Asia Pacific Power Rental Market Size, Share, Trends, and Forecast by Fuel Type, Equipment Type, Power Rating, Application, End Use Industry, and Country, 2025-2033

Asia Pacific Power Rental Market Size and Share:

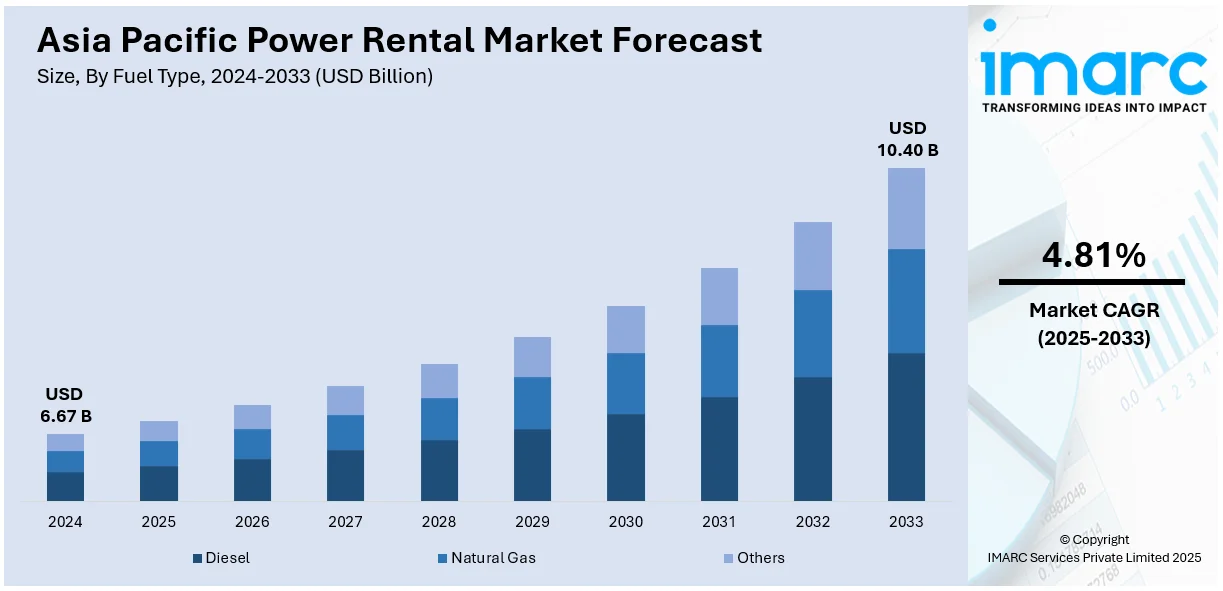

The Asia Pacific power rental market size was valued at USD 6.67 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.40 Billion by 2033, exhibiting a CAGR of 4.81% from 2025-2033. The market in the region is driven by rapid industrial growth, increasing infrastructure development, growing temporary power demand, and the need for backup and renewable energy (RE) solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.67 Billion |

|

Market Forecast in 2033

|

USD 10.40 Billion |

| Market Growth Rate (2025-2033) | 4.81% |

The Asia Pacific power rental market growth is largely fueled by the swift industrialization and infrastructure expansion in emerging economies. In addition, the increasing construction projects, including residential, commercial, and industrial developments, demand temporary power solutions, aiding the market growth. Moreover, power rental is especially crucial in regions where infrastructure is underdeveloped or when access to a reliable power grid is limited, thus providing an impetus to the market. Furthermore, the expansion of RE projects, such as solar and wind farms, boosts the need for backup power solutions to ensure a consistent energy supply, impelling the market growth. For instance, in 2024, China's installed capacity for solar power increased by 45.2%, reaching 890 million kilowatts, while wind power capacity grew by 18%, totaling 520 million kilowatts. These developments necessitate backup power solutions to ensure a consistent energy supply, thereby boosting the demand for power rental services in the region.

To get more information on this market, Request Sample

Concurrently, the growing frequency of natural disasters and climate-related events in the region has led to an increased demand for portable power generation systems. These events often disrupt electricity supply, prompting industries, governments, and individuals to seek rental power sources for emergency backup. Additionally, the growing focus on energy security and sustainability also plays a key role, as companies increasingly rely on rental power solutions for temporary projects and peak load periods. Apart from this, with the expanding markets in Southeast Asia. For example, Atlas Copco acquired the top power rental provider in Southeast Asia to build market strength and extend its service network in the Asia Pacific region, further reflecting the market's growth potential. Furthermore, in other developing nations, the power rental industry is well-positioned to cater to diverse energy needs across a wide range of applications, thereby propelling the market forward.

