Asia Pacific Luxury Yacht Market Size, Share, Trends and Forecast by Type, Size, Material, Application, and Country, 2026-2034

Asia Pacific Luxury Yacht Market Summary:

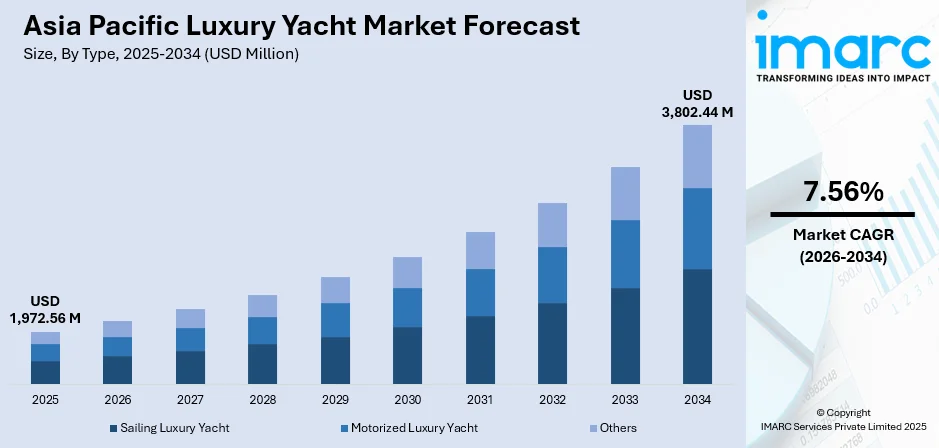

The Asia Pacific luxury yacht market size was valued at USD 1,972.56 Million in 2025 and is projected to reach USD 3,802.44 Million by 2034, growing at a compound annual growth rate of 7.56% from 2026-2034.

The Asia Pacific luxury yacht market is experiencing growth driven by the rapid expansion of ultra-high-net-worth individuals (UHNWIs) across the region, particularly in China, India, and Southeast Asian financial hubs. Rising disposable incomes, evolving lifestyle preferences toward experiential luxury, and substantial government investments in marina infrastructure are reshaping maritime tourism and recreational boating landscapes. The convergence of sustainability-focused yacht innovations, expanding charter services, and premium coastal tourism destinations is creating unprecedented opportunities for manufacturers and service providers to capture the growing demand for luxury maritime experiences across the Asia Pacific region.

Key Takeaways and Insights:

- By Type: Motorized luxury yacht dominates the market with a share of 65% in 2025, owing to superior speed, navigational capabilities, comfort features, and suitability for island-hopping and coastal cruising experiences preferred by affluent buyers.

- By Size: 75-120 feet leads the market with a share of 60% in 2025, due to its versatility, practicality for diverse yachting enthusiasts, optimal balance between luxury amenities and operational costs, and accessibility for charter operators.

- By Material: FRP/Composites represent the largest segment with a market share of 70% in 2025, driven by exceptional strength-to-weight ratios, corrosion resistance, design flexibility, fuel efficiency benefits, and reduced maintenance requirements for luxury vessel construction.

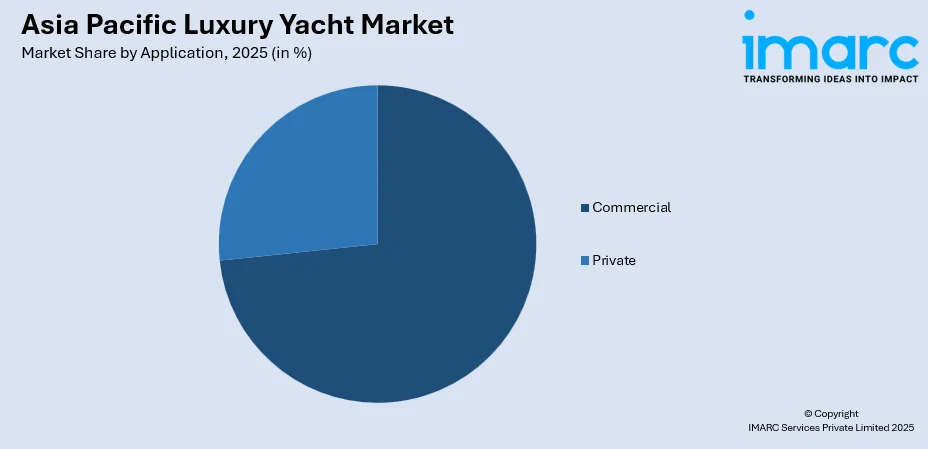

- By Application: Private leads the market with a share of 85% in 2025, owing to the rising personal wealth, lifestyle preferences, and the growing demand for exclusive leisure experiences.

