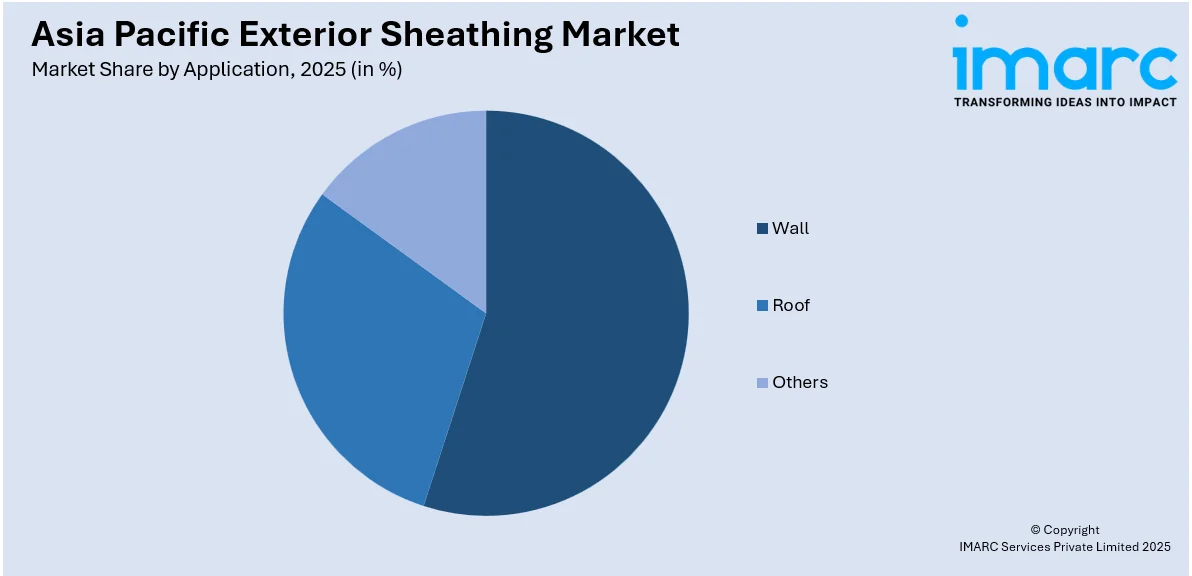

Breakup by Application:

Access the comprehensive market breakdown Request Sample

- Wall

- Roof

- Others

Breakup by End Use Sector:

- Residential

- Commercial

- Industrial

- Institutional

Breakup by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Segment Coverage | Sheathing Type, Product Type, Application, End Use Sector, Country |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Asia Pacific exterior sheathing market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Asia Pacific exterior sheathing market?

- What are the key regional markets?

- What is the breakup of the market based on the sheathing type?

- What is the breakup of the market based on the product type?

- What is the breakup of the market based on the application?

- What is the breakup of the market based on the end use sector?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the Asia Pacific exterior sheathing market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)