Asia Pacific Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2025-2033

Asia Pacific Logistics Market Size and Share:

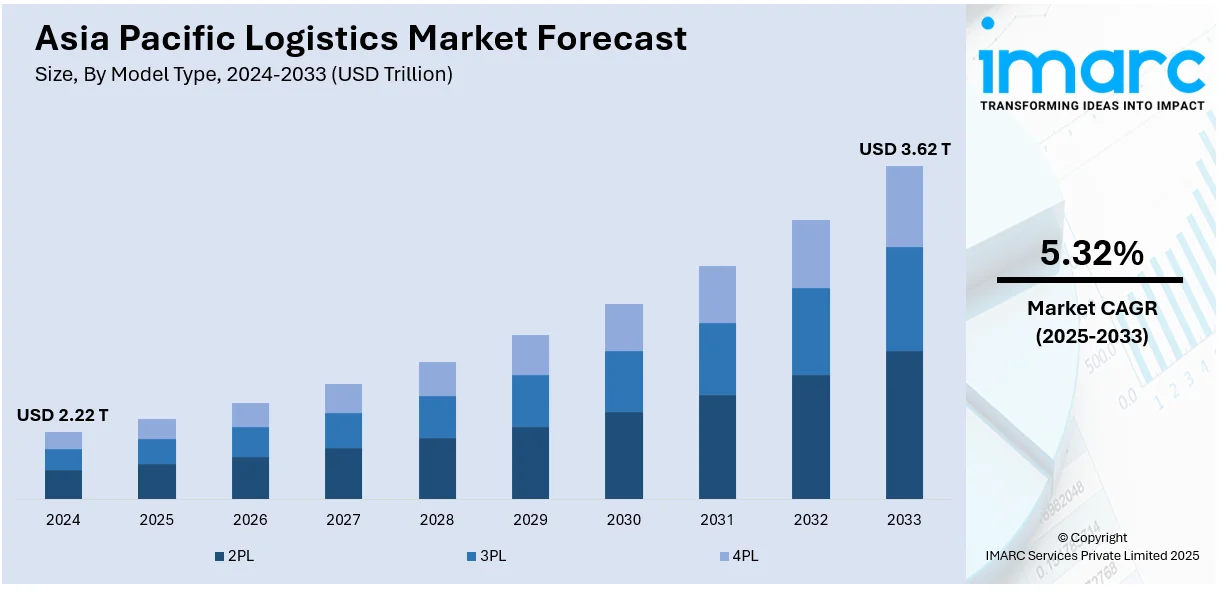

The Asia Pacific logistics market size was valued at USD 2.22 Trillion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.62 Trillion by 2033, exhibiting a CAGR of 5.32% from 2025-2033. The market is witnessing tremendous growth with the fast expansion of e-commerce, growing urbanization, enhanced infrastructure, and heightened cross-border trade activities. Advances in technology, such as automation, artificial intelligence, and the Internet of Things (IoT), are making operations highly efficient and improving delivery speed. Moreover, heightened consumer expectations for quicker and more dependable shipping are compelling logistics providers to innovate on a regular basis, contributing to the Asia Pacific logistics market share stronger.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.22 Trillion |

| Market Forecast in 2033 | USD 3.62 Trillion |

| Market Growth Rate 2025-2033 | 5.32% |

The Asia Pacific's exponential growth of e-commerce has highly spurred the need for advanced logistics networks. Increased internet penetration and ubiquitous use of smartphones have enabled consumers in both urban and rural areas to access online retail websites, causing parcel volumes and delivery frequency to surge sharply. This expansion of the digital customer base has forced the creation of flexible and scalable logistics solutions to enable quicker delivery and higher levels of service. For instance, in December 2024, Meesho's in-house logistics division Valmo handled 50% of total orders—up from 22% in 2023—across 15,000 pin codes through 6,000 partners, improving efficiency and cost-effectiveness. Moreover, logistics companies are reacting by leveraging technologies like real-time tracking, route optimization, and data analysis to enhance efficiency and customer satisfaction. Warehousing strategies are also moving towards decentralization, and micro-fulfillment centers are being introduced to address requirements for rapid delivery. The region's youth and digitally connected population continues to propel e-commerce activity at an unprecedented rate, thus affirming the pivotal position of logistics in facilitating smooth, responsive, and efficient supply chain operations over varied geographic terrain.