- By Country: China dominates the market with a share of 32% in 2025, driven by its rapidly expanding ultra-high-net-worth population and strategic government investments in world-class marina infrastructure and coastal tourism development.

- Key Players: The Asia Pacific luxury yacht market exhibits moderate competitive intensity, with multinational yacht builders competing alongside regional manufacturers through innovation, sustainable technologies, strategic partnerships, and expanding dealer networks across premium yachting destinations.

To get more information on this market Request Sample

The Asia Pacific region is emerging as a pivotal growth hub for luxury yacht, driven by increasing number of affluent individuals, improvement in marine tourism infrastructure, and favorable regulatory frameworks. Countries across the region are investing heavily in world-class marinas to enhance competitiveness and attract international yachting enthusiasts. Government initiatives supporting coastal tourism development are accelerating market expansion, while rising interest in sustainable and hybrid propulsion technologies is reshaping user preferences. This shift toward sustainable and hybrid propulsion technologies is exemplified by the 2024 unveiling of the Azimut and Volvo Penta Seadeck 7, the world's first yacht combining Volvo Penta's IPS with hybrid power. Featuring a Volvo Penta hybrid-electric system, it offered a seamless, eco-friendly boating experience with reduced CO2 emissions and advanced comfort.

Asia Pacific Luxury Yacht Market Trends:

Growth of Marine Tourism and Coastal Leisure

Travelers are increasingly drawn to quieter, flexible, and personalized itineraries that let them enjoy sea travel without strict schedules. Coastal destinations across the region are adapting by improving berthing services, enhancing traveler support, and promoting maritime recreation. As interest in ocean-based activities continues to rise, many residents seek ways to spend time on the water with greater comfort and convenience. This preference is catalyzing the demand for modern yachts that allow longer stays, smoother sailing, and a high level of onboard comfort. In 2025, it was announced that luxury yacht cruises will soon operate from Visakhapatnam, aiming to boost coastal tourism. The first phase includes 3-4 hour cruises from the city's Fishing Harbor, with plans for longer routes to Kakinada and Nellore. The service features luxury cabins, restrooms, and event-friendly facilities, while complying with maritime regulations.

Expansion of Marinas and Supporting Infrastructure

Large-scale investments in marinas, yacht clubs, and related services are making ownership more practical for residents across Asia Pacific. Improved docking facilities, maintenance services, and storage options are reducing operational challenges that previously held back potential buyers. Governments and private developers are allocating resources to create well-managed coastal hubs that support year-round activity. For example, in 2025, Indonesia unveiled its first international full-service marina, Bali Gapura Marina, under construction in Benoa, Bali. Set to offer 180 berths, including space for 50 superyachts, by Q3 2026, it aims to boost the country's maritime tourism. As infrastructure matures, the region becomes more welcoming to both experienced owners and first-time purchasers who want reliable service networks and smooth logistical support for their vessels.

Rising Interest in Experiential Travel

The shift toward immersive, personalized travel is enhancing the appeal of luxury yachts, as travelers seek experiences that offer control, comfort, and meaningful engagement with natural settings. Yachts enable tailored voyages that adapt to individual preferences, contributing to the growing interest among adventure-oriented and relaxation-focused travelers alike. The trend reflects a broader movement toward experiential luxury, where memories and quality interactions carry higher value than traditional material goods. This shift toward immersive, personalized travel is powerfully exemplified by the 2024 launch of Aliikai Luxury Yacht's expert-crafted sailings in Indonesia, which offered bespoke itineraries to explore remote destinations like the Banda Islands. The 135-foot yacht, built in the traditional phinisi style, offered luxury amenities like spacious cabins, a dive center, and water sports gear.

Market Outlook 2026-2034:

The Asia Pacific luxury yacht market is driven by increasing wealth among high-net-worth individuals. As disposable incomes rise, affluent individuals are seeking exclusive recreational experiences, with luxury yachts serving as symbols of status and luxury. The market generated a revenue of USD 1,972.56 Million in 2025 and is projected to reach USD 3,802.44 Million by 2034, growing at a compound annual growth rate of 7.56% from 2026-2034. Strong infrastructure development, coupled with a desire for unique leisure pursuits, continues to strengthen the market growth, positioning luxury yachts as a sought-after investment in the region.

Asia Pacific Luxury Yacht Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Motorized Luxury Yacht | 65% |

| Size | 75-120 Feet | 60% |

| Material | FRP/Composites | 70% |

| Application | Private | 85% |

| Country | China | 32% |

Type Insights:

- Sailing Luxury Yacht

- Motorized Luxury Yacht

- Others

Motorized luxury yacht dominates with a market share of 65% of the total Asia Pacific luxury yacht market in 2025.