Asia Pacific Power Rental Market Trends:

Movement Towards Sustainable and Eco-Friendly Energy Solutions

The Asia Pacific power rental market demand is progressively shifting towards sustainable and eco-friendly solutions. In addition, rental companies are taking advantage of the rising demand for RE and are adopting green technologies like solar generators and hybrid systems to serve eco-conscious industries and regulations. The region's governments are also encouraging the use of low-emission power sources to achieve sustainability goals. For instance, The World Bank launched a $2.5 billion program to support sustainable energy transitions across East Asia and the Pacific which targets a 60 million ton decrease in greenhouse gas emissions throughout the program duration. As a result, hybrid power systems and battery storage solutions are gaining favor. This trend also reflects the increasing push to reduce carbon footprints in industrial and commercial sectors, thereby enhancing the Asia Pacific power rental market outlook.

Technological Advancements in Power Rental Equipment

Ongoing technological innovations are transforming the Asia Pacific power rental market trends. Companies are integrating advanced features such as remote monitoring, Internet of Things (IoT)-enabled sensors, and automated load management into their rental equipment, to enhance the efficiency and performance of power generators. These advancements offer precise information in an expressly timely manner enabling organizations to curb fuel utilization, cut down on time, and enhance overall power availability. Also, the development of mobile power generation solutions is giving people options of rental services for a short-term basis and in case of emergency to the business organizations, significantly contributing to the market expansion. Moreover, the world's largest producer of new power plants, China installed 64% of all wind and solar facilities globally to reach 339 GW of utility-scale renewable projects, further reflecting the region's focus on cleaner energy solutions., thus providing an impetus to the market.

Rising Need for Temporary and Emergency Power Solutions

The rising frequency of natural disasters and unexpected power outages in the Asia Pacific region has led to an increased reliance on temporary and emergency power rental services. In confluence with this, some of the major categories including healthcare, construction, and events require constant backup power, which is driving the demand for power rentals across the region. Furthermore, short-term power rentals are being sought by businesses in countries that are vulnerable to disruptions in the power grid to reduce interruptions. For instance, organizations across the Asia Pacific region are shifting to continuous carbon-free electricity sourcing to align with their 24/7 power needs and invest in sustainable generating technologies through power rental services. This trend is further boosted by the increasing realization of energy resiliency in both the urban and rural markets, thereby strengthening the Asia Pacific power rental market share.

Asia Pacific Power Rental Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Asia Pacific power rental market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on fuel type, equipment type, power rating, application, and end-use industry.

Analysis by Fuel Type:

- Diesel

- Natural Gas

- Others

The diesel-powered segment is dominant in the Asia Pacific power rental market due to its efficiency and cost advantage. These are common in electrical power industries like construction industries, manufacturing industries, and events, as they offer high power output and do not easily break down. Despite the global trend towards maturing RE markets and a fast-growing infrastructure in emergent economies, especially in rural or off-grid areas with relatively stable power infrastructure, diesel power rental is still a preferable option for temporary power demand. Besides this, the ability of diesel generators to work in unfavorable conditions and the worst environments adds to their viability. Also, the increasing projects and industries with prime-load demands during peaks or emergencies insist on continued demand for diesel-based solutions. As a result, the shift towards the use of renewable sources of power is slowly picking up while the convenience and the relatively low capital cost of diesel generators ensure the growth of this segment.

Analysis by Equipment Type:

- Generator

- Transformer

- Load Bank

- Others

The generator holds the largest segment in the Asia Pacific power rental market due to the critical application of generators in providing power rental solutions. With industries, rising constructions, and growing commerce, the demand for temporary, standby, and emergency power is constant, and generators are an excellent solution. Moreover, the need for power in regions where access to a stable grid is a luxury, and non-existent, drives the growth of the generator rental market. They are also used in events, festivals, and seasonal businesses and the demand for the generators is guaranteed in the market. Apart from this, generators are mostly preferred by industries that seek reliable power sources since generators can operate at high levels of power, can be easily transferred from one area to another, and can work well in different terrains. Furthermore, due to the surging requirements and generator cost efficiency, the role of generators is becoming equivalent to RE solutions, thus influencing the Asia Pacific power market report.