To get more information on this market, Request Sample

Extensive investment in infrastructure and policy measures for regional economic integration are the primary drivers of logistics growth in the Asia Pacific region. Governments throughout the region are putting high priority on building transport corridors, intermodal facilities, and trade facilitation centers to save on delivery time and cost effectiveness. Upgrading of infrastructure—specifically at ports, rail, highways, and air cargo terminals—is heightening linkages between industrial production hubs and consumer markets. In parallel, free trade agreements are streamlining customs and encouraging logistics standards uniformity, thereby promoting more cross-border goods movement. Efforts to harmonize and standardize regulations and trade friction are especially advantageous to small and medium-sized businesses, allowing greater inclusion in international trade. These advancements are creating a more integrated supply chain setting, able to provide higher volumes and diversified movement of goods. For example, in May 2023, Log9 Materials collaborated with Quantum Energy to introduce the Bzinesslite e-2W for rapid charging, beginning with 200 units installed in Hyderabad via Whizzy Logistics. Furthermore, the Asia Pacific region is becoming an important logistics center, well placed to provide for the increasing complexities of worldwide commerce.

Asia Pacific Logistics Market Trends:

Rapid Economic Growth

The Asia Pacific logistics industry is witnessing strong expansion, led by rapid economic growth in the region. As per the International Monetary Fund (IMF), Asia contributed to almost 60% of world growth in 2024, highlighting its central position in the global economy. This strong economic enlargement, which propels the need for logistics services, is spurring Asia Pacific logistics market growth. Additionally, the expansion in industrial output, urbanization, and expanding consumer markets are helping to fuel the growth of the industry. For example, the Belt and Road Initiative (BRI) of China has promoted the creation of infrastructure that accommodates logistics activities throughout the region. In addition to this, India's economic reforms and policies directed toward enhancing the ease of doing business and infrastructure development are improving logistics efficiency. This economic growth means increased levels of goods being produced, consumed, and moved, thus driving the Asia Pacific logistics market growth.

Increased Technological Advancements

The use of technologies like automation, artificial intelligence (AI), the Internet of Things (IoT), and blockchain are serving as another growth drivers for the market. Most notably, China's release in January 2025 of its National Blockchain Roadmap to draw USD 54.5 Billion a year for five years into investments indicates the seriousness of the country in bringing digital innovation to fields such as logistics. For example, automation of warehousing and distribution facilities increases efficiency and minimizes operational expenses. In addition to this, AI and ML technologies are enhancing route planning and predictive maintenance, thus elevating service levels and lowering downtime. Apart from this, IoT ensures real-time tracking and visibility of shipments and blockchain ensures secure and transparent transactional records. The convergence of these technologies simplifies supply chains, reduces mistakes, and increases overall operational efficiency, hence propelling growth in Asia Pacific logistics market forecast.

Emergence of the E-commerce Sector

The Asia Pacific logistics market report cites the strong expansion of the e-commerce market as one of the key drivers for the market growth. Growing adoption of online retailing, driven by evolving consumer behavior and technological advancements in digital infrastructure, has resulted in high parcel volumes. Here, large e-commerce players are opening operations in the region that require advanced logistics solutions for order fulfillment, inventory management, and last-mile delivery. As per the India Brand Equity Foundation (IBEF), the Indian e-commerce industry is projected to grow at a CAGR of 27% to USD 163 Billion by 2026. In addition, the growth of omnichannel retailing is also promoting the implementation of integrated logistics solutions that provide end-to-end customer experiences across various platforms. With e-commerce flourishing, the need for logistics solutions that enable fast and effective delivery of products is also increasing.

Asia Pacific Logistics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific logistics market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on model type, transportation mode, and end use.

Analysis by Model Type:

- 2 PL

- 3 PL

- 4 PL

Second-party logistics (2 PL) within the Asia Pacific logistics sector operates via asset-based transportation and warehousing activities like trucking and shipping. It serves those firms that require immediate control of the logistics business, especially where trade is region-specific. Intraregional manufacturing industries make frequent use of 2 PL for their streamlined distribution activities more effectively.

Third-party logistics (3 PL) within the Asia Pacific logistics industry is seeing huge growth due to increased demand for scalable and flexible logistics services. With e-commerce, foreign trade, and urban consumption soaring, 3 PL providers are providing end-to-end services like freight forwarding, warehousing, and inventory control. This method allows companies to outsource logistics activities while enhancing service efficiency.

