Asia Pacific Flat Glass Market Size, Share, Trends and Forecast by Technology, Product Type, Raw Material, End Use, Type, End Use Industry, and Country, 2025-2033

Asia Pacific Flat Glass Market Size and Share:

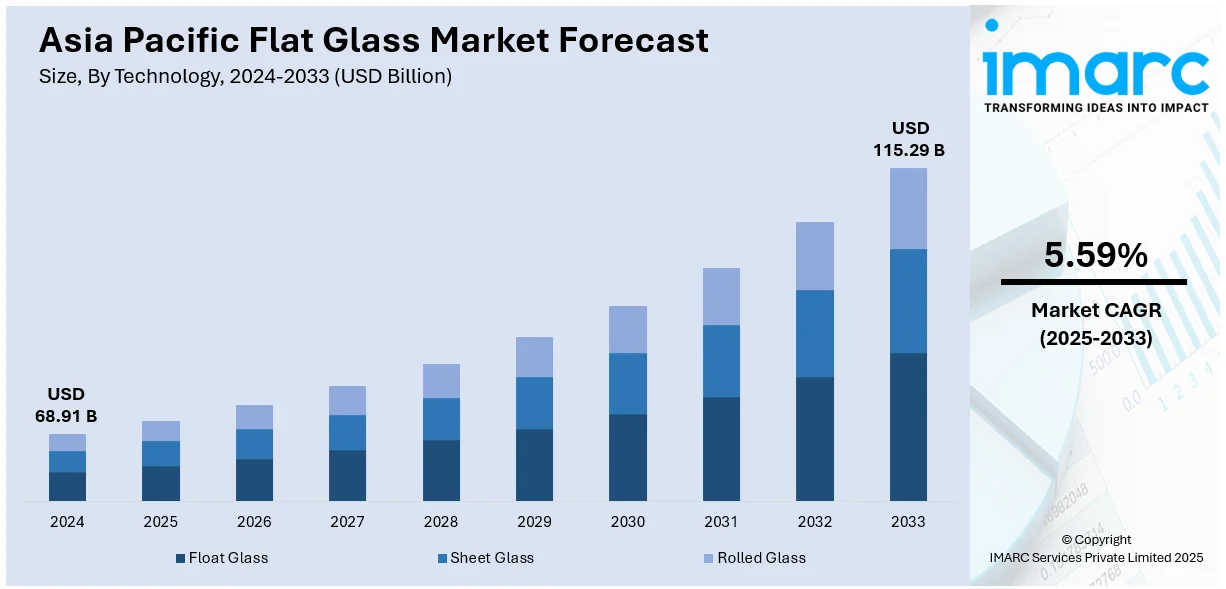

The Asia Pacific flat glass market size was valued at USD 68.91 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 115.29 Billion by 2033, exhibiting a CAGR of 5.59% from 2025-2033. The market is expanding due to rising construction, automotive, and solar energy demand. Urbanization, infrastructure growth and energy-efficient building initiatives drive market adoption. Increasing investments in smart cities and green buildings further accelerate market growth reinforcing the region’s leadership in global flat glass production.

|

Report Attribute

|

Key Statistics |

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 68.91 Billion |

| Market Forecast in 2033 | USD 115.29 Billion |

| Market Growth Rate 2025-2033 | 5.59% |

Construction activities in residential, commercial, and industrial industries are driving the demand for flat glass in the Asia Pacific region. Fast urbanization in China and India is increasing the adoption of energy-efficient glazing solutions with an intention to work towards green buildings. According to the data published by the World Bank, India is rapidly urbanizing, expecting 600 million residents in cities by 2036 up from 31% in 2011. Urban areas will contribute nearly 70% of GDP. To build necessary infrastructure India needs $840 billion by 2036 averaging $55 billion annually. Government regulations on green buildings and stringent energy conservation further contribute to the market growth. The expansion of infrastructure projects including airports, metro stations and commercial complexes is boosting demand for tempered and laminated glass particularly in high-rise buildings and modern architectural designs. Rising demand for energy-efficient buildings is influencing the Asia Pacific flat glass market price as developers prioritize low-E, solar control, and insulated glass solutions to reduce energy consumption and comply with green building regulations.