Analysis by Power Rating:

- Up to 50 kW

- 51 - 500 kW

- 501 - 2,500 kW

- Above 2,500 kW

The 51-500kW power rating segment comprises the largest share of the Asia Pacific power rental market because the equipment is highly versatile and suitable for most applications. This segment is particularly preferred for medium-scale commercial, industrial, and construction applications where power requirements are higher than regular residential use but not as high as to warrant the use of industrial-size generators. Additionally, the increase in infrastructure development especially in the emerging markets has led to increased demand for power solutions in this range which is malleable enough to support ongoing operations in construction, mining, and manufacturing industries. Moreover, the 51-500kW range is most frequently applied in events, filming, and temporary connections, which makes the direction popular for short-term rental demand. As the business world continues to seek affordable and efficient power solutions for mid to large-scale operations, generators in this power rating are experiencing robust demand, thus maintaining the stronghold of this segment in the market.

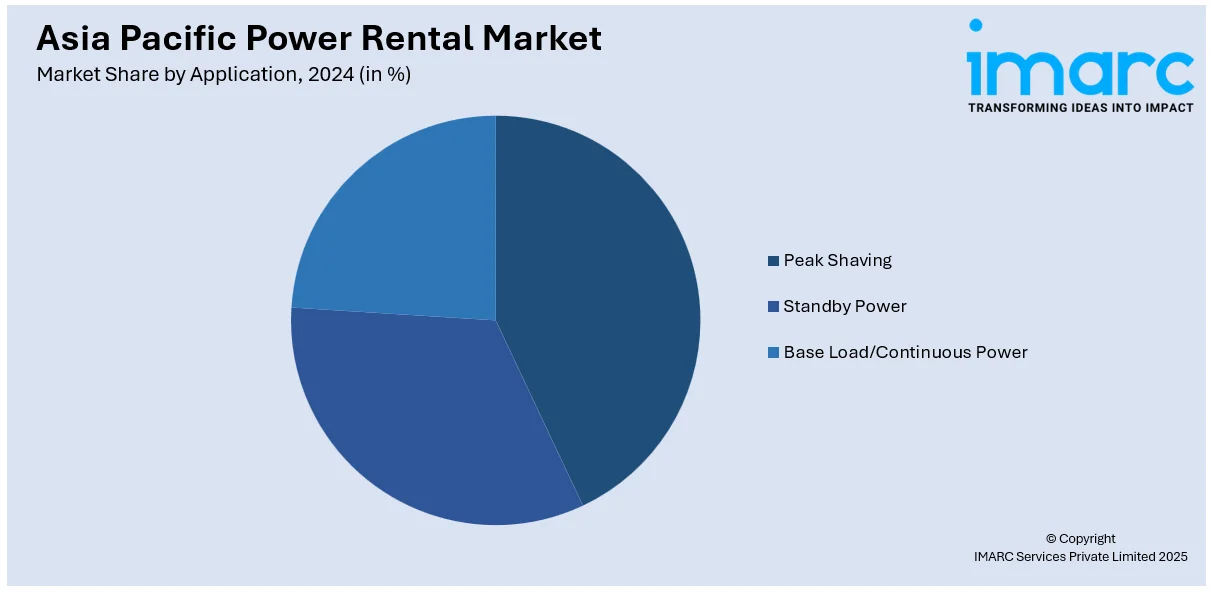

Analysis by Application:

- Peak Shaving

- Standby Power

- Base Load/Continuous Power

Base load/continuous power leads the Asia Pacific power rental market segment. This segment is expanding because power rental systems are crucial for manufacturing plants, oil and gas sites, utilities, and large construction projects to ensure their operations can run smoothly in locations without grid access. Furthermore, industrial facilities rely on diesel and gas-powered generators to ensure uninterrupted power supply when traditional grid power fails or becomes unreliable. Moreover, base load power rental services become more essential as industrial sectors expand and infrastructure growth continues while remote projects develop. The increasing threat of power grid outages and energy emergencies drives people to invest more in uninterrupted power systems. Besides this, business and government sectors across the region keep expanding their demand for reliable power rental systems to reduce service disruptions and enhance critical service stability, which is driving the market forward.

Analysis by End Use Industry:

- Utilities

- Oil & Gas

- Events

- Construction

- Mining

- Data Centers

- Others

The utilities sector represents the largest end use industry in the Asia Pacific power rental market, driven by the critical need for reliable and uninterrupted power supply to meet growing energy demands. As urbanization, industrialization, and population growth continue across the region, the demand for electricity from the utilities sector has surged. Power rental services are crucial for utility companies to meet peak demand periods, maintain grid stability, and provide backup power during unforeseen disruptions or outages. Additionally, the expansion of RE projects and the integration of intermittent sources like solar and wind energy boost the demand for rental solutions, as backup generators are necessary to ensure continuous power supply when renewable sources are insufficient. Furthermore, aging infrastructure and the need for rapid, flexible power solutions during infrastructure upgrades or new power plant developments drive the increasing use of rental equipment. Besides this, as the need for energy security and efficiency grows, the utility sector remains a key driver of market expansion.