Fourth-party logistics (4 PL) in the Asia Pacific logistics industry serves businesses that want end-to-end supply chain management. These players manage several layers of services, leveraging data analytics and technology. With logistics networks in the region becoming increasingly complex, 4 PL adoption increases for strategic command and end-to-end optimization.

Analysis by Transportation Mode:

- Roadways

- Seaways

- Railways

- Airways

Road transport in the Asia Pacific logistics market is pivotal with its vast network and adaptability in inland movement. They enable last-mile delivery and border trade across Southeast Asia and South Asia, where land infrastructure keeps developing. Rising demand for domestic freight movements further stimulates growth in this mode.

Asia Pacific seaways lead bulk and container shipping on major regional trade lanes. With strategic ports in China, Japan, Singapore, and India, maritime logistics continue to play a central role in long-distance trade. The increasing need for efficient and affordable global shipping keeps seaway transport a significant factor in total logistics volume.

Rail in the Asia Pacific logistics sector is gathering pace as intermodal transport options grow. China and India are heavily investing in freight corridors and electrified rail, providing faster, cleaner options to road freight. The mode provides high-volume, long-distance transport with improved scheduling predictability and reduced emissions.

Airways for the Asia Pacific logistics industry play a critical role in high-value, time-sensitive commodities like electronics and pharmaceuticals. Though more expensive, air transportation is most suited for express shipping and international e-commerce across borders. Increased international flights and airport modernizations in the region increase cargo efficiency in handling, which facilitates rapid regional supply chains and global linkages to trade.

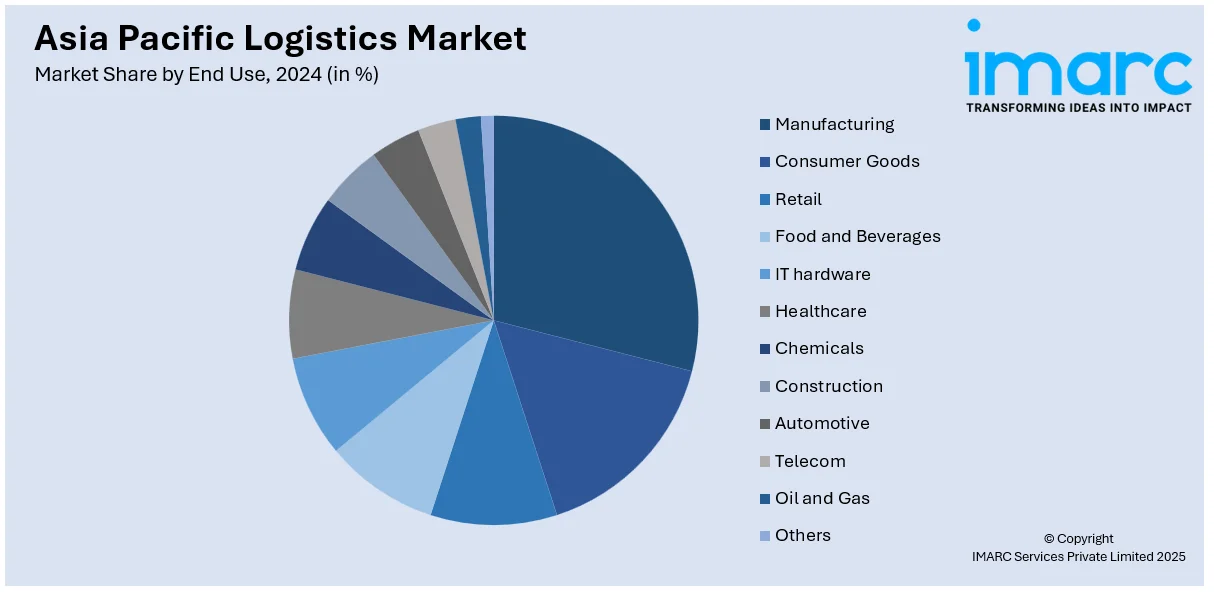

Analysis by End Use:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

Asia Pacific logistics market outlook remains strongly influenced by the region's robust manufacturing sector, which serves as a primary growth driver. As home to some of the world’s largest industrial hubs, the Asia Pacific region depends heavily on logistics services for sourcing raw materials, managing inventories, and distributing finished goods. A well-developed logistics network is essential for streamlining supply chains, minimizing lead times, and lowering operational costs—particularly in high-demand sectors such as electronics, machinery, and textiles.

