Asia Pacific Human Machine Interface Market Size, Share, Trends and Forecast by Component, Configuration, Technology Type, End Use Industry, and Country, 2025-2033

Market Overview:

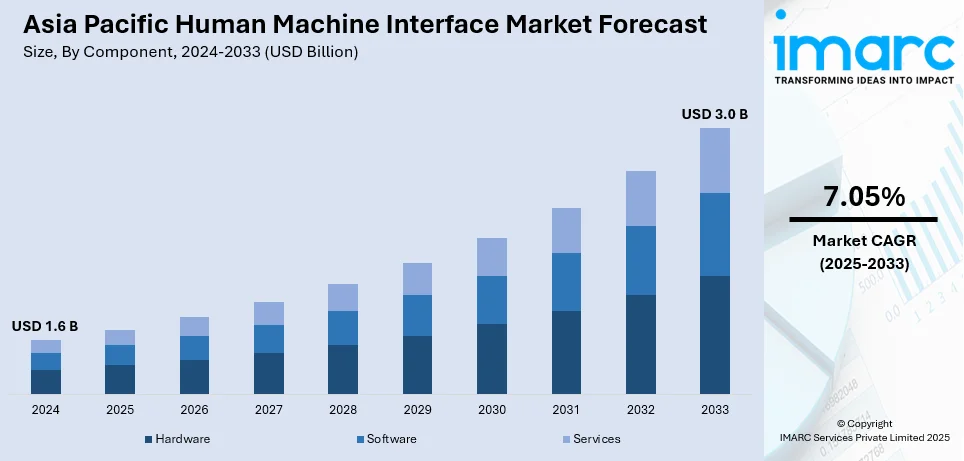

The Asia Pacific human machine interface market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.0 Billion by 2033, exhibiting a growth rate (CAGR) of 7.05% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.6 Billion |

|

Market Forecast in 2033

|

USD 3.0 Billion |

| Market Growth Rate 2025-2033 | 7.05% |

The human machine interface (HMI) refers to hardware and software components that allow information exchange between systems and human operators. It provides a clear and easy-to-understand computer representation, which is controlled by supervisory control and data acquisition (SCADA) systems. It also controls, manages and visualizes different processes of the device, ranging from simple inputs on a touch display to control panels for complex industrial automation systems. Consequently, it is gaining traction in the electronics, healthcare, automotive, education and training, and defense and military sectors in the Asia Pacific region.

To get more information on this market, Request Sample

The rising trend of automation in industrial processes represents one of the key factors bolstering the market growth in the Asia Pacific region. Apart from this, the increasing utilization of high-end software applications, such as chatbots and digital assistants, is also driving the market. Furthermore, the integration of sophisticated infotainment systems in automobiles, along with the introduction of multi-modal user interfaces to reduce driver workload, is contributing to the market growth in the region. Moreover, the escalating demand for streamlining medical processes and improving patient monitoring is increasing the adoption of HMI in the healthcare industry.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Asia Pacific human machine interface market report, along with forecasts at the regional and country level from 2025-2033. Our report has categorized the market based on component, configuration, technology type and end use industry.

Breakup by Component:

- Hardware

- Basic HMI

- Advanced Panel-Based HMI

- Advanced PC-Based HMI

- Software

- On-Premise HMI

- Advanced Panel-Based HMI

- Advanced PC-Based HMI

- Services

Breakup by Configuration:

- Embedded

- Standalone

Breakup by Technology Type:

- Motion HMI

- Bionic HMI

- Tactile HMI

- Optical HMI

- Acoustic HMI

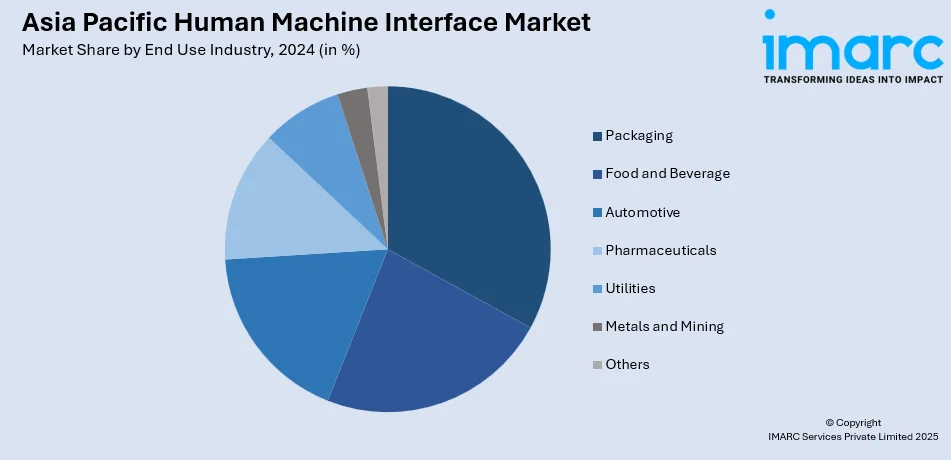

Breakup by End Use Industry:

- Packaging

- Food and Beverage

- Automotive

- Pharmaceuticals

- Utilities

- Metals and Mining

- Others

Breakup by Country:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Component, Configuration, Technology Type, End Use Industry, Country |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Asia Pacific human machine interface market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Asia Pacific human machine interface market?

- What are the key regional markets?

- What is the breakup of the market based on the component?

- What is the breakup of the market based on the configuration?

- What is the breakup of the market based on the technology type?

- What is the breakup of the market based on the end use industry?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the Asia Pacific human machine interface market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)