Automotive sector expansion is another major driver with increasing vehicle production and demand for lightweight and fuel-efficient designs. For instance, in 2024, China's automotive industry reported a record production of 31.28 million and sales of 31.44 million vehicles marking increases of 3.7% and 4.5% year-on-year. Domestic passenger car sales were reported to have increased to 22.61 million while exports rose by 19.7% to 4.96 million units with Chinese-branded vehicles leading at 17.97 million. Advanced glazing solutions including solar control and acoustic glass are gaining traction in passenger vehicles. The expanding solar energy sector driven by supportive policies in China, India and Japan is fueling the demand for photovoltaic and solar control glass. Rising disposable incomes and lifestyle changes are also increasing the adoption of premium glass products in interiors, furniture, and smart home applications.

Asia Pacific Flat Glass Market Trends:

Rising Adoption of Energy-Efficient Glass

The demand for energy efficient glass is increasing due to stricter building regulations and the need for sustainable construction solutions. Low-emissivity (Low-E) glass is gaining traction as it minimizes heat transfer improving insulation and reducing energy consumption in residential and commercial buildings. For instance, in June 2023, Saint-Gobain India announced the launch of the first low-carbon glass achieving a carbon footprint reduction of about 40%. Utilizing two-thirds recycled content and renewable energy this new product aims to support India's construction industry in meeting Net Zero goals by 2070 while maintaining quality and aesthetic performance. Solar control glass is becoming a preferred choice for high-rise structures blocking excess heat while maintaining natural light transmission. Smart glass encompassing electrochromic and thermochromic is integrated in modern designs with dynamic control of light and heat. The green building certification initiatives of the government in Asia Pacific are speeding up the growth in these advanced glazing technologies.

Growth in Solar Energy Installations

The increasing focus on renewable energy is driving the expansion of photovoltaic (PV) projects in China, India and Japan significantly boosting demand for solar glass. According to industry reports, India achieved a milestone of 100 GW of installed solar power capacity adding 15 GW in 2024 a 282% increase. Targeting 500 GW renewable energy by 2030. The PLI scheme allocates ₹24,000 crore to develop 48 GW of solar manufacturing by 2026. This specialized glass designed for solar panels enhances energy conversion efficiency and durability. China leads global solar capacity additions supported by government incentives and large-scale solar farms. India is expanding its solar infrastructure rapidly through initiatives such as the National Solar Mission and Japan is putting solar panels in urban buildings and floating solar farms. With advancements in technology increasing the efficiency of panels the production of solar glass is picking up to fulfill the growing demand for clean energy solutions.

Rising Demand in Automotive Sector

The automotive sector is witnessing a surge in demand for advanced glazing solutions due to the rising production of electric and lightweight vehicles. Automakers are increasingly using specialized flat glass such as laminated and tempered glass to improve safety, aerodynamics and fuel efficiency. Lightweight glazing materials help reduce vehicle weight enhancing battery efficiency in electric vehicles (EVs). Improved cabin comfort and energy efficiency through solar control and acoustic glass are also in vogue. Further expansion of EV production in China, India, and Japan coupled with regulatory mandates for fuel efficiency and safety is further driving the adoption of innovative flat glass technologies in the automotive industry. According to the report published by the India Brand Equity Foundation (IBEF), in September 2024, India produced a total of 2,773,039 units of passenger vehicles and other types of vehicles. From April to September of FY25 the production reached 15,622,388 units. In FY24, sales of electric vehicles (EVs) amounted to 1,325,112 units. The EV market is projected to reach USD 7.09 billion by 2025 with an estimated opportunity of USD 206 billion by 2030.

Asia Pacific Flat Glass Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific flat glass market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on technology, product type, raw material, end use, type, and end use industry.

Analysis by Technology:

- Float Glass

- Sheet Glass

- Rolled Glass

Float glass holds the largest Asia Pacific flat glass market share because of its widespread usage in construction, automotive and solar applications. It is favored for uniform thickness, high optical clarity and a cost-effective production process. The booming construction sector in China, India and Southeast Asia drives demand for float glass in windows, facades and interior applications. In the automotive industry it is essential for windshields and side windows. The solar energy sector further adds to its dominance as photovoltaic panels rely on high-transparency float glass. Increasing investments in smart cities and infrastructure projects continue to fuel its market leadership.

Analysis by Product Type:

- Basic Float Glass

- Toughened Glass

- Coated Glass

- Laminated Glass

- Insulated

- Extra Clear Glass

- Others

Basic float glass holds a dominant position in the Asia Pacific flat glass market due to its affordability, versatility and extensive use across multiple industries. The construction sector driven by rapid urbanization in China, India and Southeast Asia is the largest consumer utilizing it for windows, facades and partitions. The automotive sector also uses fundamental float glass in windshields and side windows while the solar energy industry incorporates it into photovoltaic panels. The ease with which it can be processed into tempered, laminated or coated glass further adds to its dominance in the market. Increasing investments in infrastructure and demand for cheaper glazing solutions continue to keep it on top.