Consumer goods in the Asia Pacific logistics industry continue to grow significantly. The urbanization and increasing middle class in the region fuel demand for consumer goods, from electronics to personal care products. Logistics companies need to provide quick and affordable distribution channels that serve e-commerce platforms and conventional retail channels, providing guaranteed last-mile services.

Retail in the Asia Pacific logistics industry is enhanced by a growth in e-commerce and cross-border transactions. Retailers rely on strong logistics systems to deliver goods promptly to stores and consumers. With the development of online purchasing, logistics options have been adapted to address the need for faster, more efficient delivery systems.

Food and Beverage in the Asia Pacific logistics sector need to be transported in a specialized manner because the products are perishable. Cold chain logistics, efficient distribution channels, and time-sensitive transportation are necessary to cater to the increasing demand for fresh fruits and vegetables and packaged food. Food supply chains, both local and international, are offered solutions by logistics companies, maintaining product quality and safety.

IT Hardware in the Asia Pacific logistics industry is witnessing growth with an increase in technology adoption by industries. Logistics are critical in ensuring timely distribution of IT parts, ranging from processors to intricate equipment. Proper supply chain management ensures companies continue on their production timelines while at the same time transporting high-value, delicate products to locations safely.

Healthcare within the Asia Pacific logistics industry calls for specialized logistics services for pharmaceutical distribution, medical equipment, and devices. Regulatory needs, temperature control, and time-sensitive shipments drive the sector. The growing demand for healthcare products, such as vaccines and medical devices, also fuels the demand for effective and compliant logistics solutions.

Chemicals in the Asia Pacific logistics industry is treated with care because most of the products are dangerous. Chemical logistics need to be transported in specialized containers, maintained at proper temperatures, and adhered to safety regulations. The expanding chemical industry in nations such as China, India, and Japan increases demand for efficient logistics networks for the safe transport of raw materials and finished products.

Asia Pacific logistics market construction is witnessing an increasing demand as development projects and city infrastructure pick up speed. Haulage of equipment, machinery, and materials for building structures is essential for meeting project time scales. Logistic services provide specialty hauling and storing capabilities to deliver according to growing demand in the developing construction segment, particularly across developing markets.

Auto in the Asia Pacific logistics industry relies on effective supply chains for transporting auto parts and completed automobiles. The area is a primary center for both production and assembly. Automotive logistics services are concerned with timely delivery, stock management, and transportation cost reduction for manufacturers and suppliers, aiding both domestic and overseas distribution channels.

Telecom in the Asia Pacific logistics industry enables the accelerated expansion of mobile networks and broadband infrastructure. Distribution of telecom equipment like towers, routers, and network expansion components is crucial to the logistics industry. Logistics companies are key players in the delivery of telecommunication equipment to rural and urban areas as the telecommunication industry expands.

Oil and gas in the Asia Pacific logistics industry are essential to the energy sector of the region. Heavy machinery, drilling tools, and processed products need specialized logistics solutions. The expansion of energy exploration across the region and increasing demand for oil and gas products create the demand for safe and efficient logistical networks supporting upstream and downstream production.

Others within the Asia Pacific logistics industry include textiles, agriculture, and others. These industries require different logistical services, ranging from raw material procurement to distribution. Each industry has its tailored solutions by the logistics providers, which ensure smooth transport and storage, helping in the development of various sectors in the region.

Analysis by Region:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

China dominates the Asia Pacific logistics industry because of its export and manufacturing leadership. The nation's solid infrastructure as well as a well-developed transport network facilitates the swift transit of products within and outside the country. China's logistics services support a broad spectrum of industries such as electronics, automotive, and consumer goods, thus sustaining the nation as the world's manufacturing center.

The Japanese logistics industry is distinguished by high technological integration and highly efficient infrastructure. Japan has highly developed supply chains that address a broad spectrum of industries ranging from electronics and automobiles to consumer products. Its logistics services stress timeliness, high-tech location systems, and highly advanced warehousing management, thus making Japan an essential logistic hub in the region.