Motorized luxury yacht dominates the market owing to its superior speed and performance. This yacht offers faster cruising capabilities, making it ideal for long-distance voyages and providing a more luxurious experience with efficient, smooth sailing across both calm and challenging waters.

Moreover, motorized yacht caters to the growing demand for convenience and autonomy in luxury maritime experiences. Equipped with advanced technology, this yacht allows owners and guests to enjoy seamless navigation, greater control, and sophisticated amenities, making it the preferred choice for high-net-worth individuals seeking both luxury and functionality. This catering to the growing demand for convenience and autonomy in luxury maritime experiences is exemplified by Cheoy Lee's 2024 launch of the Cheoy Lee 130 Explorer yacht at its China facility, which is motorized with twin Caterpillar C18 engines and designed for global exploration.

Size Insights:

- 75-120 Feet

- 121-250 Feet

- Above 250 Feet

75-120 feet leads with a share of 60% of the total Asia Pacific luxury yacht market in 2025.

The 75-120 feet dominates the market owing to its balance between luxury and practicality. Vessels of this size offer ample space for high-end amenities, including lavish interiors and outdoor areas, while still being manageable for private owners.

Additionally, yachts within this size range are well-suited for both private ownership and commercial use, such as luxury charters. They provide a high level of comfort and exclusivity, making it attractive to affluent individuals who seek both performance and luxury.

Material Insights:

- FRP/Composites

- Metal/Alloys

- Others

FRP/composites represent the largest segment with a 70% share of the total Asia Pacific luxury yacht market in 2025.

FRP and composites hold the biggest market share, driven by their superior strength-to-weight ratio, which enhances yacht performance and fuel efficiency. These materials provide excellent durability and resistance to corrosion, making them ideal for the demanding marine environment.

Moreover, FRP and composite materials offer greater design flexibility, allowing for more innovative, custom yacht builds. Their lighter weight reduces the overall weight of the vessel, contributing to improved speed and handling. These advantages make FRP and composites the material of choice for high-performance luxury yachts in the region.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Commercial

- Private

Private exhibits a clear dominance with 85% share of the total Asia Pacific luxury yacht market in 2025.

Private leads the market because rising high-net-worth individuals are seeking exclusive travel options, personalized comfort, and greater privacy on the water. The growing interest in bespoke designs and long-range cruising further strengthens the demand for privately held vessels.

Its dominance is also supported by expanding marina infrastructure, the growing yacht management services, and a preference for flexible, owner-controlled itineraries. Private buyers increasingly view yachts as both lifestyle assets and long-term investments, reinforcing their leading role within the regional luxury yacht market.

Country Insights:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

China leads the market with a 32% share of the total Asia Pacific luxury yacht market in 2025.

China dominates the market due to its rapidly expanding wealth among high-net-worth individuals. The country's growing number of affluent individuals, particularly in major cities, is catalyzing the demand for luxury leisure products like yachts.

Additionally, China's increasing interest in maritime tourism and luxury travel contributes to its dominance. This growing interest in maritime tourism and luxury travel is actively being supported and showcased by major events, such as the inaugural Sanya Boat Festival, held from April 15-18, 2025, in Hainan, China, showcasing 150 yachts and 45 exhibitors as part of the China International Consumer Products Expo. The event featured high-end fashion, watersports, and exclusive experiences, emphasizing luxury marine lifestyle.

Market Dynamics:

Growth Drivers:

Why is the Asia Pacific Luxury Yacht Market Growing?

Rise of Ultra-Luxury Cruising

There is an increase in the demand for ultra-luxury cruising as affluent travelers seek highly personalized leisure options that combine privacy, comfort, and curated experiences. The sector benefits from the growing interest in boutique-style voyages that offer refined amenities, tailored services, and exclusive itineraries. This trend of affluent travelers seeking highly personalized, ultra-luxury cruising with refined amenities is illustrated by the 2025 official launch of Luminara, the third superyacht from The Ritz-Carlton Yacht Collection, which began its inaugural Mediterranean season. The yacht, expanding to Asia-Pacific in December 2025, features exclusive dining, luxurious accommodations, and bespoke amenities, redefining luxury cruising.

Government Initiatives Supporting Coastal Development

Public investment in waterfront development, nautical tourism, and modernized maritime policies is creating a supportive foundation for luxury yacht expansion across the region. for instance, in 2024, Goa introduced its first superyacht, “RA11,” inaugurated as part of the state’s broader push to elevate its luxury and nautical tourism profile. The vessel, built under the “Make in India, Make in Goa” initiative, reflects the growing institutional focus on expanding premium maritime assets. Such advancements, combined with smoother licensing processes and targeted coastal tourism initiatives, enhance confidence among owners and charter operators by improving accessibility, reducing operational barriers, and encouraging greater regional sailing activity.