Country Analysis:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

The power rental market in China is driven by rapid industrialization, infrastructure development, and a growing need for temporary and backup power in the construction and manufacturing sectors. Moreover, expanding urbanization and energy security concerns in remote areas are fueling the demand for rental power solutions.

In Japan, the power rental market is propelled by frequent natural disasters, requiring emergency power solutions for infrastructure and utilities. Additionally, with a strong focus on energy resilience, particularly in the aftermath of earthquakes, storms, and grid disruptions, the demand for backup generators is boosting the market growth.

The power rental market in India is expanding due to rapid industrial growth, infrastructure development, and ongoing power supply challenges in rural and remote areas. The construction and manufacturing sectors, alongside rising demand for backup power in temporary setups, are significantly contributing to the market expansion.

In South Korea, the power rental market is growing, driven by its strong industrial base and the need for temporary power solutions during major projects, events, and energy shortages. The demand in the region is also benefiting from continuous advancements in technology and RE integration, which is strengthening the market share.

The power rental market in Australia is expanding with the surging demand from the mining, construction, and events sectors. The increasing reliance on temporary power solutions during remote operations, natural disasters, and infrastructure projects is supported by a focus on energy resilience and sustainability, thus aiding the market growth.

In Indonesia, the power rental market is mainly fueled by continuous infrastructure development, industrial expansion, and the demand for dependable energy solutions in remote areas. Additionally, the increasing need for backup power in sectors like oil, gas, and construction is boosting market growth.

Competitive Landscape:

The Asia Pacific power rental market is highly competitive, with many players competing for market share. This competition is driven by factors such as equipment availability, technological advancements, and the capacity to offer reliable and cost-efficient power solutions. Companies differentiate themselves through advanced offerings, including RE solutions, hybrid systems, and remote monitoring capabilities. Additionally, players focus on offering flexible rental terms and customized solutions to cater to industries like construction, utilities, and events. Apart from this, the growing demand for temporary and backup power, coupled with regional infrastructure development, intensifies competition, making it essential for companies to adapt to changing market dynamics.

The report provides a comprehensive analysis of the competitive landscape in the Asia Pacific power rental market with detailed profiles of all major companies.

Latest News and Developments:

- In December 2024, Caterpillar Inc. released rental generators with state-of-the-art monitoring technology to boost service quality across Asia Pacific.

- In October 2024, SunCable obtained provisional authorization from Singapore's Energy Market Authority to provide 1.75 gigawatts of low-emission power from Australia to Singapore using a 4,300 km undersea transmission line, marking a major advancement in transnational renewable energy projects.

- In October 2024, Lendlease joined forces with Nippon Steel Kowa Real Estate to launch a $500 million apartment project in Melbourne's Docklands as Nippon Steel entered the Australian real estate market for the first time. The project underscores the rising need for reliable power rental solutions in large-scale urban developments.

- In September 2024, JERA announced to build a natural gas power plant in Vietnam as part of its plan to replace coal power plants with cleaner energy, aligning with its strategy to transition from coal to cleaner fuels across Asia.

- In July 2024, Singapore-based Cyan Renewables made an A$1.1 billion acquisition of MMA Offshore in Australia to enhance its offshore wind capabilities throughout the Asia Pacific region, strengthening its position in the offshore wind industry.

Asia Pacific Power Rental Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | Diesel, Natural Gas, Others |

| Equipment Types Covered | Generator, Transformer, Load Bank, Others |

| Power Ratings Covered | Up to 50 kW, 51 – 500 kW, 501 -2,500 kW, Above 2,500 kW |

| Applications Covered | Peak Shaving, Standby Power, Base Load/Continuous Power |

| End Use Industries Covered | Utilities, Oil &Gas, Events, Construction, Mining, Data Centers, Others |

| Countries Covered | China, Japan, India, South Korea, Australia, Indonesia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Asia Pacific power rental market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Asia Pacific power rental market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Asia Pacific power rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Asia Pacific power rental market was valued at USD 6.67 Billion in 2024.

Key factors driving the Asia Pacific power rental market include rapid industrialization, infrastructure development, increasing demand for temporary and backup power, urbanization, energy security concerns, the rising frequency of natural disasters, and the growing integration of renewable energy solutions.

IMARC estimates the Asia Pacific power rental market to exhibit a CAGR of 4.81% during 2025-2033, reaching a value of USD 10.40 Billion by 2033.

Based on fuel type, diesel accounted for the largest segment in the Asia Pacific power rental market, due to its reliability, cost-effectiveness, and high efficiency. It is widely used across industries, diesel generators are ideal for providing consistent power in construction, manufacturing, and remote operations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)