India's logistics market is expanding quickly due to the nation's rising demand for products and services in a variety of sectors. With its huge population and burgeoning middle class, logistics is an important segment in sectors like manufacturing, e-commerce, and agriculture. India's logistics network, including roads, railways, and ports, keeps evolving to cater to expanding needs.

South Korea's logistics industry is largely influenced by its cutting-edge technology environment and strong transportation network. South Korea's geographical position in East Asia positions it centrally in international trade. The logistics services in South Korea assist industries such as electronics, the automobile industry, and machinery, emphasizing timely delivery and high-efficiency capabilities.

Australia's market for logistics is bolstered by its enormous landmass and trade alliances with surrounding nations. Increased e-commerce, combined with solid demand from industries such as mining, farming, and retail, has spurred logistics solution innovation. Australia's logistics infrastructure is constantly advancing, with world-class road, rail, and air networks backing up domestic and international trade.

The Indonesian logistics market is growing as a result of the country's growing economy and the rise in urbanization. Its strategic location within Southeast Asia has boosted its function as a regional logistics hub. Indonesia's logistics industry serves the manufacturing, retail, and agricultural industries, emphasizing the development of transportation infrastructure for domestic and global trade purposes.

Several other nations within the Asia Pacific area also play vital roles within the logistics market. Malaysia, Thailand, the Philippines, and Vietnam are fast becoming logistics hubs because they have strategic positions, expanding industries, and increasing transport facilities. These nations are spending more on infrastructure to improve supply chain efficiency and are consequently drawing domestic and foreign logistics operators.

Competitive Landscape:

The competitive environment of the Asia Pacific logistics industry is marked by fast-paced innovation, regional growth, and diversified service coverage. Players in the market vary from seasoned logistics companies to young regional players who all vie to present holistic, technology-driven solutions addressing a wide range of industries. The industry is also observing specialization, with organizations providing customized logistics solutions in cold chain management, last-mile delivery, and multimodal transport. The integration of technology continues to be a major differentiator with real-time monitoring, predictive analytics, and automation of warehousing increasing operational visibility and customer satisfaction. Strategic partnerships and network optimization are also helping companies build a stronger presence across borders, both in urban and rural markets. Service reliability, speed of delivery, and scalable infrastructure are at the heart of sustaining competitive edge. The evolving nature of consumer expectations and trade dynamics is continually transforming the landscape of logistics, encouraging players to innovate and transform to remain relevant in a changing regional market.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific logistics market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Loft Logistics expanded its operations into Malaysia with a new warehouse in Shah Alam. The move strengthens cross-border logistics between Singapore and Malaysia.

- March 2025: Jayud Global Logistics launched an exclusive chartered air cargo service between Fuzhou and Jakarta, enhancing cross-border logistics in Asia Pacific. The service supports lithium battery shipments and e-commerce growth in Southeast Asia, operating thrice weekly with an 18-ton capacity per flight to meet rising regional demand.

- February 2025: Yusen Logistics became the first logistics company in Asia to sign the "ONE LEAF+" agreement with Ocean Network Express. The partnership enables customers to reduce Scope 3 GHG emissions through biofuel-powered ocean freight, reinforcing sustainable logistics initiatives across the Asia Pacific region.

- February 2025: NX Logistics India inaugurated a 21,024m² state-of-the-art warehouse in Sri City, Andhra Pradesh to support mobility, technology, and other industries. Strategically located near major ports and Chennai Airport, the facility enhances the company's logistical capabilities and reinforced its presence in the Asia Pacific region.

- January 2025: Sustainable Shared Transport and Fujitsu launched a joint transportation and delivery platform in Japan, enhancing logistics efficiency across industries. The system optimizes trunk transport using standardized pallets and blockchain-secured data integration, addressing Japan’s logistics challenges and promoting sustainability and collaboration within the Asia Pacific logistics sector.

Asia Pacific Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Trillion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Regions Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific logistics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific logistics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The logistics market in the Asia Pacific was valued at USD 2.22 Trillion in 2024.

The Asia Pacific logistics market is projected to exhibit a CAGR of 5.32% during 2025-2033, reaching a value of USD 3.62 Trillion by 2033.

Major drivers of the Asia Pacific logistics market are increasing e-commerce, urbanization, infrastructure development, and increasing cross-border trade. Growing demand for quick, efficient delivery and adoption of cutting-edge technologies like automation, AI, and IoT also greatly contribute to market growth throughout the region.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)