Asia Pacific Feed Additives Market Size, Share, Trends and Forecast by Source, Product Type, Livestock, Form, and Country, 2025-2033

Market Overview:

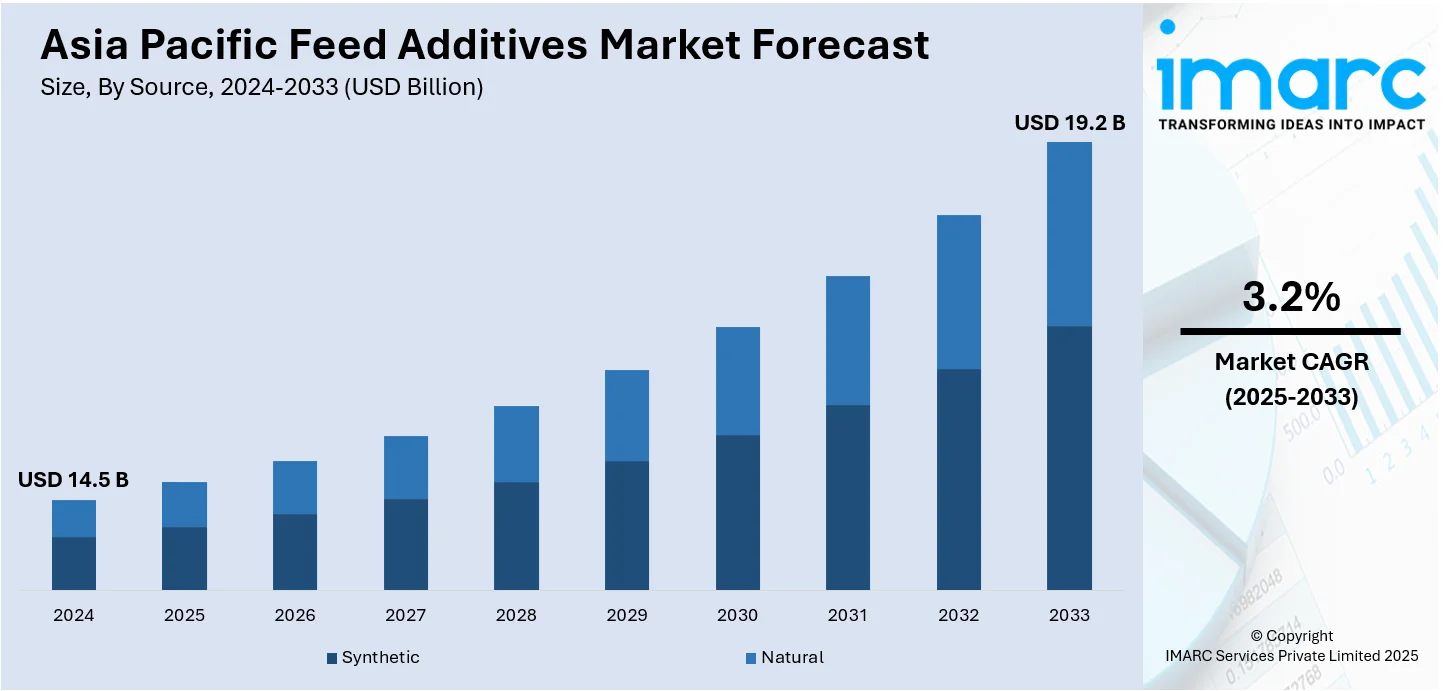

The Asia Pacific feed additives market size reached USD 14.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 19.2 Billion by 2033, exhibiting a growth rate (CAGR) of 3.2% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 14.5 Billion |

|

Market Forecast in 2033

|

USD 19.2 Billion |

| Market Growth Rate (2025-2033) | 3.2% |

Feed additives refer to ingredients that are made using essential nutrients like feed attractants, immunostimulants, probiotics, acidifiers and essential oils. They are used to improve the health and metabolism of animals and affect their various physiological processes like immune function, stress resistance and reproduction. Feed additives facilitate growth and efficient reproduction in animals, which results in improved food safety and minimized waste. In recent years, there has been a considerable demand for feed additives in the Asia Pacific region as they are used to improve the shelf-life of the feed due to the presence of various lipid and fat components in them.

To get more information on this market, Request Sample

The Asia Pacific region is currently dominating the global feed additives industry based on seafood consumption and aquafeed utilization, with China being the leading country. This has led to a rise in the sales of animal-derived products like meat, milk and eggs. Besides this, the increasing usage of feed additives by farmers to prevent disease outbreaks in livestock and improve the nutritional content of the animal-derived products for human consumption is driving the market in the region. They also support in realizing high production and efficiency while maintaining the well-being of the livestock and developing product’s quality and safety. Moreover, the top players in this region are expected to discover new feed additives, which will perform multiple functions in stimulating the fish production capacities, in the upcoming times.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific feed additives market report, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on source, product type, livestock and form.