Improvements in Yacht Design and Technology

Continuous improvements in engineering, navigation systems, and fuel efficiency are making modern yachts more attractive to discerning buyers. These vessels now feature quieter engines, better stabilization, and advanced digital controls, enhancing both safety and comfort for long-distance cruising. Additionally, interior layouts are becoming more flexible, supporting extended voyages without compromising on luxury. For example, in 2024, Lexus introduced the LY 680, a luxury yacht that expanded relaxation spaces, including a larger flybridge and swimming platform, blending cutting-edge technology with Lexus' "Crafted" design philosophy. Such innovations, coupled with a focus on sustainability and wellness, are attracting more buyers in the Asia Pacific region, who value performance, customization, and modern aesthetics for regional sailing environments.

Market Restraints:

What Challenges the Asia Pacific Luxury Yacht Market is Facing?

High Ownership and Maintenance Cost Barriers

The substantial financial investment required for luxury yacht ownership and ongoing operational expenses presents significant barriers constraining broader market adoption. Annual maintenance costs typically range from ten to fifteen percent of initial purchase price, encompassing crew salaries, berthing fees, insurance, and routine servicing requirements. These cumulative expenses limit accessibility to ultra-affluent segments capable of sustaining long-term ownership commitments.

Regulatory Complexities and Fragmented Maritime Policies

Inconsistent maritime regulations across Asia Pacific countries create operational complexities for yacht owners and charter operators navigating varying requirements for vessel registration, crew certifications, and customs procedures. The fragmented regulatory landscape complicates cross-border voyages and increases administrative burdens. Harmonization efforts remain ongoing but progress varies significantly across jurisdictions, affecting seamless yachting experiences.

Limited Marine Infrastructure in Emerging Markets

Inadequate marina facilities and marine service networks in developing markets restrict accessibility for luxury yacht owners and charter operations. While established destinations offer comprehensive infrastructure, emerging markets frequently lack sufficient berthing capacity, qualified maintenance services, and essential support facilities. These infrastructure gaps constrain market expansion into potentially attractive cruising destinations and limit growth opportunities.

Competitive Landscape:

The Asia Pacific luxury yacht market exhibits moderate competitive intensity characterized by the presence of established multinational yacht builders alongside regional manufacturers competing across diverse price segments and application categories. Market dynamics reflect strategic positioning ranging from premium innovation-driven offerings emphasizing advanced sustainability technologies and bespoke customization to value-oriented products targeting cost-conscious buyers seeking accessible entry points into luxury yachting. The competitive landscape is increasingly shaped by sustainability initiatives incorporating hybrid propulsion systems, expanding dealer networks across key markets, and strategic partnerships facilitating technology transfers. Leading players are focusing on enhancing regional presence through showroom expansions, after-sales service improvements, and participation in major yachting exhibitions to strengthen brand recognition and capture growing demand.

Recent Developments:

- In June 2025, Ritz-Carlton Yacht Collection announced the launch of its third luxury yacht, Luminara, set to debut in July 2025. The yacht will offer exclusive cruises in the Mediterranean and later expand into the Asia-Pacific market. This marks a significant step in Ritz-Carlton’s expansion into luxury cruising, focusing on personalized and intimate experiences.

- In March 2025, Yanmar Marine International Asia announced the launch of the CX570, a new crossover yacht designed for both fishing and cruising. Set to begin taking orders in autumn 2025, this semi-customizable yacht combines luxury with versatility, featuring a spacious interior and advanced sailing systems. It will debut at the Japan International Boat Show in March 2025.

Asia Pacific Luxury Yacht Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Sailing Luxury Yacht, Motorized Luxury Yacht, Others |

| Sizes Covered | 75-120 Feet, 121-250 Feet, Above 250 Feet |

| Materials Covered | FRP/Composites, Metal/Alloys, Others |

| Applications Covered | Commercial, Private |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Asia Pacific luxury yacht market size was valued at USD 1,972.56 Million in 2025.

The Asia Pacific luxury yacht market is expected to grow at a compound annual growth rate of 7.56% from 2026-2034 to reach USD 3,802.44 Million by 2034.

China dominated the Asia Pacific luxury yacht market in 2025, driven by its rapidly expanding ultra-high-net-worth population, strategic government investments in marina infrastructure, and the growing interest in coastal leisure experiences.

Key factors driving the Asia Pacific luxury yacht market include the growing investment in marinas and service hubs. Indonesia’s Bali Gapura Marina, offering 180 berths with 50 for superyachts by Q3 2026, reflects this shift, giving owners better docking, maintenance, and year-round operational support

Major challenges include high ownership and maintenance costs creating accessibility barriers, regulatory complexities and fragmented maritime policies across countries, limited marine infrastructure in emerging markets, skilled crew shortages, and environmental compliance requirements necessitating costly vessel upgrades.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)