Analysis by Raw Material:

- Sand

- Soda Ash

- Recycled Glass

- Dolomite

- Limestone

- Others

Sand is the primary raw material in the Asia Pacific flat glass market dominating production due to its high silica content and widespread availability. The region's booming construction, automotive and solar industries drive the demand for high-purity silica sand essential for manufacturing float glass. China, India and Southeast Asian countries are major consumers relying on domestic and imported sand for large-scale glass production. Advances in glassmaking technology combined with growing demand for high-quality glass in energy-efficient buildings and electric vehicles are driving the importance of silica sand. Environmental concerns and mining regulations are affecting supply chain strategies in the industry.

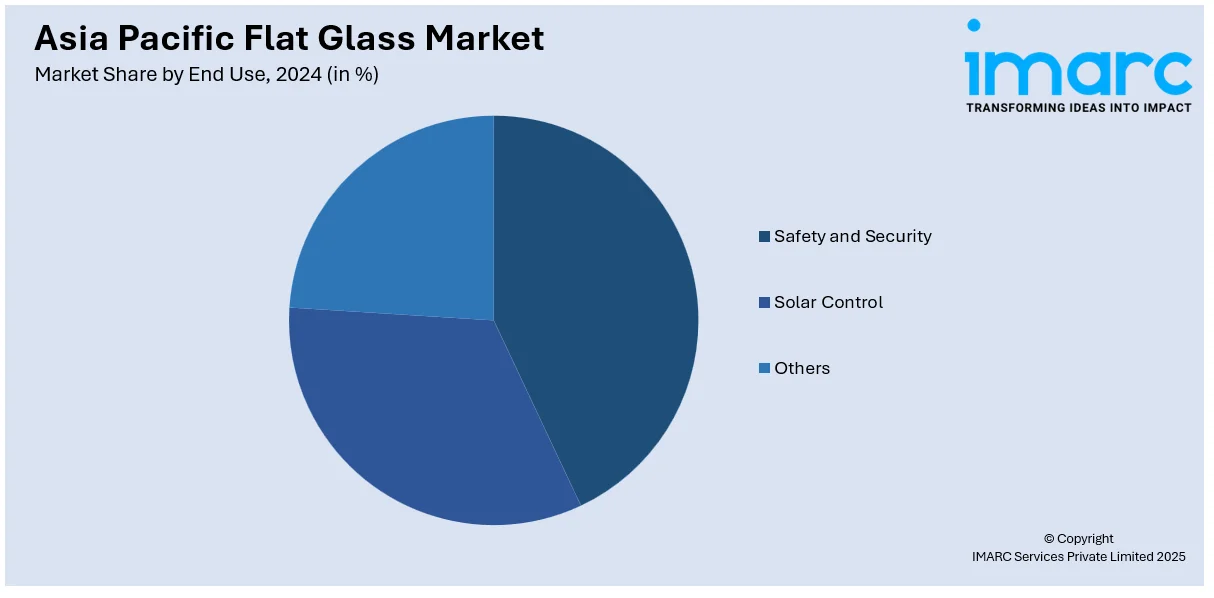

Analysis by End Use:

- Safety and Security

- Solar Control

- Others

Safety and security are the major drivers for the dominance of specialized flat glass in the Asia Pacific market. Urbanization, high-rise construction and stringent building codes are increasing demand for tempered, laminated and impact-resistant glass in residential, commercial and infrastructural projects. The automotive sector also uses safety glass for windshields and side windows to improve passenger safety. Governments are enforcing stricter safety standards boosting the adoption of high-strength glass in public spaces, transportation and industrial applications. Growing awareness of burglary prevention, extreme weather resistance and accident mitigation further strengthens the role of safety and security glass.

Analysis by Type:

- Fabricated

- Non-Fabricated

Fabricated flat glass dominates the Asia Pacific market due to its enhanced properties making it suitable for high-performance applications in construction, automotive and solar industries. This category includes tempered, laminated, insulated and coated glass which offer improved strength, energy efficiency and safety. Rapid urbanization and infrastructure development in China, India and Southeast Asia are driving demand for high-quality glass facades, windows and doors. The automotive industry also uses fabricated glass for windshields and side windows to provide strength and impact resistance. Further adoption of energy efficient and smart glass solutions is likely to cement the region's position under the dominance of fabricated flat glass.