Breakup by Source:

- Synthetic

- Natural

Breakup by Product Type:

- Amino Acids

- Lysine

- Methionine

- Threonine

- Tryptophan

- Phosphates

- Monocalcium Phosphate

- Dicalcium Phosphate

- Mono-Dicalcium Phosphate

- Defulorinated Phosphate

- Tricalcium Phosphate

- Others

- Vitamins

- Fat-Soluble

- Water-Soluble

- Acidifiers

- Propionic Acid

- Formic Acid

- Citric Acid

- Lactic Acid

- Sorbic Acid

- Malic Acid

- Acetic Acid

- Others

- Carotenoids

- Astaxanthin

- Canthaxanthin

- Lutein

- Beta-Carotene

- Enzymes

- Phytase

- Protease

- Others

- Mycotoxin Detoxifiers

- Binders

- Modifiers

- Flavors and Sweeteners

- Flavors

- Sweeteners

- Antibiotics

- Tetracycline

- Penicillin

- Others

- Minerals

- Potassium

- Calcium

- Phosphorus

- Magnesium

- Sodium

- Iron

- Zinc

- Copper

- Manganese

- Others

- Antioxidants

- Bha

- Bht

- Ethoxyquin

- Others

- Non-Protein Nitrogen

- Urea

- Ammonia

- Others

- Preservatives

- Mold Inhibitors

- Anticaking Agents

- Phytogenics

- Essential Oils

- Herbs and Spices

- Oleoresin

- Others

- Probiotics

- Lactobacilli

- Stretococcus Thermophilus

- Bifidobacteria

- Yeast

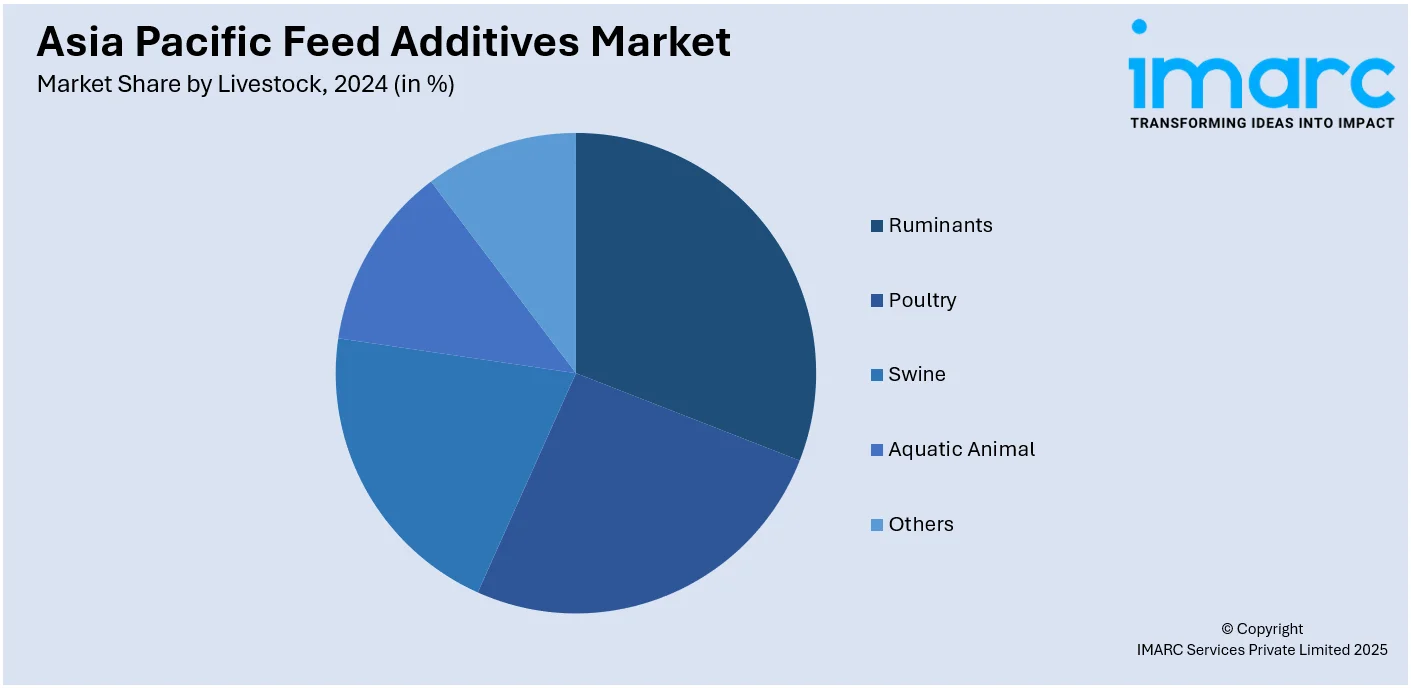

Breakup by Livestock:

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- Breeders

- Swine

- Starters

- Growers

- Sows

- Aquatic Animal

- Others

Breakup by Form:

- Dry

- Liquid

Breakup by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Source, Product Type, Livestock, Form, Country |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Asia Pacific feed additives market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Asia Pacific feed additives market?

- What are the key regional markets?

- What is the breakup of the market based on the source?

- What is the breakup of the market based on the product type?

- What is the breakup of the market based on the livestock?

- What is the breakup of the market based on the form?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the Asia Pacific feed additives market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)