Analysis by End Use Industry:

- Construction

- Automotive

- Solar Energy

- Electronics

- Others

The construction sector dominates the Asia Pacific flat glass market due to rapid urbanization, infrastructure expansion and rising demand for energy-efficient buildings. Countries like China, India and Indonesia are experiencing high investments in commercial and residential projects driving demand for tempered, laminated, and coated glass in windows, facades and partitions. Green building initiatives and stringent regulations promoting sustainability are increasing the adoption of solar control and low-emissivity glass. Large-scale infrastructure projects including airports, metro stations and smart cities further contribute to the Asia Pacific flat glass market growth. The increasing preference for aesthetic and functional glass solutions reinforces construction as the leading end-use industry.

Country Analysis:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

China dominates the Asia Pacific flat glass market driven by its massive construction, automotive and solar energy sectors. As the world’s largest producer and consumer of flat glass China benefits from abundant raw material availability, advanced manufacturing capabilities and strong government support for infrastructure and renewable energy projects. The rapid expansion of high-rise buildings, smart cities and green building initiatives fuels demand for energy-efficient and high-performance glass. China’s leadership in solar panel production significantly boosts demand for solar glass. With major domestic players like Xinyi Glass and China Glass Holdings the country continues to shape regional and global market trends.

Competitive Landscape:

The Asia Pacific flat glass market is highly competitive, with numerous manufacturers operating across the region to meet growing demand from construction, automotive, and solar industries. Companies are expanding production capacities, investing in advanced manufacturing technologies, and developing high-performance glass solutions such as low-emissivity, solar control, and smart glass. Sustainability is a key focus, driving innovations in low-carbon and energy-efficient glass production. Intense competition has led to price fluctuations, with raw material costs and supply chain disruptions influencing market dynamics. Strategic partnerships, mergers, and acquisitions are common, as companies aim to strengthen market presence. With rising urbanization and infrastructure projects, competition remains strong, pushing manufacturers to enhance product quality and technological capabilities.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific flat glass market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2025, Gold Plus Glass Industry Limited announced the commissioning of its new manufacturing facility in Karnataka enhancing its float glass capacity to over 1 million tons annually and introducing solar glass production. The project represents a ₹2,500 crore investment aligning with India’s demand for quality glass and renewable energy solutions.

- In December 2024, China Glass announced the construction commencement of a multimillion-dollar facility in Ain Sokhna, Egypt, to manufacture flat and photovoltaic (PV) glass. Located within the China-Egypt Suez Economic and Trade Cooperation Zone, the plant is projected to produce an annual output of 230,000 tons, serving both local and export markets.

- In October 2024, KCC Glass launched a $258 million flat glass facility in Batang, Central Java, Indonesia, with a production capacity of 1,200 tons per day. The plant, KCC's first overseas venture, aims for 80% of its output to be exported and will create 400 jobs in the region.

- In May 2024, Asahi India Glass (AIS) announced its partnership with INOX Air Products (INOXAP) to establish a green hydrogen plant in Rajasthan, supplying AIS's float glass facility. The project, set for July 2024, aims to eliminate CO2 emissions by using green hydrogen instead of natural gas. AIS targets 94% of its power from sustainable sources.

- In January 2024, a Qatari conglomerate Aria Holding signed a $240 million agreement to establish a float glass manufacturing facility in Maharashtra, India. The deal announced at the World Economic Forum 2024 aims to meet growing local and international demand enhancing India's infrastructure and supporting the 'Make in India' initiative.

Asia Pacific Flat Glass Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | Float Glass, Sheet Glass, Rolled Glass |

| Product Types Covered | Basic Float Glass, Toughened Glass, Coated Glass, Laminated Glass, Insulated, Extra Clear Glass, Others |

| Raw Materials Covered | Sand, Soda Ash, Recycled Glass, Dolomite, Limestone, Others |

| End Uses Covered | Safety and Security, Solar Control, Others |

| Types Covered | Fabricated, Non-Fabricated |

| End Use Industries Covered | Construction, Automotive, Solar Energy, Electronics, Others |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific flat glass market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific flat glass market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific flat glass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The flat glass market was valued at USD 68.91 Billion in 2024.

Key drivers include rapid urbanization and infrastructure development, rising demand for energy-efficient glazing in buildings, expansion of solar energy projects, and increasing adoption of advanced glazing solutions in the automotive sector. Government policies supporting green buildings, smart cities, and renewable energy further accelerate market growth.

IMARC estimates the Asia Pacific flat glass market to exhibit a CAGR of 5.59% from 2025-2033, reaching USD 115.29 Billion by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)